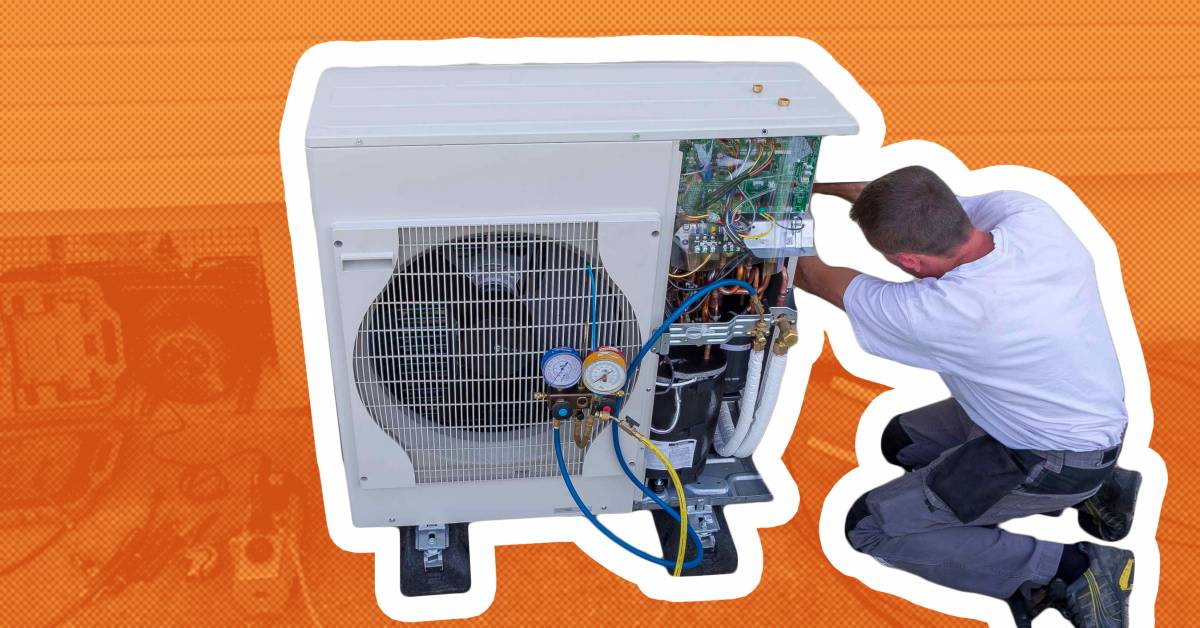

How To Apply For Heat Pump Tax Credit Heat pumps and biomass stoves and boilers with a thermal efficiency rating of at least 75 qualify for a credit Qualified improvements include new Costs may include labor for

Read on to learn why you might want to consider installing a heat pump in your home the tax credits that may help make it possible and how you can go about applying Learn how to claim tax credits for energy improvements to your home including heat pumps solar panels and insulation Find out the eligibility requirements credit amounts and

How To Apply For Heat Pump Tax Credit

How To Apply For Heat Pump Tax Credit

https://www.raysplumbinginc.com/wp-content/uploads/tax-credits-2023-social.png

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

https://www.symbiontairconditioning.com/wp-content/uploads/2020/06/money-ac-graphic-2.png

Federal Tax Credits For Air Conditioners Heat Pumps 2023

https://kobiecomplete.com/wp-content/uploads/2023/01/federal-tax-credits-2023-graphic-white.png

Claim the credits using the IRS Form 5695 What products are eligible Heat pump water heaters that have earned the ENERGY STAR are eligible for this credit Is placed into service initially used by the taxpayer making the expenditure and Meets the energy efficiency requirements Qualified energy property is Electric or natural gas heat pump water heater 30 percent of the

Tax credits covering 30 of the project costs will be available for qualifying improvements to your primary residence through 2032 For an ENERGY STAR Home Upgrade this would apply to the heat pump for heating Here s a step by step guide to help you claim your heat pump tax credit Step 1 Determine Your Eligibility Ensure you meet the eligibility criteria Verify that your heat pump meets the energy efficiency requirements and check if you qualify

Download How To Apply For Heat Pump Tax Credit

More picture related to How To Apply For Heat Pump Tax Credit

300 Federal Tax Credits For Air Conditioners And Heat Pumps 2022

https://www.symbiontairconditioning.com/wp-content/uploads/2023/01/tax-credit-2023-1024x536.png

How To Take Advantage Of The Heat Pump Tax Credit

https://media.marketrealist.com/brand-img/QX3ShkFit/1600x837/heat-pump-1-1660837497727.jpg?position=top

How To Take Advantage Of The Heat Pump Tax Credit

https://media.marketrealist.com/brand-img/bjAd12-bt/1024x536/heat-pump-2-1660837533114.jpg

To apply for the heat pump tax credit you ll simply need to indicate that you purchased and installed a qualifying heat pump HVAC system or heat pump water heater within the tax year and provide required information Starting in 2023 you are eligible for an annual tax credit of 2 000 for qualifying heat pumps and heat pump water heaters under the new tax guidelines included in the Inflation Reduction Act

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air A taxpayer may claim the credit for a home energy audit of a home the taxpayer rents Due to the principal residence requirement a taxpayer may not claim the credit for a

300 Federal Tax Credit For Heat Pumps Alaska Heat Smart

https://akheatsmart.org/wp-content/uploads/2022/04/heat-pump-indoor_300.jpg

How To Earn Tax Credits On A Geothermal Heat Pump In 2023 Reliant

https://reliant.team/wp-content/uploads/black-woman-doing-bills.jpg

https://www.irs.gov › credits-deductions › how-to...

Heat pumps and biomass stoves and boilers with a thermal efficiency rating of at least 75 qualify for a credit Qualified improvements include new Costs may include labor for

https://www.forbes.com › ... › hvac › heat-…

Read on to learn why you might want to consider installing a heat pump in your home the tax credits that may help make it possible and how you can go about applying

Heat Pump Tax Credits And Rebates Now Available For Homeowners Moneywise

300 Federal Tax Credit For Heat Pumps Alaska Heat Smart

Tax Credits Offered For Heat Pump Installation YouTube

300 Federal Water Heater Tax Credit 2022 And Earlier Ray s

Tax Credits Offered For Heat Pump Installation YouTube

2023 Heat Pump Tax Credit What You Need To Know Flotechs Plumbing

2023 Heat Pump Tax Credit What You Need To Know Flotechs Plumbing

How To Use 2023 s New Heat Pump Tax Credits

New Electric Heat Pump Tax Credits Climate Control

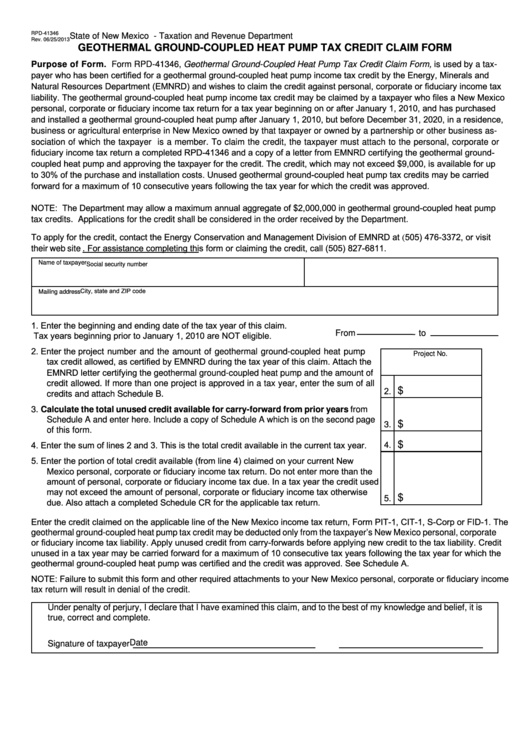

Form Rpd 41346 Geothermal Ground Coupled Heat Pump Tax Credit Claim

How To Apply For Heat Pump Tax Credit - How do you claim the tax credit for your heat pump Once you ve established that your heat pump is eligible for a federal tax credit you can use IRS Form 5695 Residential