How To Claim Child Tax Credit You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

You can only claim Child Tax Credit for children you re responsible for The amount you could get depends on when your children were born You could get the child element of Child Tax Everything you need to know about the 2024 child tax credit CTC including eligibility income limits and how to claim up to 2 000 per child on your federal tax return

How To Claim Child Tax Credit

How To Claim Child Tax Credit

https://www.the-sun.com/wp-content/uploads/sites/6/2022/08/JF-US-CHILD-TAX-CREDIT-OFF-PLATFORM-03.jpg?w=1920

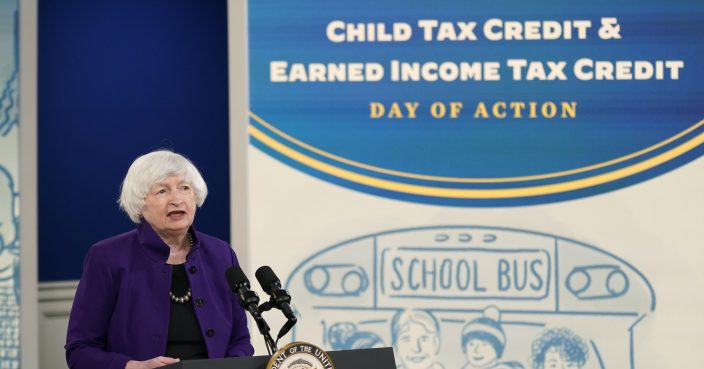

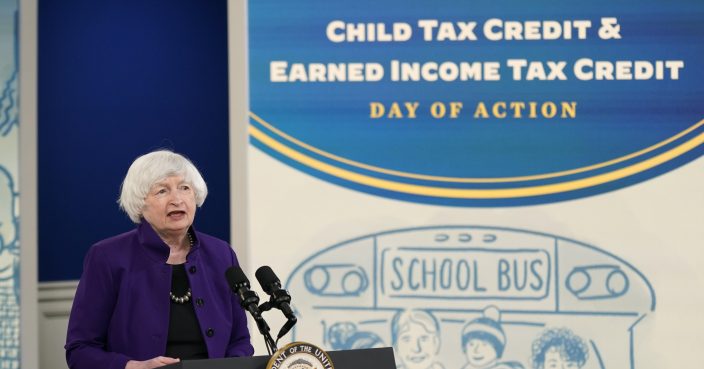

EXPLAINER How To Claim Child Tax Credit On Your Taxes News

https://media.bastillepost.com/wp-content/uploads/global/2022/02/facebook_704x369_a8710a68ddff8f6ae6653bf2a79d6042-9ae9b4c60d34477896c5685ee88dc7f3.jpg

Child Tax Credit 2023 24 How To Claim Markets Today US

https://marketstodayus.com/wp-content/uploads/2023/12/comprehensive-guide-on-how-to-claim-child-tax-credit.png

You can claim the 2024 child tax credit on the tax return you will file in 2025 You ll also need to fill out Schedule 8812 There are seven qualifying tests to determine eligibility for the Child Tax Credit age relationship support dependent status citizenship length of residency and family income If you aren t able to claim the Child Tax Credit for a dependent they might be eligible for the Credit for Other Dependent

The Child Tax Credit is a valuable tax benefit claimed by millions of American parents with the goal of offsetting the costs of raising a child The Child Tax Credit 2024 is worth up to 2 000 for each qualifying child for returns filed in 2025 Universal Credit has replaced child tax credits for most people you should check if you can get child tax credits before you apply If you share care of your children with another person for example their other parent the person who spends most

Download How To Claim Child Tax Credit

More picture related to How To Claim Child Tax Credit

EXPLAINER How To Claim Child Tax Credit On Your Taxes WNY News Now

https://wnymedia.s3.us-east-2.amazonaws.com/wp-content/uploads/2022/02/09090018/Child-Tax-Credit.jpg

Child Tax Credit Other Dependents Part 1 Income Tax 2023 Accounting

http://accountinginstruction.info/wp-content/uploads/2023/04/Child-Tax-Credit-Other-Dependents-Part-1.jpg

Child Tax Credit When Will The IRS Start Refunding Your Credit Money

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18r4vk.img?w=1920&h=1080&m=4&q=75

If Congress doesn t address the soon expiring expanded child tax credit parents could see a higher tax bill in the coming years If you made a claim for Child Tax Credits in the last tax year you might be able to make a new claim You should talk to an adviser to find out if you can You can t make a new claim for tax credits but you can claim Universal Credit instead

[desc-10] [desc-11]

Proposal Would Expand Child Tax Credit The Iola Register

https://iolaregister.s3.amazonaws.com/production/uploads/2024/01/child-tax-credit.jpg

Child Tax Credit The Nation

https://www.thenation.com/wp-content/uploads/2022/12/FEATURE_TGQ-11-28-22-Child-Tax-Credit-CRX.jpg

https://www.irs.gov › credits-deductions › individuals › child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

https://www.gov.uk › child-tax-credit › new-claim

You can only claim Child Tax Credit for children you re responsible for The amount you could get depends on when your children were born You could get the child element of Child Tax

Additional Child Tax Credit Eligibility Income Limit Calculator

Proposal Would Expand Child Tax Credit The Iola Register

Claim Child Tax Credit West Adams Neighborhood Council

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

What Is The Two child Benefit Cap Universal Credit And Tax Credit

New Bill Could Expand The Child Tax Credit Here s What To Know For

New Bill Could Expand The Child Tax Credit Here s What To Know For

Child Tax Credit Changes To Expect This Year YouTube

Child Tax Credit 2024 Eligibility Can You Get The Child Tax Credit If

House Passes Child Tax Credit Expansion NPR Tmg News

How To Claim Child Tax Credit - Universal Credit has replaced child tax credits for most people you should check if you can get child tax credits before you apply If you share care of your children with another person for example their other parent the person who spends most