How To Claim Recovery Rebate Credit 2024 To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help Qualified taxpayers can also find free one on one tax preparation help nationwide through the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs

How Do I Claim the Recovery Rebate Credit To claim the Recovery Rebate Credit you must file a US tax return for the year in which the Economic Impact Payment was sent out For example if you re hoping to claim one or both of the two payments sent out in 2020 you will need to file a 2020 tax return Most taxpayers eligible for Economic Impact Payments linked to the coronavirus tax relief have already received or claimed their payments via the Recovery Rebate Credit But for those who haven t yet filed a

How To Claim Recovery Rebate Credit 2024

How To Claim Recovery Rebate Credit 2024

https://www.greenbacktaxservices.com/wp-content/uploads/2022/03/Recovery-Rebate-Credit-for-US-expats.jpg

Recovery Rebate Credit 2024 Eligibility Calculator How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEimxxHMVm4XxeDkVaSMSFoj9CX2XqGBjiPWj49fhO8klFSJrHN4Rbr5b3-zi4xSiAaa58C9r_f4Fc9AdeFh2CA51yQPsKTignpJ4wQvAhC7rp8drJR7xe5CxkmwSkVk1nWyZPNxWcqS2tVks6h4fP0QiW59YCZUG37lxHpjiqBAgggUng7A4gFgvhWK/s958/RRR.jpg

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

The May 17 2024 deadline is fast approaching for taxpayers who have not yet filed a 2020 tax return to claim a refund of withholdings estimated taxes or their 2020 Recovery Rebate Credit Eligible people must file a 2020 tax return by May 17 2024 to cash in on the recovery rebate tax credit potentially worth thousands of dollars

If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Taxpayers eligible for recovery rebate credits for tax year 2020 have until May 17 2024 to file a tax return to claim the payment By law taxpayers can make a claim for refund up to

Download How To Claim Recovery Rebate Credit 2024

More picture related to How To Claim Recovery Rebate Credit 2024

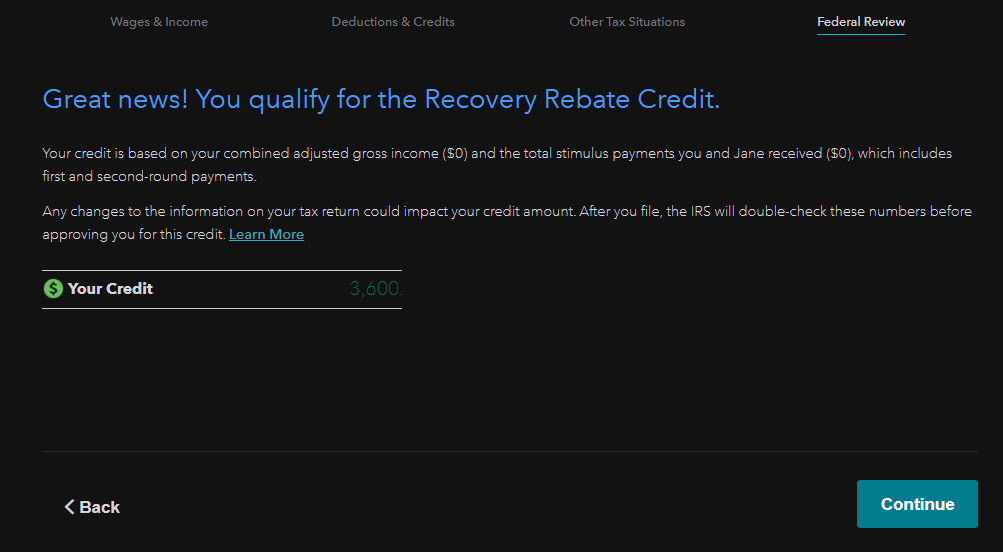

How To File Recovery Rebate Credit Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/it-s-not-too-late-claim-a-recovery-rebate-credit-to-get-your-27.png

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different Than Expected The

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

Unlock the secrets of the Recovery Rebate Credit before the 2024 deadline with our comprehensive guide Discover eligibility how to claim and maximize your credit especially for U S expats How to claim the recovery rebate credit As a credit the Recovery Rebate Credit can be claimed when you file your income tax return However since the stimulus payments were made in 2020 and 2021 the Recovery Rebate Credit must be claimed on your tax returns for those two years

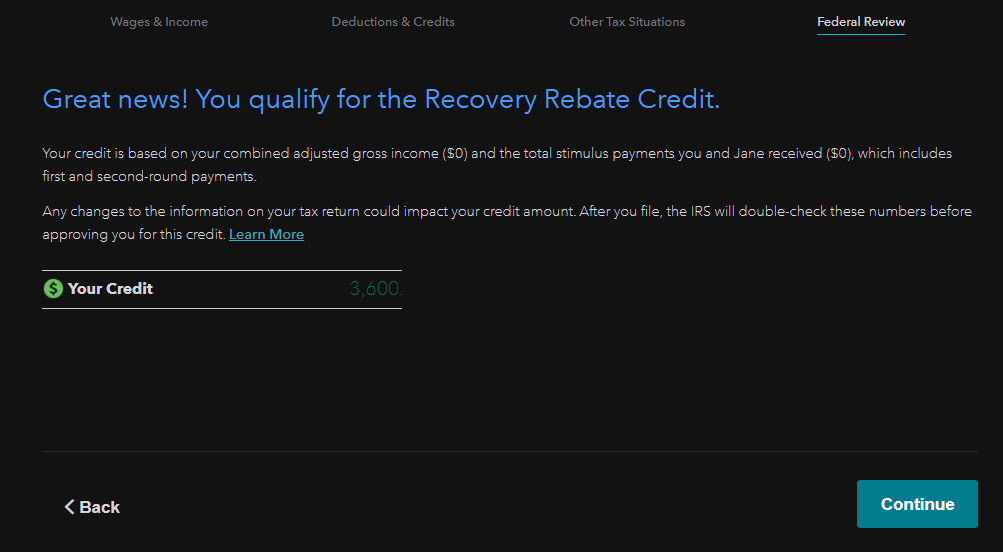

How do I claim the credit If you didn t receive the full credit amount as an economic impact payment claiming the tax credit is relatively easy TurboTax can help you claim the credit by asking you questions about your tax situation and the economic impact payments you may have received Eligible taxpayers must file a tax return first to claim a Recovery Rebate Credit even if their income from a job business or other source was minimal or non existent For individuals wanting to claim the 2021 Recovery Rebate Credit they have until April 15 2025 to file the required tax return

What Happens If You Claim The Recovery Rebate Credit Leia Aqui Do I Have To Pay Back The

https://e00-marca.uecdn.es/assets/multimedia/imagenes/2023/03/02/16777757725863.jpg

How To Claim The 2021 Recovery Rebate Credit On Tax Return

https://www.myexpattaxes.com/wp-content/uploads/Claim-the-2021-Recovery-Rebate-Credit-on-Your-US-Tax-Return.jpg

https://www.irs.gov/newsroom/irs-reminds-eligible...

To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help Qualified taxpayers can also find free one on one tax preparation help nationwide through the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs

https://www.greenbacktaxservices.com/blog/recovery-rebate-credit

How Do I Claim the Recovery Rebate Credit To claim the Recovery Rebate Credit you must file a US tax return for the year in which the Economic Impact Payment was sent out For example if you re hoping to claim one or both of the two payments sent out in 2020 you will need to file a 2020 tax return

How To Use The Recovery Rebate Credit To Claim Your Missing Stimulus Payment Forbes Advisor

What Happens If You Claim The Recovery Rebate Credit Leia Aqui Do I Have To Pay Back The

You Can STILL Claim Your 1 400 Stimulus Check With The Recovery Rebate Credit The US Sun

Recovery Rebate Credit Here s How You Can Qualify For 1 400 Payments Marca

Recovery Rebate Credit Refund Claim

How To Claim Stimulus Recovery Rebate Credit On TurboTax

How To Claim Stimulus Recovery Rebate Credit On TurboTax

Recovery Rebate Credit Form Printable Rebate Form

How To Claim The Recovery Rebate Credit Stimulus Checks On TurboTax YouTube

Recovery Rebate Credit How To Get It Taxes For Expats US Expat Tax Service

How To Claim Recovery Rebate Credit 2024 - If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return