How Quickly Do Hmrc Pay Vat Refunds How HMRC deals with VAT repayment returns and what happens when there s a delay in a repayment

You will usually get your refund within ten days of HMRC receiving your return but it may take longer You should contact HMRC if you have not heard anything after 30 days Overview You must pay your VAT bill by the deadline shown on your VAT return You may have to pay a surcharge or penalty if you do not pay on time There are different

How Quickly Do Hmrc Pay Vat Refunds

How Quickly Do Hmrc Pay Vat Refunds

https://www.gatwickaccountant.com/wp-content/uploads/2022/08/How-to-Pay-HMRC-Self-Assessment-Income-Tax-Bill-in-UK.jpg

HMRC VAT Refunds VAT Refunds Explained How To Claim VAT Refunds

https://i.ytimg.com/vi/EzmvBPjCJQY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYfyApKDMwDw==&rs=AOn4CLAJjnwlnigdp3Fb0hQBiADGdKlbFA

Co To Jest Deklaracja VAT FreeAgent I m Running

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1000/dpr_auto,f_auto/website-images/screenshots/screenshot_vat-return.png

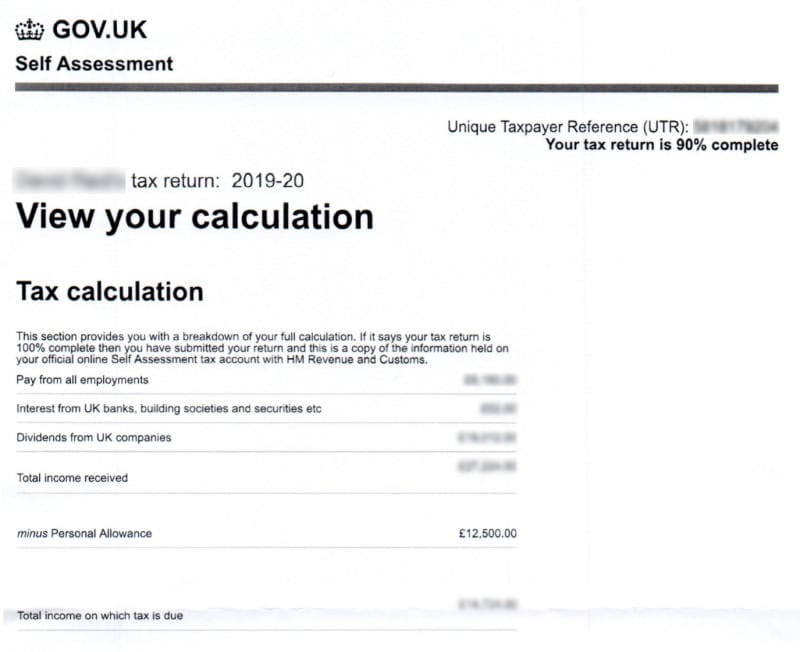

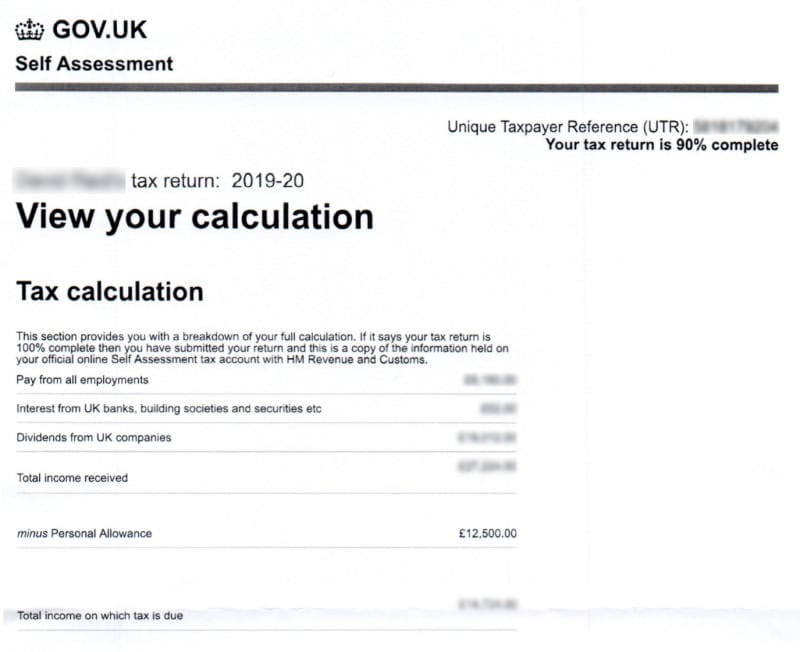

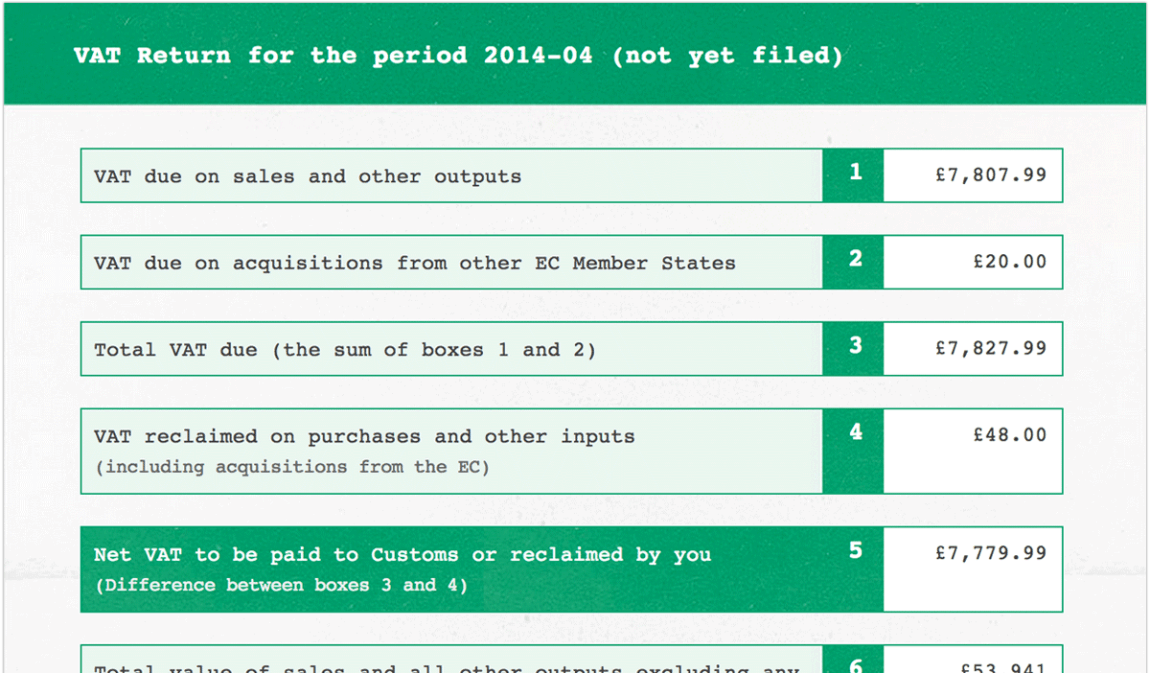

Once HMRC has received your VAT return you should receive a VAT refund in 30 days Sometimes VAT refunds can be processed in as quickly as 10 days Most VAT repayment delays are due to HMRC opening an enquiry into the return but even if this happens there are still steps you can take to ensure you recover

HMRC pays refunds within 6 months of receiving your claim If your claim is refused do not fret You can either ask HMRC to review the decision or you can appeal to an An HMRC spokesperson said it aims to make all repayments within 30 days of receiving a VAT return They added In most cases claims are paid within five

Download How Quickly Do Hmrc Pay Vat Refunds

More picture related to How Quickly Do Hmrc Pay Vat Refunds

UK VAT Return After Brexit Vatcalc

https://www.vatcalc.com/wp-content/uploads/UK-VAT-return.jpg

How To Get A Copy P60 Online Or Employer Other Options

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/63c00b62157cc60ae818848e_P60_Document_2023_01_Top.jpeg

Simple Assessment Letters Call HMRC On 0300 322 7835

https://static.wixstatic.com/media/91de1d_29b3b4e0ad2947c2bb033e894161a46e~mv2.jpg/v1/fill/w_805,h_568,al_c,lg_1,q_85/91de1d_29b3b4e0ad2947c2bb033e894161a46e~mv2.jpg

The 30 day period for HMRC to enquire into your VAT return starts from the day you submit it So let s say your return is due by 7 August for the period ending June 30 If you are I submitted my first new business VAT return on 25th May which had a refund amount The expected refund date was 23rd June It s nearly two weeks past this

HMRC try to get refunds out within a month of receiving your return However if they have any queries or concerns this could be longer while they get you to Tax refunds in the UK can take up to 12 weeks to be processed by HMRC with a further 5 days to 5 weeks added to receive your money There are a number of

HMRC Tax Refunds Tax Rebates 3 Options Explained

https://www.ratednearme.com/wp-content/uploads/employee-tax-calculation.jpg

How To File A VAT Return To HMRC YouTube

https://i.ytimg.com/vi/FODDLhG03GI/maxresdefault.jpg

https://www.gov.uk/guidance/treatment-of-vat...

How HMRC deals with VAT repayment returns and what happens when there s a delay in a repayment

https://www.annetteandco.co.uk/how-long-for …

You will usually get your refund within ten days of HMRC receiving your return but it may take longer You should contact HMRC if you have not heard anything after 30 days

Number 1 Way To Pay HMRC Self Assessment Tax Quickly

HMRC Tax Refunds Tax Rebates 3 Options Explained

Effective HMRC Penalty Appeal Letter Template

FreeAgent VAT Online Submission 1Stop Accountants

Fill Free Fillable HMRC New Starter Checklist 2020 PDF Form

What Is VAT And How Do You Get Your Maximum VAT Refund The Points Guy

What Is VAT And How Do You Get Your Maximum VAT Refund The Points Guy

Vat Return Form Pdf Fill Online Printable Fillable Bl Vrogue co

How To Print Your SA302 Or Tax Year Overview From HMRC Love

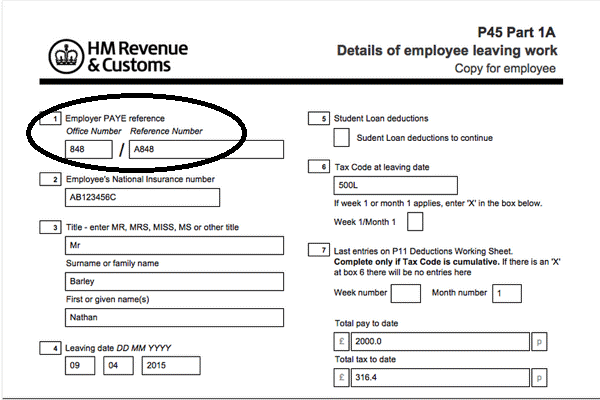

What Is Employer s PAYE Ref Number Claim My Tax Back

How Quickly Do Hmrc Pay Vat Refunds - Most VAT repayment delays are due to HMRC opening an enquiry into the return but even if this happens there are still steps you can take to ensure you recover