How To Calculate Foreign Tax Credit Relief Uk 2023 If you ve paid foreign tax on income received or capital gains made that are also taxable in the UK you may be able to claim relief for the foreign tax paid This

Part 1 Calculate tax liability one source of foreign income Calculate the equivalent UK tax on your foreign income This is done by carrying out 2 calculations One to calculate Total Foreign Tax Credit Relief on your income You do not have to work out the FTCR yourself We ll do this for you if you complete other relevant boxes and send your tax

How To Calculate Foreign Tax Credit Relief Uk 2023

How To Calculate Foreign Tax Credit Relief Uk 2023

https://brighttax.com/wp-content/uploads/2022/08/Untitled-design-20-1024x683.png

Foreign Tax Credit Relief 2023 Notices

https://info.mooredm.com/hubfs/GettyImages-1925453799.jpg

Foreign Tax Credit Relief Explained YouTube

https://i.ytimg.com/vi/FWkkktgFhhE/maxresdefault.jpg

Last updated 07 Feb 2024 Foreign Tax Credit Relief FTCR can be claimed if an individual has paid foreign tax on a source of income which is also chargeable to UK A basic report to show the FTCR calculation can be found by clicking the Reports menu and selecting Foreign Tax Credit Relief This report will show each source of foreign

Foreign tax relief UK residents are usually able to claim a credit for foreign taxes suffered on overseas income or gains that are taxable in the United Kingdom This is either Part 1 Calculate taxable income after an item of foreign income is removed This section deducts items of foreign income from your total income in the way that is likely to be most

Download How To Calculate Foreign Tax Credit Relief Uk 2023

More picture related to How To Calculate Foreign Tax Credit Relief Uk 2023

How To Calculate Revenue For A Startup

https://www.kanakkupillai.com/learn/wp-content/uploads/2022/10/How-to-Calculate-Revenue-for-a-Startup.png

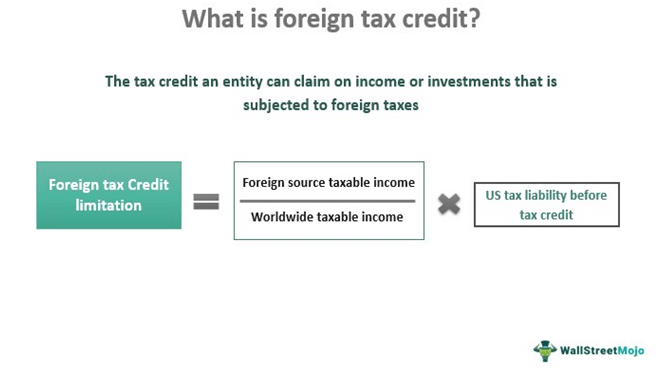

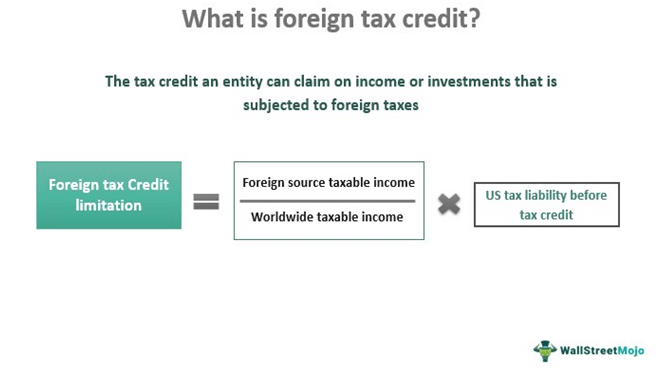

What Is The Foreign Tax Credit Commons credit portal

https://i4.ytimg.com/vi/5VSmmake6x8/sddefault.jpg

Foreign Tax Credit May Not Be Available For Gains Derived Outside The U

http://static1.squarespace.com/static/52a5de52e4b03685242fc87b/54c6725ce4b00caefdcdb864/591f13cfff7c506d7c244d62/1565716520243/ftc.jpeg?format=1500w

If you ve already paid foreign tax on your income which is also chargeable to UK tax use this guide to work out how to claim Foreign Tax Credit Relief The guide can How to calculate Double Taxation Relief DTR Excel example where tax payer has more than one source of overseas income There is a relief available called

If you re an employer based in the UK you may be able to operate foreign tax credit relief if you send an employee to work abroad deduct UK PAYE using your 8 866 views 1 year ago Overseas aspects of UK taxation are extremely complicated In this video we breakdown the three methods to claim Foreign Tax Credit

Carryover Foreign Tax Credit

https://www.wallstreetmojo.com/wp-content/uploads/2021/02/what-is-foreign-tax-credit.png.webp

Local Taxes Paid In USA Which Isn t Eligible For Foreign Tax Credit To

https://ttplimages.imgix.net/Researchimages/101010000000321638/141518.jpg?fm=jpg&w=1200

https://www.gov.uk/government/publications/...

If you ve paid foreign tax on income received or capital gains made that are also taxable in the UK you may be able to claim relief for the foreign tax paid This

https://assets.publishing.service.gov.uk/...

Part 1 Calculate tax liability one source of foreign income Calculate the equivalent UK tax on your foreign income This is done by carrying out 2 calculations One to calculate

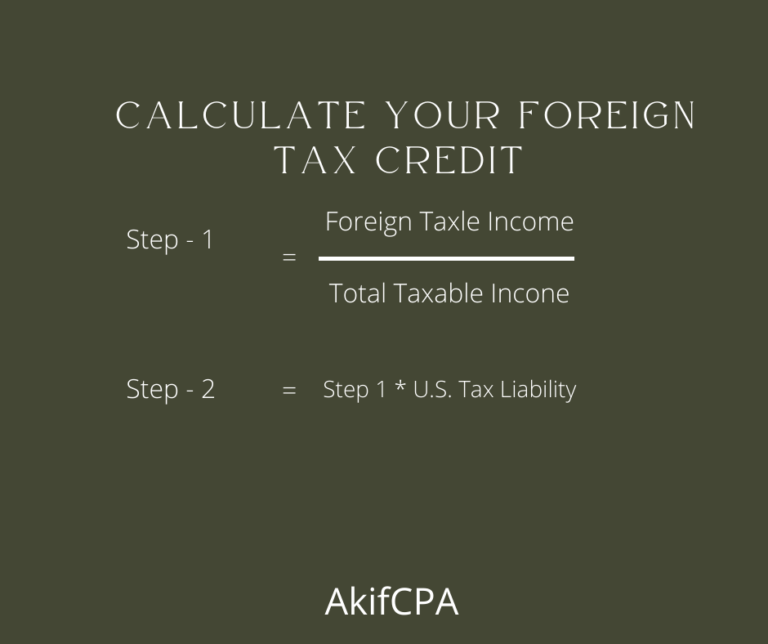

Everything You Need To Know About Foreign Tax Credit Calculation AKIF CPA

Carryover Foreign Tax Credit

Form 1118 Foreign Tax Credit Corporations 2014 Free Download

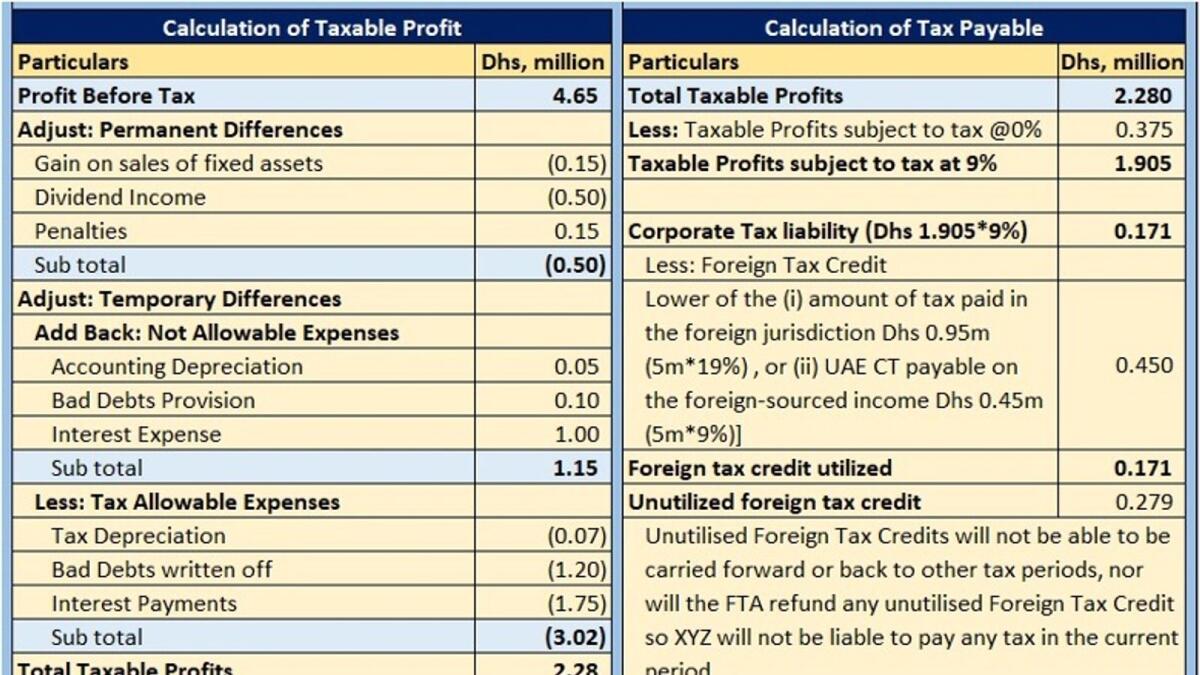

How To Calculate Income Tax Payable And Adjust Foreign Tax Credits

How To Calculate Debt to Income DTI Ratios YouTube

Foreign Tax Credit PDF Taxation In The United States Income Tax

Foreign Tax Credit PDF Taxation In The United States Income Tax

Premium Tax Credit Form Edit Fill Sign Online Handypdf

Calculating The Credit How Foreign Tax Credits Work HowStuffWorks

Foreign Tax Credit Form 1116

How To Calculate Foreign Tax Credit Relief Uk 2023 - Part 1 Calculate taxable income after an item of foreign income is removed This section deducts items of foreign income from your total income in the way that is likely to be most