How To Calculate Foreign Tax Credit In India Foreign Tax Credit FTC in India is governed by Rule 128 of the Income Tax Rules which became effective on April 1 2017 The following conditions are covered under the rule 1 Only a resident assessee is qualified to claim FTC if he paid tax in a country or defined territory other than India 2

You must file Form 67 before 31st Dec 2024 to claim the tax credit Contents Of Form 67 Form 67 contains the below four sections Part A Part A contains basic information such as name PAN or Aadhaar number address assessment year receipt of details of the income from a country outside India and details of foreign tax credit claimed As per Rule 128 of the Income Tax Rules 1962 a resident taxpayer is eligible to claim credit for any foreign tax paid in a country or specified territory outside India The credit shall be allowed only if the assessee furnishes the required particulars in Form 67 within the specified timelines

How To Calculate Foreign Tax Credit In India

How To Calculate Foreign Tax Credit In India

https://freemanlaw.com/wp-content/uploads/2022/01/Foreign-Tax-Credit-scaled-1.jpeg

How To Claim Foreign Tax Credit In India YouTube

https://i.ytimg.com/vi/CPDB1vXFF_o/maxresdefault.jpg

How To Calculate Your Foreign Tax Credits Carryover With Examples

https://brighttax.com/wp-content/uploads/2022/08/Untitled-design-20-1024x683.png

Explore 41 FAQs on Foreign Tax Credit FTC and the determination of residential status in India Learn about Form No 67 rules procedures and key considerations for claiming FTC A detailed guide for residents and non residents To claim Foreign Tax Credit on your Indian tax return follow these steps A Determine Indian Tax Liability

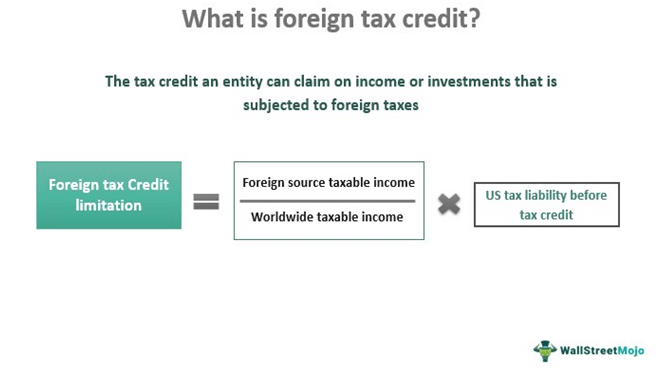

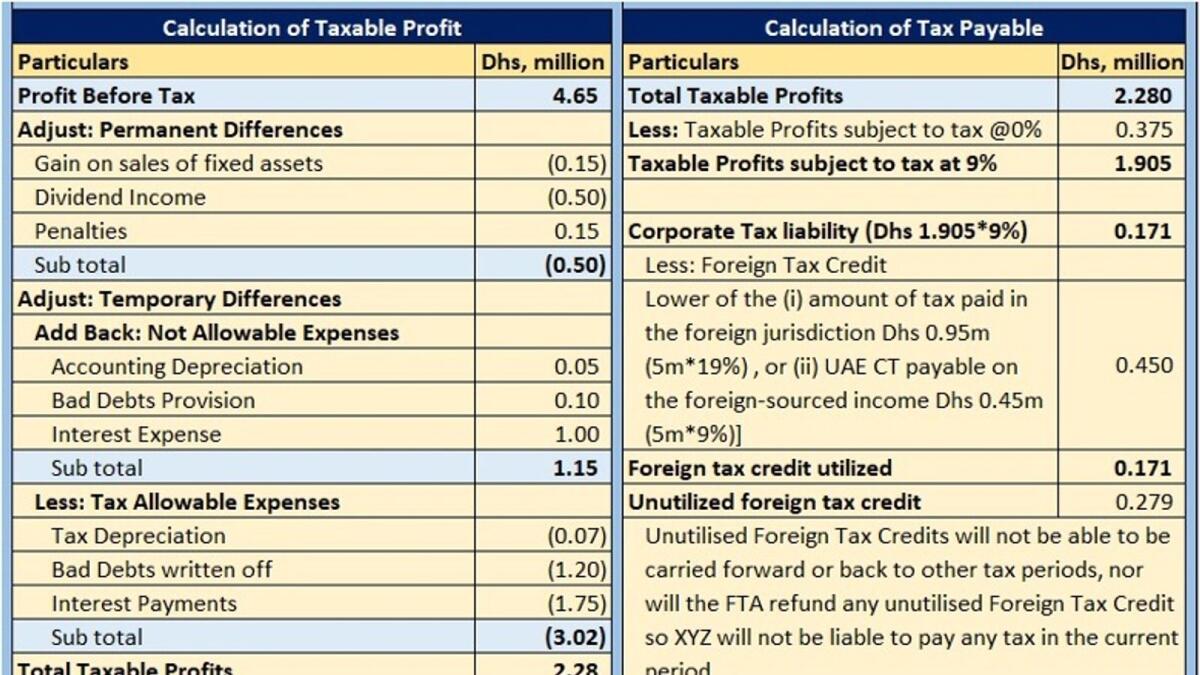

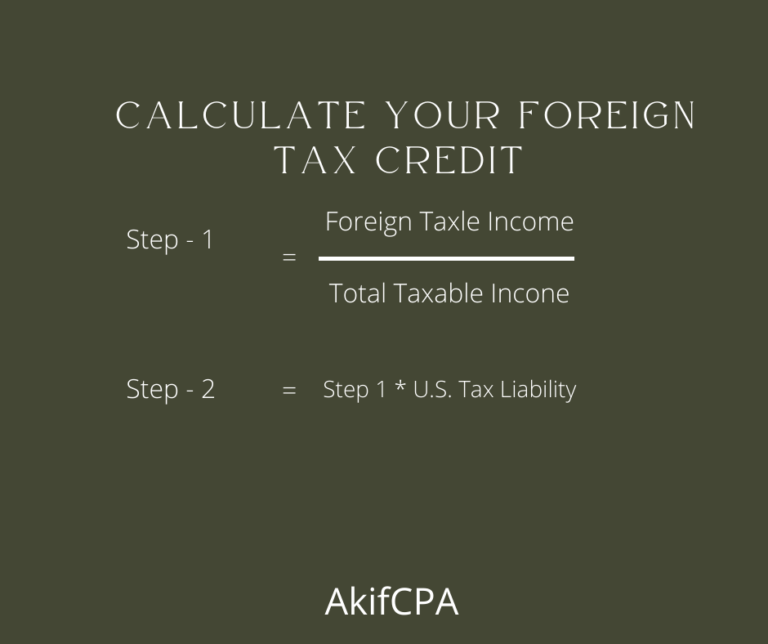

Foreign Tax Credit Calculation Example in India If the tax paid in a foreign country amounts to Rs 100 and the income tax surcharge and cess payable in India total Rs 90 with an additional Rs 10 in interest under sections 234B and C only Rs 90 of the foreign tax credit would be eligible Synopsis The Foreign Tax Credit FTC alleviates double taxation on income earned in one country crucial in today s globalized world Tax Treaties distribute taxing rights between source and residence countries aiming to prevent double taxation

Download How To Calculate Foreign Tax Credit In India

More picture related to How To Calculate Foreign Tax Credit In India

How To Claim Credit On Foreign Tax Paid

https://diligen.in/wp-content/uploads/2022/10/Diligen-Blog-Images-July-22-63.jpg

How To Claim Foreign Tax Credit In India Foreign Tax Credit Foreign

https://i.ytimg.com/vi/D2Da55iEpXA/maxresdefault.jpg

Foreign Tax Credit In India

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/08/Foreign-Tax-Credit-in-India.jpg

Fill Schedule FSI Enter details of foreign income in Schedule FSI of the Income Tax Return ITR including country code taxpayer identification number income amount tax paid in the source country and tax payable in India Calculate Tax Relief Calculate foreign tax relief as the lower of tax paid in the foreign country or tax payable This is in line with the tax laws in India While taking TDS credit make sure the correct DTAA is applied so you can take credit for the foreign tax deducted Resident in India earning a foreign income should report such income and foreign assets in the Income Tax Return

A taxpayer might have to pay taxes on the income from foreign assets or investments in India Here is a step by step guide on incorporating foreign income on your tax returns Step 1 Convert your foreign earnings into Indian rupees The rate of conversion will be based on the Telegraphic Transfer Buying Rate TTBR of the State Tax Rate in India 30 Tax in Foreign Country 35 Working Indian Tax on global Income A 75 000 Indian Tax on Foreign Income B 30 000 Foreign tax on Foreign Income C 35 000 Relief as per Ordinary credit Method lower of B and C D 30 000 Tax Payable in India A D E 45 000

Input Tax Credit In India Legal 60

http://legal60.com/wp-content/uploads/2021/12/input-tax-credit-in-india-2.png

Foreign Tax Credit May Not Be Available For Gains Derived Outside The U

http://static1.squarespace.com/static/52a5de52e4b03685242fc87b/54c6725ce4b00caefdcdb864/591f13cfff7c506d7c244d62/1565716520243/ftc.jpeg?format=1500w

https://cleartax.in/s/claim-tax-credit-on-foreign-income-of-resident-indian

Foreign Tax Credit FTC in India is governed by Rule 128 of the Income Tax Rules which became effective on April 1 2017 The following conditions are covered under the rule 1 Only a resident assessee is qualified to claim FTC if he paid tax in a country or defined territory other than India 2

https://cleartax.in/s/form-67-claim-foreign-tax-credit

You must file Form 67 before 31st Dec 2024 to claim the tax credit Contents Of Form 67 Form 67 contains the below four sections Part A Part A contains basic information such as name PAN or Aadhaar number address assessment year receipt of details of the income from a country outside India and details of foreign tax credit claimed

Carryover Foreign Tax Credit

Input Tax Credit In India Legal 60

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Local Taxes Paid In USA Which Isn t Eligible For Foreign Tax Credit To

How To Calculate Income Tax Payable And Adjust Foreign Tax Credits

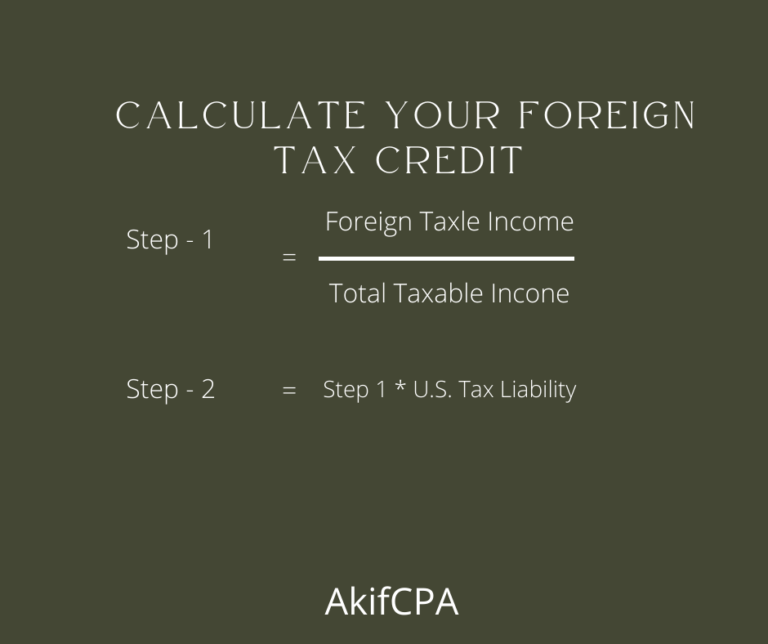

Everything You Need To Know About Foreign Tax Credit Calculation AKIF CPA

Everything You Need To Know About Foreign Tax Credit Calculation AKIF CPA

How To Fill Form 1116 Foreign Tax Credit For Individuals Explained

How To Claim Foreign Tax Credit Claim In India India Financial

Foreign Tax Credit Form 1116

How To Calculate Foreign Tax Credit In India - Foreign Tax Credit Calculation Example in India If the tax paid in a foreign country amounts to Rs 100 and the income tax surcharge and cess payable in India total Rs 90 with an additional Rs 10 in interest under sections 234B and C only Rs 90 of the foreign tax credit would be eligible