How To Claim House Rent Exemption In Income Tax Yes you can claim Section 80GG benefit when the property is in your father s name and you are paying rent to him You must enter into a rental agreement

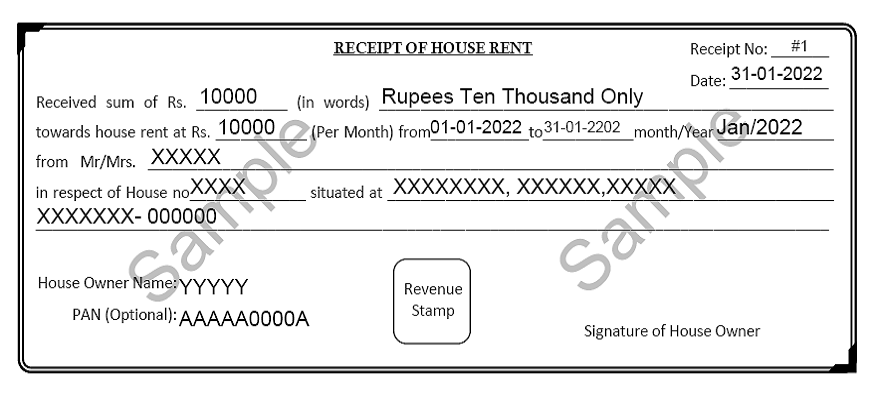

According to tax experts it is mandatory to have both rent agreement and rent receipts from landlord to claim the HRA tax exemption Further it is mandatory for an An employee has to submit Form 12BB to the employer to claim the exemptions like HRA LTA etc and Income Tax deductions under Chapter VI A It should be noted that self employed individuals can

How To Claim House Rent Exemption In Income Tax

How To Claim House Rent Exemption In Income Tax

https://www.pdffiller.com/preview/50/825/50825271/large.png

HRA Exemption House Rent Exemption U S 10 13A

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2019/01/House-Rent-Exemption-Under-Section-1013A.jpg

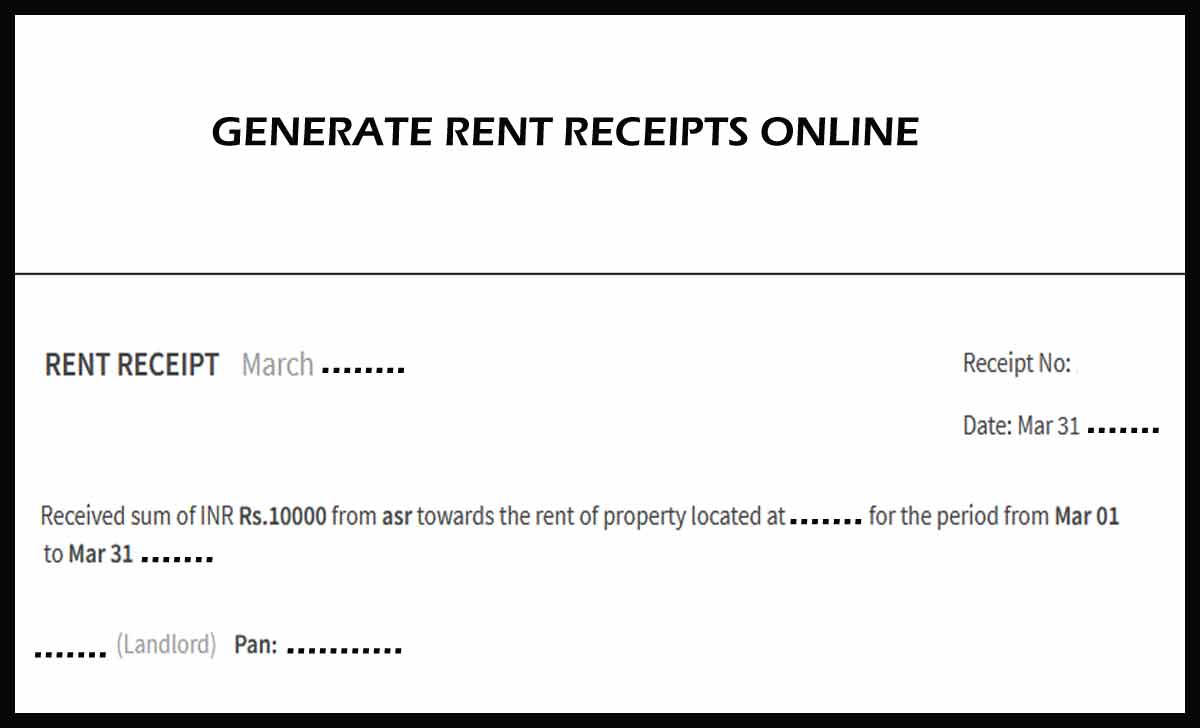

Rent Receipt Generator Online Download Rent Receipt For HRA

https://localitydetails.com/images/rental-receipt-fromat-2.png

No HRA is an allowance and is exempt from Salary Income u s 10 13A of the Income Tax Act Can HRA exemption be claimed if living parents A taxpayer can Salaried individuals can claim tax exemption on house rent allowance HRA provided they are living in a rented house paying rent and have certain valid documents

How to Claim HRA Benefit By providing the rental agreement or rent receipts to your employer you can claim income tax HRA exemption without excess tax deduction at The tax exemption on HRA can be claimed while filing ITR even though you have forgotten to submit rent proofs to the employer An individual can save tax on the

Download How To Claim House Rent Exemption In Income Tax

More picture related to How To Claim House Rent Exemption In Income Tax

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

However if you reside in a rented accommodation you have the opportunity to claim a tax exemption either partially or wholly under Section 10 13A of the As per Section 80GG of income tax rules self employed individuals who do not receive a house rent allowance from the employer can claim a deduction for the rent

From the drop down menu select 10 13 Allowance to meet expenditure incurred on house rent You are required to copy the tax exempt portion of HRA from A guide on how to claim HRA exemption and save taxes Tweet What is HRA Salaried individuals who live in a rented house can claim House Rent Allowance or HRA to lower

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

https://www.signnow.com/preview/497/332/497332572/large.png

Rent Receipt For Income Tax Deductions Under HRA

https://www.bankbazaar.com/images/india/infographic/House_Rent_Receipt_Format.png

https://cleartax.in/s/claim-deduction-under-section-80gg-for-rent-paid

Yes you can claim Section 80GG benefit when the property is in your father s name and you are paying rent to him You must enter into a rental agreement

https://m.economictimes.com/wealth/tax/all-you...

According to tax experts it is mandatory to have both rent agreement and rent receipts from landlord to claim the HRA tax exemption Further it is mandatory for an

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Tax Exempt Donation Letter Sample Form Fill Out And Sign Printable

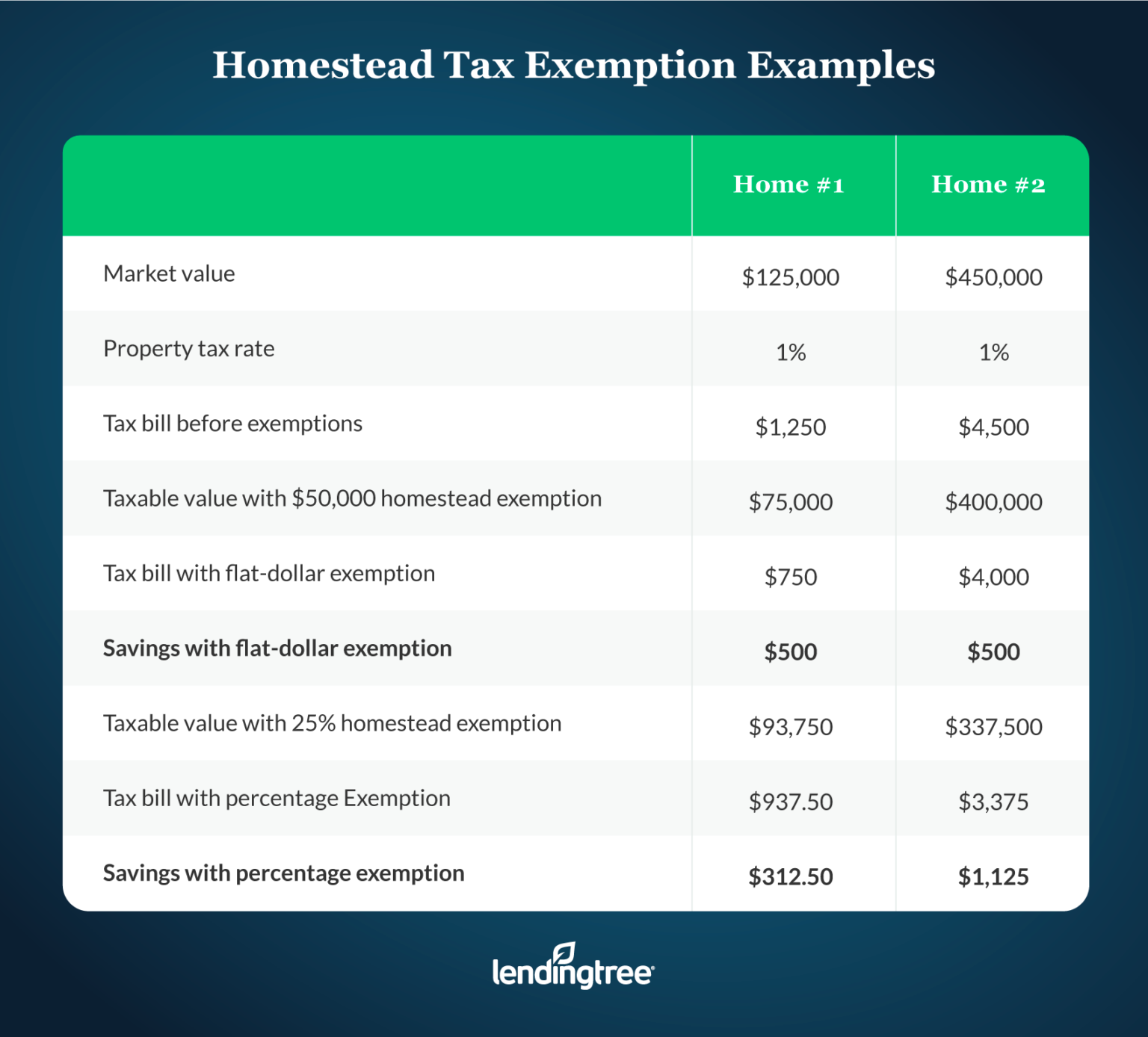

Texas Homestead Tax Exemption Cedar Park Texas Living

What Is A Homestead Exemption And How Does It Work LendingTree

Generate Rent Receipt To Claim Income Tax Financial Year

House Rent Allowance HRA Exemption Rules Its Tax Benefits Chandan

House Rent Allowance HRA Exemption Rules Its Tax Benefits Chandan

Fillable Online How To Claim The Earned Income Tax Credit EITC Fax

Section 80GG Of Income Tax Act And Deductions In Respect Of Rent Paid

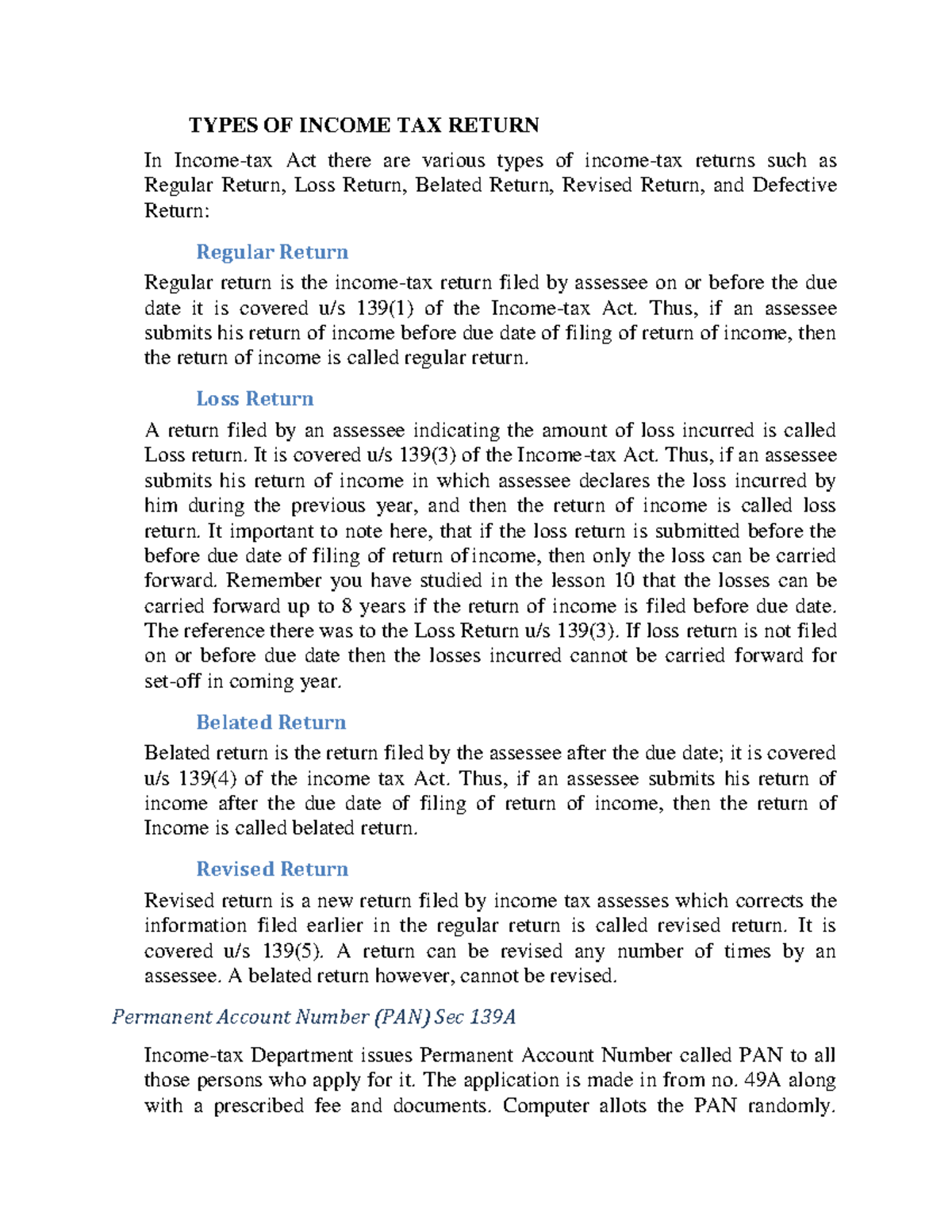

Types OF Income TAX Return TYPES OF INCOME TAX RETURN In Income tax

How To Claim House Rent Exemption In Income Tax - How to Claim HRA Benefit By providing the rental agreement or rent receipts to your employer you can claim income tax HRA exemption without excess tax deduction at