How Much You Get For Child Tax Credit 2023 The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or 200 000 for all other tax filing statuses

How Much You Get For Child Tax Credit 2023

How Much You Get For Child Tax Credit 2023

https://i.ytimg.com/vi/nX2QbXSnS_Y/maxresdefault.jpg

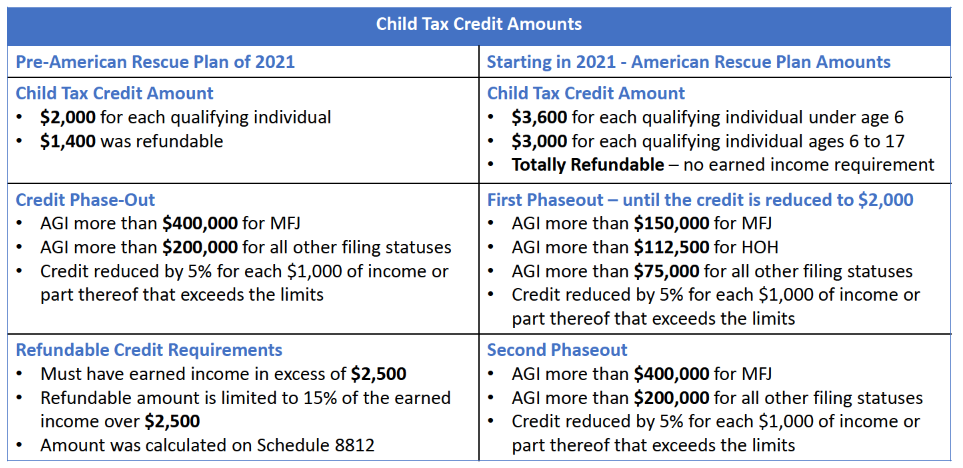

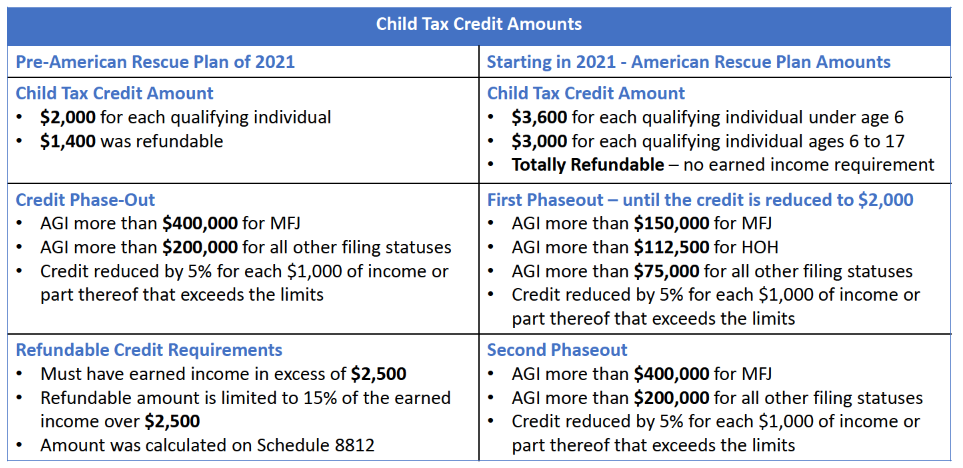

How The Advanced Child Tax Credit Payments Impact Your 2021 Return

https://taxprocpa.com/images/increased-child-tax-credit.jpg

The Child Tax Credit ZOBUZ

https://i0.wp.com/zobuz.com/wp-content/uploads/2020/05/The-Child-Tax-Credit.jpg

Under the expansion a family can receive up to 1 800 of the remainder for the 2023 tax year By 2025 families would be able to receive the full tax credit as a refund if they owe no income For 2024 taxes filed in 2025 the child tax credit will be worth 2 000 per qualifying dependent child if your MAGI is 400 000 or below married filing jointly or 200 000 or below all

How much is the 2023 child tax credit Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child Taxpayers with children may be eligible for a credit of up to 2 000 and 1 500 of that may be refundable

Download How Much You Get For Child Tax Credit 2023

More picture related to How Much You Get For Child Tax Credit 2023

Why The Child Tax Credit Is Lower In 2023 Khou

https://media.khou.com/assets/VERIFY/images/15a040f1-9821-4933-a978-2b8b0a8fc521/15a040f1-9821-4933-a978-2b8b0a8fc521_1140x641.jpg

How Much Do I Get For Child Tax Credit 2021 YouTube

https://i.ytimg.com/vi/s6RUFL2rGII/maxresdefault.jpg

Child Tax Credit Income Limit 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2021/01/Child-Tax-Credit-Income-Limit.jpg

The amount you can get depends on how many children you ve got and whether you re making a new claim for Child Tax Credit already claiming Child Tax Credit Child Tax Credit will not affect For 2023 taxes for returns filed in 2024 the Child Tax Credit is worth 2 000 for each qualifying child You can claim this full amount if your income is at or below the modified adjusted gross income threshold see the income phase out information below

For 2023 and 2024 the maximum amount of the Child Tax Credit is 2 000 per qualifying child However it s important to note that the full credit amounts are based on filing status and income level This CHILDucator will let you know if you qualify for the Child Tax Credit and or the Other Dependent Tax Credit on your 2023 Tax Return the amounts are also included The Additional Child Tax Credit or ACTC requires information that is based on your 2023 Tax Return

Maximum Amount Of Child Tax Credit 2023 Texas Breaking News

https://texasbreaking.com/wp-content/uploads/2023/02/child-tax-credit-in-2023-check-eligibility-how-to-claim.jpg

2021 Child Tax Credit Advances Payment Schedule Atlanta CPA

https://www.wilsonlewis.com/wp-content/uploads/2021/06/Child-Tax-Credit.jpg

https://smartasset.com/taxes/all-about-child-tax-credits

The child tax credit is limited to 2 000 for every dependent you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year

https://finance.yahoo.com/personal-finance/child...

See how much the 2023 child tax credit is worth how to claim it on your federal tax return and differences in the child tax credit 2023 vs 2022 s credit

Child Tax Credit 2022 How To Apply Kitchen Cabinet

Maximum Amount Of Child Tax Credit 2023 Texas Breaking News

Child Tax Credit

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

How Much Money Will I Get For Child Support

2021 Changes To Child Tax Credit Support

2021 Changes To Child Tax Credit Support

What Is The Phase out For Child Tax Credit And How Does It Affects Your

FAQ For Child Tax Credit And Other Tips On Tax Filing PriorTax Blog

How Much Do I Get For Child Tax Credit 2021 YouTube

How Much You Get For Child Tax Credit 2023 - How much is the 2023 child tax credit Right now unless Congress makes last minute changes the 2023 child tax credit is worth up to 2 000 per qualifying child