How To Compute Tax Table To calculate total income tax based on multiple tax brackets you can use VLOOKUP and a rate table structured as shown in the example The formula in G5 is VLOOKUP

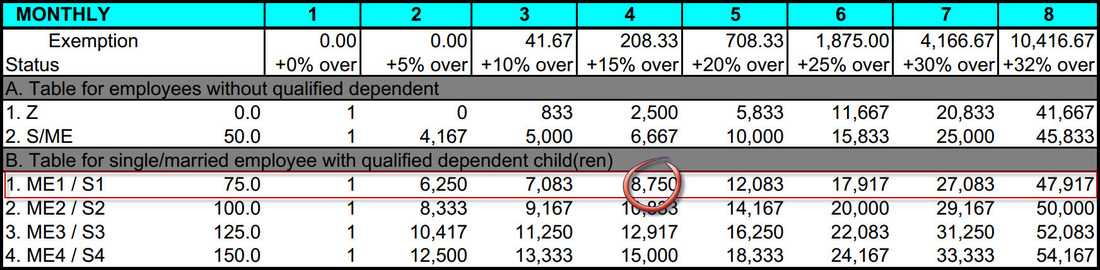

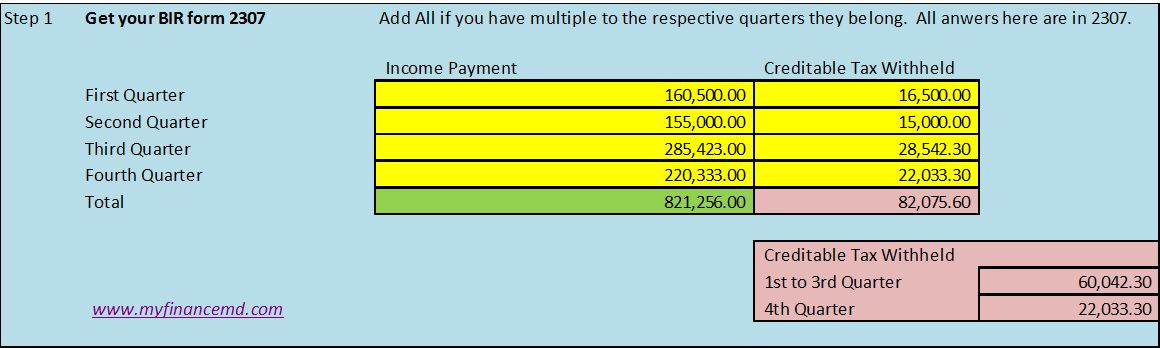

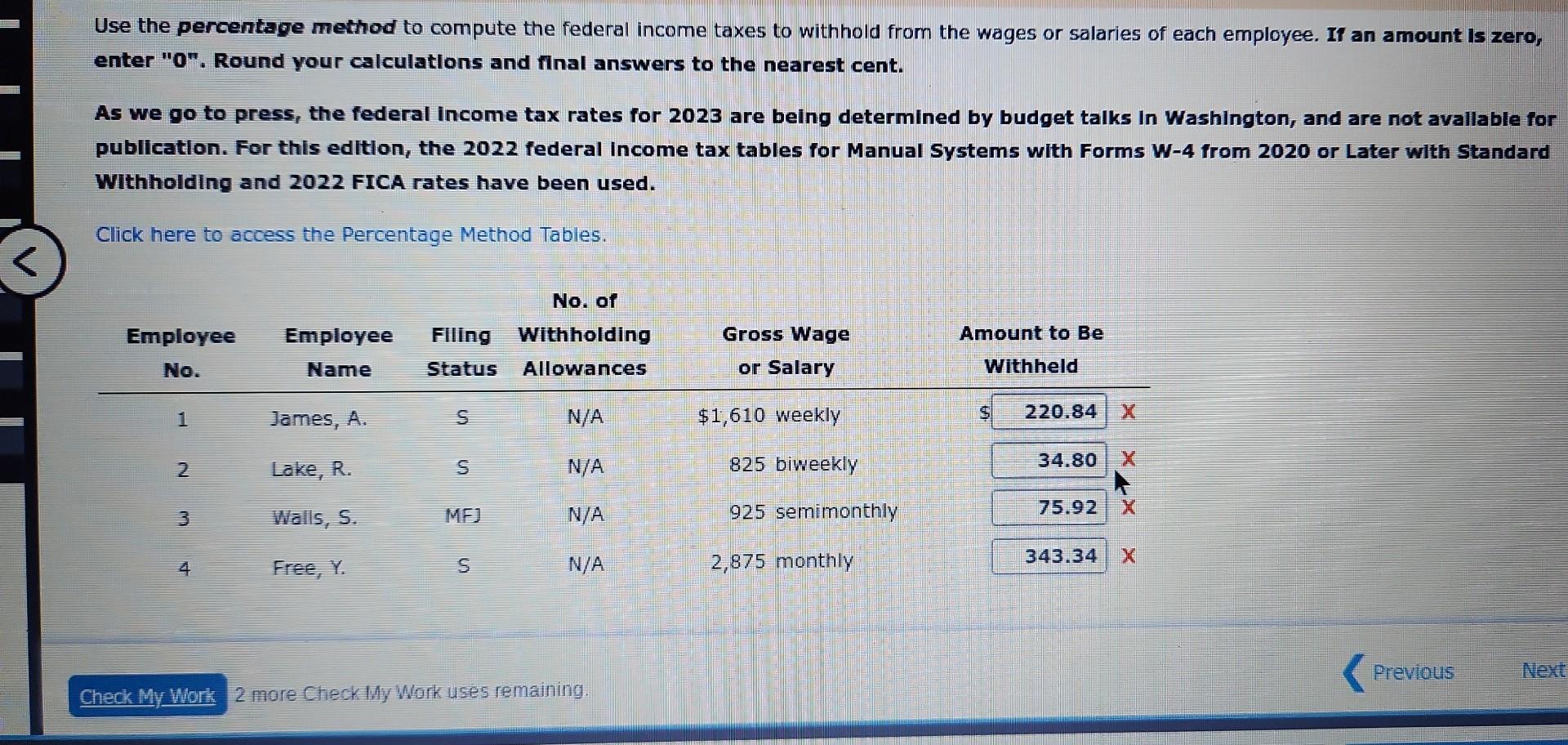

Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax If you re not sure how much to report on your taxes or how to calculate the correct amount a tax table may come in handy Read on to learn more about what

How To Compute Tax Table

How To Compute Tax Table

http://e-pinoyguide.weebly.com/uploads/5/7/4/3/5743966/5627100_orig.jpg

Solved Use The Percentage Method To Compute The Federal Chegg

https://media.cheggcdn.com/study/724/7249ecb8-d142-4a06-9865-446456975411/image.jpg

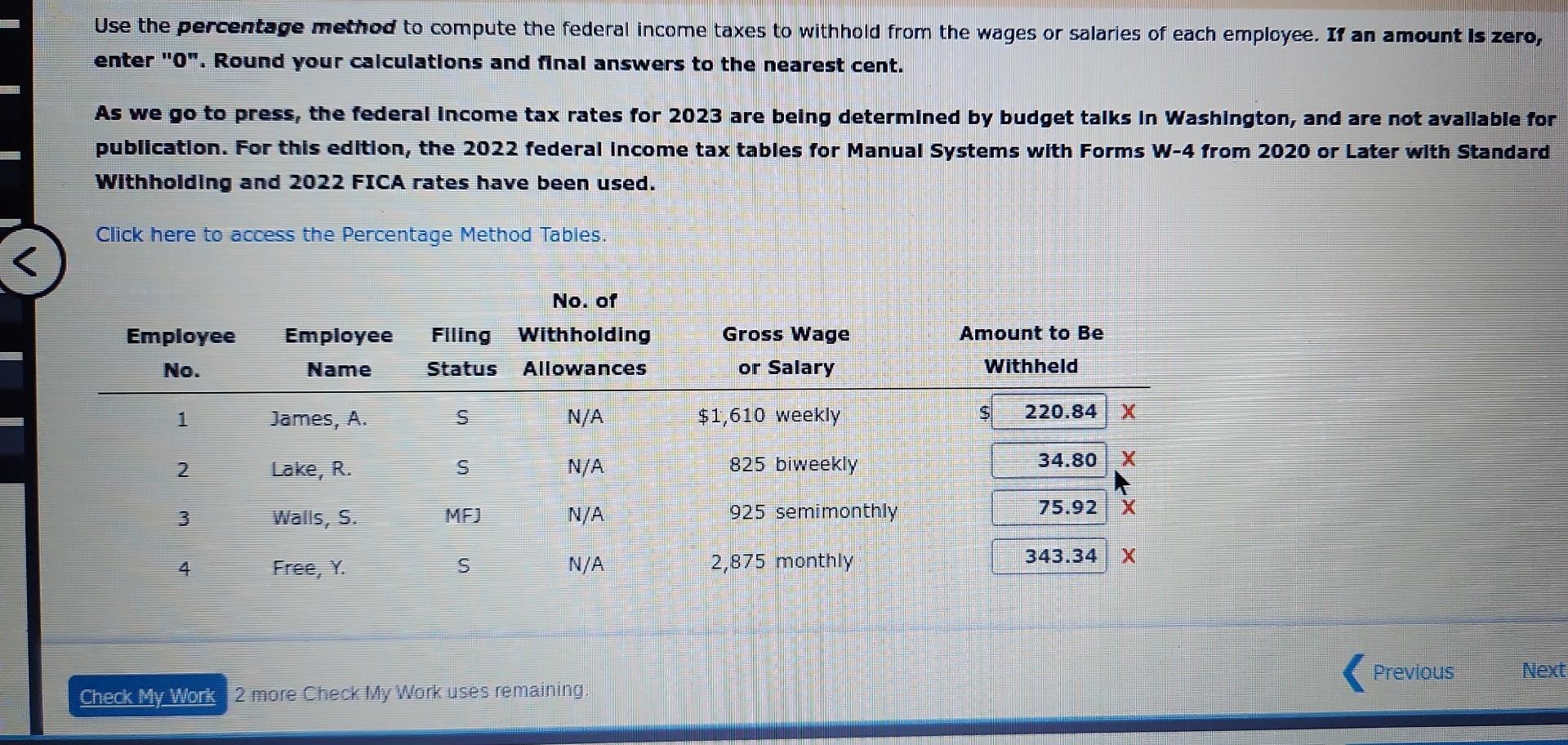

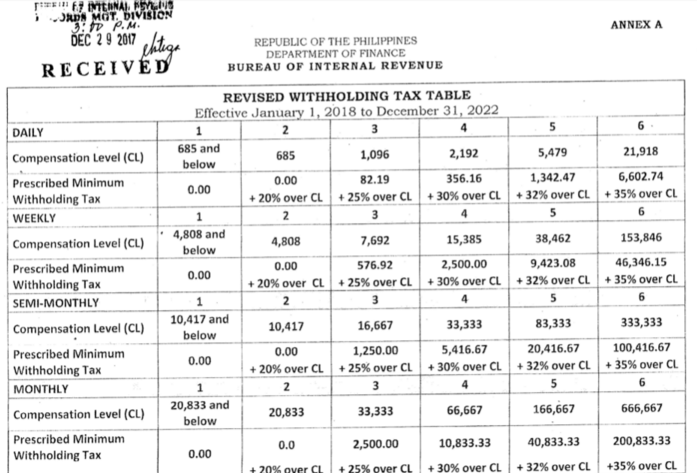

WITHHOLDING TAX COMPUTATION UNDER TRAIN LAW USING VERSION 2 TABLE EBV

http://www.ebvlaw.com/wp-content/uploads/2018/03/Slide1-1-677x1024.jpg

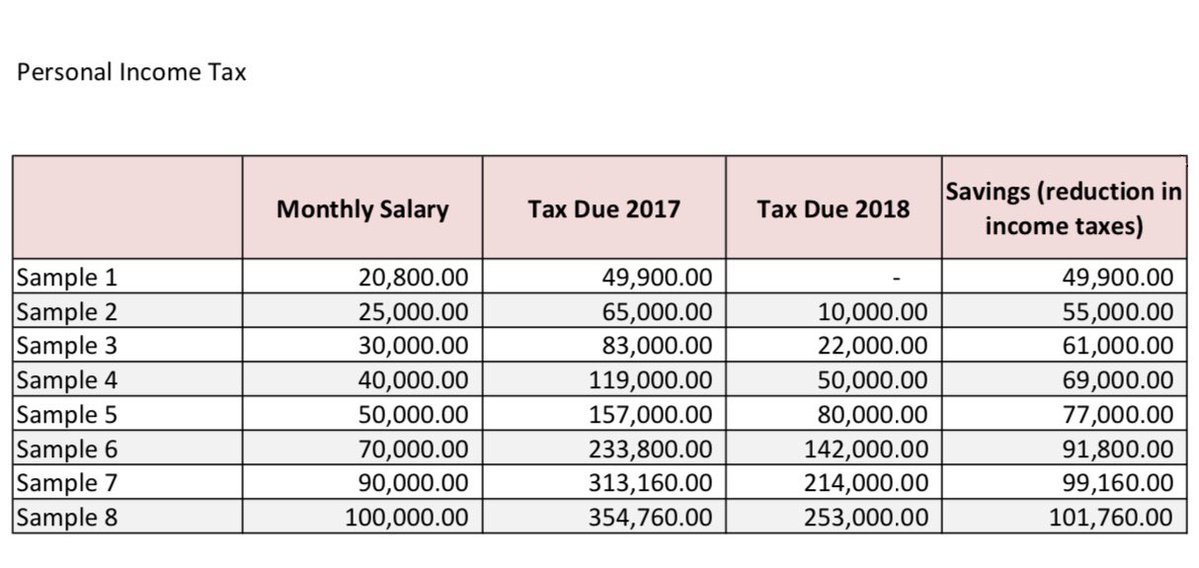

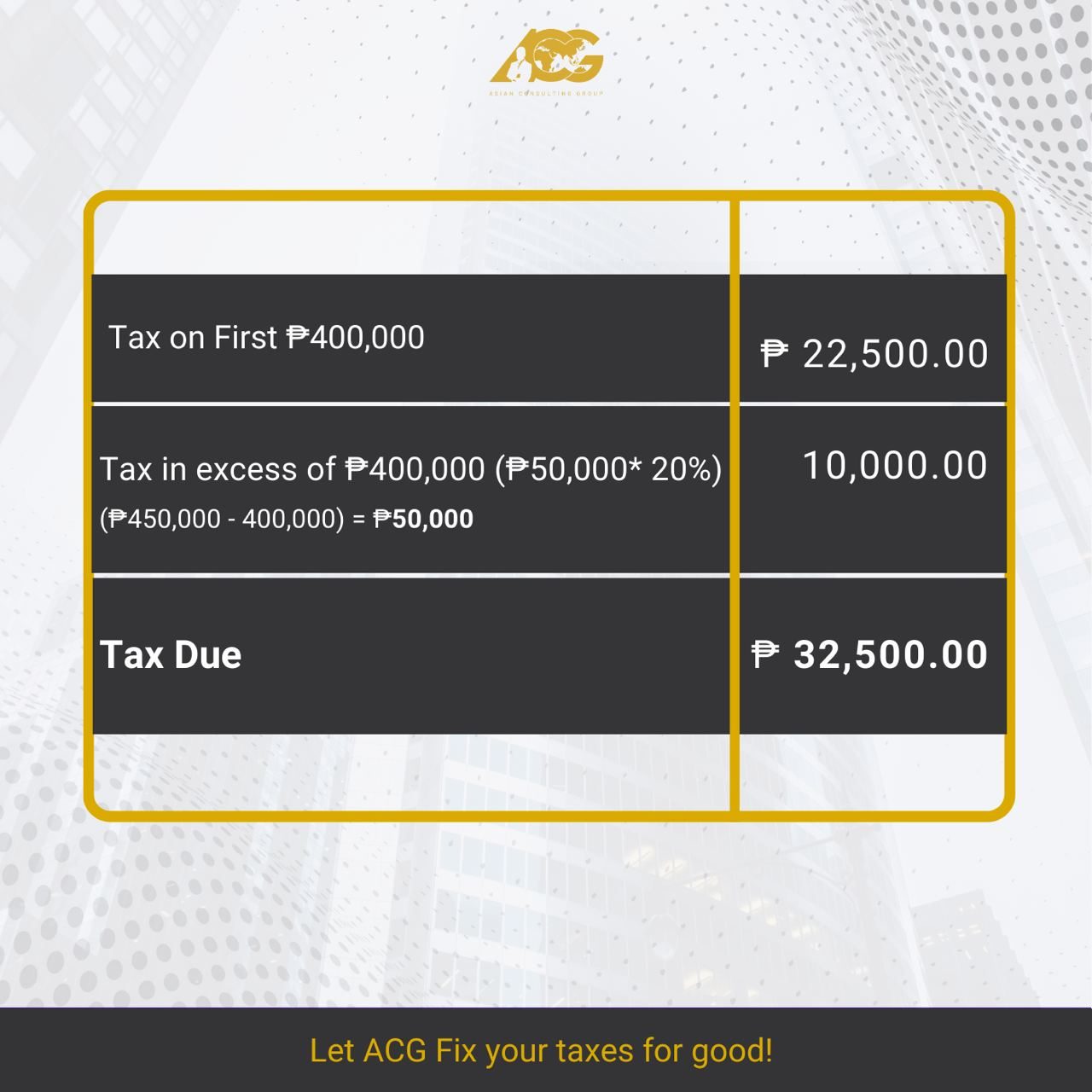

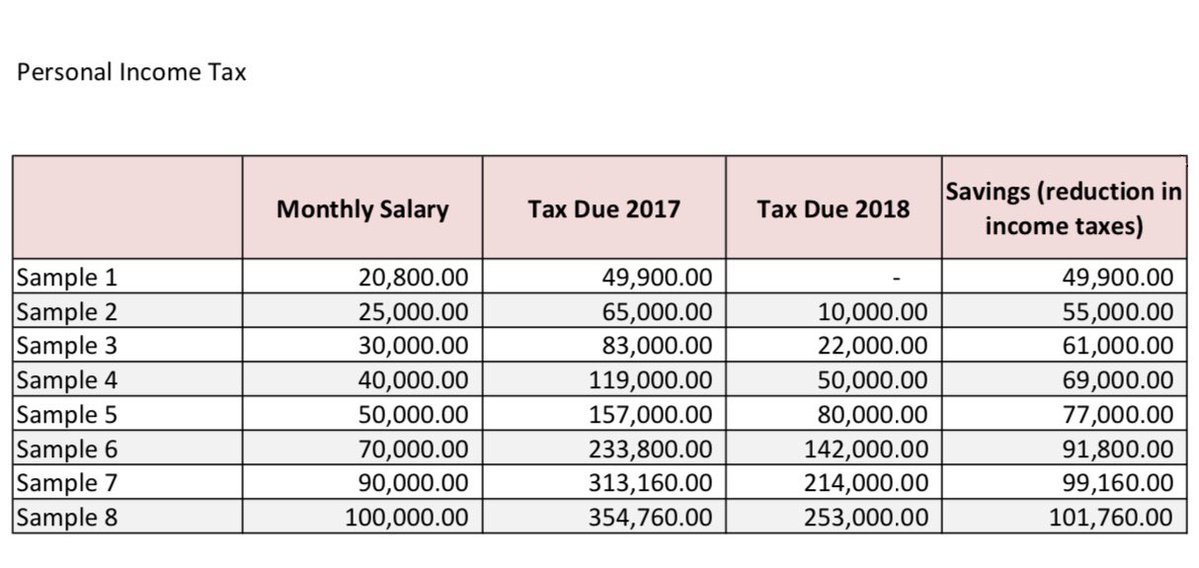

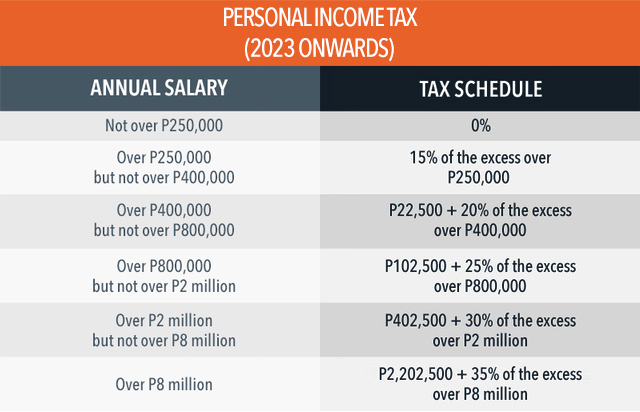

See current federal tax brackets and rates based on your income and filing status 1 Itemized deduction 2 Optional standard deduction TRAIN Law Tax Table 2023 Graduated income tax rates for January 1 2023 and onwards How To

This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income The Tax NOTE We also compiled various articles related to the TRAIN law on this page TRAIN Tax Law Sample Computations and BIR Implementing

Download How To Compute Tax Table

More picture related to How To Compute Tax Table

How To Compute Income Tax In The Philippines Free Calculator APAC

https://emcw7g93bqt.exactdn.com/wp-content/uploads/sites/5/2022/07/Revised-withholding-tax-table-Philippines-2022.jpg?strip=all&lossy=1&resize=619%2C425&ssl=1

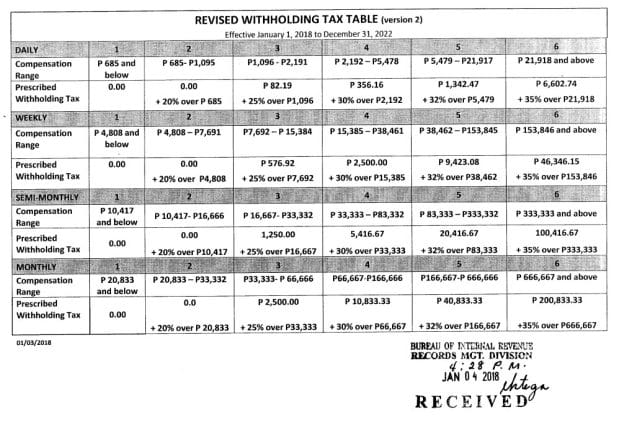

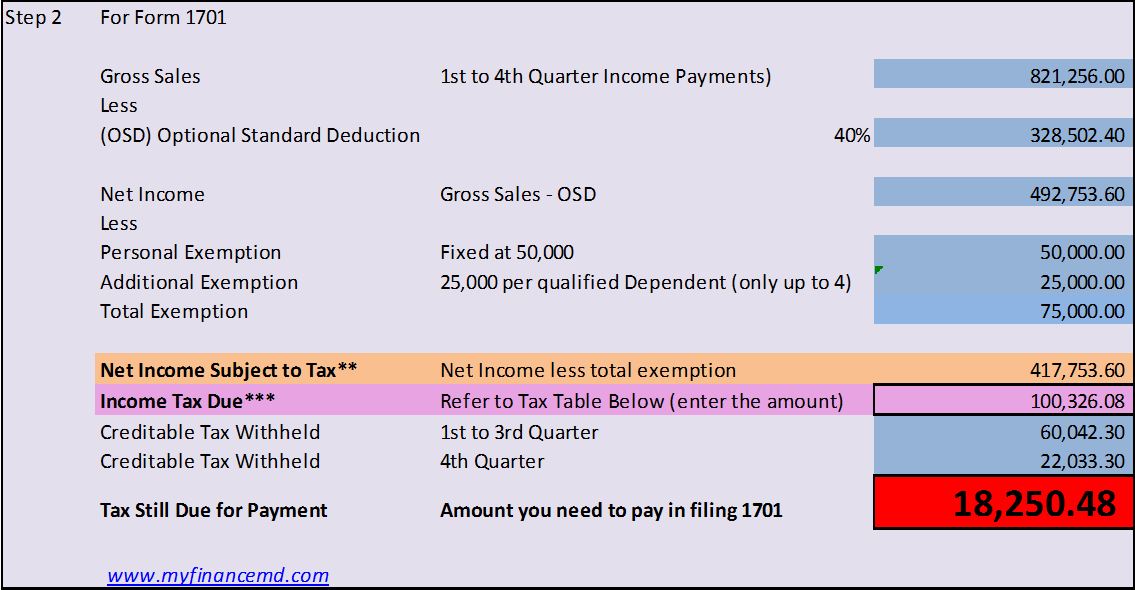

Doctor s Taxation How To Compute Your Income Tax Return Part 5 My

https://myfinancemd.com/wp-content/uploads/2016/01/1.jpg

How To Compute Income Tax In The Philippines

https://www.thinkpesos.com/wp-content/uploads/2016/07/BIR-Tax-table.png?x98359

In this guide we ll discuss different ways to compute your income tax from the manual method using the tax table to the most straightforward option of using online tax The 2020 federal income tax brackets on ordinary income 10 tax rate up to 9 875 for singles up to 19 750 for joint filers 12 tax rate up to 40 125

Individual Sample personal income tax calculation Below is the basis of PAYE calculation for an individual whose gross income is NGN 4 million For the In this post we ll examine a couple of ideas for computing income tax in Excel using tax tables Specifically we ll use VLOOKUP with a helper column we ll

Here s A Sample Computation Of Your Personal Income Tax With The TRAIN

https://pbs.twimg.com/media/DRK0BM-VoAAMpbF.jpg

How To Compute Income Tax Using Tax Table When To Attach 2316 2306

https://i.ytimg.com/vi/ZTs-8L-QXkQ/maxresdefault.jpg

https://exceljet.net/formulas/income-tax-bracket-calculation

To calculate total income tax based on multiple tax brackets you can use VLOOKUP and a rate table structured as shown in the example The formula in G5 is VLOOKUP

https://turbotax.intuit.com/tax-tools/calculators/tax-bracket

Use our Tax Bracket Calculator to understand what tax bracket you re in for your 2023 2024 federal income taxes Based on your annual taxable income and filing status your tax

Ask The Tax Whiz How To Compute Income Tax Under The New Income Tax

Here s A Sample Computation Of Your Personal Income Tax With The TRAIN

Tax Calculator Compute Your New Income Tax

2023 Payroll Withholding Calculator LesleyMehek

Doctor s Taxation How To Compute Your Income Tax Return Part 5 My

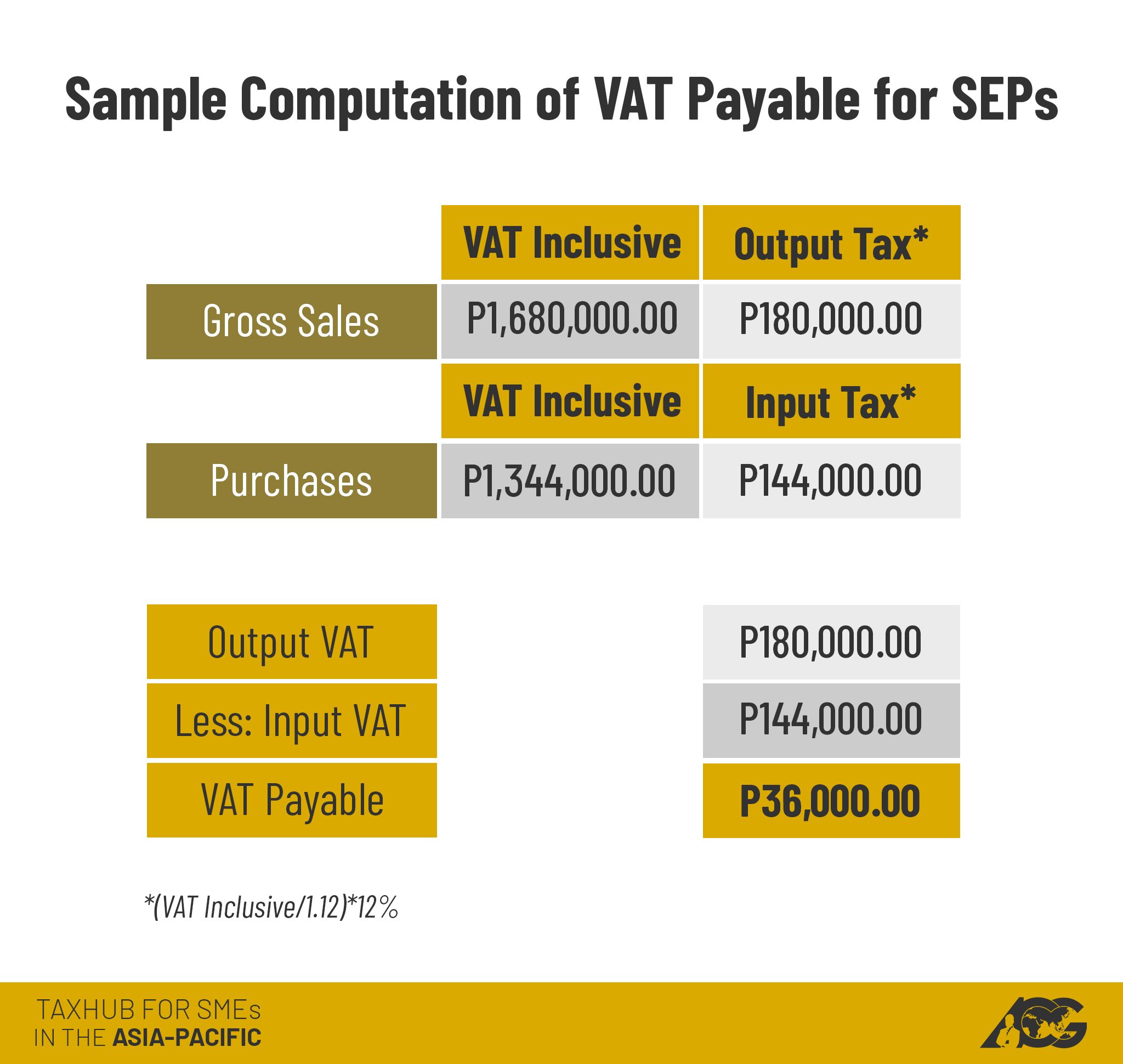

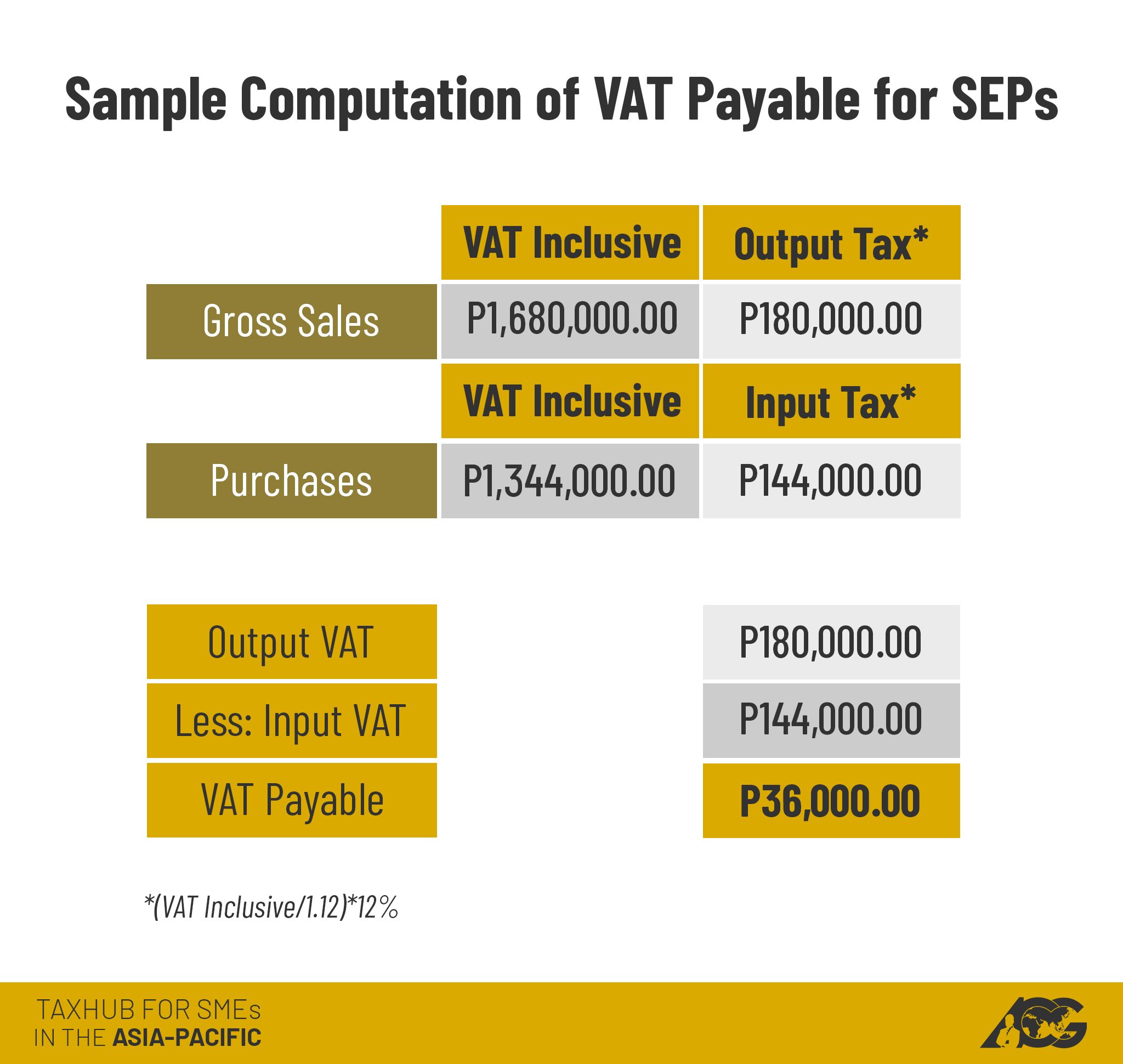

AskTheTaxWhiz VAT Or Non VAT Taxpayer

AskTheTaxWhiz VAT Or Non VAT Taxpayer

Withholding Tax On Compensation Most Common Computation Error

How To Compute Withholding Tax Based On The Newly Enacted TRAIN Law

What Is Withholding Tax Malaysia Andrew Ellison

How To Compute Tax Table - 1 Itemized deduction 2 Optional standard deduction TRAIN Law Tax Table 2023 Graduated income tax rates for January 1 2023 and onwards How To