How To Claim Tax Back On Donations A Gift Aid declaration allows charities and community amateur sports clubs CASCs to claim tax back on eligible donations It s important that you keep records of

Tax credits for donations You can claim 33 33 cents for every dollar you donated to approved charities and organisations You can only claim on donations that added up to If you weren t aware you could claim additional tax relief on charity donations then you can make a claim for overpayment relief going back four tax years We re currently in the

How To Claim Tax Back On Donations

How To Claim Tax Back On Donations

https://www.etax.com.au/wp-content/uploads/2017/07/etax-tax-deduction-for-charitable-donations.jpg

How To Claim Donations On Your Tax Return Etax Plus

https://etaxplus.com.au/media/1105/how-to-claim-donations-on-your-tax-return.jpg

How To Claim Tax Deductions For Donations And Gifts

https://static.imoney.my/articles/wp-content/uploads/2021/03/11080722/income-tax-receipts.jpg

For example if you are a higher rate taxpayer and donate 200 to a charity the charity can claim Gift Aid to make your donation 250 you pay 40 tax ie the Gift Aid is a government initiative that allows donations given to charity to be tax effective As soon as you give your permission by completing our Gift Aid declaration form we

Gift Aid allows UK charities to claim back the basic rate tax paid on donations by a donor This means charities can claim back from HMRC 25p for every 1 donated boosting the The easiest way to claim your donation tax credit is online in myIR and you ll receive your refund sooner Using myIR means we can work out your tax credit without you having to file a claim when the tax year ends on

Download How To Claim Tax Back On Donations

More picture related to How To Claim Tax Back On Donations

How To Claim Tax Back On PPI Interest Refund EasyFinance4u

https://www.easyfinance4u.com/wp-content/uploads/2021/04/How-To-Claim-Tax-Back-On-PPI-Refund.jpg

How To Claim Tax Deductible Donations With Churches Or Charities

https://inspire.accountants/wp-content/uploads/2020/09/JobKeeper252028329.png

How To Claim Tax Back Ireland Tax Returns Submitted In 3 Easy Steps

https://www.mytaxrebate.ie/wp-content/uploads/2022/02/How-It-Works-1.png

If you re in a higher tax band at 40 then you can claim tax back on your donation as the charity can only claim up to the 20 tax rate This means that you are Claiming tax back through Self Assessment or by asking HMRC to amend tax codes means you need to keep records that show the amount the date and which particular

Nearly nine in 10 taxpayers now take the standard deduction and could potentially qualify to claim a limited deduction for cash contributions These individuals Now that donation tax credits claims are able to be entered online the whole process is quicker and smoother You can start a claim form during the year This means you can

Tips On Tax Deductions For Donations

http://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

How To Claim Charitable Donations As Tax Deduction YouTube

https://i.ytimg.com/vi/SvPUP4NLYZY/maxresdefault.jpg

https://www.gov.uk/guidance/gift-aid-declarations...

A Gift Aid declaration allows charities and community amateur sports clubs CASCs to claim tax back on eligible donations It s important that you keep records of

https://www.ird.govt.nz/.../individual-tax-credits/tax-credits-for-donations

Tax credits for donations You can claim 33 33 cents for every dollar you donated to approved charities and organisations You can only claim on donations that added up to

Tax Benefits On Charity Donation In India How To Claim It SERUDS

Tips On Tax Deductions For Donations

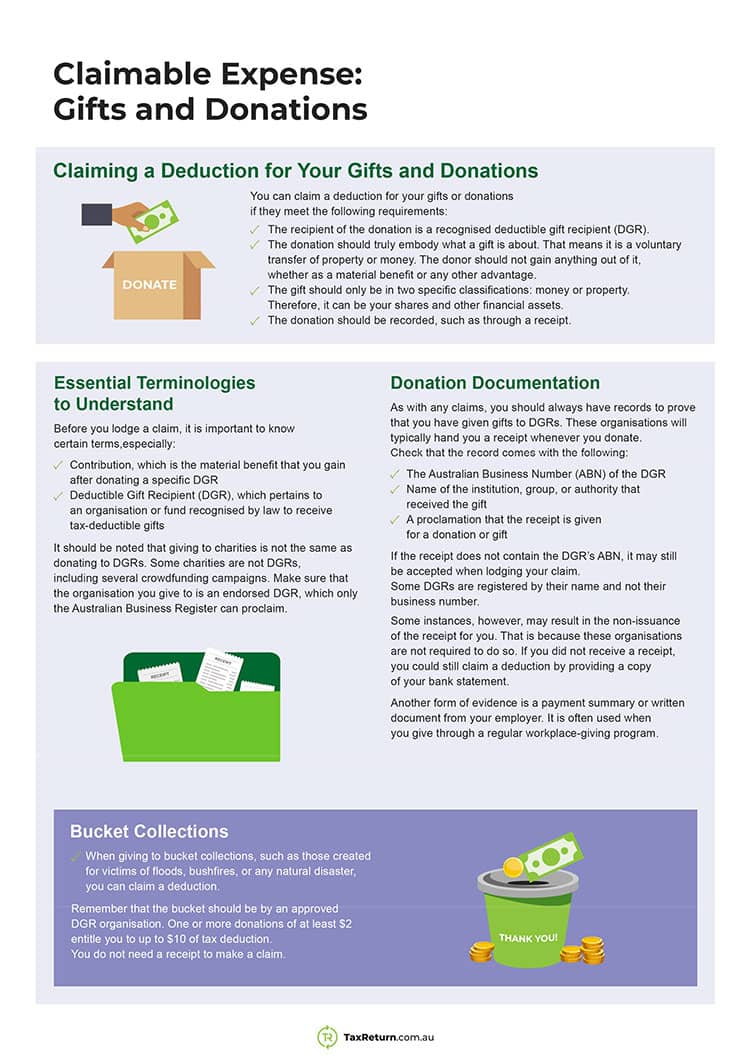

Claimable Expenses What You Can Claim On Your Tax Return

Understanding The Tax Implications Of Donations

Everything You Need To Know About Your Tax Deductible Donation Learn

How To Maximize Your Charity Tax Deductible Donation WealthFit

How To Maximize Your Charity Tax Deductible Donation WealthFit

Charitable Donation Tax Credits Tax Tip Weekly YouTube

How To Claim Tax Back On Ppi 2023 Updated

How To Successfully Complete The UK GOV PPI TAX R40 Refund Claim Form

How To Claim Tax Back On Donations - Charitable contribution tax information search exempt organizations eligible for tax deductible contributions learn what records to keep and how to report