How To Account For Discounts Under Ifrs 15 Verkko 30 maalisk 2021 nbsp 0183 32 Discounts under IFRS 15 are recognized as using as a reference the performance obligations established in a contract and based on the independent sales prices of said obligations If

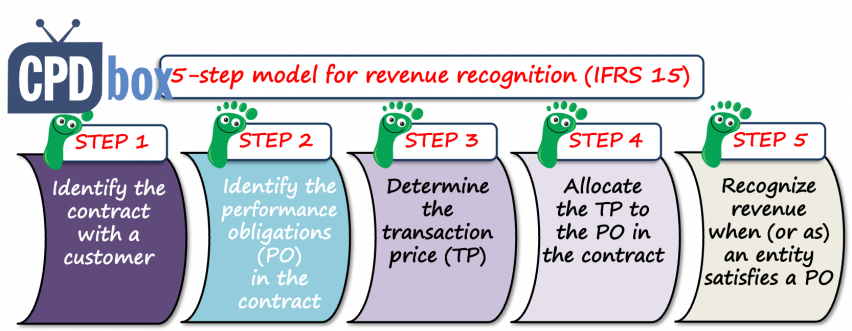

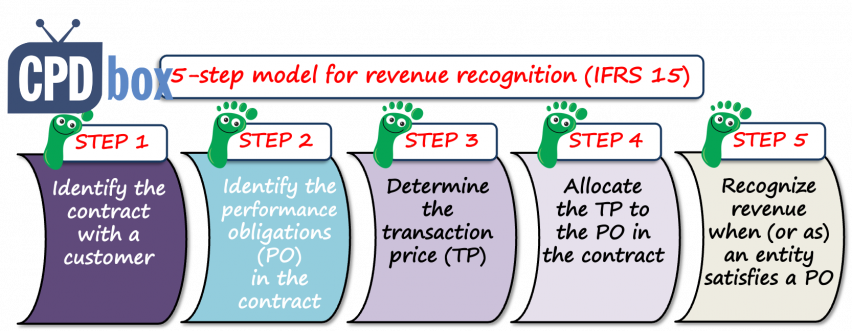

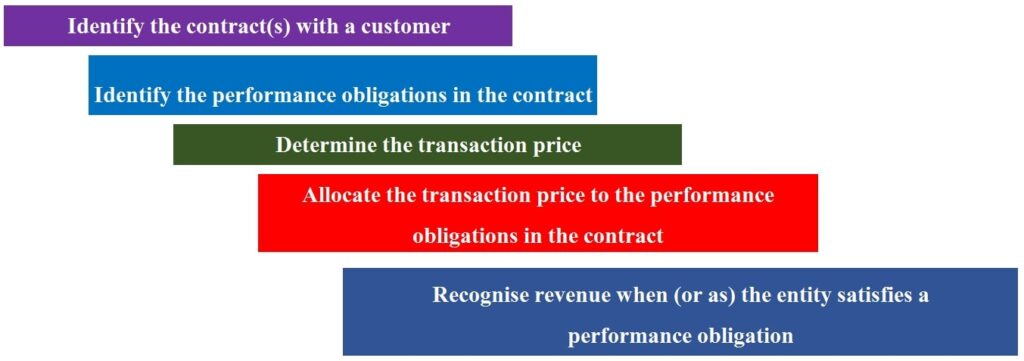

Verkko IFRS 15 considers there to be a five step approach when recognising revenue Step 1 Identify the contract with the customer Step 2 Identify the performance Verkko Under IFRS 15 can we recognise the full selling price of the service as revenue if it is offered for free e g Sign in now and get 2 months worth

How To Account For Discounts Under Ifrs 15

How To Account For Discounts Under Ifrs 15

https://i.ytimg.com/vi/G7UCcv3TOok/maxresdefault.jpg

5 Step Model For Revenue Recognition Under IFRS 15 Journal Entries

https://www.cpdbox.com/wp-content/uploads/5stepModelIFRS15-852x331.png

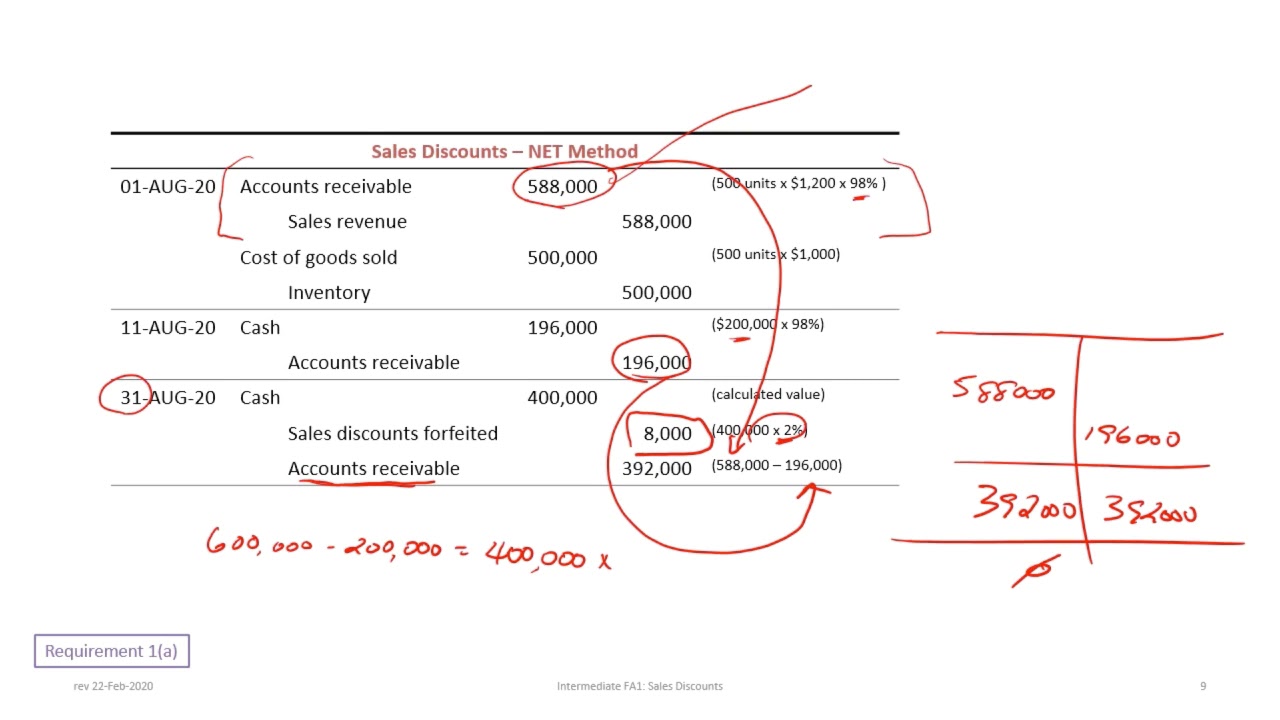

Accounting For Sales Discounts Gross And Net Methods Under IFRS And

https://i.ytimg.com/vi/qwKLX5sZ-sM/maxresdefault.jpg

Verkko How to Account for Customer Incentives under IFRS CPDbox Making IFRS Easy How to Account for Customer Incentives under IFRS by Silvia Revenue Recognition 46 Verkko 28 kes 228 k 2023 nbsp 0183 32 Entity A operates a customer loyalty programme Customers receive 5 loyalty points for every 100 worth of purchases Each point equates to 1 worth of

Verkko 18 lokak 2020 nbsp 0183 32 Here s how the updated approach to accounting for Discounts Allowed works with a simple example including the idea unexpected discounts allowed Verkko Paragraph B21 of IFRS 15 requires entities to account for sales with a right of return recognising all of the following a Revenue for the transferred products in the amount

Download How To Account For Discounts Under Ifrs 15

More picture related to How To Account For Discounts Under Ifrs 15

Understand How Discounts Allowed Works Under IFRS 15 ACCA Paper FA

https://i.ytimg.com/vi/6vbTZ8XVMq4/maxresdefault.jpg

IFRS 15 Revenue Recognition Certification Training

https://meritglobaltraining.com/backend/uploads/CeRTunm.jpeg

PDF The Adequacy Of IFRS 15 For Revenue Recognition In The

https://d3i71xaburhd42.cloudfront.net/79bd763adb42ff02b203d4ff5857aa9b5204cc45/9-Figure2-1.png

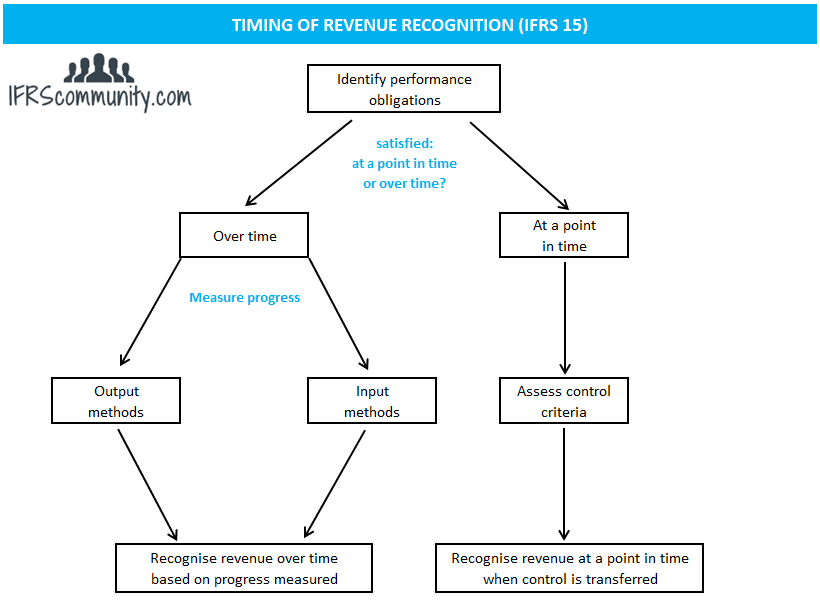

Verkko Any consideration received for a contract that does not meet the criteria is accounted for under the requirements in Section 1 3 IFRS 15 13 If a contract meets all of the criteria Verkko 1 lokak 2014 nbsp 0183 32 In addition to the five step model IFRS 15 sets out how to account for the incremental costs of obtaining a contract and the costs directly related to fulfilling a contract and provides guidance to assist entities in applying the model to licences warranties rights of return principal versus agent considerations

Verkko This article considers the application of IFRS 15 Revenue from Contracts with Customers and the impact it will have on accounting for prompt payment discounts it is most Verkko IFRS 15 specifies how and when an IFRS reporter will recognise revenue as well as requiring such entities to provide users of financial state 173 ments with more in 173 for 173 ma 173 tive

PDF The Adequacy Of IFRS 15 For Revenue Recognition In The

https://d3i71xaburhd42.cloudfront.net/79bd763adb42ff02b203d4ff5857aa9b5204cc45/2-Figure1-1.png

Performance Obligations IFRS 15 IFRScommunity

https://ifrscommunity.com/wp-content/uploads/IFRS-15-timing-of-revenue-recognition.png

https://www.ifrsmeaning.com/rebates-a…

Verkko 30 maalisk 2021 nbsp 0183 32 Discounts under IFRS 15 are recognized as using as a reference the performance obligations established in a contract and based on the independent sales prices of said obligations If

https://www.accaglobal.com/.../f3/technical-articles/discounts.html

Verkko IFRS 15 considers there to be a five step approach when recognising revenue Step 1 Identify the contract with the customer Step 2 Identify the performance

Revenue Accounting Principle IFRS 15 IFRS MEANING

PDF The Adequacy Of IFRS 15 For Revenue Recognition In The

IFRS 15 5 Step Model For Revenue Recognition Explained

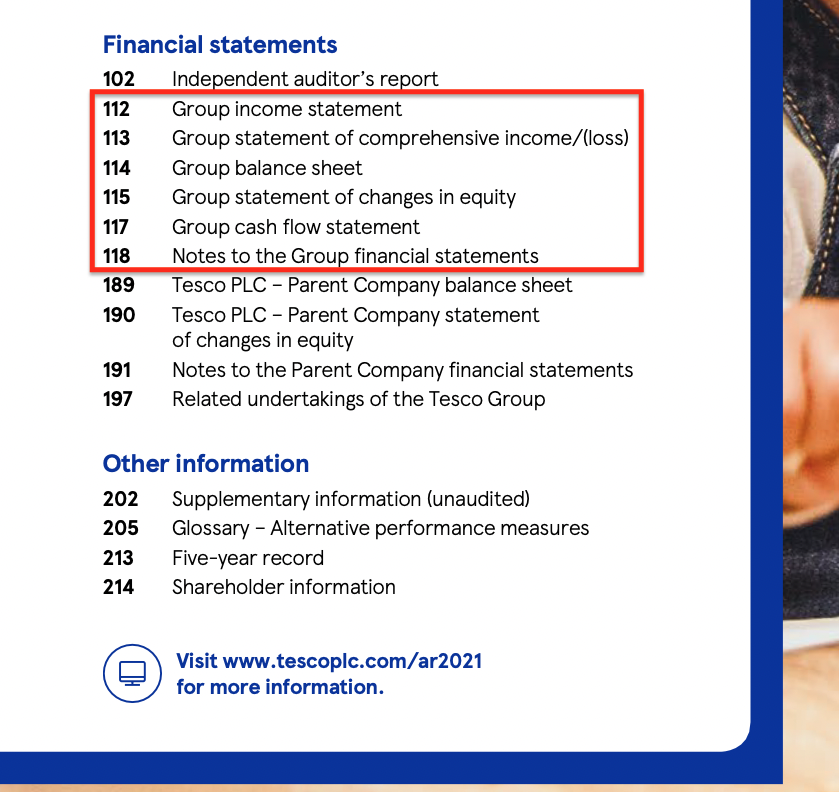

How To Write Notes To Financial Statements Under IFRS CPDbox Making

Implementing The New Revenue Standard IFRS 15 Revenue Recognition

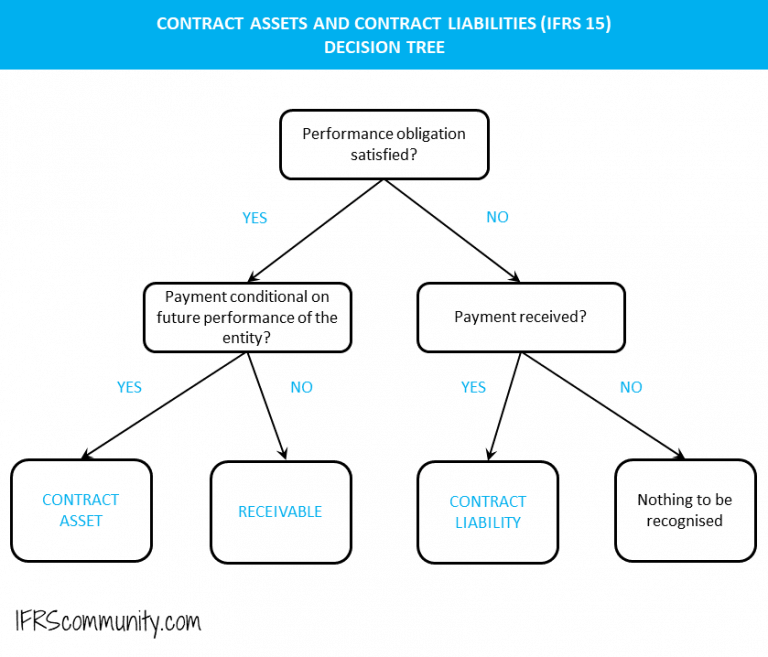

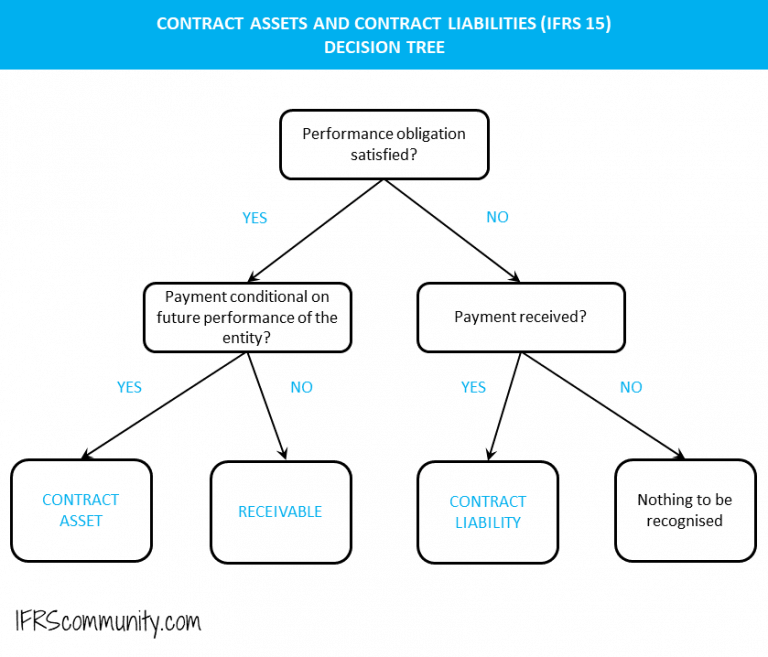

Contract Assets And Liabilities IFRScommunity

Contract Assets And Liabilities IFRScommunity

Information In The Income Statement Helps Users To Financial

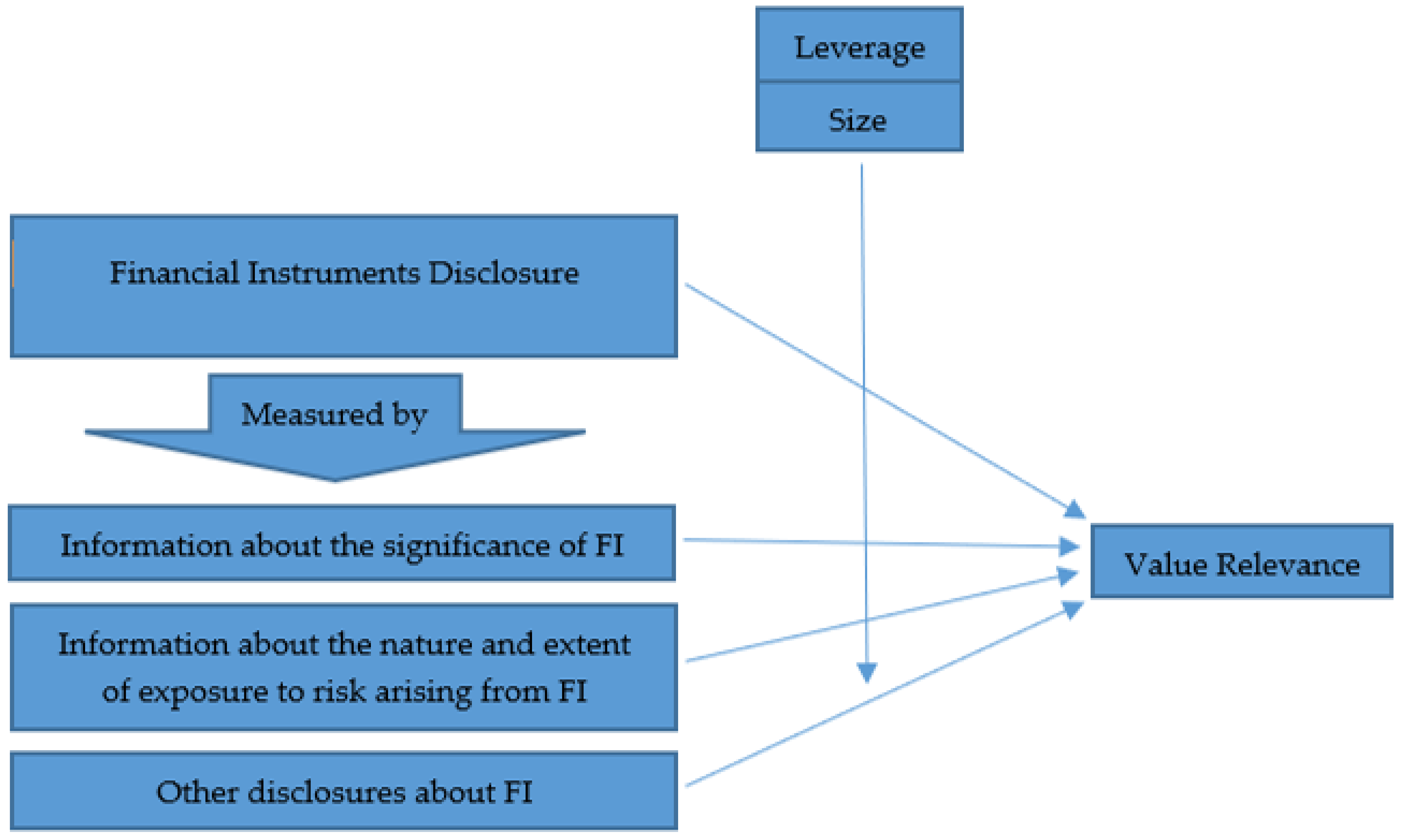

JRFM Free Full Text The Implication Of IFRS Financial Instruments

Accounting For Discounts Under IFRS CPDbox Making IFRS Easy

How To Account For Discounts Under Ifrs 15 - Verkko IFRS 15 outlines a single comprehensive model of accounting for revenue arising from contracts with customers What has changed IFRS 15 is a complex Standard