How To Calculate Income Tax Expense Understand what income tax expense is and how to calculate it Review an example calculation of income tax expense and read answers to frequently asked questions on the topic

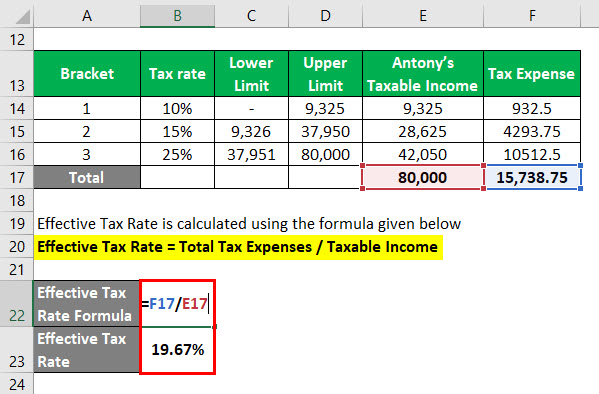

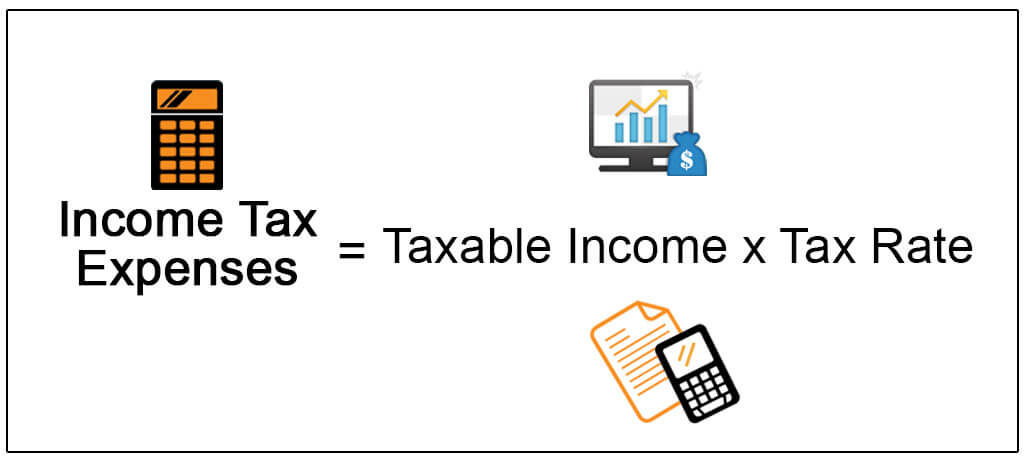

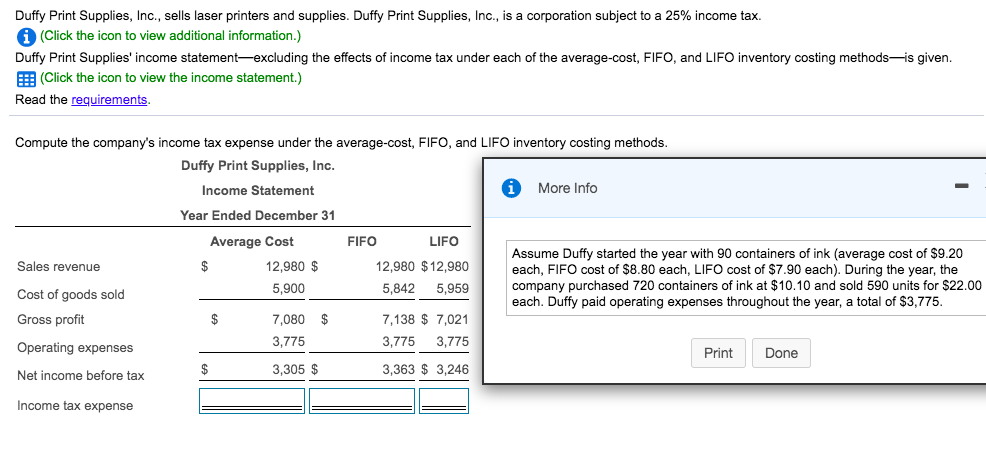

Income tax expense can be calculated using a simple formula Income tax expense Taxable income x Tax rate It can be recorded in the accounting books as a debit to income tax expense and a credit to income tax payable It can be optimized and reduced by using various tax planning strategies By understanding the basics of income tax expense accounting including taxable income tax rates and the calculation process businesses and individuals can accurately determine their tax obligations and optimize their overall tax position

How To Calculate Income Tax Expense

How To Calculate Income Tax Expense

https://www.learntocalculate.com/wp-content/uploads/2020/08/Income-Tax-Expenses.jpg

How To Calculate Tax

https://i.ytimg.com/vi/n88iQ1EfB-Y/maxresdefault.jpg

Average Tax Rate Calculator StuartKendall

https://cdn.educba.com/academy/wp-content/uploads/2019/04/Effective-Tax-Rate-Formula-Example-1-9.jpg

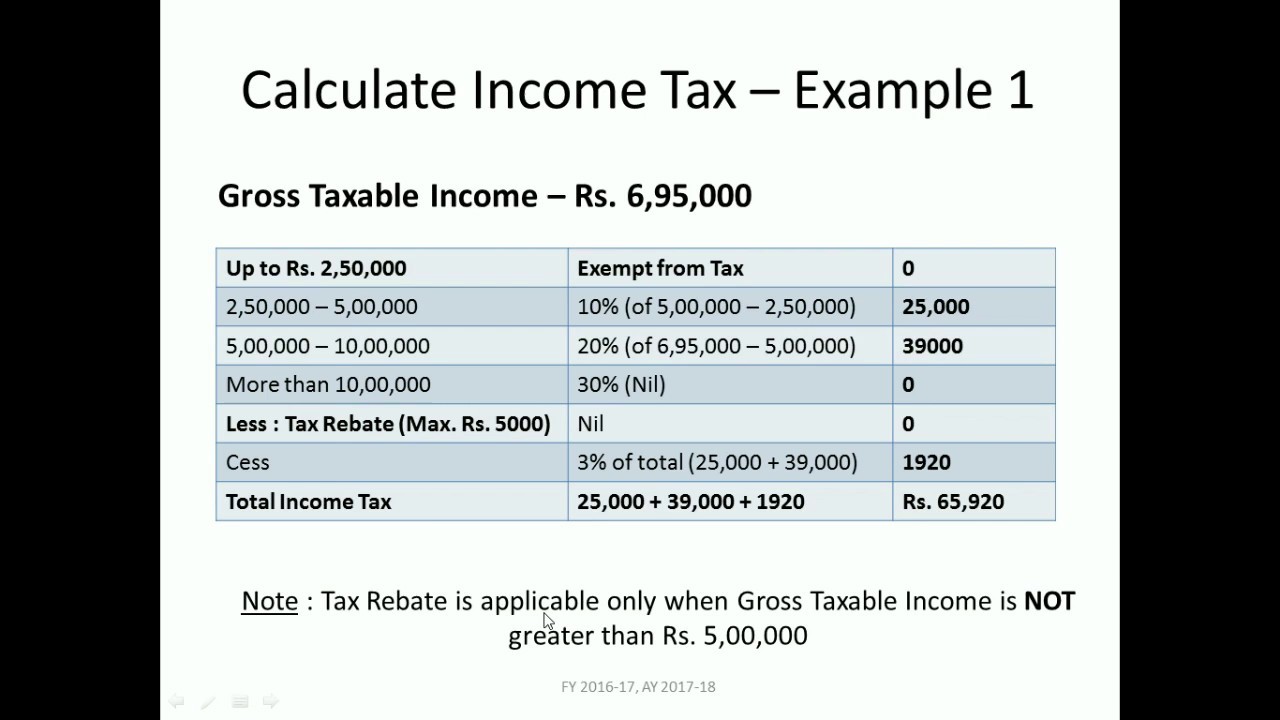

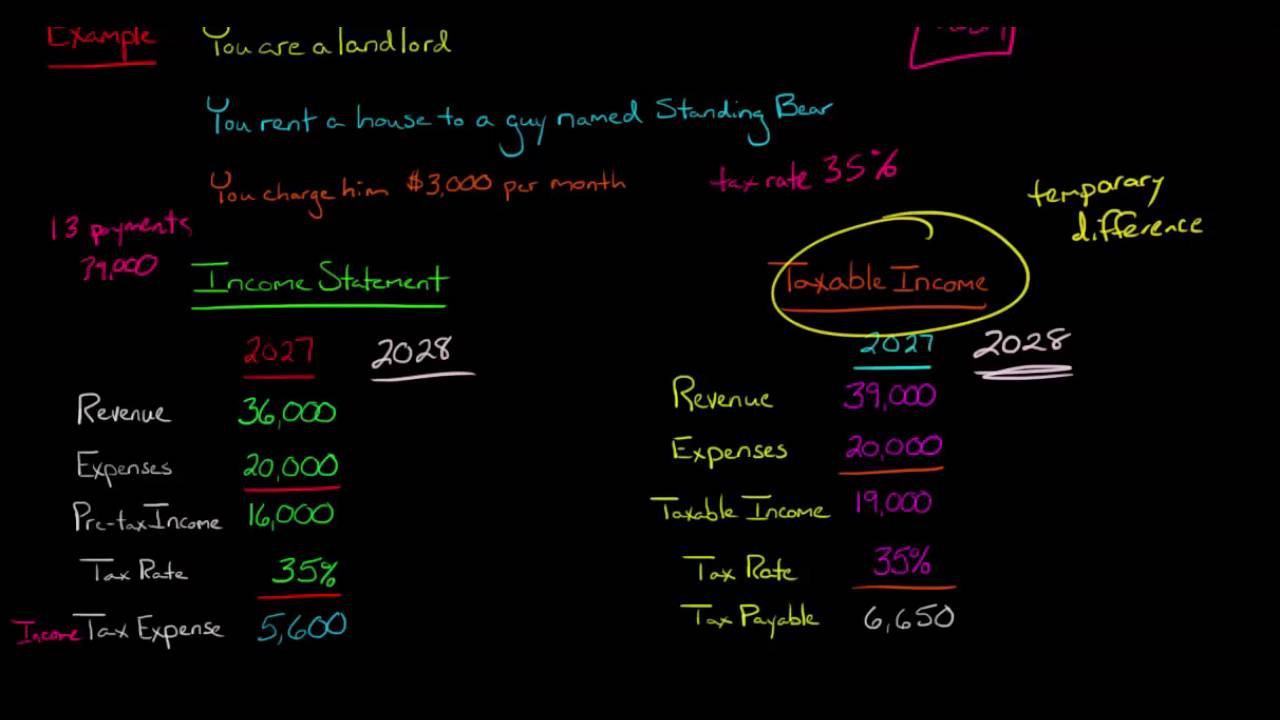

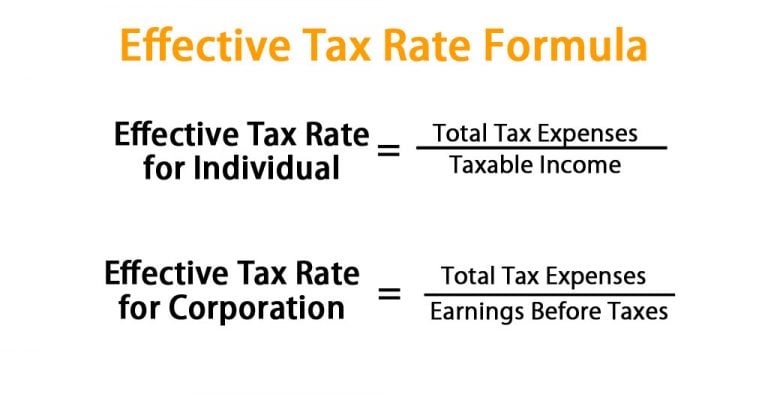

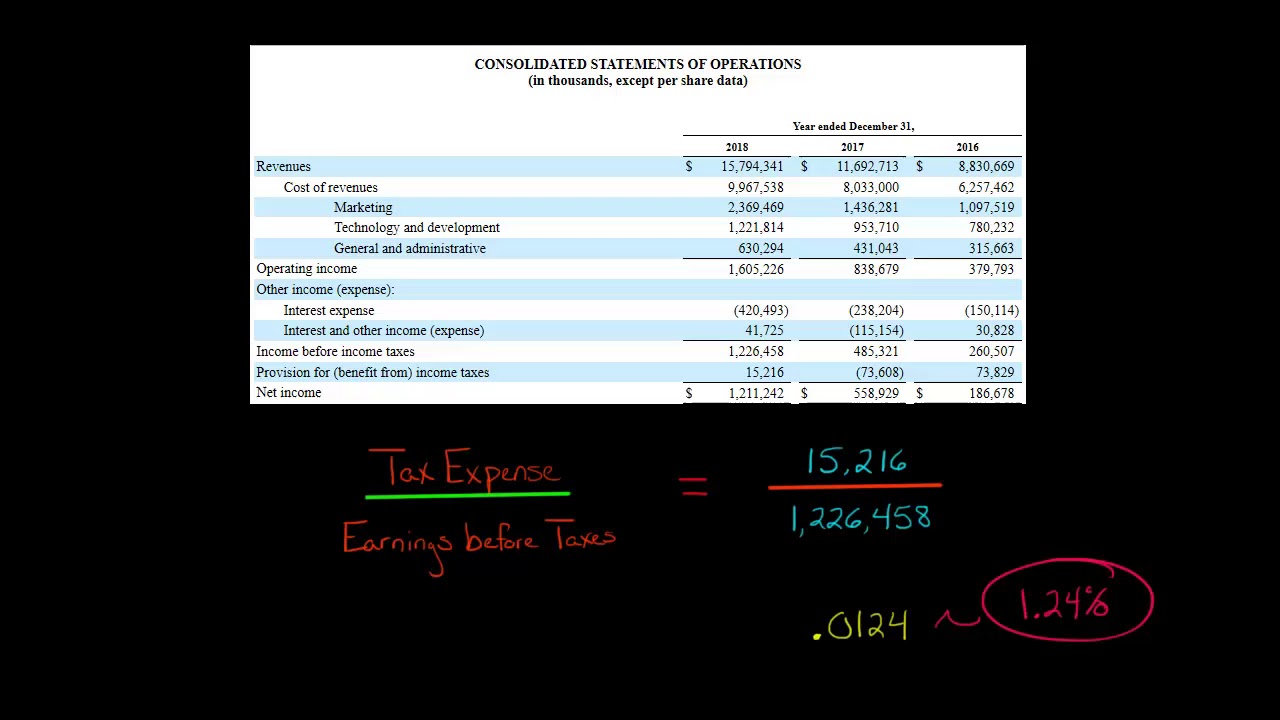

Income tax expense is calculated by multiplying taxable income by the effective tax rate Other taxes may be levied against an asset s value such as property or estate taxes Income tax expense can include the current tax expense and a deferred tax expense or benefit The current tax expense is the amount that a business expects to pay in its current fiscal year based on its reported taxable income and the

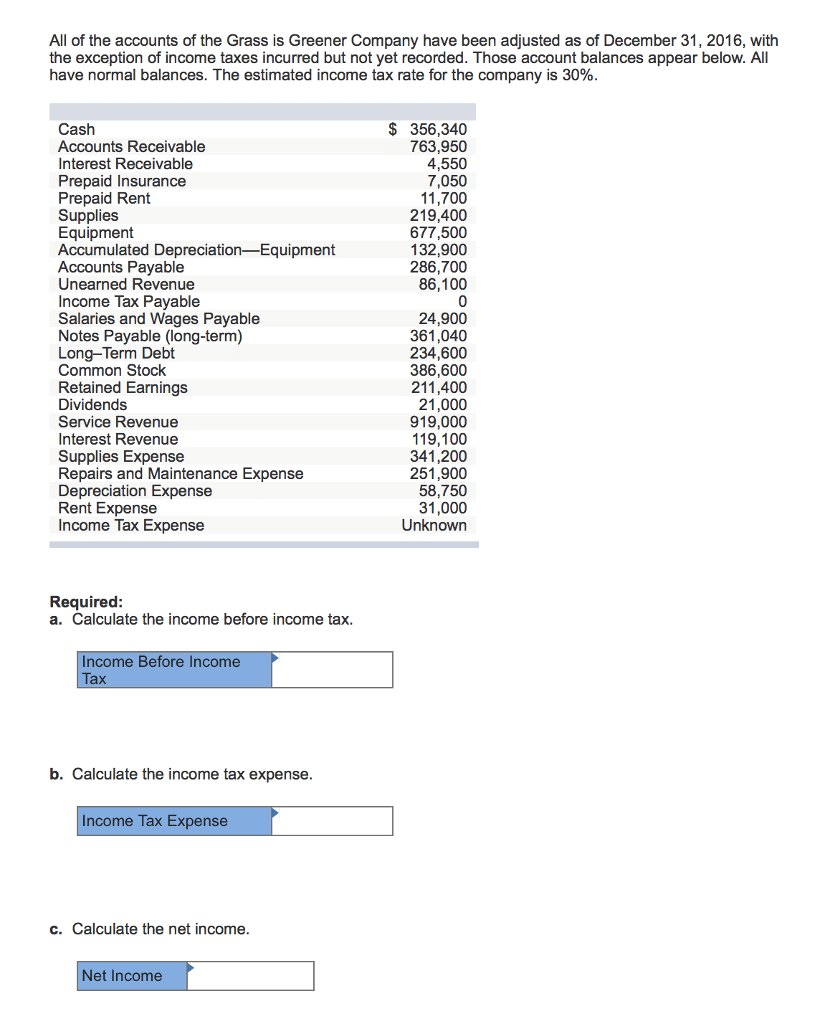

How to Calculate Income Tax Expense Following are the steps to calculate income tax expenses for a company Deduct the cost of revenue manufacturing costs from the total revenue generated to obtain gross profit How is Tax Expense Calculated The calculation of tax expense relies on several factors such as income type applicable tax rates deductions credits and exemptions Here s a step by step breakdown of the calculation process

Download How To Calculate Income Tax Expense

More picture related to How To Calculate Income Tax Expense

Difference Between Liability And Expense

http://4.bp.blogspot.com/-6GvW7nVPB9Y/U2S77OCodOI/AAAAAAAANek/_KV-_gHK7sk/s1600/tax+payable+and+tax+expenses.PNG

How To Calculate Income Tax Expense

https://www.learntocalculate.com/wp-content/uploads/2020/08/income-tax-expense.png

How To Calculate Income Tax Expense Insurance Noon

http://insurancenoon.com/wp-content/uploads/2020/12/how-to-calculate-income-tax-expense.jpg

How to calculate provision for income tax A company s tax provision has two parts current income tax expense and deferred income tax expense To make things more complicated most accounting departments use Generally Accepted Accounting Principles GAAP to calculate their financial position Use this income tax calculator to project your 2023 2024 federal income tax bill or refund based on earnings age deductions and credits The IRS allows you to deduct a litany of expenses

[desc-10] [desc-11]

What Is The Difference Between Tax Expense And Taxes Payable

http://4.bp.blogspot.com/-6GvW7nVPB9Y/U2S77OCodOI/AAAAAAAANek/_KV-_gHK7sk/w1200-h630-p-k-no-nu/tax+payable+and+tax+expenses.PNG

Income Tax Expense Vs Income Tax Payable YouTube

https://i.ytimg.com/vi/iKzdgjYERnE/maxresdefault.jpg

https://www.indeed.com/.../income-tax-expense

Understand what income tax expense is and how to calculate it Review an example calculation of income tax expense and read answers to frequently asked questions on the topic

https://www.speakaccounting.com/what-is-income-tax...

Income tax expense can be calculated using a simple formula Income tax expense Taxable income x Tax rate It can be recorded in the accounting books as a debit to income tax expense and a credit to income tax payable It can be optimized and reduced by using various tax planning strategies

Effective Tax Rate Formula Calculator Excel Template

What Is The Difference Between Tax Expense And Taxes Payable

How To Calculate Income Tax Expense And Income Tax Payable

How To Find Ebit With Net Income And Tax Rate Haiper

How To Calculate Income Tax Expense

Operating Income

Operating Income

How To Calculate Income Before Taxes Business Blog

Net Income Formulas What Is Net Income Formula Examples

/Sampleincomestatement-d92415c1850943f99cad74a3cb3bbf20.jpg)

Net Income Formula DrBeckmann

How To Calculate Income Tax Expense - [desc-13]