How To Claim Tax Back On Redundancy Payment How to claim tax back after redundancy or losing your job Step 1 Are you due a tax rebate You might be due a refund if you answer yes to all of the questions below Were you dismissed or made redundant part way through the tax year Tax years start on 6 April and end on the following 5 April

Get an Income Tax refund You might be able to claim back some Income Tax if you have had your final pay from your employer you re not getting a pension from your employer Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a

How To Claim Tax Back On Redundancy Payment

How To Claim Tax Back On Redundancy Payment

https://www.aradvisors.com.au/awcontent/aradvisors/images/news/teasers/maximisetaxreturn.jpg

Redundancy Notice Sample Template Word PDF

https://www.wonder.legal/Les_thumbnails/redundancy-notice.png

Termination Pay Redundancy CooperAitken Chartered Accountants

http://www.cooperaitken.co.nz/wp-content/webpc-passthru.php?src=https://www.cooperaitken.co.nz/wp-content/uploads/2020/08/Redundancy.png&nocache=1

You may receive a lump sum payment on redundancy or retirement from your employer A lump sum payment on termination of employment may be exempt from tax or may qualify for tax relief You will only be liable to pay tax on the amount of your payment that is more than either basic exemption and increased exemption if due If you have been made redundant it s highly likely you will be eligible for a tax refund Tommy McNally founder of the Tommy s Tax app explains how to claim money owed If like many people right now you ve just lost your job and are struggling with money I have some good news for you

The first 30000 00 of the redundancy payment is tax free Anything over this sum is shown in box 5 of SA101 page Ai2 The guidance advises This includes redundancy pay How to claim tax back after redundancy or losing your job Step 1 Are you due a tax rebate You might be due a refund if you answer yes to all of these questions Were you dismissed or made redundant part way through the tax year Tax years start on 6 April and end on the following 5 April

Download How To Claim Tax Back On Redundancy Payment

More picture related to How To Claim Tax Back On Redundancy Payment

How To Claim Tax Back In Ireland Irish Tax Rebates

https://blog.irishtaxrebates.ie/wp-content/uploads/2022/01/Blog-Image-how-do-i-claim-tax-back.jpg

3 Ways To Claim Tax Back WikiHow

https://www.wikihow.com/images/c/ca/Claim-Tax-Back-Step-15-Version-2.jpg

Letter Of Termination Of Employment Redundancy

https://www.wonder.legal/Les_thumbnails/letter-of-termination-of-employment-redundancy.png

You ll pay tax and National Insurance on the full 3 000 of your severance payment You do not pay tax on the remaining 10 000 of your total payment as it is under 30 000 If I remain unemployed after my redundancy how do I claim a tax refund Claiming Jobseeker s Allowance JSA or Universal Credit UC If you are claiming jobseeker s allowance JSA or universal credit UC you must give your form P45 to the Jobcentre as soon as you claim the allowance

Any redundancy pay over 30 000 When you get it your employer will usually have deducted the tax but it s likely they won t have taken off the right amount So you might need to claim tax back or pay extra tax See Overpayment or underpayment of tax below How do I pay tax or claim a rebate If you owe tax or need to claim a rebate for over payment you ll need to notify HMRC When you re made redundant make sure you obtain a copy of your P45 from your employer

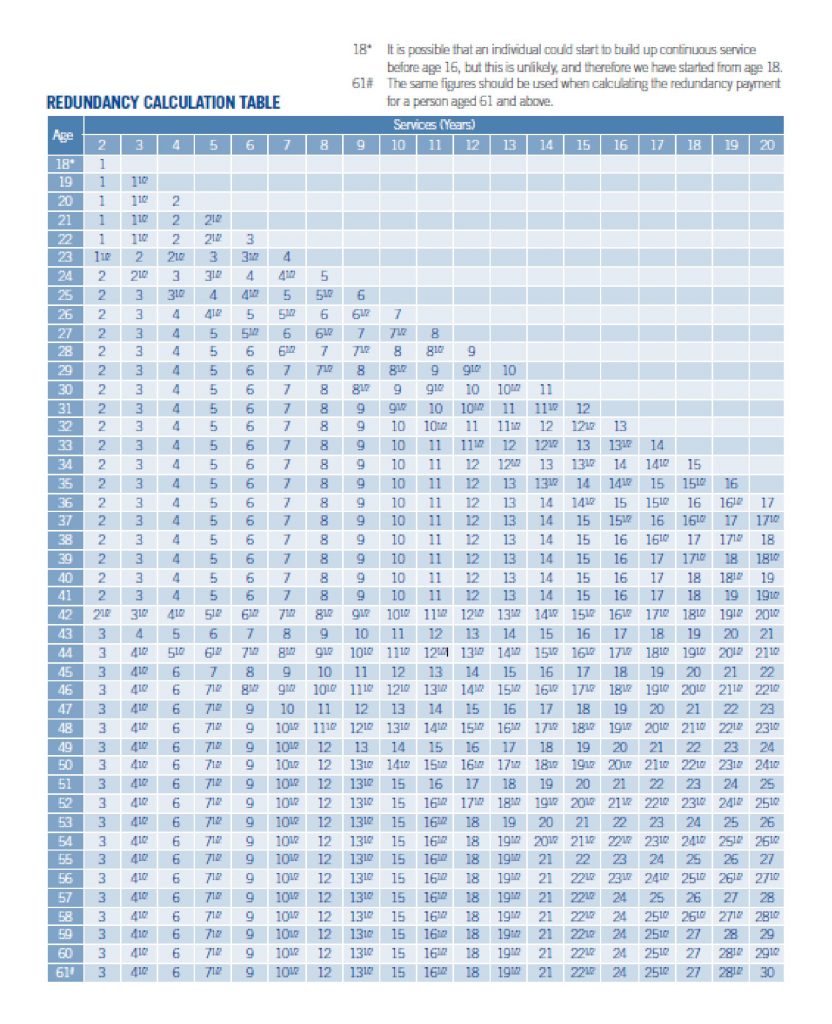

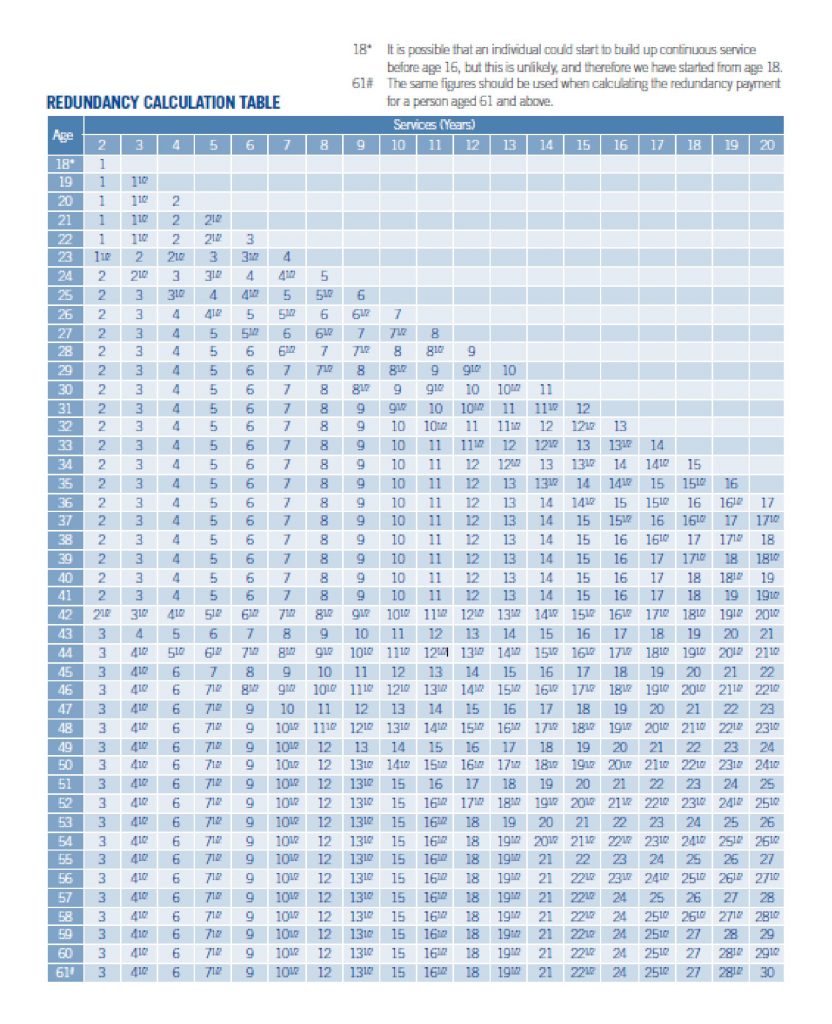

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Tax Advisor For SEIS And EIS Tax Relief Gatwick Accountant

https://www.gatwickaccountant.com/wp-content/uploads/2022/07/accountant-for-tax-return-near-me.png

https://www.moneyhelper.org.uk/en/work/losing-your...

How to claim tax back after redundancy or losing your job Step 1 Are you due a tax rebate You might be due a refund if you answer yes to all of the questions below Were you dismissed or made redundant part way through the tax year Tax years start on 6 April and end on the following 5 April

https://www.gov.uk/guidance/redundancy-help...

Get an Income Tax refund You might be able to claim back some Income Tax if you have had your final pay from your employer you re not getting a pension from your employer

Tips To Claim Tax Losses With The US Internal Revenue Service

Redundancy Pay Calculations

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

How To Claim Rent Exemption Without An HRA Component In Your Salary

Can I Claim Back Tax Paid In The US

How To Claim Tax Back After Losing Job Tax Rebate Redundancy

How To Claim Tax Back After Losing Job Tax Rebate Redundancy

How Redundancy Affects Your Income Tax Ean Brown Partners Limited

5 Redundancy Letter Template Uk Sampletemplatess Within Failed

How To Claim Tax Back Taxfiler

How To Claim Tax Back On Redundancy Payment - The first 30 000 of your redundancy pay is tax free but any amount above this will be subject to income tax at the standard rate You don t have to pay National Insurance on any of your redundancy pay Outstanding holiday pay owed to you or any other money such as bonuses will be taxed as pay