How To Calculate Taxable Income In Pakistan Income earned Salary 5 000 000 Benefits 500 000 Less Deductions Zakat to approved institutions 50 000 Medical allowance 100 000 Taxable income

Taxable income PKR Tax on column 1 PKR Tax on excess Over column 1 Not over 0 600 000 0 600 000 800 000 7 5 800 000 1 200 000 15 000 15 0 1 200 000 Taxable Income Taxable Income means Total Income reduced by donations qualifying straight for deductions and certain deductible allowances Total Income Total Income

How To Calculate Taxable Income In Pakistan

How To Calculate Taxable Income In Pakistan

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2.jpg

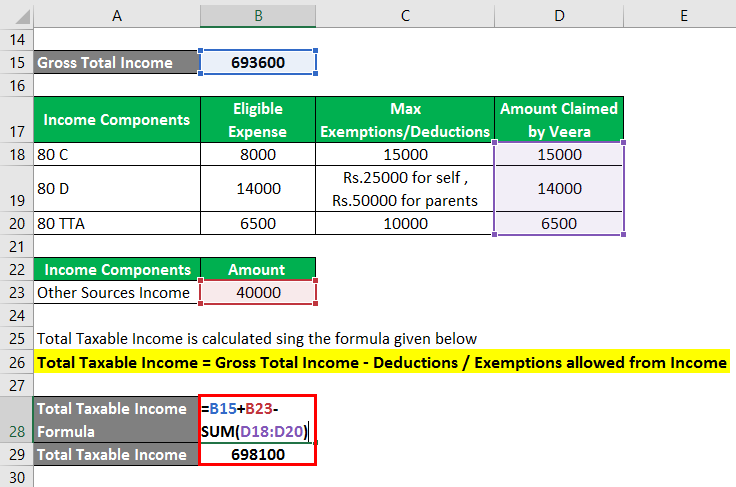

Taxable Income Calculator India

https://i1.wp.com/www.thewealthwisher.com/wp-content/uploads/2012/05/IncomeTaxCalci-Final2.jpg

How To Calculate Taxable Income In Canada

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cabd5ae4910dd8558fa6_60d8c67b9b981f2f12a31332_calculating_taxes_1300x867.jpeg

Step 1 Determining your taxable income To begin ascertain your taxable income This encompasses income subject to taxation calculated by 0 Yearly Tax 0 0 0 Yearly Income After Tax 0 0 0 Monthly Income Breakdown Net Income 100 0 Net Income 100 0 Tax 0 0 Tax 0 0 Click here for Pakistan

This income tax calculator Pakistan helps you to calculate salary monthly yearly payable income tax according to tax slabs 2023 2024 Calculator Tax Calculator Pakistan 2022 2023 Income Tax Slabs As per Federal Budget 2022 2023 presented by Government of Pakistan following slabs and income tax rates will be

Download How To Calculate Taxable Income In Pakistan

More picture related to How To Calculate Taxable Income In Pakistan

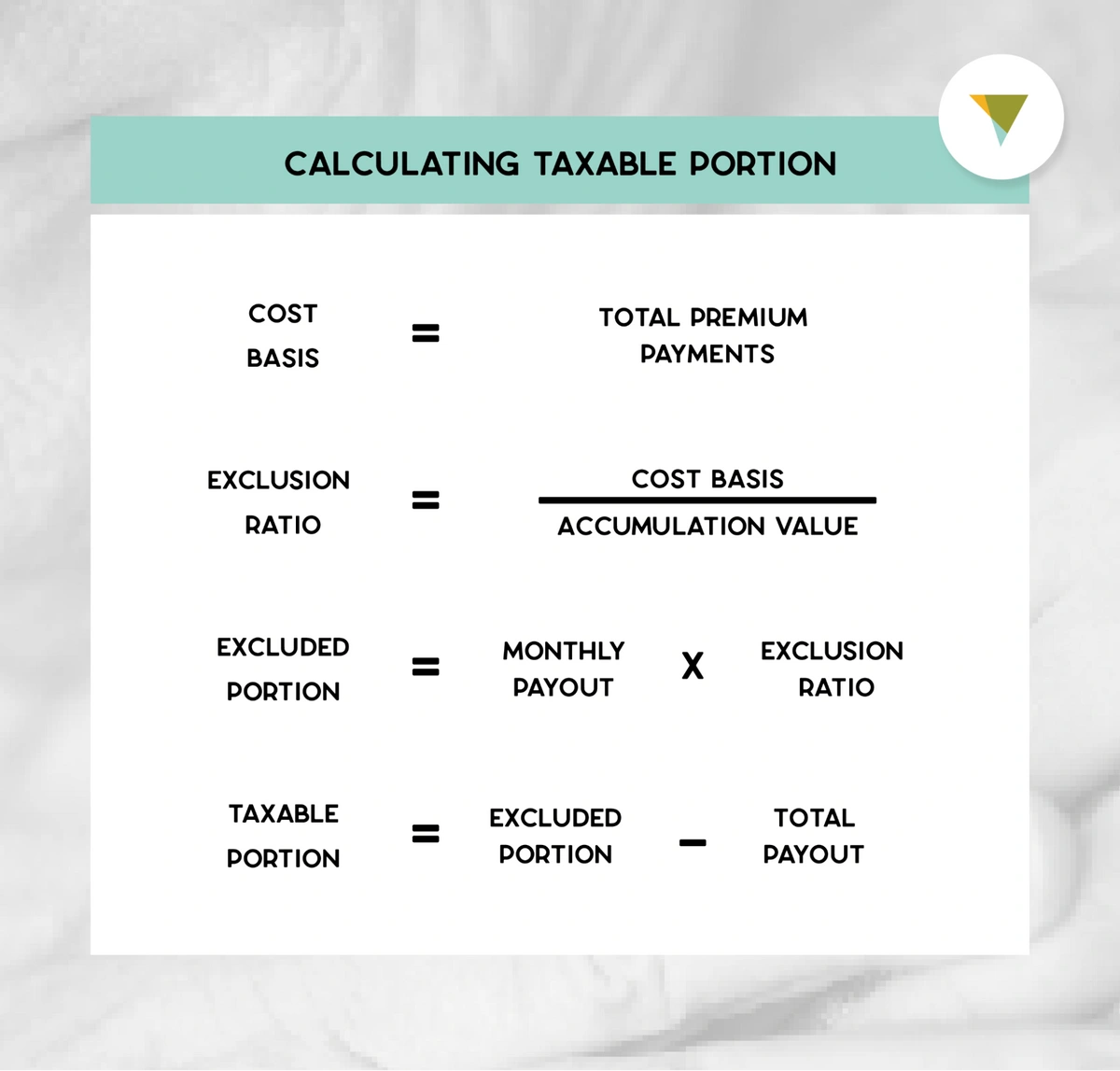

How To Calculate The Taxable Income Of An Annuity

https://cdn.buttercms.com/XcS30FnbSIuKWap6KZ6w

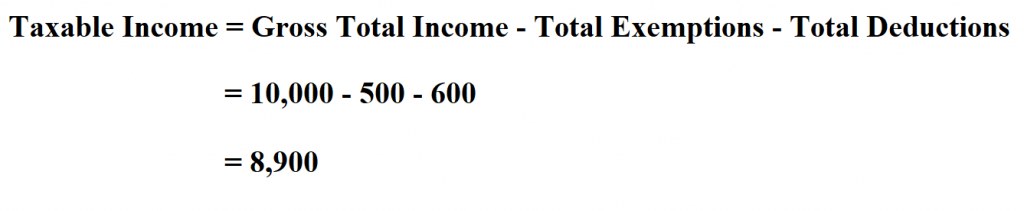

How To Calculate Taxable Income

https://www.learntocalculate.com/wp-content/uploads/2020/06/taxable-income-2-1024x211.png

How Do You Get From Net Income For Tax Purposes To Taxable Income To

https://kpu.pressbooks.pub/app/uploads/sites/162/2019/04/Screen-Shot-2020-01-04-at-2.42.00-PM-1.png

The Pakistan Tax Calculator below is for the 2023 tax year the calculator allows you to calculate income tax and payroll taxes and deductions in Pakistan This includes Online Method Go to Income Tax Calculator Enter your income Click whether you want to enter monthly or annual income Hit Calculate Results will be

Calculating Taxable Income Determining your taxable income involves two crucial steps Calculating Total Income This includes all earnings throughout the tax To calculate taxable income in Pakistan you need to consider your total income and deductions Total income includes earnings from sources like salaries bonuses

How To Calculate Taxable Business Income In Pakistan Doctor Engineer

https://i.ytimg.com/vi/u1Hv9UsgYSI/maxresdefault.jpg

How To Calculate Gross Income Tax Haiper

https://www.educba.com/academy/wp-content/uploads/2019/06/Taxable-Income-2.7.png

https://taxsummaries.pwc.com/pakistan/individual/...

Income earned Salary 5 000 000 Benefits 500 000 Less Deductions Zakat to approved institutions 50 000 Medical allowance 100 000 Taxable income

https://taxsummaries.pwc.com/pakistan/individual/...

Taxable income PKR Tax on column 1 PKR Tax on excess Over column 1 Not over 0 600 000 0 600 000 800 000 7 5 800 000 1 200 000 15 000 15 0 1 200 000

Nebun Evaluare ngrijire Personal Income Tax Calculator R sucit Jurnal

How To Calculate Taxable Business Income In Pakistan Doctor Engineer

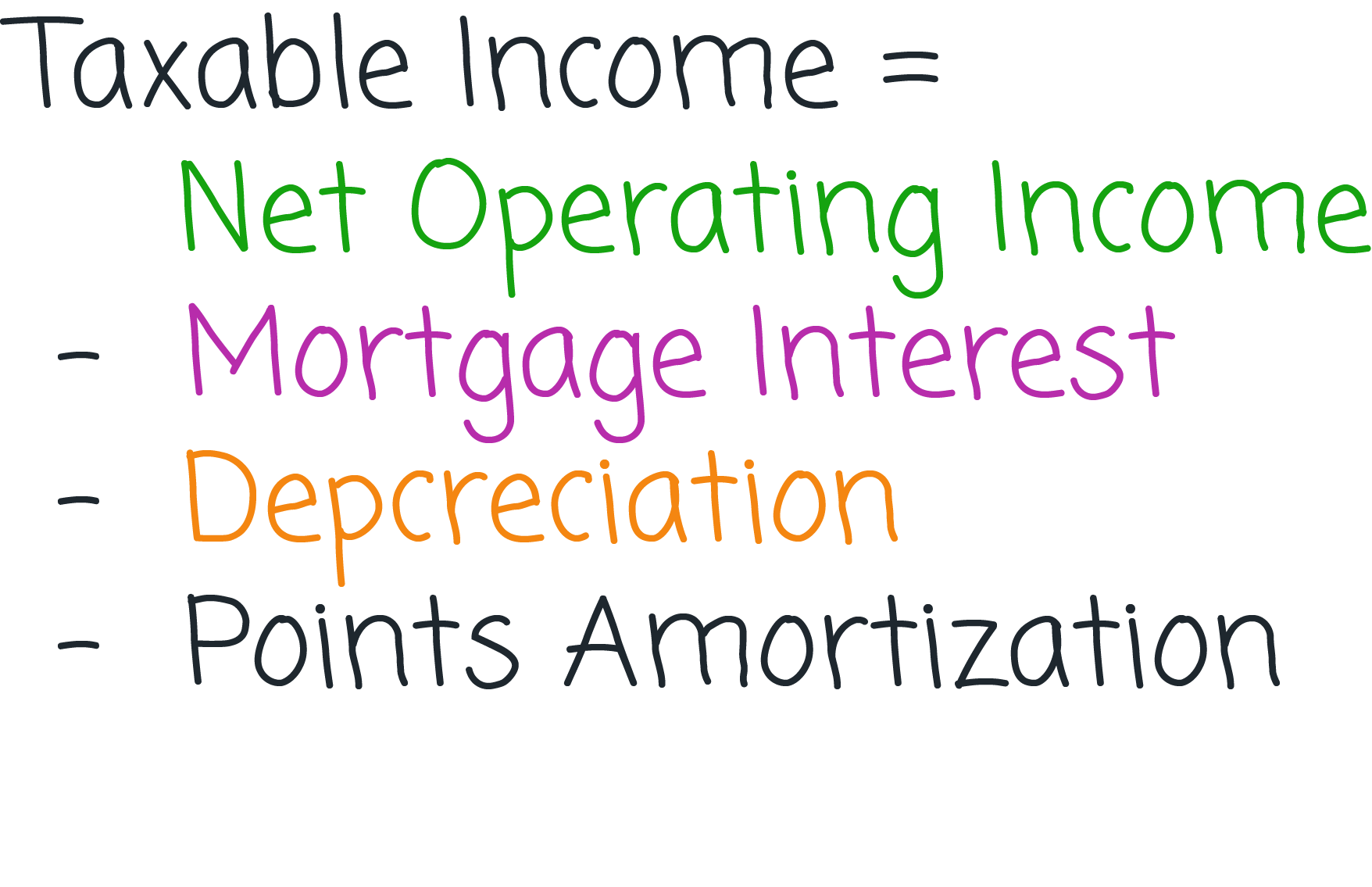

How Much Tax Do You Pay On Income From A Rental Property Minimum Wage

How To Calculate Taxable Income From Your Salary updated 2020 Under

What Is Taxable Income Explanation Importance Calculation Bizness

How To Calculate Income Tax FY 2020 21 EXAMPLES New Income Tax

How To Calculate Income Tax FY 2020 21 EXAMPLES New Income Tax

Taxable Income Formula Calculator Examples With Excel Template

Income Taxes

Taxable Income Calculation Formula Excel Example Zilculator

How To Calculate Taxable Income In Pakistan - Calculator Tax Calculator Pakistan 2022 2023 Income Tax Slabs As per Federal Budget 2022 2023 presented by Government of Pakistan following slabs and income tax rates will be