How To Account For Refunds In Accounting The refund money is transferred directly from the vendor to the company s bank account In this case the company ABC can make the journal entry for refund from vendor on October 15 by debiting the 1 000 into the bank account and crediting the same amount to the inventory account

Explore the accounting for refunds from returned inventory and PP E to rebates and rewards Learn key journal entries for the proper accounting treatment In this guide we ll provide a step by step walkthrough of how to handle refunds under GAAP covering everything from the basic definitions to practical examples and best practices What is a Refund in Accounting Terms A refund in accounting terms is a transaction where a business returns funds to a customer after the initial

How To Account For Refunds In Accounting

How To Account For Refunds In Accounting

https://www.coursehero.com/qa/attachment/14352054/

Tax Refund Tax Refund Journal Entry

http://www.principlesofaccounting.com/chapter12/warrantyje.png

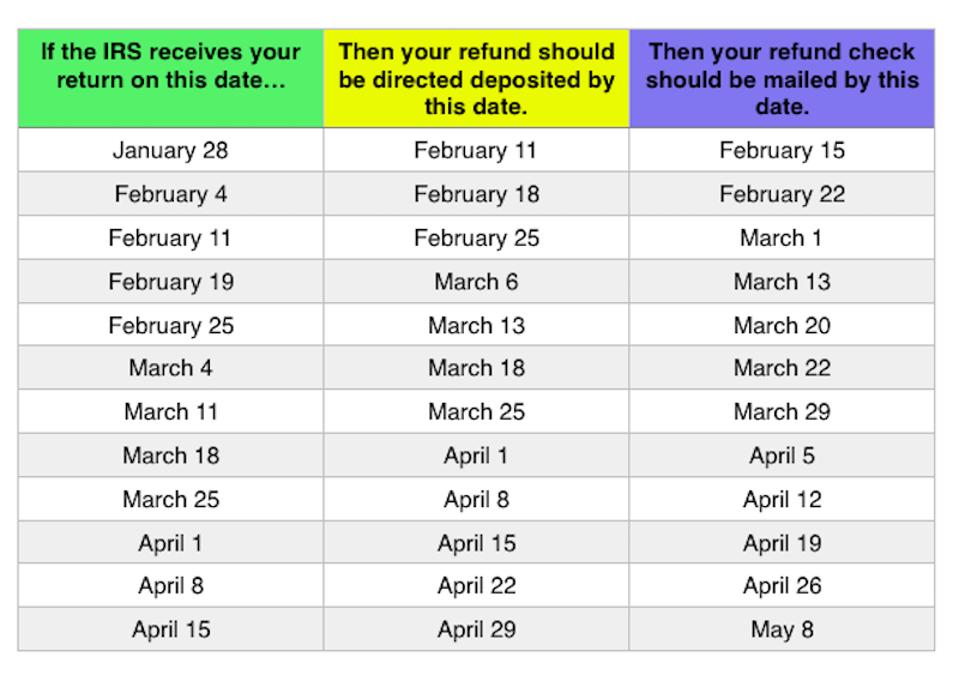

Where s My Refund Bill Brooks CPA

https://www.billbrookscpa.com/wp-content/uploads/2019/03/tax-return.jpg

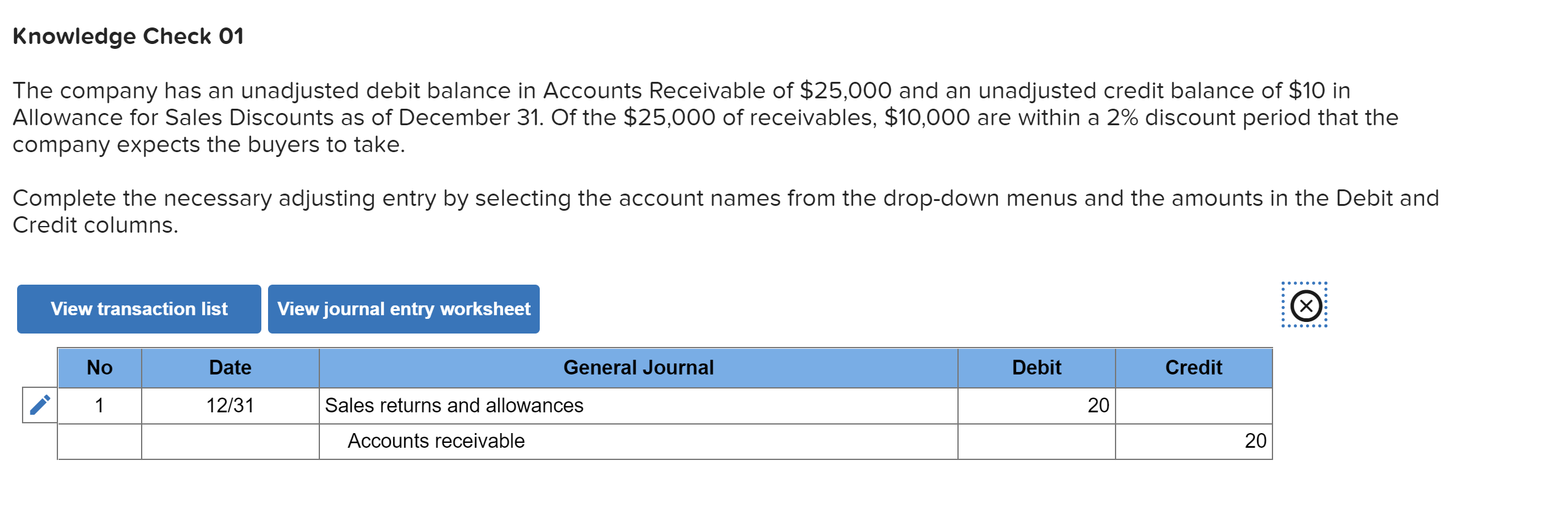

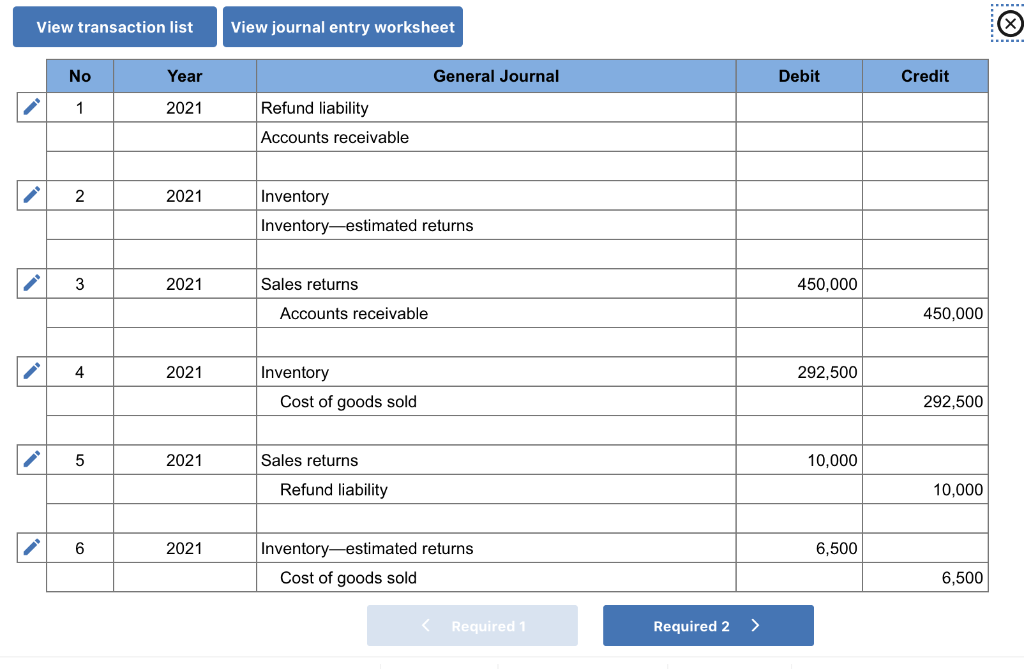

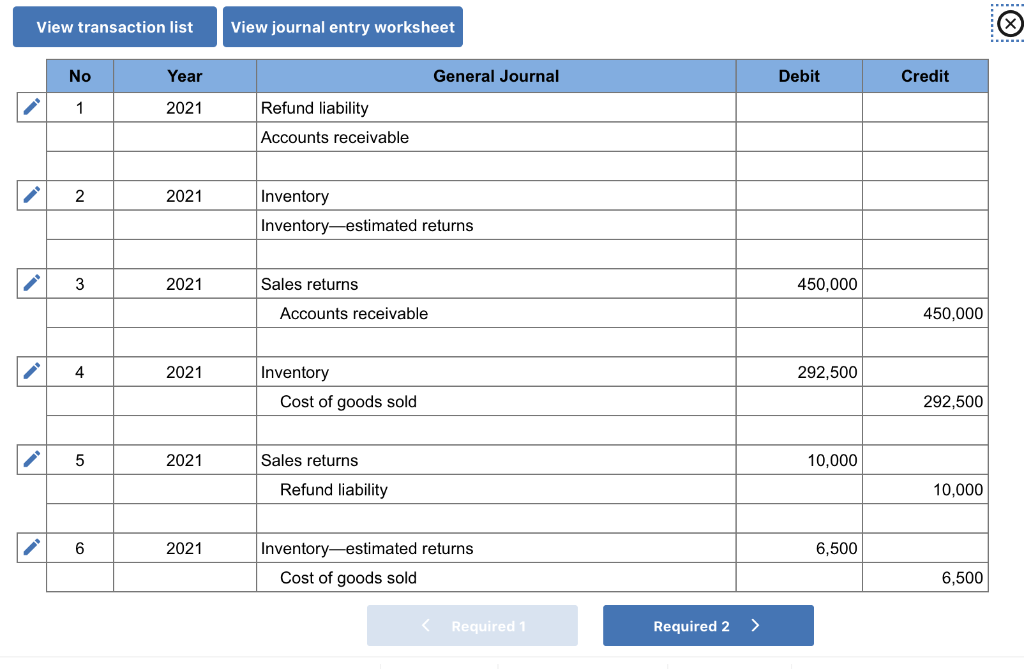

Today I m going to show you which accounts are involved in the accounting transaction to process a cash refund on a sales return I ll show the journal entries with and without sales tax And I ll also show how a cash refund affects the Inventory and Cost of Goods COGS accounts Accounting for refunds received is handled and reflected in financial statements in several ways Use The Appropriate Account Using the appropriate account in the general ledger keeps your records in balance and explains where the cash flow is going A contra revenue account is the most appropriate when dealing with a sales return

Proper accounting treatment for returns and refunds is fundamental to maintaining accurate financial records This involves both the correct journal entries and comprehensive documentation for every transaction Record a customer or supplier refund on a credit note overpayment or prepayment Reconcile a refund against a bank statement line If you don t want to issue or receive a refund you can apply the payment to an invoice or bill instead

Download How To Account For Refunds In Accounting

More picture related to How To Account For Refunds In Accounting

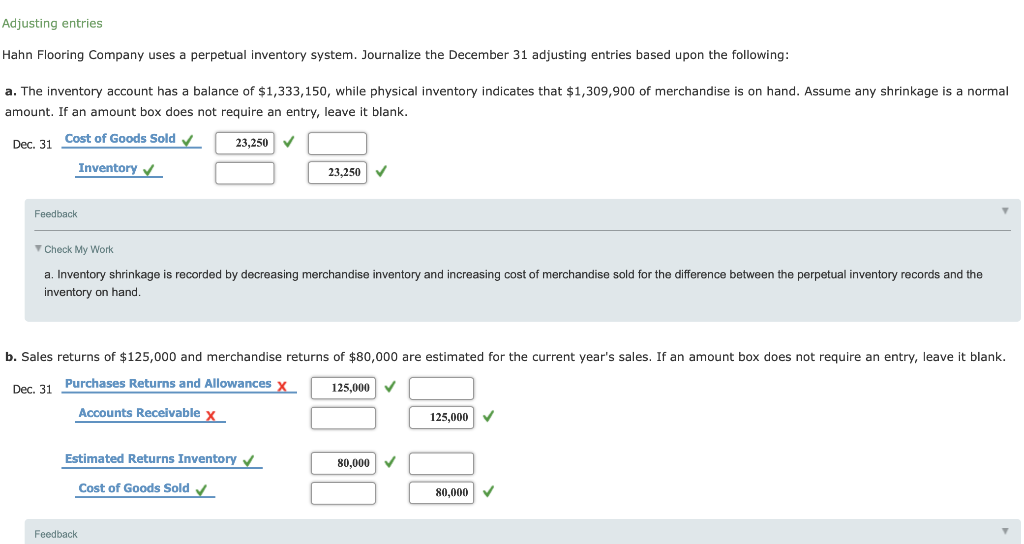

Solved Adjusting Entries Hahn Flooring Company Uses A Chegg

https://media.cheggcdn.com/media/194/194c8ff4-7b8b-49f9-af31-85b7d487a820/phpOZjWzD.png

Refund Email 4 Examples

https://global-uploads.webflow.com/5f6fde4c74a4afd8fb269414/63d05b8dc9b3c4134909f797_How to write a refund email with 4 samples.png

Solved A Company Uses A Periodic Inventory System And During Chegg

https://media.cheggcdn.com/media/b1d/b1df23b9-90ca-450e-b33d-0ea9d86f9909/php3gAVp4

In this article we will cover the various steps that need to be followed in order to successfully record a refund from a supplier in accounting By following these simple steps you can ensure that your refund is correctly reflected in your books and records The Financial Accounting Standards Board FASB has outlined how to account for refunds under the Generally Accepted Accounting Principles GAAP How a purchase was made how a customer receives a refund and other factors all affect the way a return is recorded in the books

[desc-10] [desc-11]

Solved Exercise 7 8 Sales Returns L07 4 Halifax Chegg

https://media.cheggcdn.com/media/9f7/9f70129b-9fc5-40cf-978e-616cf2c84be4/php8SKCSH.png

How To Account For Customer Returns Accounting Guide Simplestudies

https://simplestudies.com/repository/lectures/sales_slip.png

https://accountinguide.com/journal-entry-for-refund-from-vendor

The refund money is transferred directly from the vendor to the company s bank account In this case the company ABC can make the journal entry for refund from vendor on October 15 by debiting the 1 000 into the bank account and crediting the same amount to the inventory account

https://www.sadaccountant.com/journal-entry-for...

Explore the accounting for refunds from returned inventory and PP E to rebates and rewards Learn key journal entries for the proper accounting treatment

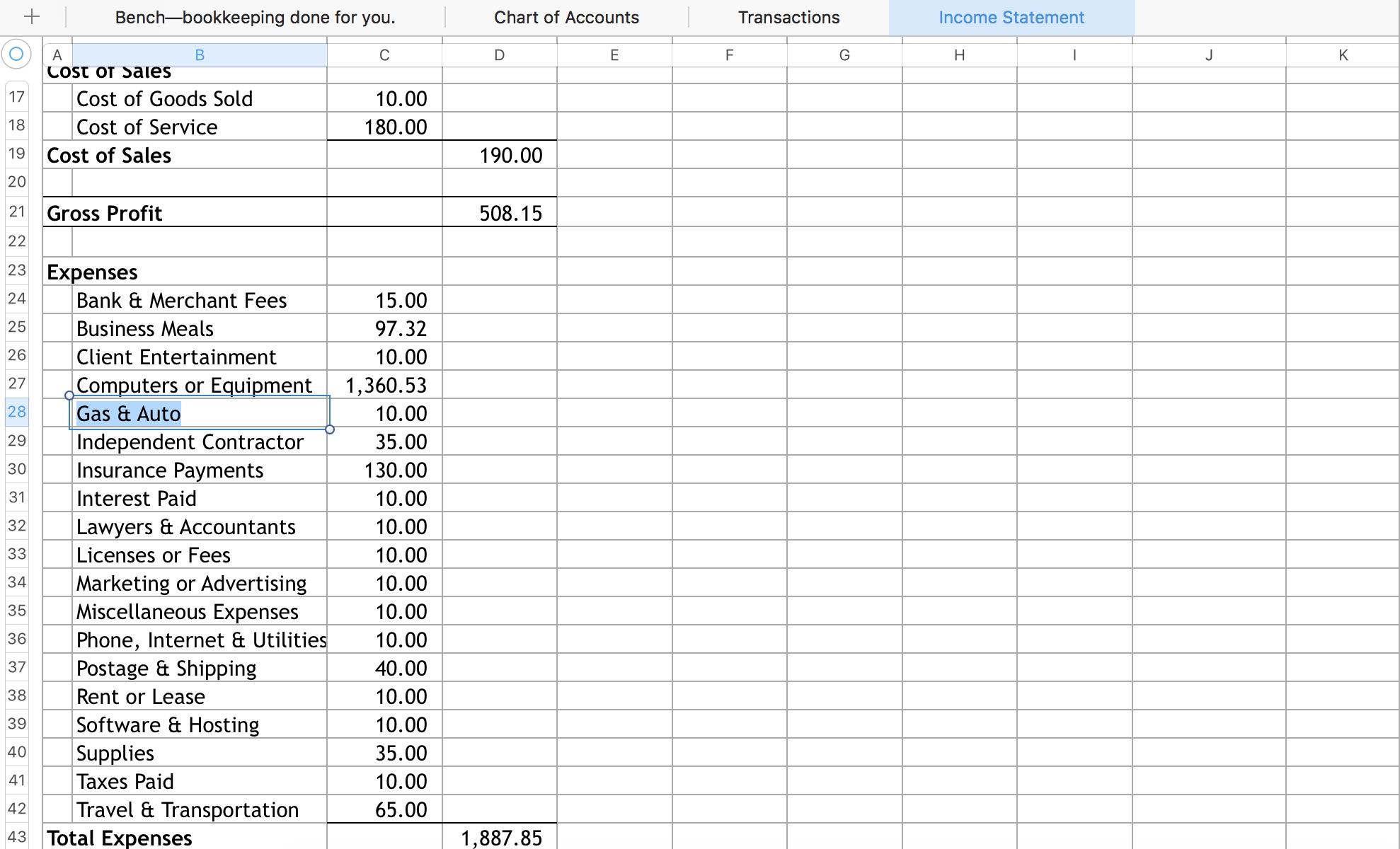

Excel Accounting And Bookkeeping Template Included Bench Accounting

Solved Exercise 7 8 Sales Returns L07 4 Halifax Chegg

Where Is My Refund 2019 How Long Does It Take IRS To Process Taxes

Return Policy Template Word

All Sales Are Final No Returns Or Refunds Buying Rules Restrictions

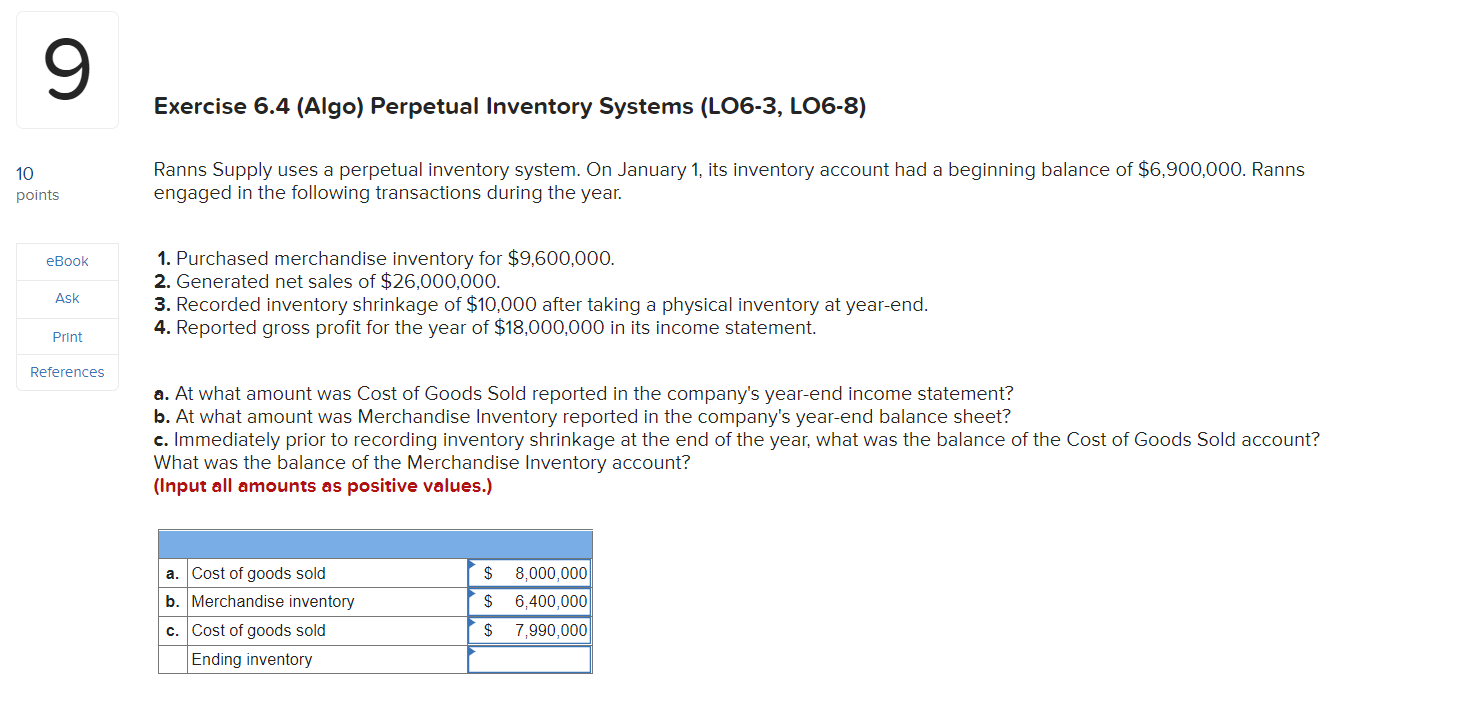

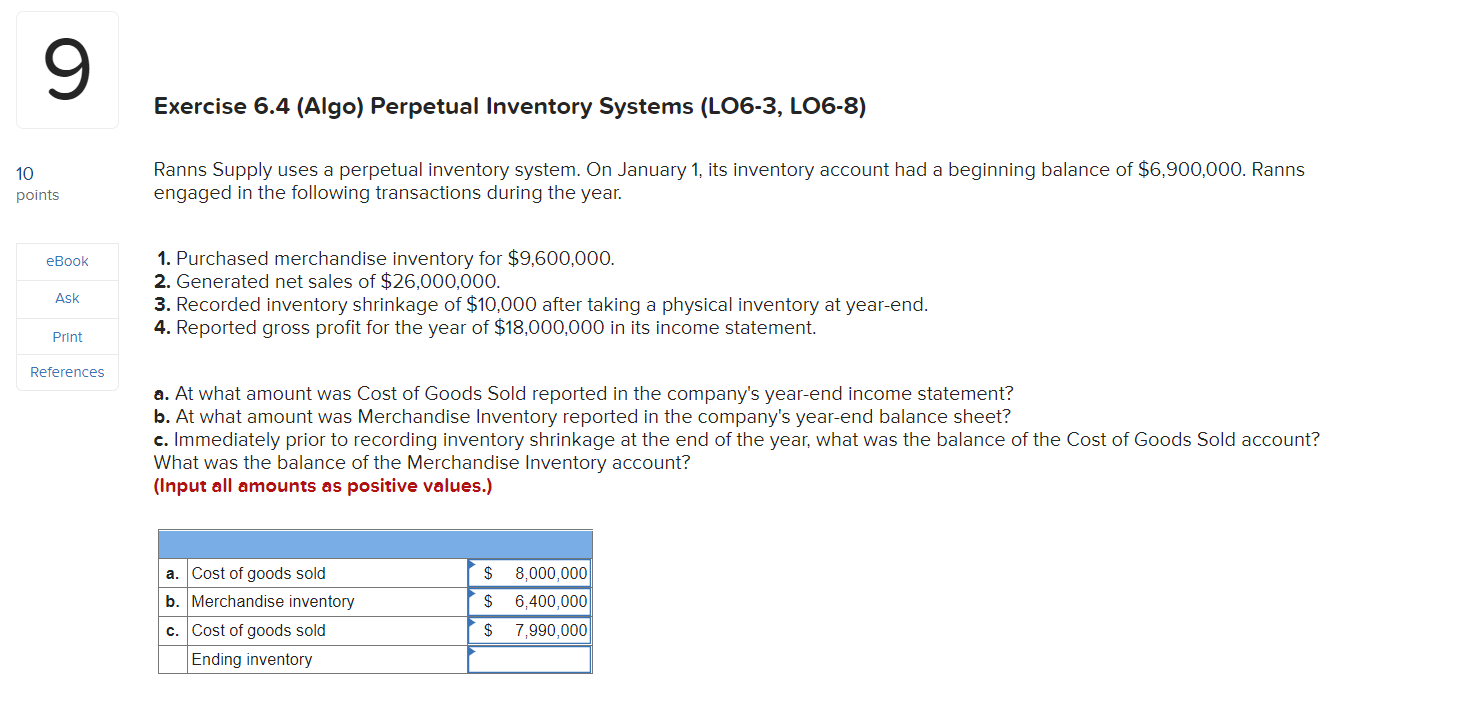

Solved 9 Exercise 6 4 Algo Perpetual Inventory Systems Chegg

Solved 9 Exercise 6 4 Algo Perpetual Inventory Systems Chegg

2019 Tax Refund Chart Can Help You Guess When You ll Receive Your Money

Why Is My Federal Refund Lower Than Last Year The Daily CPA

General Journal Entries Accounting

How To Account For Refunds In Accounting - Proper accounting treatment for returns and refunds is fundamental to maintaining accurate financial records This involves both the correct journal entries and comprehensive documentation for every transaction