How To Claim Energy Tax Credit 2022 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

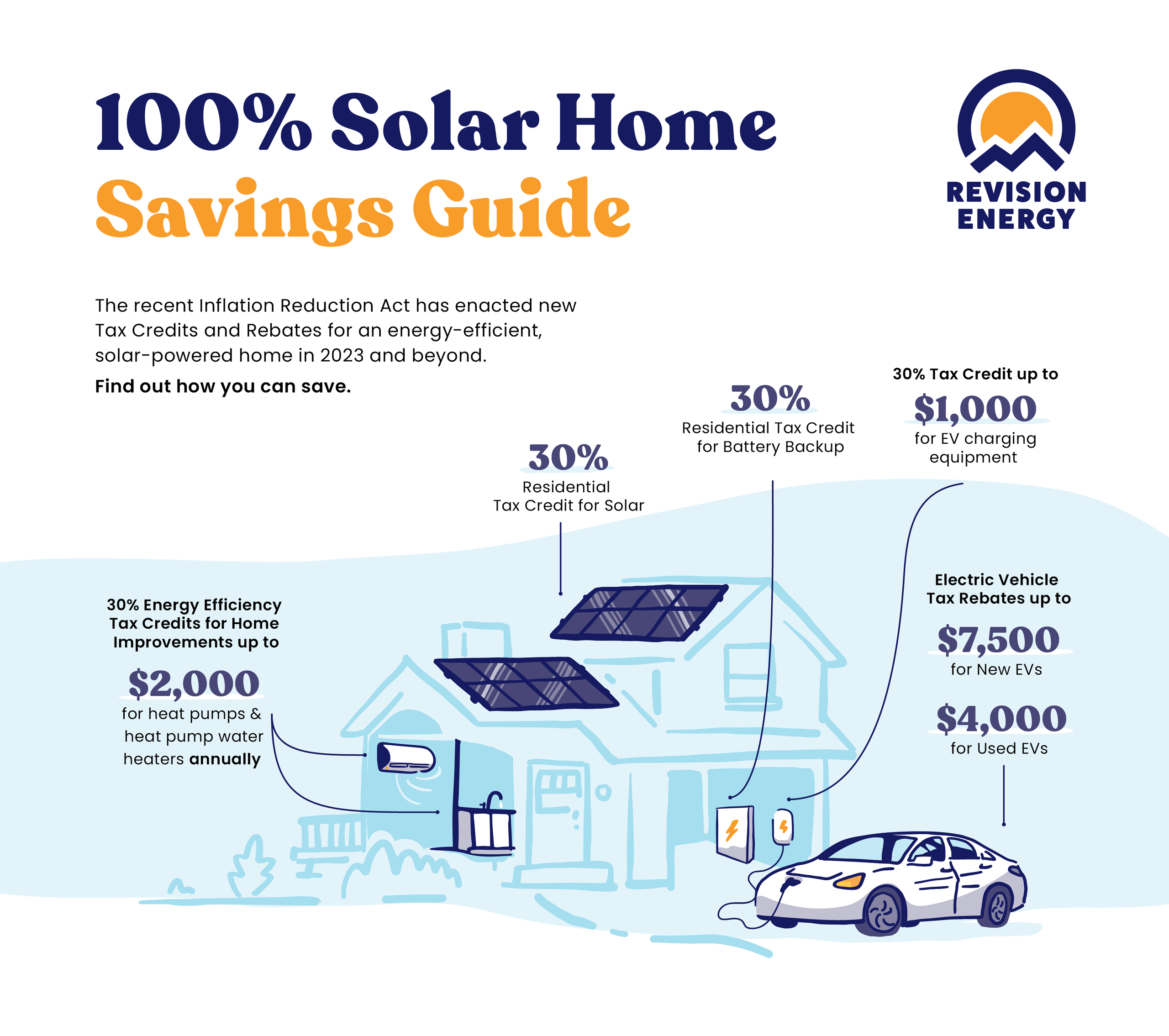

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we

How To Claim Energy Tax Credit 2022

How To Claim Energy Tax Credit 2022

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

https://www.eesi.org/images/content/Summary_of_Clean_Energy_Credits.png

How Does The Federal Solar Tax Credit Work

https://www.paradisesolarenergy.com/hs-fs/hubfs/solar-energy-tax-credit-step-down-chart_2022.png?width=560&name=solar-energy-tax-credit-step-down-chart_2022.png

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q

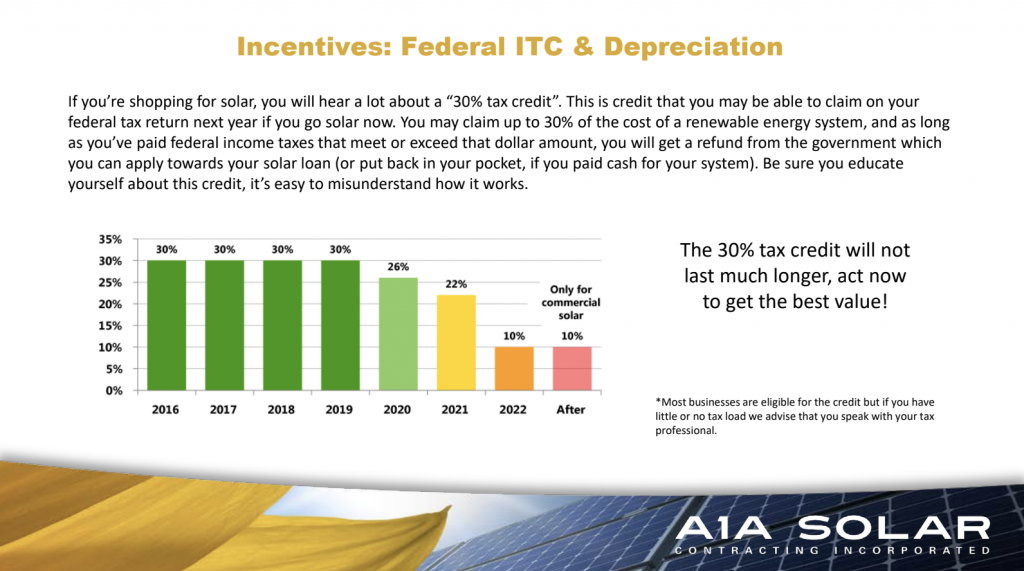

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types of renewable energy are In order to receive this credit you need to claim it on your taxes for the year the system was deemed operational by a government inspector So if you got installed and got approved in 2022 then you would claim the

Download How To Claim Energy Tax Credit 2022

More picture related to How To Claim Energy Tax Credit 2022

How To File IRS Form 5695 To Claim Your Renewable Energy Credits

https://images.unboundsolar.com/media/5695-line-6.png?auto=compress%2Cformat&fit=scale&h=1163&ixlib=php-3.3.0&q=45&w=2048&wpsize=2048x2048&s=fa4a7bb76f365b9e242cac8ff4ca17fd

Renewable Electricity Tax Credit Equalization Act Introduced In House

https://dailyenergyinsider.com/wp-content/uploads/2019/08/shutterstock_625631687.jpg

How To Qualify For Energy Efficiency Tax Credits In 2020

https://images.ctfassets.net/0fol1oltsp9p/7fECLuxqXKDTEh9izw3DDS/b7500db5e159c6ea9949a6968d4971e8/Energy_Tax_Credits_For_Home_Improvements.jpg?w=1200&h=630&fit=fill

2022 Tax Credit Information Information updated 12 30 2022 The Non Business Energy Property Tax Credits outlined below apply retroactively through 12 31 2022 Tax Credit TABLE OF CONTENTS How do energy tax credits work What did the Inflation Reduction Act of 2022 do for energy tax credits What energy tax credits are available

Key Takeaways An energy tax credit is a government incentive that reduces the cost for people and businesses to use alternative energy resources The credit amount either Homeowners may be able to save thousands of dollars by claiming tax credits and rebates under the Inflation Reduction Act of 2022

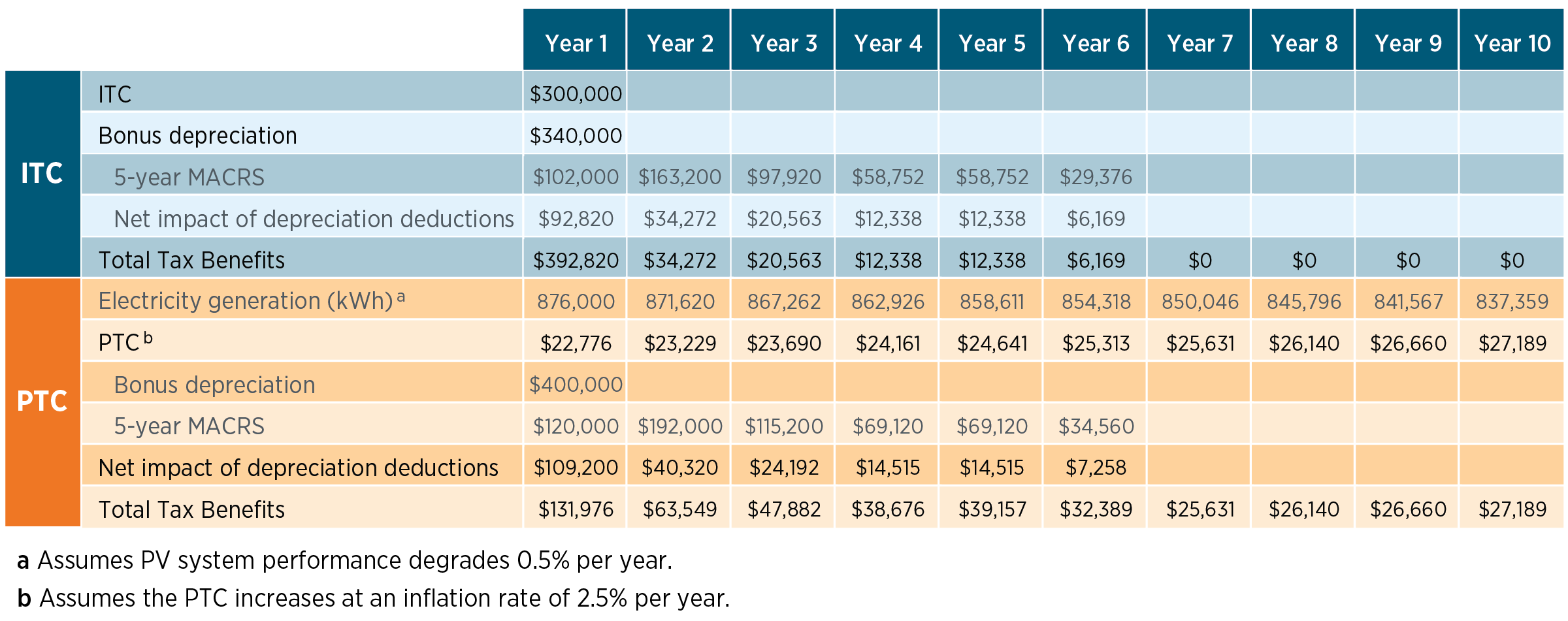

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/2022-10/Summary-ITC-and-PTC-Values-Table.png

.png)

Federal Solar Tax Credit Extended Through 2022 Solar

https://s3.amazonaws.com/solarassets/wp-content/uploads/Pick My Solar LIVE (10).png

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements

https://www.irs.gov/credits-deductions/residential...

If you invest in renewable energy for your home such as solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy

Clean Energy Tax Credits Get A Boost In New Climate Law Article EESI

Federal Solar Tax Credits For Businesses Department Of Energy

How To File The Federal Solar Tax Credit A Step By Step Guide Solar

Federal Solar Tax Credits For Businesses Department Of Energy

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

How To Claim The Federal Solar Tax Credit SAVKAT Inc

How To Claim The Federal Solar Tax Credit SAVKAT Inc

Will Solar Energy Plummet If The Investment Tax Credit Fades Away WSJ

Get A 30 Federal Tax Credit For Your Solar Panel System While You Can

Energy Secretary Says Time Is Right For Clean Energy Tax Credits

How To Claim Energy Tax Credit 2022 - Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q