How To Calculate Your Property Tax Rate Use SmartAsset s property tax calculator by entering your location and assessed home value to find out your property tax rate and total tax payment

Property taxes are calculated by multiplying your assessed home value and local tax rate Learn more about what affects your property tax bill and calculation methods Calculate property taxes based on assessed value and a tax rate California property tax calculations with annual assessment increases up to 2

How To Calculate Your Property Tax Rate

How To Calculate Your Property Tax Rate

https://i.ytimg.com/vi/e3fBMuZFFcs/maxresdefault.jpg

How To Calculate Your Credit Utilization Ratio And 3 Ways To Improve It

https://hellogenius.org/wp-content/uploads/2022/10/Credit-Utilization-Ratio-scaled.jpg

How To Calculate Property Taxes

https://www.stlouis-mo.gov/government/departments/assessor/media/images/How-To-Calculate-Property-Taxes-2019.png

How are property taxes calculated Your state and local governments determine how your property taxes are calculated Generally this is done by multiplying your home s assessed value Property Tax Definition and How to Calculate Taxes on Real Estate Your property tax bill is mostly based on your property s location and value Here s more on what it is how to pay

To estimate your real estate taxes you merely multiply your home s assessed value by the levy So if your home is worth 200 000 and your property tax rate is 4 you ll pay Property taxes are based on your property s value multiplied by a tax or millage rate set by the local government or taxing authority Get the lowdown

Download How To Calculate Your Property Tax Rate

More picture related to How To Calculate Your Property Tax Rate

How To Calculate Property Tax Now That You Found Your Dream Home

https://www.homesforheroes.com/wp-content/uploads/2018/03/How-to-calculate-property-tax.jpg

2024

https://img.cs-finance.com/img/the-basics/how-to-calculate-income-tax-expense.jpg

Tax Rules On International Money Transfers To Canada Loans Canada

https://loanscanada.ca/wp-content/uploads/2022/04/Tax-Rules-On-International-Money-Transfers-To-Canada-1.png

The mill rate is the amount of tax payable per dollar of a property s value Learn more about how mill rate is determined and how it is used to assess property taxes Calculate how much you ll pay in property taxes on your home given your location and assessed home value Compare your rate to the Pennsylvania and U S average

Calculate average property tax rates by state or county with Tax Rates s free property tax calculator tool Calculate your Local Property Tax This service allows you to calculate the amount of Local Property Tax due on your property for any period Instructions Select the desired period Select the Local Authority of your property Select your Property band e g A property valued at 210 000 falls into the band 200 001 250 000 e g

How To Calculate Revenue In Accounting Countingup

https://countingup.com/wp-content/uploads/2021/06/report-calculator-user-cog-money.png?w=1024

State Corporate Income Tax Rates And Key Findings What You Need To

https://files.taxfoundation.org/20230210132819/2023-CIT-rates.png

https://smartasset.com/taxes/property-taxes

Use SmartAsset s property tax calculator by entering your location and assessed home value to find out your property tax rate and total tax payment

https://www.investopedia.com/articles/tax/09/calculate-property-tax.asp

Property taxes are calculated by multiplying your assessed home value and local tax rate Learn more about what affects your property tax bill and calculation methods

Property Taxes By State County Median Property Tax Bills

How To Calculate Revenue In Accounting Countingup

Here s How To Calculate Your Personal Inflation Rate

How High Are Property Taxes In Your State

Putnam County Property Tax Rate Lynwood Parr

Tax Rate Calculation With Fixed Base Excel Formula Exceljet

Tax Rate Calculation With Fixed Base Excel Formula Exceljet

How Much Are You Paying In Property Taxes Real Estate Investing Today

How To Calculate Your Exact Tax Liability YouTube

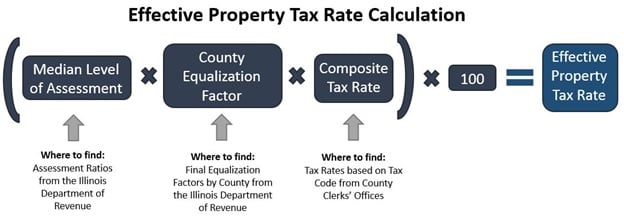

Calculate Your Community s Effective Property Tax Rate The Civic

How To Calculate Your Property Tax Rate - Understanding how your property rates are calculated is essential for budgeting and financial planning By staying informed about your property s municipal valuation and the rateable value set by your municipality you can better anticipate and manage your property tax obligations