How To Claim Deduction Under Section 80ddb Section 80DDB Understand the deduction limit under the Income Tax Act diseases covered how to claim deductions and the required medical certificate for tax benefits

Under Section 80DDB of the Income Tax Act financial relief is given to the taxpayer by allowing him deduction for medical treatment of specified diseases These limits differ according to the patient s age and have been revised from time to time to adjust for an escalation in health care costs Individual taxpayers who have incurred medical expenses for specific diseases or conditions may claim deductions under Income Tax Act Section 80DDB The taxpayer or a dependent such as a spouse kid or parent can be eligible

How To Claim Deduction Under Section 80ddb

How To Claim Deduction Under Section 80ddb

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/06/section-80gg.jpg

Learn How To Claim Tax Deduction On Cancer Treatment Expenses Under

https://media.assettype.com/bloombergquint/2022-09/3d3132d5-2425-4927-b2f6-fcdabfc6be7d/Tax_Deduction_on_Medical_Expense_Image_by_atlascompanya_on_Freepik.jpg?w=1200&auto=format%2Ccompress&ogImage=true

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in respect of amount actually paid by the taxpayer on medical treatment of specified disease or ailment prescribed by the Board see rule 11DD for prescribed disease or ailment The deduction under Section 80DDB can be claimed by individuals or Hindu Undivided Families HUFs It is available to resident Indians The taxpayer can claim the deduction if they have paid for the treatment of a dependent A dependent includes a spouse child parent or sibling

Deduction under section 80DDB can be claimed by a resident individual or by a resident Hindu Undivided Family HUF for a member only Therefore non resident individuals NRIs and non resident HUFs cannot claim this deduction For the assessment year of 2022 23 the amount allowed under Section 80DDB income tax deductions is discussed below Rs 40000 or the amount paid which of the two is less Senior citizens can claim a deduction up to Rs 100000 or

Download How To Claim Deduction Under Section 80ddb

More picture related to How To Claim Deduction Under Section 80ddb

Section 80C Deductions List Save Income Tax With Section 80C Options

https://i.ytimg.com/vi/6nlYwNEIo48/maxresdefault.jpg

Section 80DD Deductions Claim Tax Deduction On Medical Expenses Of

https://life.futuregenerali.in/media/2xjl3phd/section-80dd-tax-deduction.jpg

How To Claim Standard Deduction Under Section 16 ia YouTube

https://i.ytimg.com/vi/W6jHfZqywq0/maxresdefault.jpg

As per section 80DDB if you are an individual taxpayer or HUF you can reduce an amount as per the specified limits from the total income to reduce your total tax payable The deduction can be claimed for medical expenses incurred on treatment of self or a dependent relative To claim deduction under Section 80DD you will need to submit a certificate in Form 10IA attested by medical authority This certificate is for certifying the person with disability severe disability cerebral palsy autism and multiple disability for purposes of section 80DD

Any of the following taxpayer or dependents who suffers from the disease mentioned under section 80DDB is eligible to claim the deduction of medical expenditure incurred Yes you can claim deduction under section 80D and section 80DDB simultaneously Section 80D provides a deduction against the medical insurance policy premium payment for dependents and senior citizens Section 80DDB provides a tax deduction against the medical treatment of specified diseases

Section 80DDB Tax Benefits Eligible Medical Expenses Claiming Deductions

https://www.wishfin.com/blog/wp-content/uploads/2023/03/Section-80DDB-of-Income-Tax-Act_-Diseases-Covered-Form-Certificate-Claiming-Deductions.jpg

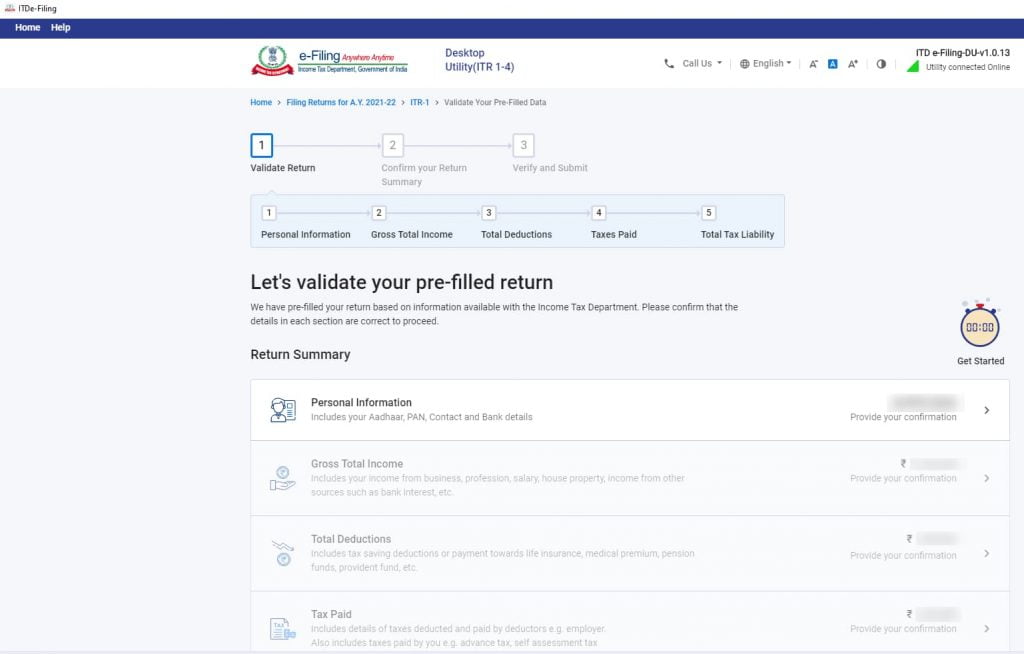

How To Claim Deduction In ITR 2 Section 80TTA 80TTB For AY 2023 24 II

https://i.ytimg.com/vi/lemeBzSvtrY/maxresdefault.jpg

https://tax2win.in/guide/section-80ddb

Section 80DDB Understand the deduction limit under the Income Tax Act diseases covered how to claim deductions and the required medical certificate for tax benefits

https://www.taxbuddy.com/blog/80ddb-deduction

Under Section 80DDB of the Income Tax Act financial relief is given to the taxpayer by allowing him deduction for medical treatment of specified diseases These limits differ according to the patient s age and have been revised from time to time to adjust for an escalation in health care costs

Who Can Claim Deduction Under Section 80U And How Much Services

Section 80DDB Tax Benefits Eligible Medical Expenses Claiming Deductions

Claim Deduction Under Section 80DD Learn By Quicko

7 Section 80DDB SAVE MONEY Claim deduction Upto 1 00 000 IncomeTax

Tax Saving Deductions Under Section 80DD 80DDB 80E Of Income Tax Act

Deductions Under Section 80C Benefits Works Myfinopedia

Deductions Under Section 80C Benefits Works Myfinopedia

Section 80TTA How You Can Claim Tax Deduction

Senior Citizens Can Claim Tax Deductions For FDs Post Office Schemes

Deduction Under Section 80TTB Of The Income Tax Act 1961 Palgou India

How To Claim Deduction Under Section 80ddb - Section 80DDB is a section introduced in the Income Tax Act for allowing individuals suffering from specific diseases to claim a deduction from the taxable income For certain specific diseases the Government offers tax deduction to individuals and HUFs under Section 80DDB on the basis of expenses incurred for the treatment of the