How To Calculate Tax In Nevada SmartAsset s Nevada paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k Next from AGI we subtract exemptions and deductions either itemized or standard to get your taxable income You are able to use our Nevada State Tax Calculator to calculate your total tax costs in the tax year 2024 25 Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates

How To Calculate Tax In Nevada

How To Calculate Tax In Nevada

https://cdn.educba.com/academy/wp-content/uploads/2019/08/Calculate-Income-Tax-in-Excel-1-1024x640.png

Calculating Tax Liability Personal Finance Series YouTube

https://i.ytimg.com/vi/V_n5Lg_ppd4/maxresdefault.jpg

How To Calculate Tax Liabilities The Tech Edvocate

https://www.thetechedvocate.org/wp-content/uploads/2023/10/taxliability.asp-final-a8ea9ba48a1f40149767a30961b171e6.png

You can use our Nevada Sales Tax Calculator to look up sales tax rates in Nevada by address zip code The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location The Nevada Tax Calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in Nevada the calculator allows you to calculate income tax and payroll taxes and deductions in Nevada This includes calculations for Employees in Nevada to calculate their annual salary after tax

Nevada Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck Use our paycheck tax calculator If you re an You can quickly estimate your Nevada State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries in Nevada and for quickly estimating your tax commitments in 2024

Download How To Calculate Tax In Nevada

More picture related to How To Calculate Tax In Nevada

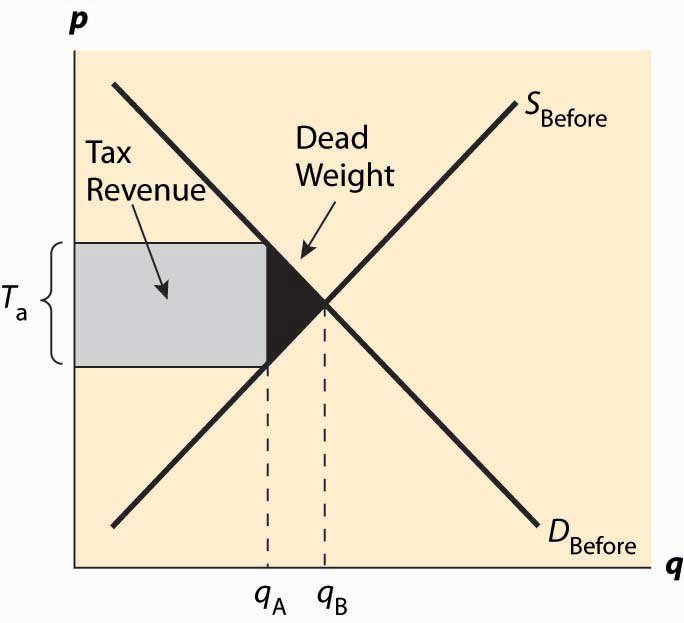

HOW TO CALCULATE TAX REVENUE GMU Consults

https://gmuconsults.com/wp-content/uploads/2022/08/HOW-TO-CALCULATE-TAX-REVENUE.jpg

Overtime And Bonuses How To Calculate In California Infinium HR

https://blog.infiniumhr.com/wp-content/uploads/2023/08/iStock-1266931351-1024x683.jpg

Tax Calculating Program In Python Report By Rahul

https://1.bp.blogspot.com/-wsawyF37dF0/XkQxX_Ca0hI/AAAAAAAAA4Q/-UC89kus6L86kDHuMBV1jnnbJ8yF4bUCACLcBGAsYHQ/s1600/tax_calculating_program.PNG

Income tax calculator Nevada Where do you work Salary rate Annual Month Biweekly Weekly Day Hour Withholding Salary 55 000 Federal Income Tax 4 868 Social Security 3 410 Medicare 798 Total tax 9 076 Net pay 45 925 Marginal tax rate 29 6 Average tax rate 16 5 83 5 Net pay 16 5 Total tax Calculate your take home pay per paycheck for salary and hourly jobs after federal Nevada taxes Updated for 2024 tax year on Apr 24 2024 What was updated Tax year Job type Salary hourly wage Overtime pay State Filing status Self employed Pay frequency Additional withholdings Pre tax deduction s Post tax deduction s

This paycheck calculator also works as an income tax calculator for Nevada as it shows you how much income tax you may have to pay based on your salary and personal details Our Nevada State Tax Calculator will display a detailed graphical breakdown of the percentage and amounts which will be taken from your 10 000 00 and go towards tax While this calculator can be used for Nevada tax calculations by using the drop down menu provided you are able to change it to a different State

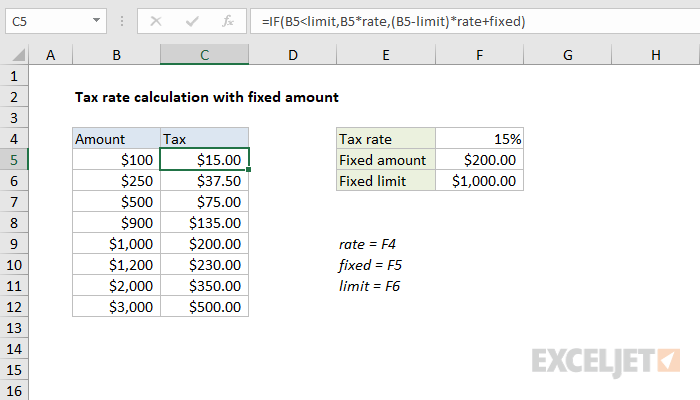

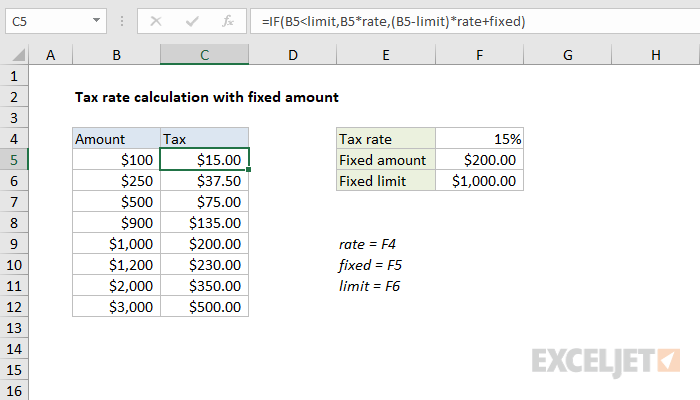

Tax Rate Calculation With Fixed Base Excel Formula Exceljet

https://exceljet.net/sites/default/files/styles/original_with_watermark/public/images/formulas/tax rate calculation with fixed base2.png

Where Is Nevada Located Mapsof

http://mapsof.net/uploads/static-maps/where_is_nevada_located.png

https://smartasset.com/taxes/nevada-paycheck-calculator

SmartAsset s Nevada paycheck calculator shows your hourly and salary income after federal state and local taxes Enter your info to see your take home pay

https://smartasset.com/taxes/nevada-tax-calculator

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401 k Next from AGI we subtract exemptions and deductions either itemized or standard to get your taxable income

Do You Know How To Calculate The regular Rate Of Pay For Your

Tax Rate Calculation With Fixed Base Excel Formula Exceljet

What Is Sales Tax And How Do I Calculate It Sellercloud

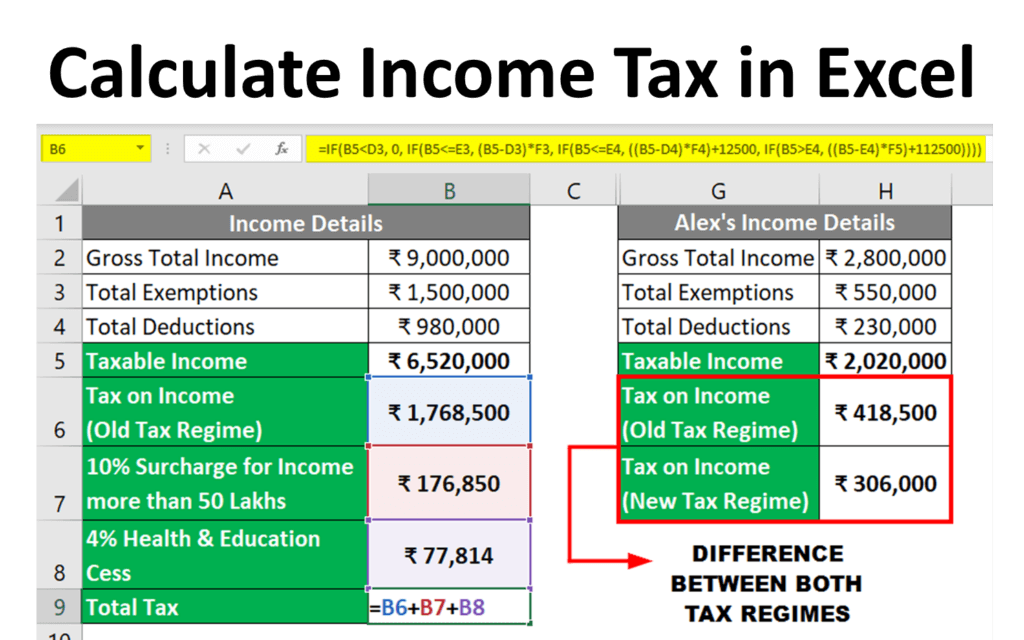

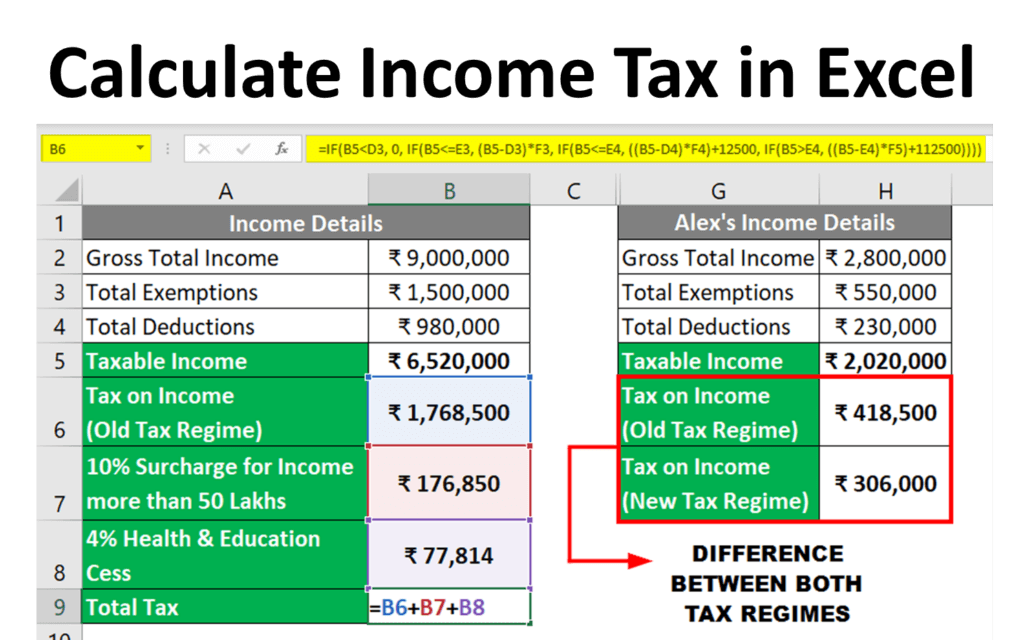

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

What Is The Profit Margin How To Calculate It And Why Does It Matter

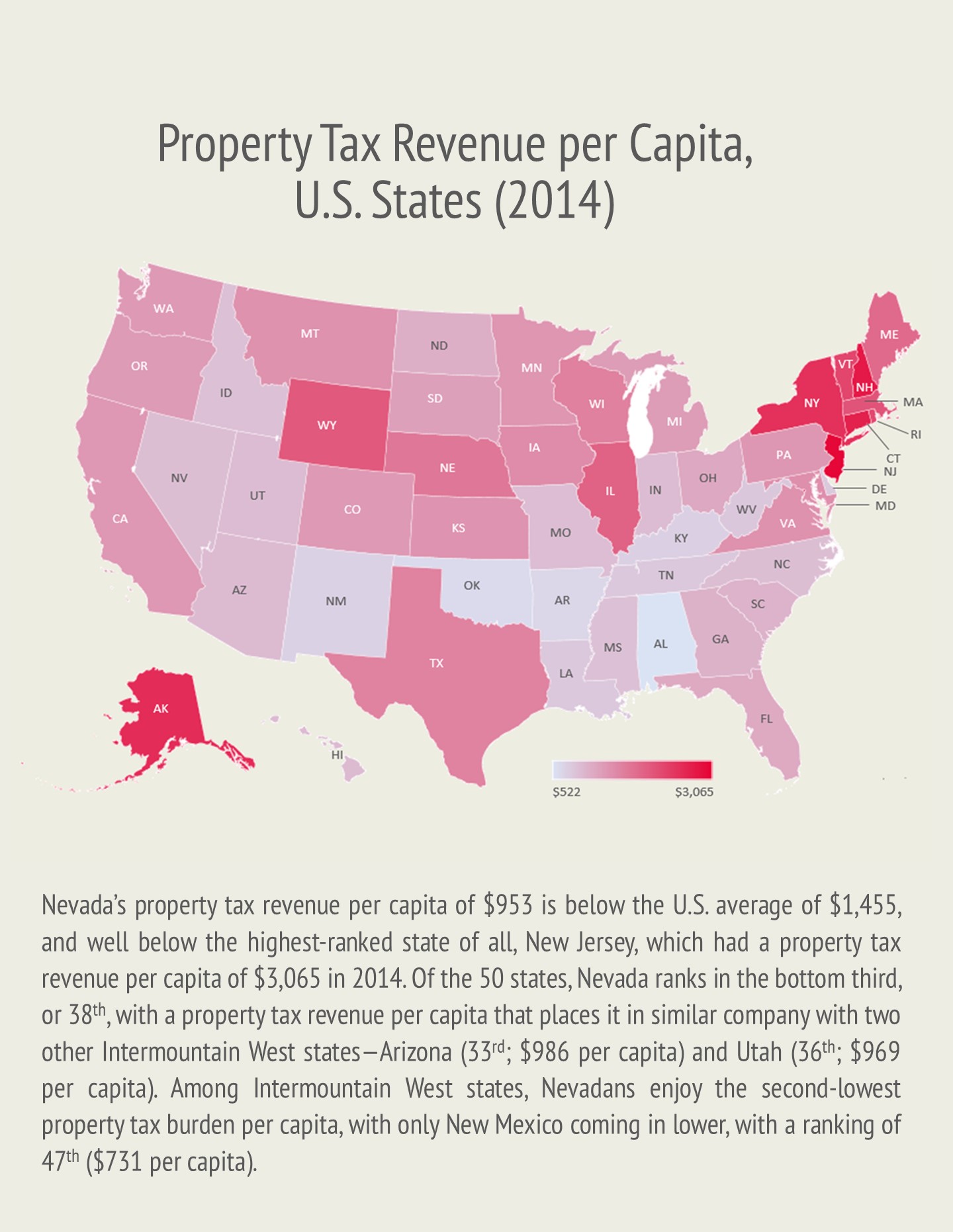

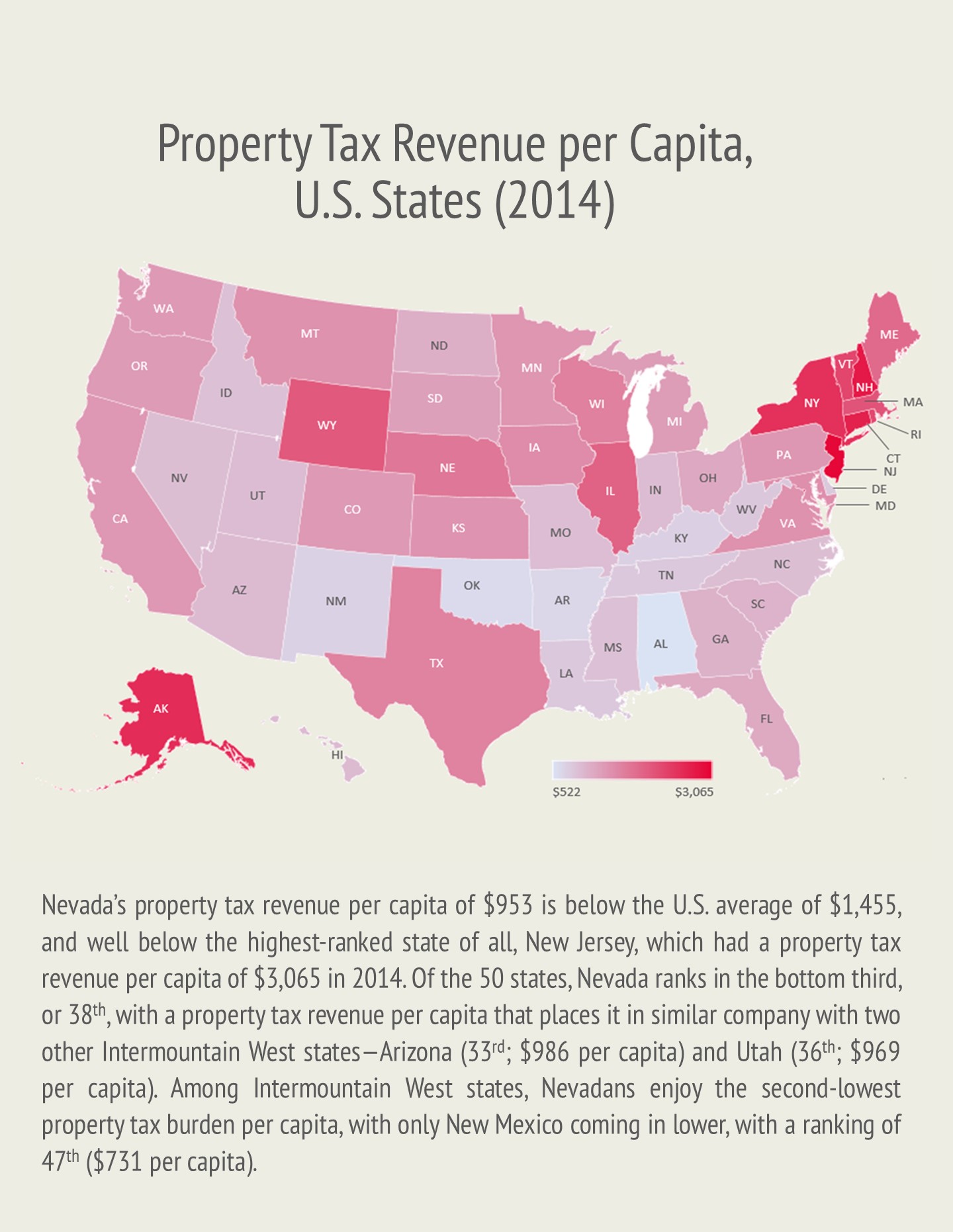

Property Taxes In Nevada Guinn Center For Policy Priorities

Property Taxes In Nevada Guinn Center For Policy Priorities

How To Calculate Accounts Payable Formula Modeladvisor

California Income Tax Brackets 2020 In 2020 Income Tax Brackets Tax

Calculating Taxes In SamCart SamCart Knowledge Base

How To Calculate Tax In Nevada - The Nevada Tax Calculator is for the 2024 tax year which means you can use it for estimating your 2025 tax return in Nevada the calculator allows you to calculate income tax and payroll taxes and deductions in Nevada This includes calculations for Employees in Nevada to calculate their annual salary after tax