How Rebate Is Calculated In Income Tax Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

Rebate under Sec 87A Tax rebate is a form of tax incentive provided by the government to individuals earning an income below a specified limit In case your total taxable income after deductions doesn t exceed Rs 5 lakh you You just have to input your income and deduction details in the Income tax calculator and it will calculate your tax liability along with surcharge and cess It will also calculate rebate if it is applicable to you

How Rebate Is Calculated In Income Tax

How Rebate Is Calculated In Income Tax

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-15-1-1024x538.png

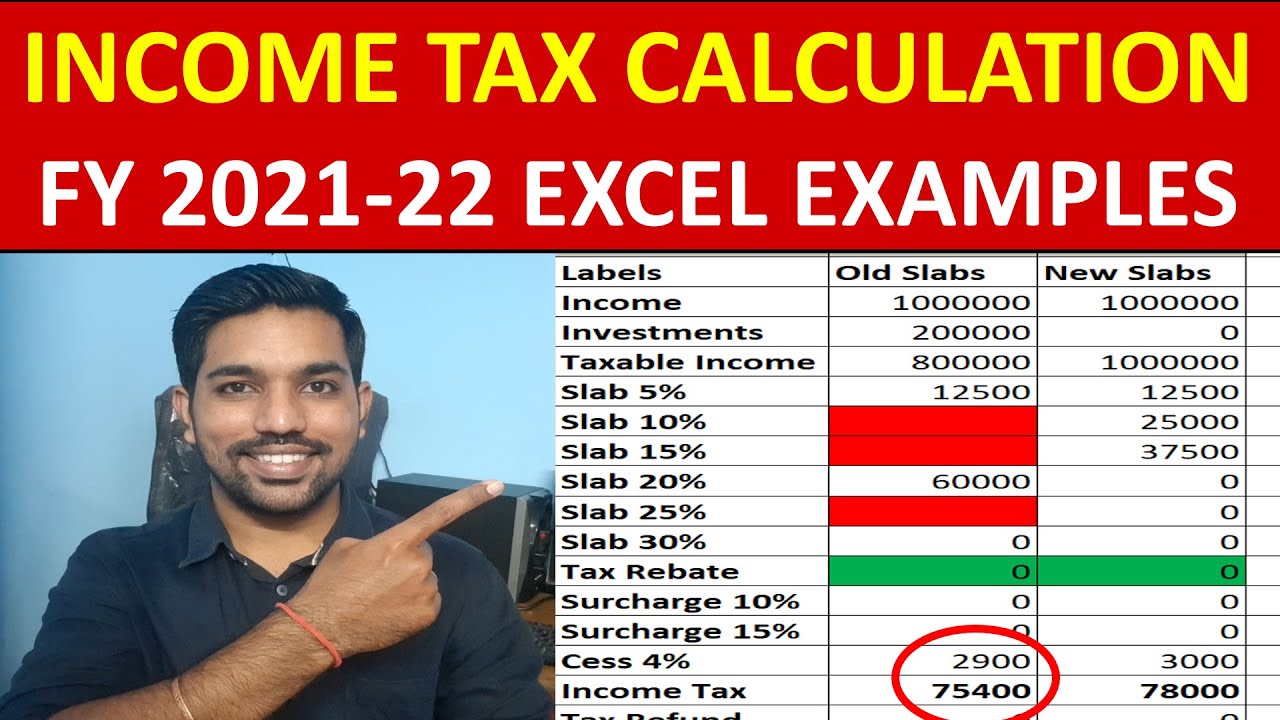

How To Calculate Income Tax FY 2021 22 New Tax Slabs Rebate

https://i.ytimg.com/vi/mw-erFuYboM/maxresdefault.jpg

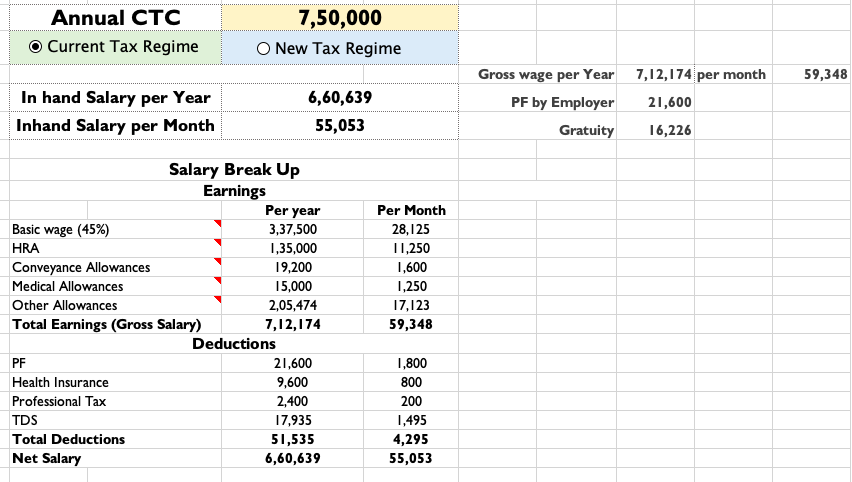

Salary Break Up Calculator Online LaynaCsenge

https://www.hrcabin.com/wp-content/uploads/2021/07/Screenshot-2021-07-28-at-12.03.38-AM.png

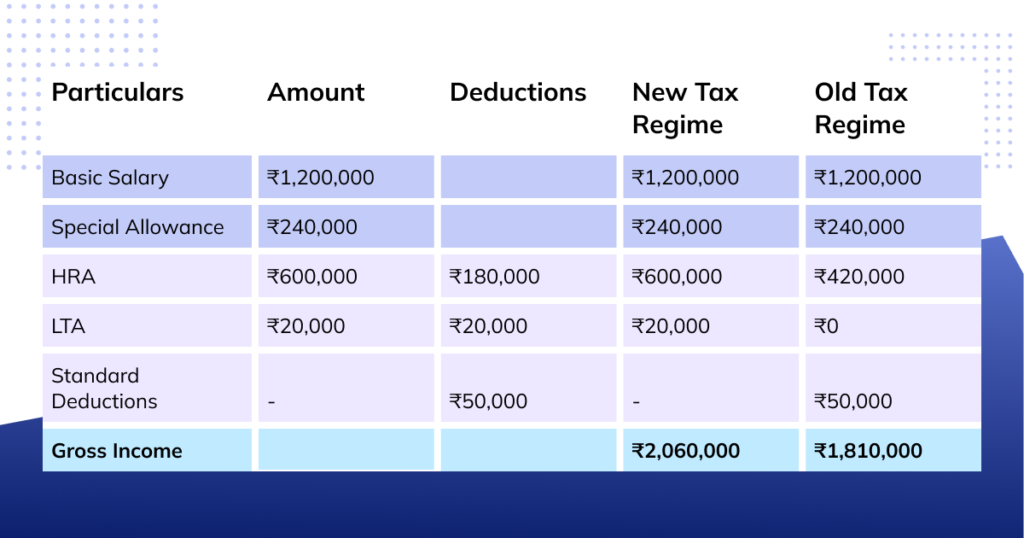

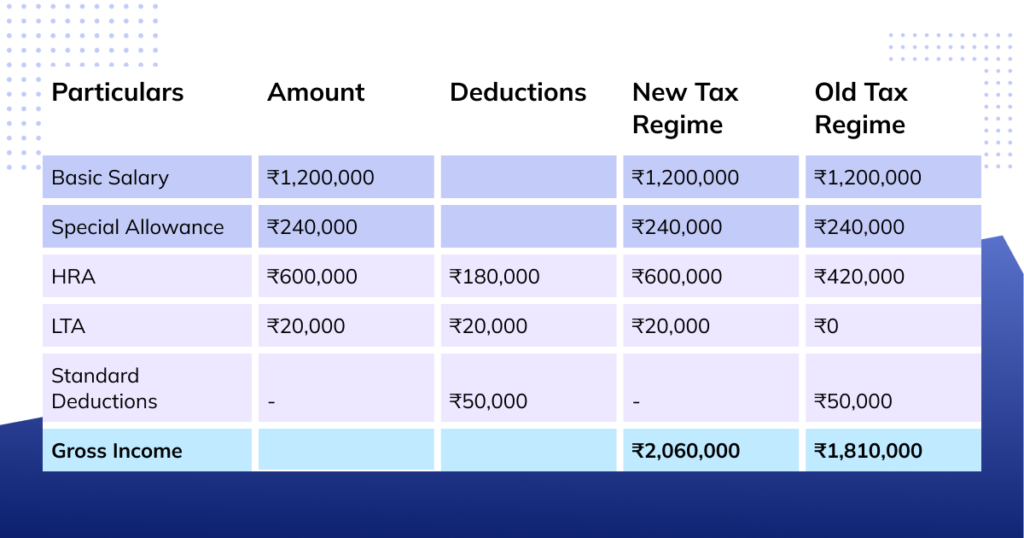

How is Income Tax Rebate Calculated To calculate the rebate 1 Calculate Gross Income Add up income from all sources like salary capital gains house rent and income from other sources 2 Find the Net Taxable Income Apply deductions under Section 80 to your gross income as applicable Use our income tax calculator to calculate tax payable on your income for FY 2024 25 old tax regime vs new tax regime as per Union Budget 2024 FY 2023 24 and FY 2022 23 in a few simple steps Check how much income tax you need to pay

The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will cover the eligibility steps to claim points to keep in mind while claiming the rebate Marginal Relief under section 87A of Income Tax Act 1961 for New Tax Regime u s 115BAC 1A Presently rebate is allowed u s 87A of Rs 12 500 in old regime of Income Tax if any resident individual whose total income during the

Download How Rebate Is Calculated In Income Tax

More picture related to How Rebate Is Calculated In Income Tax

How To Calculate Income Tax FY 2021 22 Excel Examples Income Tax

https://i.ytimg.com/vi/_bM1Y6-JXl4/maxresdefault.jpg

Rebate Calculations 101 How Are Rebates Calculated Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/63638715cda5ce39da72168b_Blog banners 2400x1348px3.png

How To Calculate Tax Rebate In Income Tax Of Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2017/08/Calculate-tax-rebate.jpg

Let us take a look at all the slab rates applicable for FY 2023 24 AY 2024 25 and FY 2024 25 AY 2025 26 Old Tax Regime For Old Regime a tax rebate up to Rs 12 500 is applicable if the total income does not exceed Rs 5 00 000 not applicable for NRIs New Tax Regime Tax Slab for FY 2023 24 Tax Rate A tax rebate on an income of Rs 7 lakh has been introduced in the new tax regime applicable for FY 2023 24 Rebate under Section 87A helps taxpayers to reduce their income tax liability You can claim the said rebate if your total income i e after Chapter VIA deductions does not exceed Rs 5 lakh under the old regime in FY 2023 24

How do you calculate tax rebates To calculate tax rebates Determine taxable income Calculate the income subject to taxation by subtracting exemptions and deductions from the gross income Exemptions Identify income items that are exempt from tax such as interest earned on tax saving instruments Rebate Applicability Old Tax Regime Rebate under Section 87A is available only if the taxable income is Rs 5 lakhs or less New Tax Regime The rebate is now applicable to individuals and HUFs with taxable income exceeding Rs 7 lakhs providing a marginal relief for those with incomes just above this threshold 2 Illustrative Examples

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

How To Calculate Tax Rebate In Income Tax Of Bangladesh BDesheba Com

https://bdesheba.com/wp-content/uploads/2023/02/Calculate-Tax-Rebate-in-Income-Tax-of-Bangladesh-725x405.jpg

https://tax2win.in › guide

Discover the income tax rebate available under Section 87A of the Income Tax Act Learn how to claim the 87A rebate eligibility criteria and the applicable rebate amount

https://www.etmoney.com › learn › income-tax › how-to...

Rebate under Sec 87A Tax rebate is a form of tax incentive provided by the government to individuals earning an income below a specified limit In case your total taxable income after deductions doesn t exceed Rs 5 lakh you

How To Activate Middle Class Tax Refund Card MCTR Payment Activate Card

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

How Is My Monthly Savings Rebate Calculated

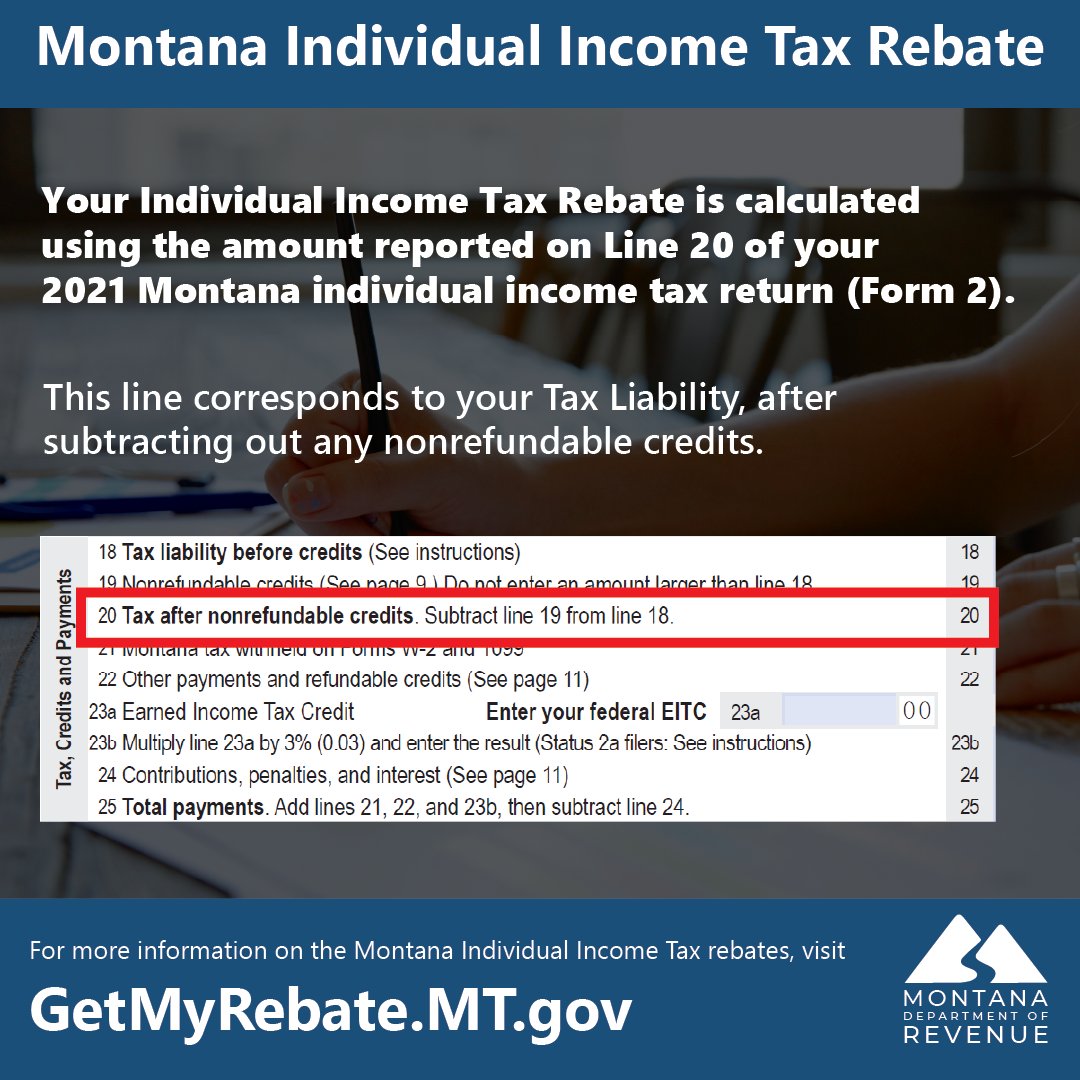

Montana Department Of Revenue On Twitter Your Individual Income Tax

Tax Formula Math

How Is Agricultural Income Tax Calculated With Example Updated 2022

How Is Agricultural Income Tax Calculated With Example Updated 2022

Tax Rebate For First Time Homeowners How To Claim Your Tax Rebate

How To Get Full Rebate On HRA In Income Tax

Income Tax Rebate Under Section 87A

How Rebate Is Calculated In Income Tax - Use our income tax calculator to calculate tax payable on your income for FY 2024 25 old tax regime vs new tax regime as per Union Budget 2024 FY 2023 24 and FY 2022 23 in a few simple steps Check how much income tax you need to pay