How Much Tax To Pay On Fixed Deposit Interest In India If your interest income from all FDs is less than Rs 40 000 in a year the income is TDS exempt On the other hand if your interest income is over Rs 40 000 the TDS would be

For example suppose the total interest income from fixed deposits is Rs 60 000 and the threshold is Rs 40 000 Once the interest exceeds the above limit In Interest income from FDs is taxable as Income from other sources under the provisions of the Income Tax Act 1961 the Act Banks may deduct taxes at source

How Much Tax To Pay On Fixed Deposit Interest In India

How Much Tax To Pay On Fixed Deposit Interest In India

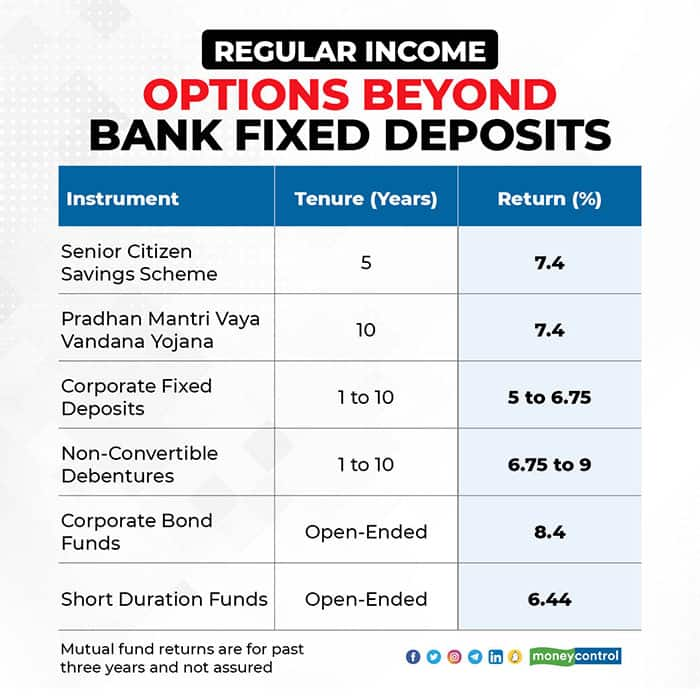

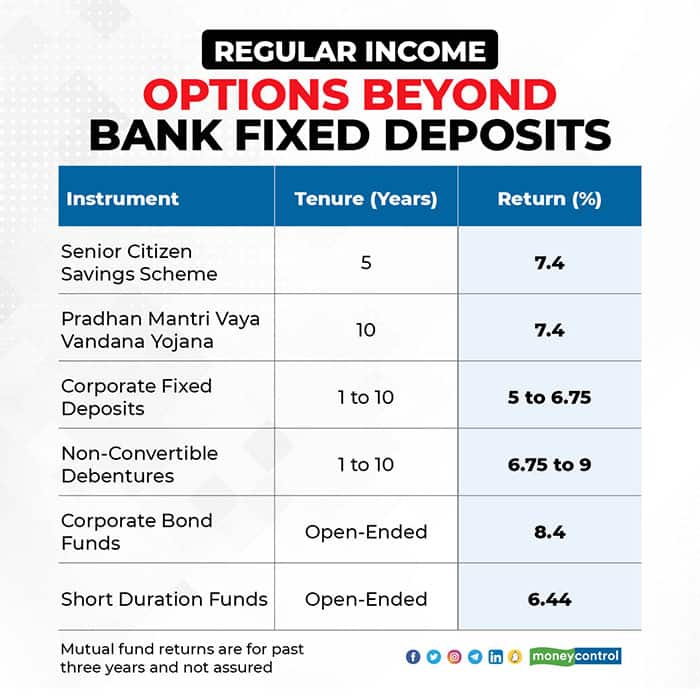

https://images.moneycontrol.com/static-mcnews/2021/09/Regular-Income-Options-beyond-bank-fixed-deposits-R.jpg

All You Need To Know About Fixed Deposits And Fd Calculators Free Hot

https://ffxivgilstudio.com/wp-content/uploads/2021/06/Fixed-Deposits-And-FD-Calculators.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

In case of FDs banks deduct tax at source at the rate of 10 if the interest income for the year is more than Rs 40 000 Kindly Fixed Deposits FDs enable you to utilise the benefits offered by Section 80C of the Indian Income Tax Act and lessen your tax liability up to Rs 1 5 lakh in a financial

Updated Jan 02 2024 12 05 PM IST TDS on FD schemes is currently deducted at a rate of 10 per cent SUMMARY It is to be noted that the tax is levied only on the interest For individuals excluding senior citizens if the interest earned on fixed deposits is more than 40 000 the bank will deduct tax at source TDS at the time of crediting the

Download How Much Tax To Pay On Fixed Deposit Interest In India

More picture related to How Much Tax To Pay On Fixed Deposit Interest In India

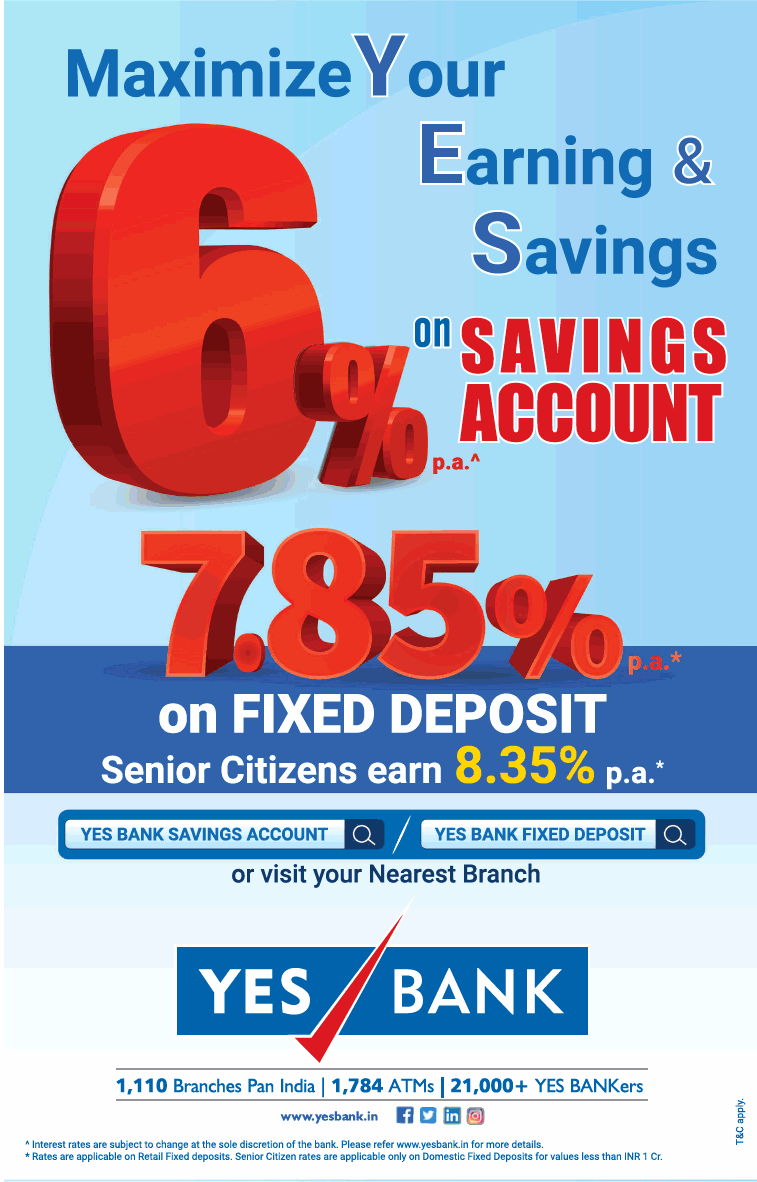

Yes Bank Maximize Your Earning And Savings On Fixed Deposit Ad Advert

https://newspaperads.ads2publish.com/wp-content/uploads/2018/12/yes-bank-maximize-your-earning-and-savings-on-fixed-deposit-ad-times-of-india-mumbai-21-12-2018.png

Cukai Pendapatan How To File Income Tax In Malaysia JobStreet Malaysia

https://media.graphassets.com/j9n1ArmpRreKvI9fooEq

Fixed Deposit Interest Rates In Nepal 2023 Nepali Nerd

https://nepalinerd.com/wp-content/uploads/2022/12/Fixed-Deposit-Interest-Rates-in-Nepal.webp

TDS return Timeline for payment of tax How can you reduce tax on your FDs 1 Ensure timely submission of Forms 15G and 15H 2 Spread your FDs to It will face a tax of Rs 31 200 tax rate of 30 and 0 4 cess The TDS on fixed deposit is 10 if the interest amount for the entire financial year exceeds Rs

If you are in the 10 tax bracket the tax payable on FD interest is 10 and if you are in the 30 tax bracket then you pay tax on the FD interest at 30 This is The earned income interest from the fixed deposit is subjected to tax and you must pay taxes following applicable tax rates for the particular financial year under IT

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

INCOME TAX ON SAVING BANK INTEREST AND INTEREST ON FIXED DEPOSITS YouTube

https://i.ytimg.com/vi/Qhdr8jcfEKk/maxresdefault.jpg

https://www.icicibank.com/blogs/fixed-deposits/tax...

If your interest income from all FDs is less than Rs 40 000 in a year the income is TDS exempt On the other hand if your interest income is over Rs 40 000 the TDS would be

https://tax2win.in/guide/income-tax-on-fixed-deposit-interest

For example suppose the total interest income from fixed deposits is Rs 60 000 and the threshold is Rs 40 000 Once the interest exceeds the above limit In

Fixed Deposit Interest Rate In India Dollar Keg

How Much Tax Will I Pay On 41000 Update New Countrymusicstop

Top 1 Pay Nearly Half Of Federal Income Taxes

Safe Mode Of Investment

Highest Fixed Deposit Rate In 2023 At 9 36 This Corporate FD Beats

Review Of Fixed Deposit Interest Rates In Banks In India Vrogue

Review Of Fixed Deposit Interest Rates In Banks In India Vrogue

Amended Finance Bill 2023 How Much Tax Will You Pay On Your Income

How To Increase The Value Of A Business By Paying More Taxes

Bank Of Maharashtra Revises Fixed Deposit Interest Rates Check Details

How Much Tax To Pay On Fixed Deposit Interest In India - How much amount of FD interest is Tax free How can I save Tax through FD Do I need to file an income tax return when FD is my only Income On what