How To Claim Interest On Home Loan Under Section 24 All you need to do is satisfy the conditions under both the section First claim tax benefit under section 24 of income tax act up to Rs 2 lakh Further claim the next Rs

How to claim income tax benefits on home loans in FY23 4 min read 20 Mar 2023 06 18 PM IST Join us Vipul Das A Home Loan is a financial Conditions to Claim Tax benefits on Housing Loan Interest under Section 24 To avail the tax benefit of interest on Housing Loan under Section

How To Claim Interest On Home Loan Under Section 24

How To Claim Interest On Home Loan Under Section 24

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/Home-Loan-Comparison-768x513.png

Home Loan Interest Rates Compare Rates Of Top Banks Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/07/Home-Loan-Interest-Rates-loanfasttrack-1-1024x684.png

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

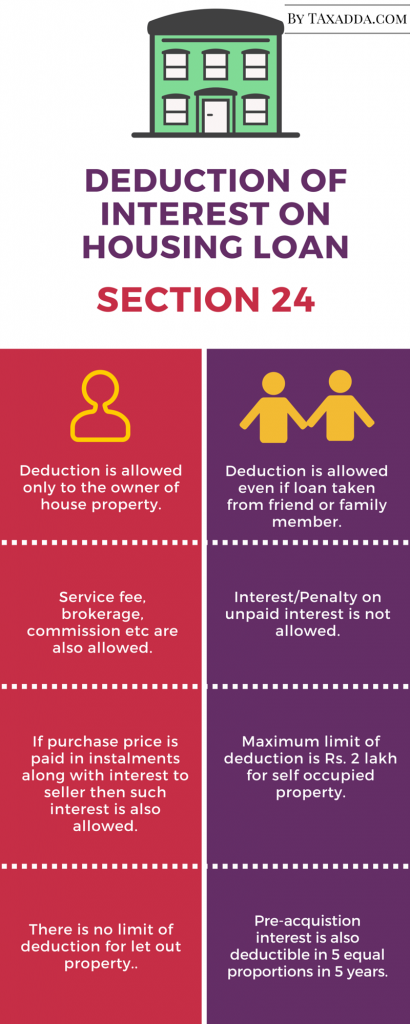

Section 24 b Under this section you can claim a deduction of up to Rs 2 lakhs on the interest paid on a home loan for a self occupied property Introduction Section 24b of income tax act allows deduction of interest on home loan from the taxable income Such loan should be taken for

Section 24 lets homeowners claim yearly tax exemptions of up to Rs 2 00 000 on interest payments against home loans It also allows Section 24 allows a Rs 2 lakh deduction on the home loan interest paid whether the property is self occupied or let out In case the property

Download How To Claim Interest On Home Loan Under Section 24

More picture related to How To Claim Interest On Home Loan Under Section 24

Download Sbi Home Loan Processing Time Home

https://assets-news.housing.com/news/wp-content/uploads/2020/04/12093140/Home-loan-interest-rates-and-EMI-in-top-15-banks-FB-1200x700-compressed.jpg

Best Guide On Interest On Housing Loan Section 24b TaxAdda

https://taxadda.com/wp-content/uploads/Section-24b-410x1024.png

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/s1600/1644859917358770-0.png

Interest on Home Loan Pre Construction Interest How to determine Income from House Property FAQ Income from House Property The annual value of any property How to maximise tax rebate under Section 24 Deductions under Section 80EE How to maximise tax benefits under Section 80EE Deductions

In such a case the borrower can claim tax deduction of up to Rs 2 lakh on home loan interest paid in a financial year under Section 24B In case Any interest paid before possession is tax deductible in 5 equal installments beginning from the financial year in which construction was

Home Loans Top Tips To Close Your Loan Account Early As RBI Keeps Repo

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202304/home-loan-gfx.jpg?itok=qzpDT2qi

How To Fill Housing Loan Interest And Principal In Income Tax Return

https://i.ytimg.com/vi/0xIFd-jhyEU/maxresdefault.jpg

https://scripbox.com/tax/section-24-of-income-tax-act

All you need to do is satisfy the conditions under both the section First claim tax benefit under section 24 of income tax act up to Rs 2 lakh Further claim the next Rs

https://www.livemint.com/money/personal-finance/...

How to claim income tax benefits on home loans in FY23 4 min read 20 Mar 2023 06 18 PM IST Join us Vipul Das A Home Loan is a financial

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Home Loans Top Tips To Close Your Loan Account Early As RBI Keeps Repo

THOUGHTSKOTO

Don t Just Consider The Interest Rates When Taking A Home Loan

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

Is Interest On Home Loan Allowed As Deduction Under New Tax Section 115BAC

Is Interest On Home Loan Allowed As Deduction Under New Tax Section 115BAC

Can I Claim Both Home Loan And HRA Tax Benefits

Home Loan Interest Rates Top 15 Banks That Offer The Lowest

How To Make Your Home Loan Interest Free The Prudent Investor

How To Claim Interest On Home Loan Under Section 24 - Section 24 of the Income Tax Act allows us to claim Home Loan Interest amount of maximum Rs 2 lakh in a financial year against a property for which you have