How To Be Eligible For Child Tax Credit Key Takeaways There are seven qualifying tests to determine eligibility for the Child Tax Credit age relationship support dependent status citizenship length of residency and family income If you aren t able to claim the Child Tax Credit for a dependent they might be eligible for the Credit for Other Dependent

To qualify for the refundable version of the child tax credit filers must earn at least 2 500 In tax years 2024 and 2025 the taxes filed in 2025 and 2026 filers could opt to use Child Tax Credit The Child Tax Credit is given to taxpayers for each qualifying dependent child who is under the age of 17 at the end of the tax year Currently it s a 1 000 nonrefundable

How To Be Eligible For Child Tax Credit

How To Be Eligible For Child Tax Credit

https://www.the-sun.com/wp-content/uploads/sites/6/2021/11/KB_COMP_child-tax-credit-ctc-2.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

2023 2024 Child Tax Credit Schedule 8812 H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

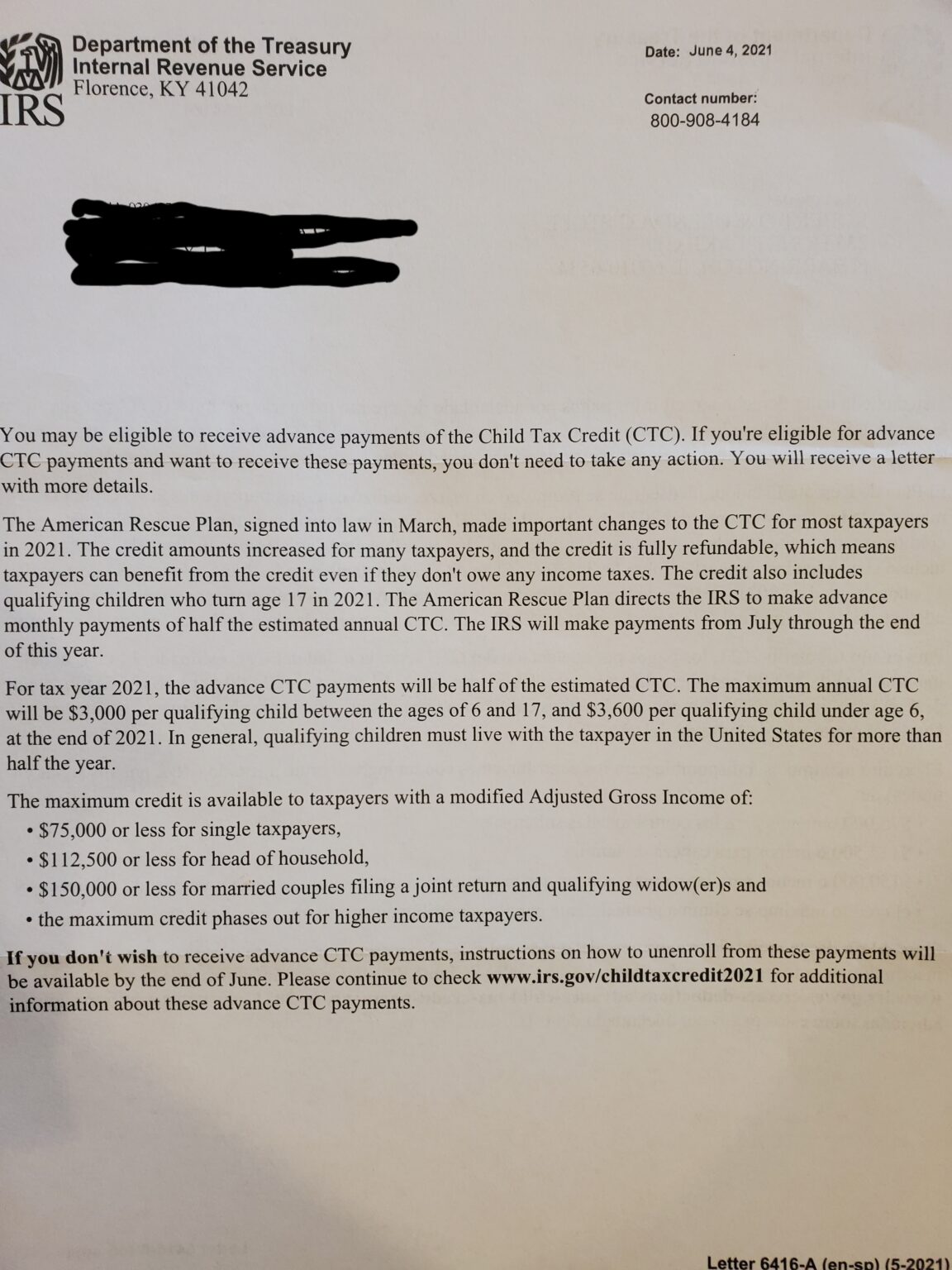

If you are eligible for the Child Tax Credit but did not receive advance Child Tax Credit payments you can claim the full credit amount when you file your 2021 tax return during the 2022 tax filing season Overview You can only make a claim for Child Tax Credit if you already get Working Tax Credit If you cannot apply for Child Tax Credit you can apply for Universal Credit instead You

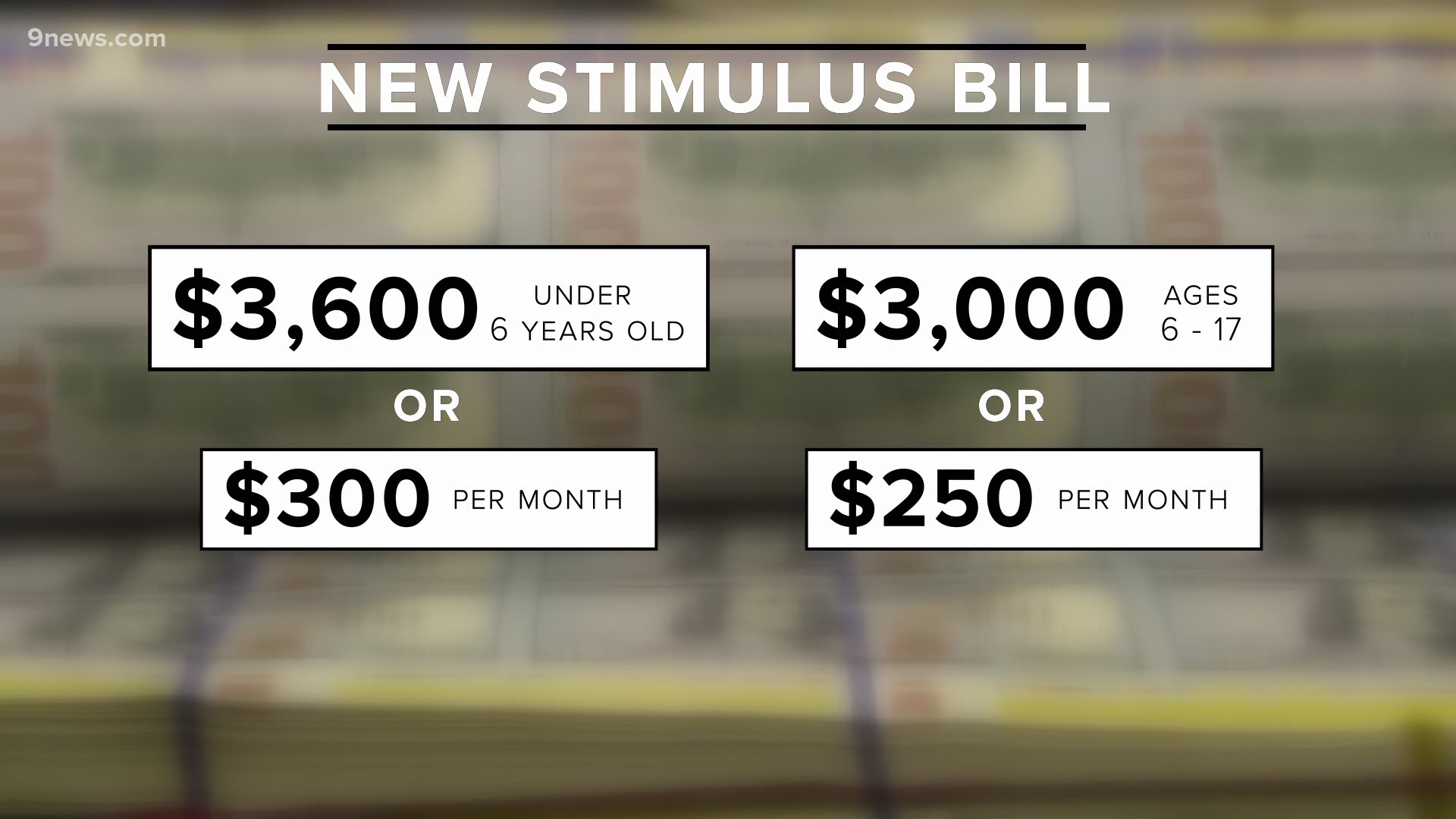

It offers a free and easy way for eligible people who don t normally have to file taxes to provide the IRS the basic information needed name address and Social Security numbers to figure and issue advance child tax credit payments Published June 25 2021 Updated Sept 21 2021 In about three weeks millions of American families will receive the first of six monthly payments of up to 300 per child from the federal

Download How To Be Eligible For Child Tax Credit

More picture related to How To Be Eligible For Child Tax Credit

2022 Education Tax Credits Are You Eligible

https://www.taxdefensenetwork.com/wp-content/uploads/2022/11/2022-Education-Credits-Comparison-scaled.jpg

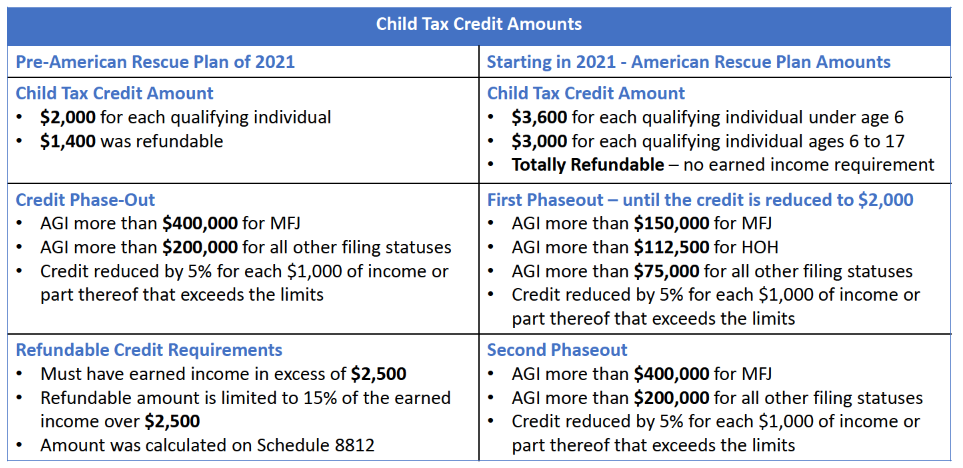

2021 Changes To Child Tax Credit Support

https://support.taxslayerpro.com/hc/article_attachments/4410684614938/mceclip0.png

Child Tax Credit

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

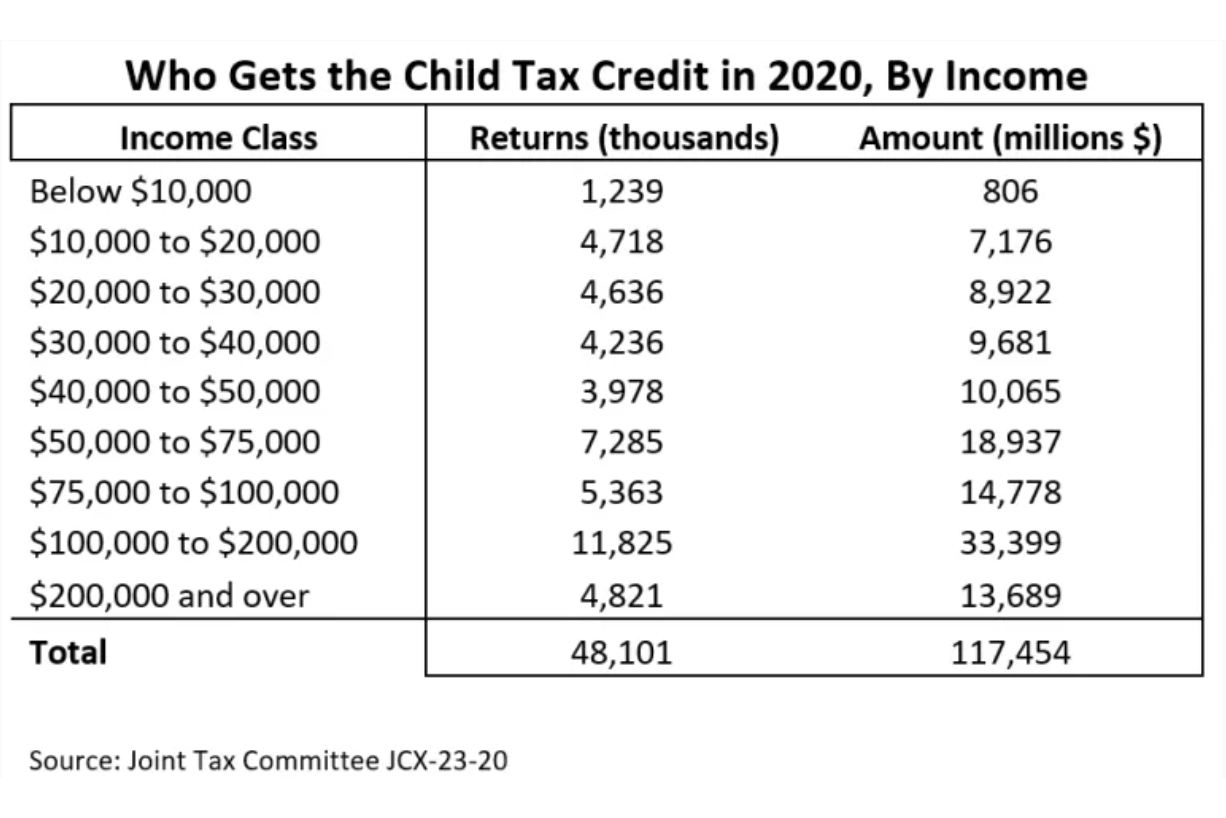

Your eligibility depends on your income the child s age how you are related to the child and other factors Learn how the Child Tax Credit works if you qualify how to claim it and what additional credits you may be able to claim If you re a taxpayer who claims a child as a dependent you may qualify for the credit up to 2 000 per child In 2019 the average CTC benefit was about 2 380 ranging from 619 for those

Are you eligible for the child tax credit More than 96 of families with children 17 and younger are eligible for the child tax credit The IRS interactive eligibility assistant The American Rescue Plan increased the Child Tax Credit from 2 000 per child to 3 000 per child for children over the age of six and from 2 000 to 3 600 for children under the age of

2021 Child Tax Credit Advances Payment Schedule Atlanta CPA

https://www.wilsonlewis.com/wp-content/uploads/2021/06/Child-Tax-Credit.jpg

Do You Have To Pay Back The Child Tax Credit In 2022 Leia Aqui Will

https://static01.nyt.com/images/2022/12/14/upshot/14up-child-tax-credit-promo-promo/14up-child-tax-credit-promo-promo-mediumSquareAt3X.png

https://turbotax.intuit.com/tax-tips/family/7...

Key Takeaways There are seven qualifying tests to determine eligibility for the Child Tax Credit age relationship support dependent status citizenship length of residency and family income If you aren t able to claim the Child Tax Credit for a dependent they might be eligible for the Credit for Other Dependent

https://www.nerdwallet.com/article/taxes/qualify...

To qualify for the refundable version of the child tax credit filers must earn at least 2 500 In tax years 2024 and 2025 the taxes filed in 2025 and 2026 filers could opt to use

What To Do If You Didn t Get Your First Child Tax Credit Payment Newswire

2021 Child Tax Credit Advances Payment Schedule Atlanta CPA

2022 Child Tax Credit Chart Latest News Update

Child Tax Credit 2022 Tax Form Latest News Update

New Child Tax Credit Explained When Will Monthly Payments Start

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

Child Tax Credit 2022 Income Limit Phase Out TAX

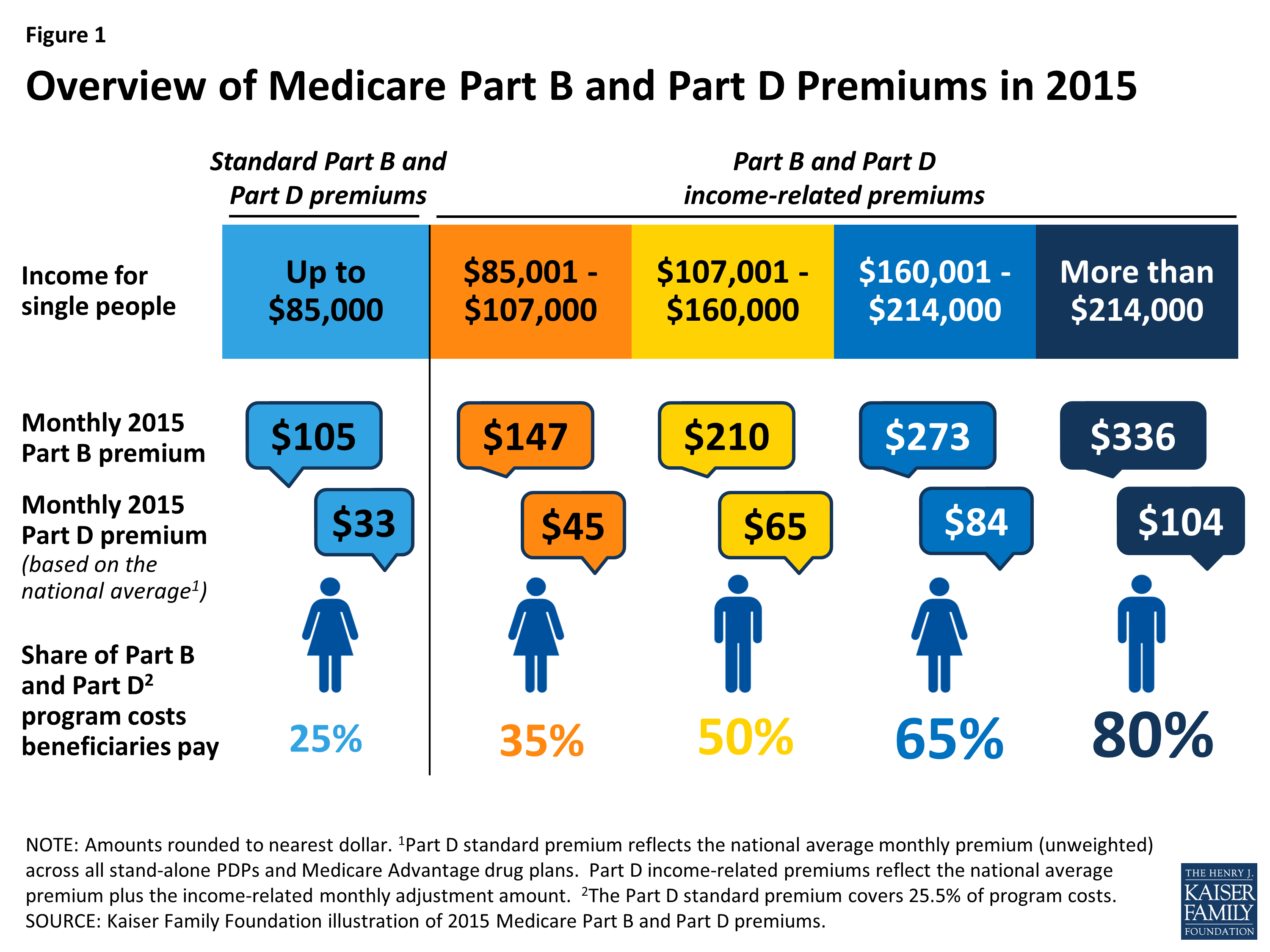

Medicare s Income Related Premiums A Data Note KFF

2021 Advanced Child Tax Credit What It Means For Your Family

How To Be Eligible For Child Tax Credit - Published June 25 2021 Updated Sept 21 2021 In about three weeks millions of American families will receive the first of six monthly payments of up to 300 per child from the federal