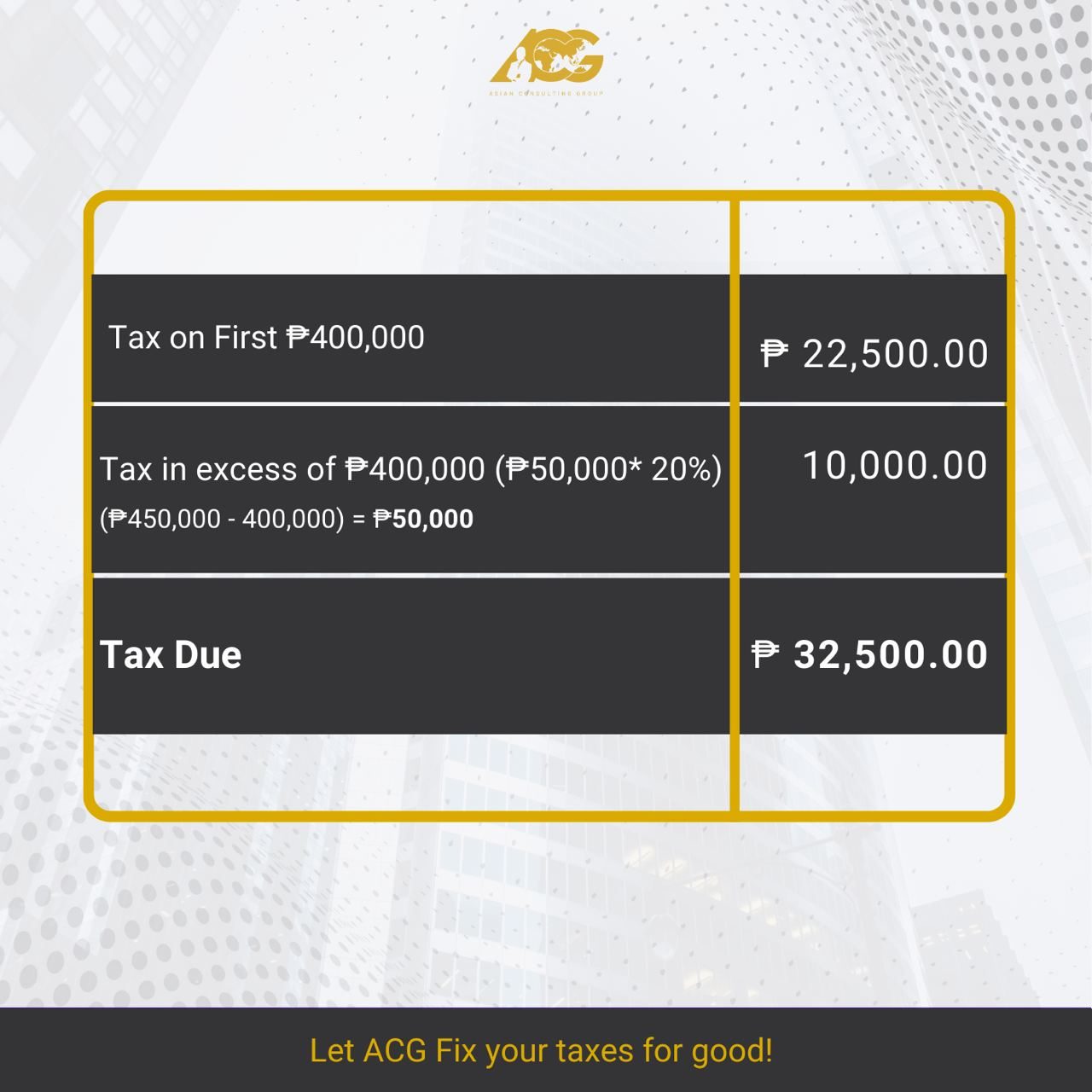

How To Compute Tax Refund Philippines 2023 Calculation of Refund Tax Withheld PHP 25 000 Tax Due PHP 20 000 PHP 5 000 Tax Refund Leah is eligible for a PHP 5 000 tax refund from her Philippine income

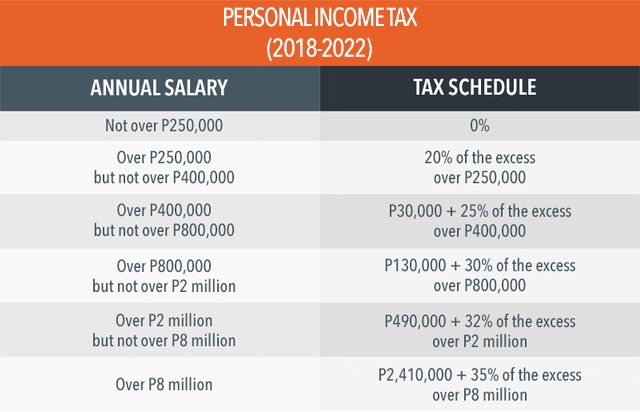

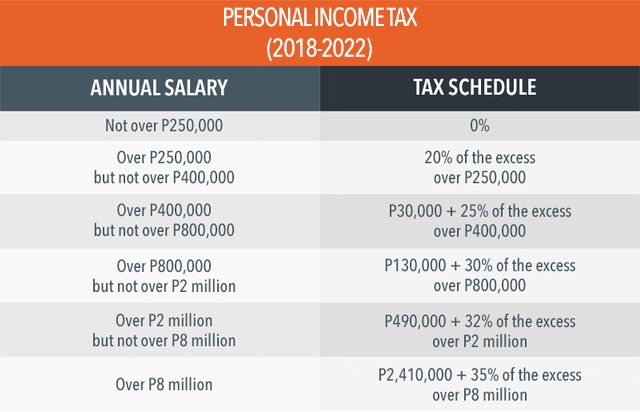

Easily determine accurate withholding tax amounts for salaries services and other income types How To Compute Income Tax in the Philippines 4 Ways 1 How to Compute Your Income Tax Using the New BIR Tax Rate Table This manual computation of

How To Compute Tax Refund Philippines 2023

How To Compute Tax Refund Philippines 2023

https://i2.wp.com/www.pinoymoneytalk.com/wp-content/uploads/2020/06/income-tax-rates-bir-train-law-2023.png

How To Compute Income Tax Refund Philippines 2023 PELAJARAN

https://filipiknow.net/wp-content/uploads/2020/04/tax-refund-philippines-1.jpg

Payroll Federal Tax Withholding Chart 2023 IMAGESEE

https://www.rappler.com/tachyon/r3-assets/612F469A6EA84F6BAE882D2B94A4B421/img/59E5BC7E67DE4B28AE72117E70BF1C8D/bir.jpg

This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income The Tax Caculator Calculate your income tax due effective tax rate and marginal tax rate based on your taxable income in Philippines in 2023 Enter your income select your tax residence status and review the results with the online tool

Our tool will instantly show you your corresponding taxable income and withholding tax You can also see the total deductions calculated and net pay after tax and after deductions How To Compute Your Income Tax Based on Graduated Rates You can calculate your income tax independently whether you re curious about how your employer computes it or you need to file and pay your tax by

Download How To Compute Tax Refund Philippines 2023

More picture related to How To Compute Tax Refund Philippines 2023

How To Compute Income Tax Refund Philippines 2023 PELAJARAN

https://filipiknow.net/wp-content/uploads/2020/04/tax-refund-philippines-4.jpg

How To Compute Tax Refund Philippines 2018 Tax Reforms Before The

https://i.ytimg.com/vi/CRf9VCwiBgY/maxresdefault.jpg

How To Compute Income Tax Refund In The Philippines A Definitive Guide

https://filipiknow.net/wp-content/uploads/2020/04/tax-refund-philippines-8.jpg

By using this tool taxpayers can plan their finances efficiently and estimate how much they owe or refund 1 Enter your gross income in the input box 2 Enter your Learn how to compute income tax in the Philippines in 2025 Follow these steps to calculate your income tax return tax due and tax payable

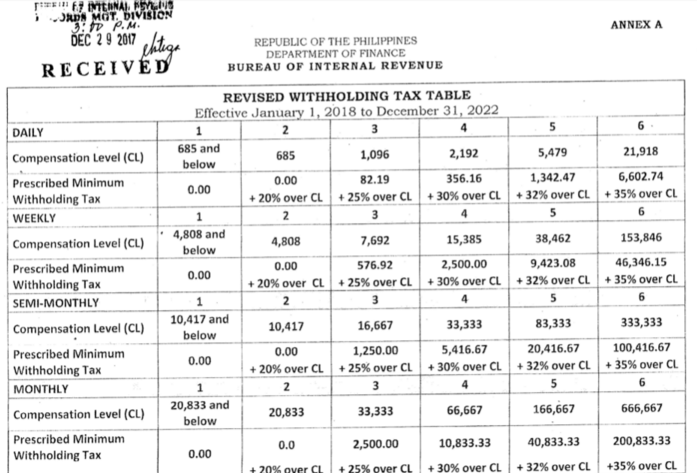

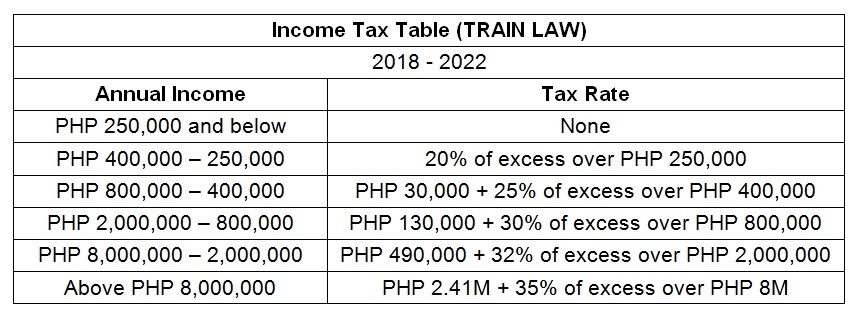

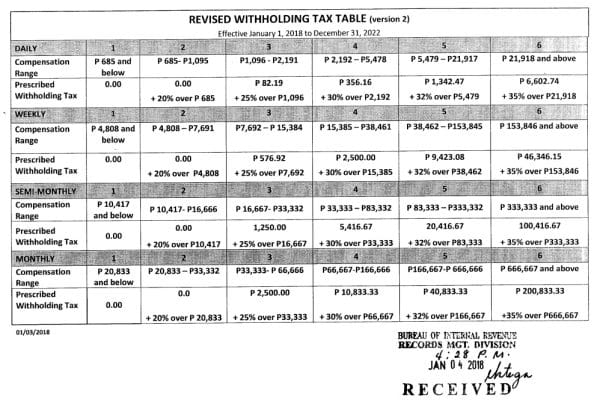

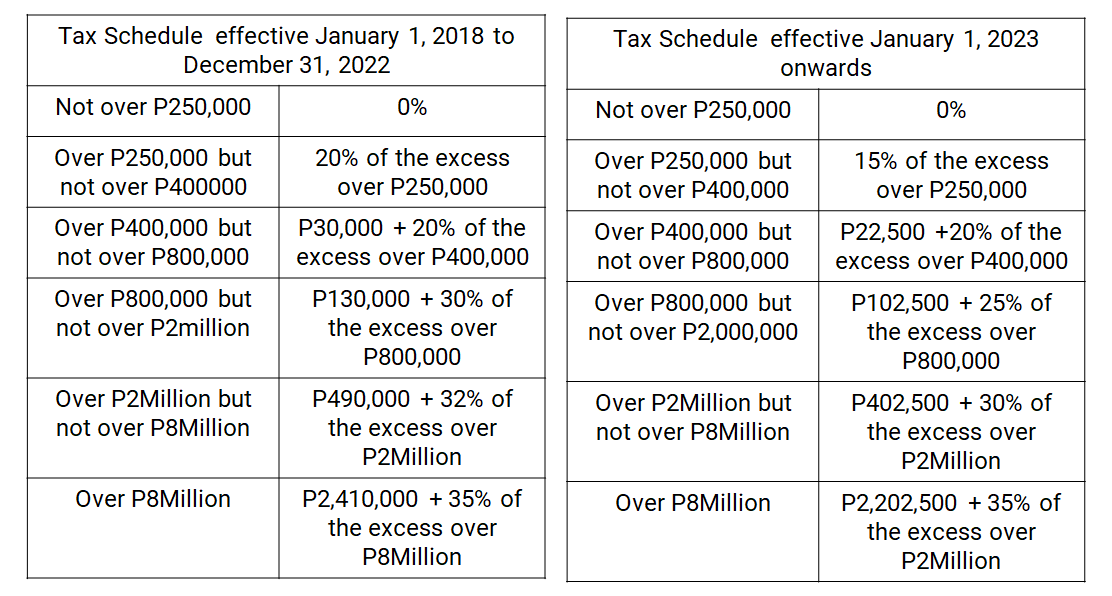

Once you have computed for your taxable income proceed to computing for the income tax Compute for the Income Tax Tax computation in the Philippines changed last January 1 2023 The updated Withholding tax table is seen Then follow these steps so to guide you on how tax calculators compute your taxes in the Philippines Determine Your Taxable Income To compute your taxable income you may

How To Compute Income Tax Refund In The Philippines A Definitive Guide

https://filipiknow.net/wp-content/uploads/2020/04/tax-refund-philippines-9.jpg

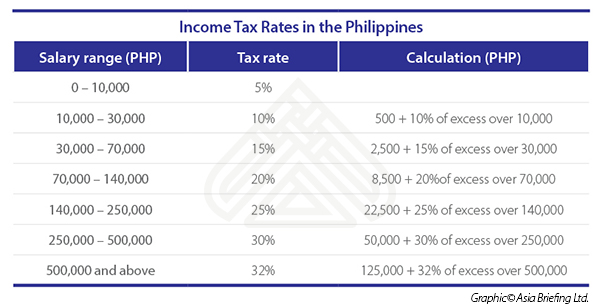

Types Of Income Tax In The Philippines Search Bovenmen Shop

https://www.aseanbriefing.com/news/wp-content/uploads/2016/12/Income-Tax-Rates-in-the-Philippines.jpg

https://www.philippinetaxationguro.com › t…

Calculation of Refund Tax Withheld PHP 25 000 Tax Due PHP 20 000 PHP 5 000 Tax Refund Leah is eligible for a PHP 5 000 tax refund from her Philippine income

https://www.bir.gov.ph › wtcalculator

Easily determine accurate withholding tax amounts for salaries services and other income types

Tax Refund Table Philippines Brokeasshome

How To Compute Income Tax Refund In The Philippines A Definitive Guide

How To Compute Income Tax In The Philippines Free Calculator APAC

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

How To Compute Income Tax Refund In The Philippines A Definitive Guide

Tax Calculator Compute Your New Income Tax

Tax Calculator Compute Your New Income Tax

Surat Permohonan Penempatan Latihan Industri Surat Tarik Diri Dari

Ask The Tax Whiz How To Compute Income Tax Under The New Income Tax

Computation Of Regular Tax How To Calculate Income Tax In Excel

How To Compute Tax Refund Philippines 2023 - My current computation is Gross Income minus my 13th month pay Gov t contributions and non taxable allowances The difference of that will be deducted to my bracket minimum The result