How To Apply For Senior Tax Exemption Earned income includes pay from employment as well as pensions and benefits Your exact tax rate depends on your annual income home municipality

The tax card indicates your tax rate or how much tax you will pay on your income If your income or deductions change your tax rate may be too high or too low If this happens Customers can get information about taxation in Finland and apply for a tax card IHH also provides consultation and guidance for employers on matters related to

How To Apply For Senior Tax Exemption

How To Apply For Senior Tax Exemption

https://rossum.ai/use-cases/img/illust/documents/sales_tax_exemption_certificate.png

Power Finance Corporation Recruitment 2022 For 22 Posts Check Posts

https://studycafe.in/wp-content/uploads/2022/09/PFC-Recruitment-2022.jpg

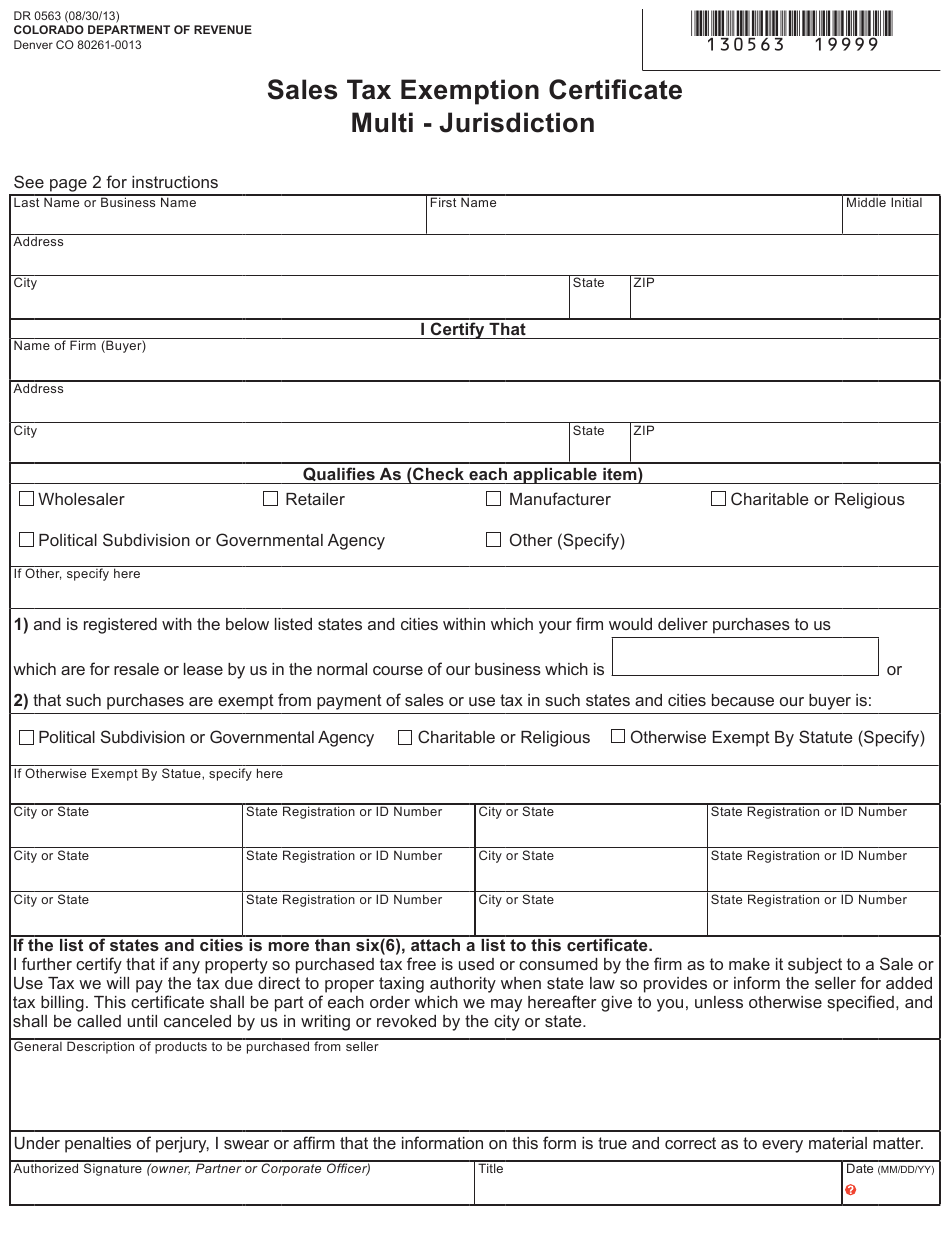

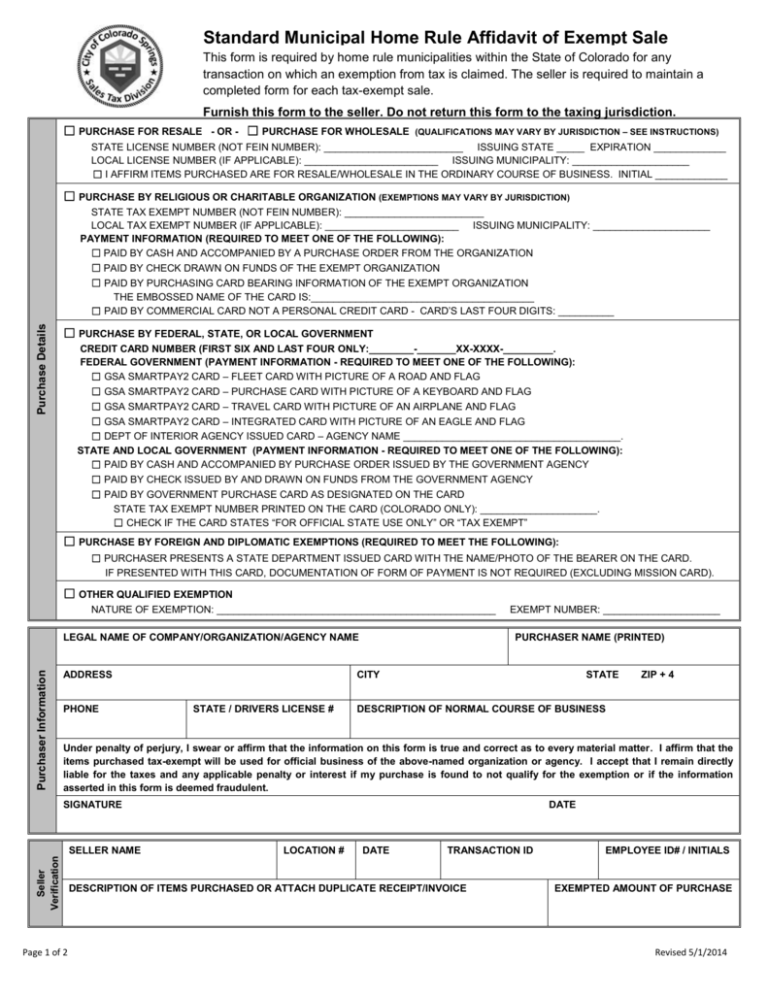

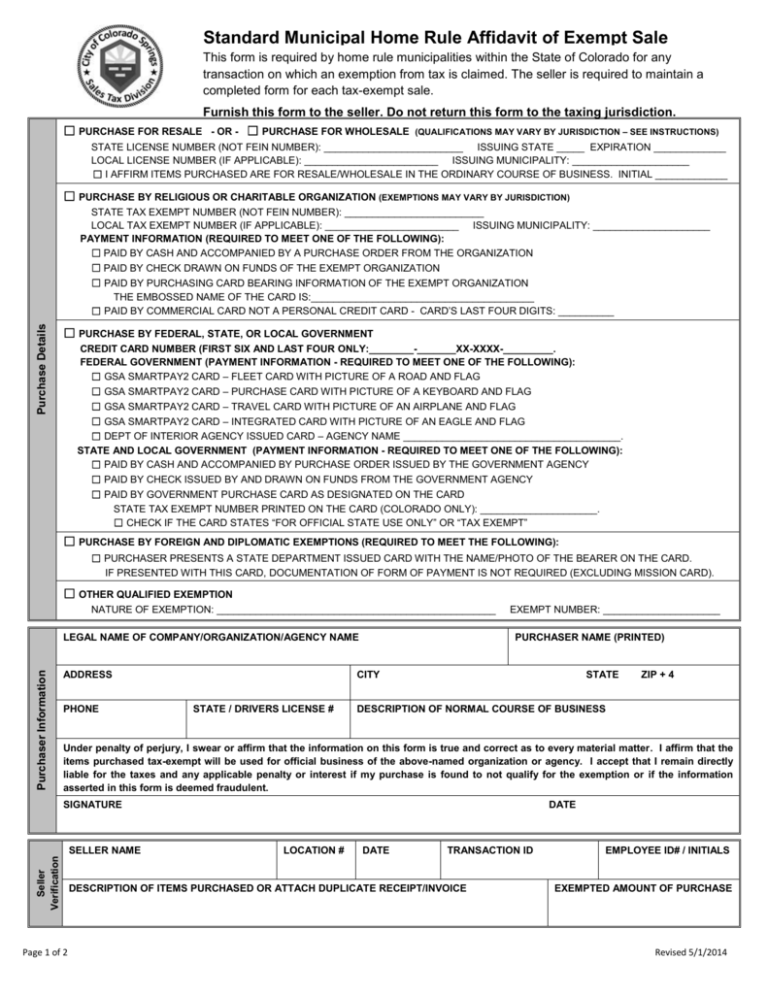

How To Get A Sales Tax Exemption Certificate In Colorado ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/form-dr0563-download-fillable-pdf-or-fill-online-sales-tax-exemption-3.png

If your home was eligible for the Homeowner Exemption for past tax years including 2023 2022 2021 2020 or 2019 and the exemption was not applied to your property tax bill Learn what a property tax exemption for seniors is how it works and how to qualify for one Find out the eligibility criteria application process and examples by

LOUIS COUNTY Mo If you re at least 62 years old and live in St Louis County you could be eligible for the Senior Property Tax Freeze program Applications LOUIS COUNTY Mo Residents can start applying for St Louis County s senior property tax freeze program as the application portal opened this week The

Download How To Apply For Senior Tax Exemption

More picture related to How To Apply For Senior Tax Exemption

County Legislature Increases Senior Citizen Tax Exemption Rodney J

https://www.rodneyjstrange.com/wp-content/uploads/2019/05/Elderly-Tax-Exemption-1.jpg

Application Letter For Tax Exemption PDF

https://imgv2-1-f.scribdassets.com/img/document/326384257/original/11b6a58523/1627289253?v=1

Tax Exempt Form Tn Fill And Sign Printable Template Online Bank2home

https://www.signnow.com/preview/1/649/1649273/large.png

Eligible individuals or families can get free help preparing their tax return at Volunteer Income Tax Assistance VITA or Tax Counseling for the Elderly TCE sites Applying for more than one year You can apply for a property tax exemption for 2024 2023 2022 and 2021 You will need to fill out a separate application for each year

This exemption provides a reduction of up to 50 in the assessed value of the residence of the eligible disabled person s Those municipalities that opt to offer the exemption Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying senior citizens This is

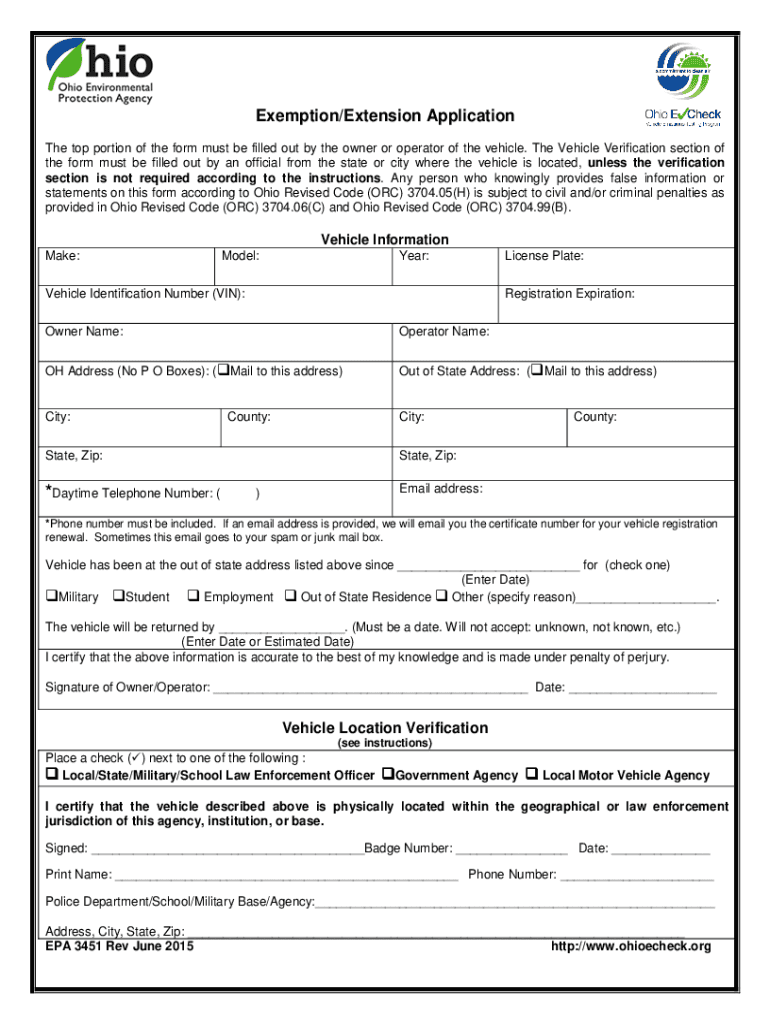

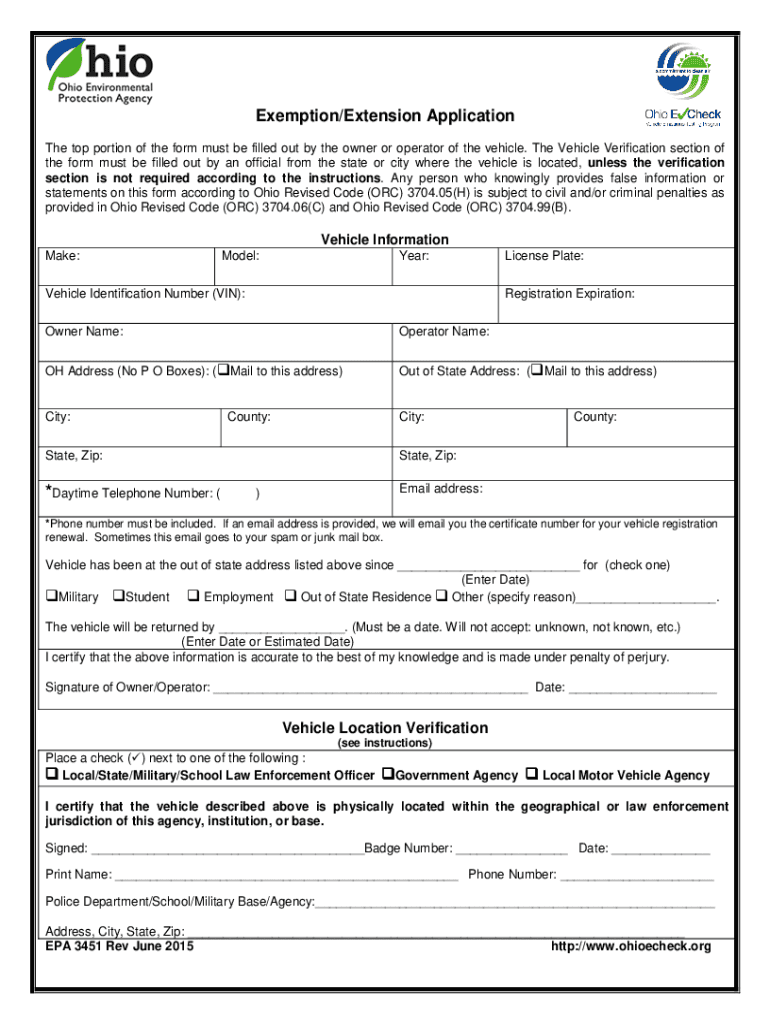

For The Tax Exempt In Ohio 2015 2023 Form Fill Out And Sign Printable

https://www.signnow.com/preview/468/833/468833564/large.png

Illinois Tax Exempt Certificate Five Mile House

https://images.squarespace-cdn.com/content/v1/58cf3fa8e6f2e19aff948d4c/1593946918567-M3LZJC3J24BR72W9BKW6/Sales+Tax+Certificate.jpg

https://www.vero.fi/en/individuals/tax-cards-and...

Earned income includes pay from employment as well as pensions and benefits Your exact tax rate depends on your annual income home municipality

https://www.vero.fi/en/individuals/tax-cards-and-tax-returns/tax_card

The tax card indicates your tax rate or how much tax you will pay on your income If your income or deductions change your tax rate may be too high or too low If this happens

Low income Seniors May Apply For Special Property Tax Exemption

For The Tax Exempt In Ohio 2015 2023 Form Fill Out And Sign Printable

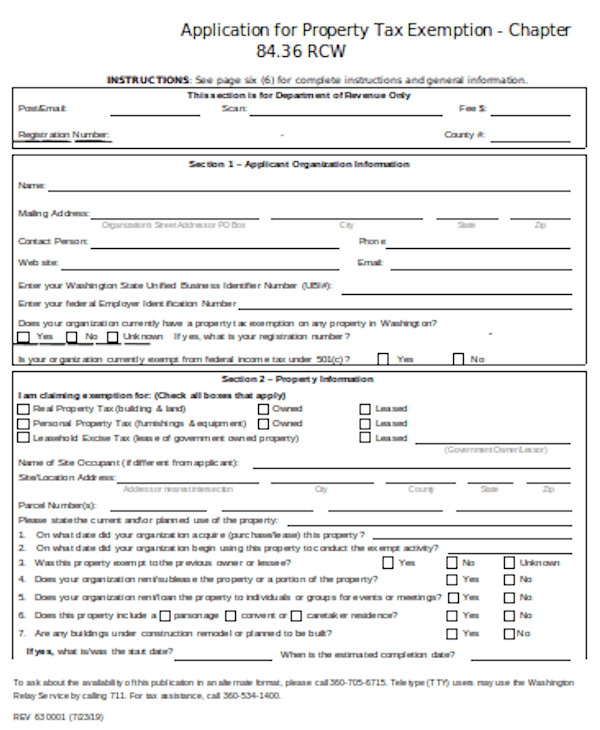

Exemption Applications Fill Out Sign Online DocHub

Fillable Form Ab 30p Personal Property Tax Exemption Application

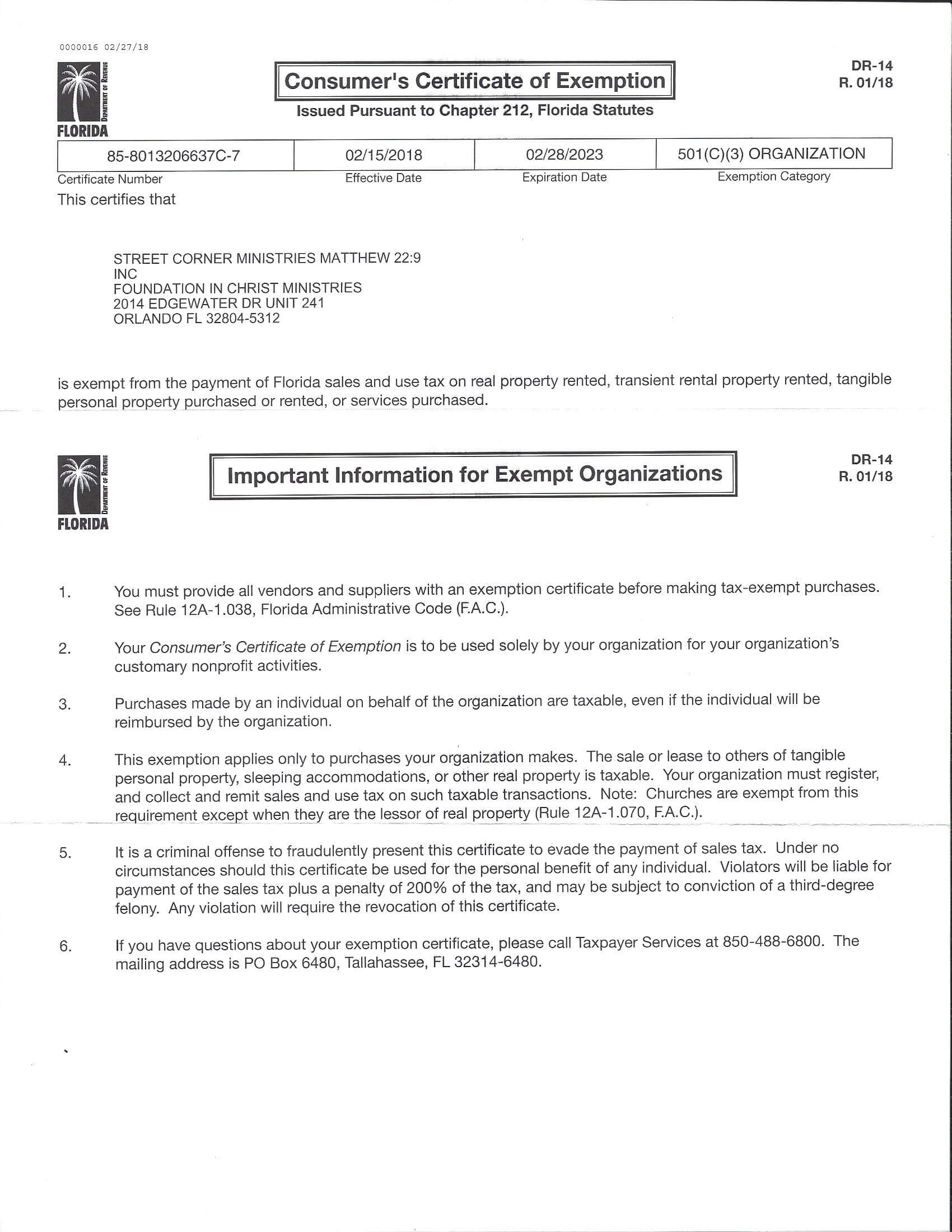

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

New Tax Exempt Form

New Tax Exempt Form

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

Jefferson County Property Tax Exemption Form ExemptForm

Blessings Images And Quotes

How To Apply For Senior Tax Exemption - If your home was eligible for the Homeowner Exemption for past tax years including 2023 2022 2021 2020 or 2019 and the exemption was not applied to your property tax bill