How To Claim Marriage Allowance Rebate The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Start now Other ways to apply If you cannot apply online you can

How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should make the claim The marriage tax allowance means you may be eligible to claim a 1 250 tax rebate but an estimated 2 4 million married and civil partnered couples are missing out

How To Claim Marriage Allowance Rebate

How To Claim Marriage Allowance Rebate

https://blog.joshualeighandco.com/wp-content/uploads/2022/02/Marriage-Allowance-2.jpg

Marriage Allowance

https://gmcgca.com/media/1705/marraige.jpg

Marriage Allowance Explained Tax Rebate Online

https://tax-rebate.online/wp-content/uploads/2020/06/julia-solonina-UTMIln3hT9o-unsplash-1024x768.jpg

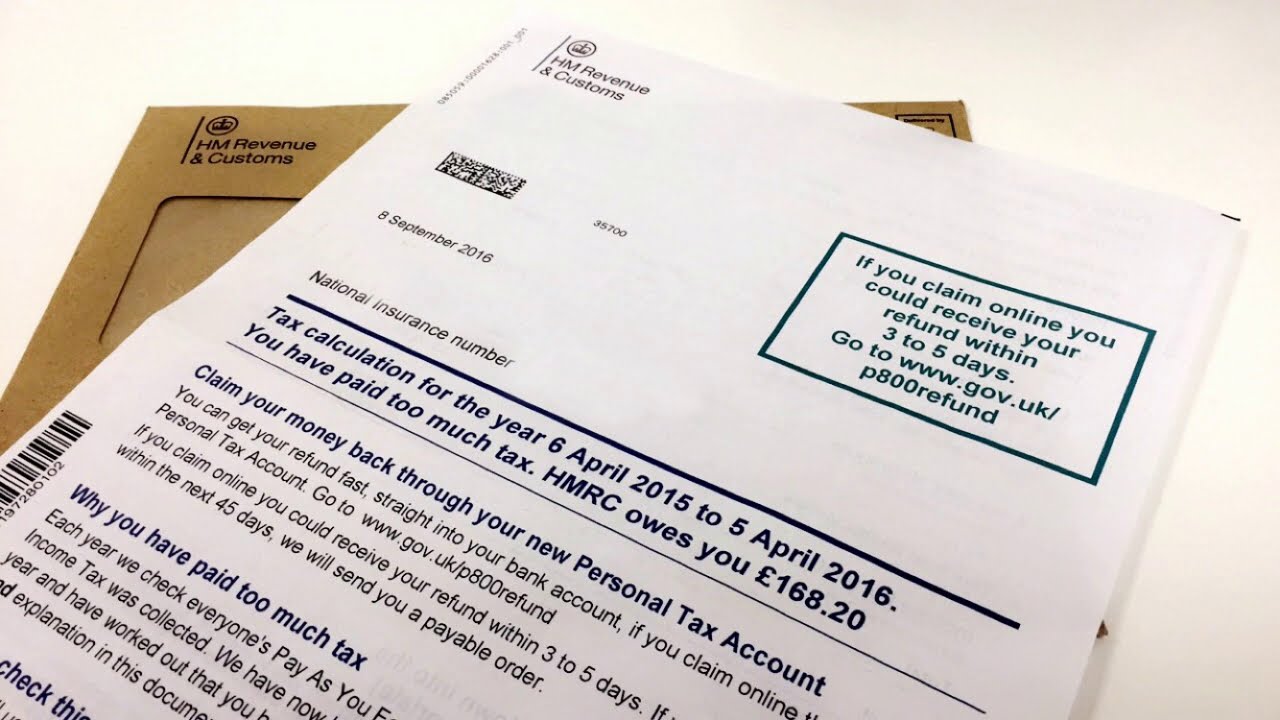

If your partner has died since 5 April 2018 it is possible to backdate your marriage allowance claim to include any tax year since 5 April 2018 that you were eligible to receive it To receive backdated marriage allowance you can Claiming marriage allowance You can apply for marriage allowance online on GOV UK If you cannot claim online you can telephone HMRC on 0300 200 3300 to make the

How To Claim The Marriage Allowance The easiest way to claim the marriage allowance is to apply online using this HMRC link The information required includes National Insurance Numbers and a form of Identification In this article we explain how marriage tax allowance is calculated how you can make a claim and how it is paid Additionally marriage allowance can be backdated which means married couples may be eligible to claim up

Download How To Claim Marriage Allowance Rebate

More picture related to How To Claim Marriage Allowance Rebate

Marriage Allowance Should I Claim Alpha Business Services

https://www.alphalimited.co.uk/wp-content/uploads/2017/11/Tax-return.jpg

Are You Due A Marriage Allowance Refund Money Advice And Help

https://www.moneyadviceandhelp.com/marriage/images/marriage_allowance.jpg

Are You Eligible For A Tax Rebate Of Up To 662 Lighthouse Financial

https://www.lighthousefp.co.uk/wp-content/uploads/2017/12/Marriage-Allowance.jpg

How to apply for the marriage allowance If you want to apply for the marriage allowance the person who earns the least should make the claim Before you head to the You can claim Married Couple s Allowance in your Self Assessment tax return If you don t complete a Self Assessment tax return contact HMRC Opens in a new window with details

How to claim If you fill in a Self Assessment tax return each year Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax Your marriage allowance claim can be backdated for up to four years Any claimants in this current tax year are able to backdate their claim to include any tax year since

Tax Claimer Marriage Allowance Tax Rebate

https://taxclaimer.com/wp-content/uploads/2022/01/photo-1591604466107-ec97de577aff.jpg

HMRC Urges Eligible Couples To Claim Marriage Allowance SB P

https://sb-p.co.uk/media/insights/headers/wedding-rings-person-signing-marriage-document-header.jpg

https://www.gov.uk/apply-marriage-allowance

The quickest way to apply for Marriage Allowance is online You ll get an email confirming your application within 24 hours Start now Other ways to apply If you cannot apply online you can

https://www.gov.uk/marriage-allowance/how-to-apply

How to apply You can apply for Marriage Allowance online It s free to apply If both of you have no income other than your wages then the person who earns the least should make the claim

Marriage Allowance Claim Your 252 Tax Rebate

Tax Claimer Marriage Allowance Tax Rebate

Marriage Allowance Tax Rebate YouTube

We Thought We Were Dealing With HMRC Marriage Allowance Claimants

HOW TO CLAIM MARRIAGE ALLOWANCE Townends Accountants LLP

Quick Tips Making Use Of The Marriage Allowance Holden Associates

Quick Tips Making Use Of The Marriage Allowance Holden Associates

What Is Marriage Tax Allowance The UK Marriage Tax Rebate Explained

Marriage Tax Allowance Rebate My Tax Ltd

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

How To Claim Marriage Allowance Rebate - If your partner has died since 5 April 2018 it is possible to backdate your marriage allowance claim to include any tax year since 5 April 2018 that you were eligible to receive it To receive backdated marriage allowance you can