How To Create A Vat Return In Xero Filing your VAT return through Making Tax Digital Once you ve registered for VAT you ll need to submit returns online regularly and square up with HMRC Here s how

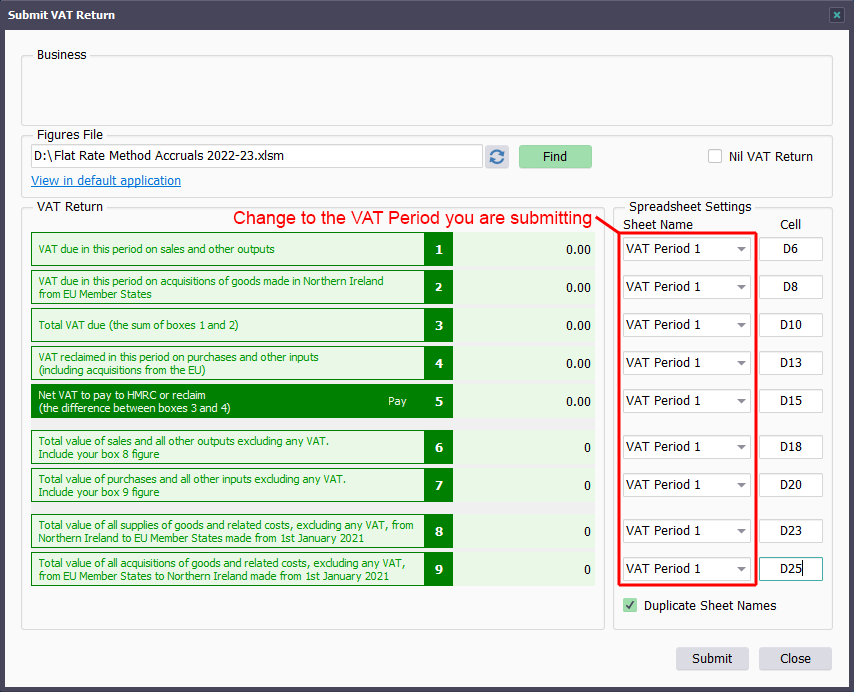

You need to select your flat rate VAT scheme in your financial settings to create a flat rate VAT return in Xero Your VAT scheme also controls which transactions your VAT return Xero creates your MTD VAT returns using the date ranges supplied by HMRC and the details from the VAT section in your financial settings The date ranges supplied by

How To Create A Vat Return In Xero

How To Create A Vat Return In Xero

https://www.edwardsofgwynedd.com/wp-content/uploads/2022/11/Xero-VAT-Return.png

EXCEL Of Simple VAT Schedule xlsx WPS Free Templates

https://newdocer.cache.wpscdn.com/photo/20191014/9aa665f9cbc94adeae65869532a3fab4.jpg

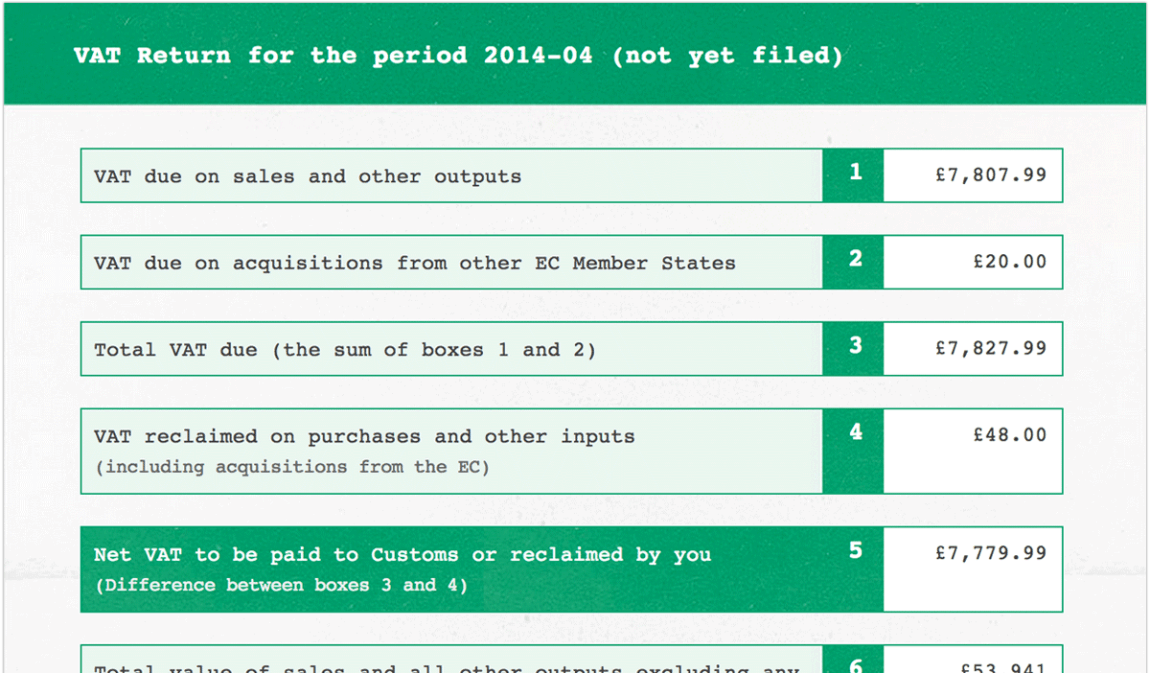

UK VAT Return After Brexit Vatcalc

https://www.vatcalc.com/wp-content/uploads/UK-VAT-return.jpg

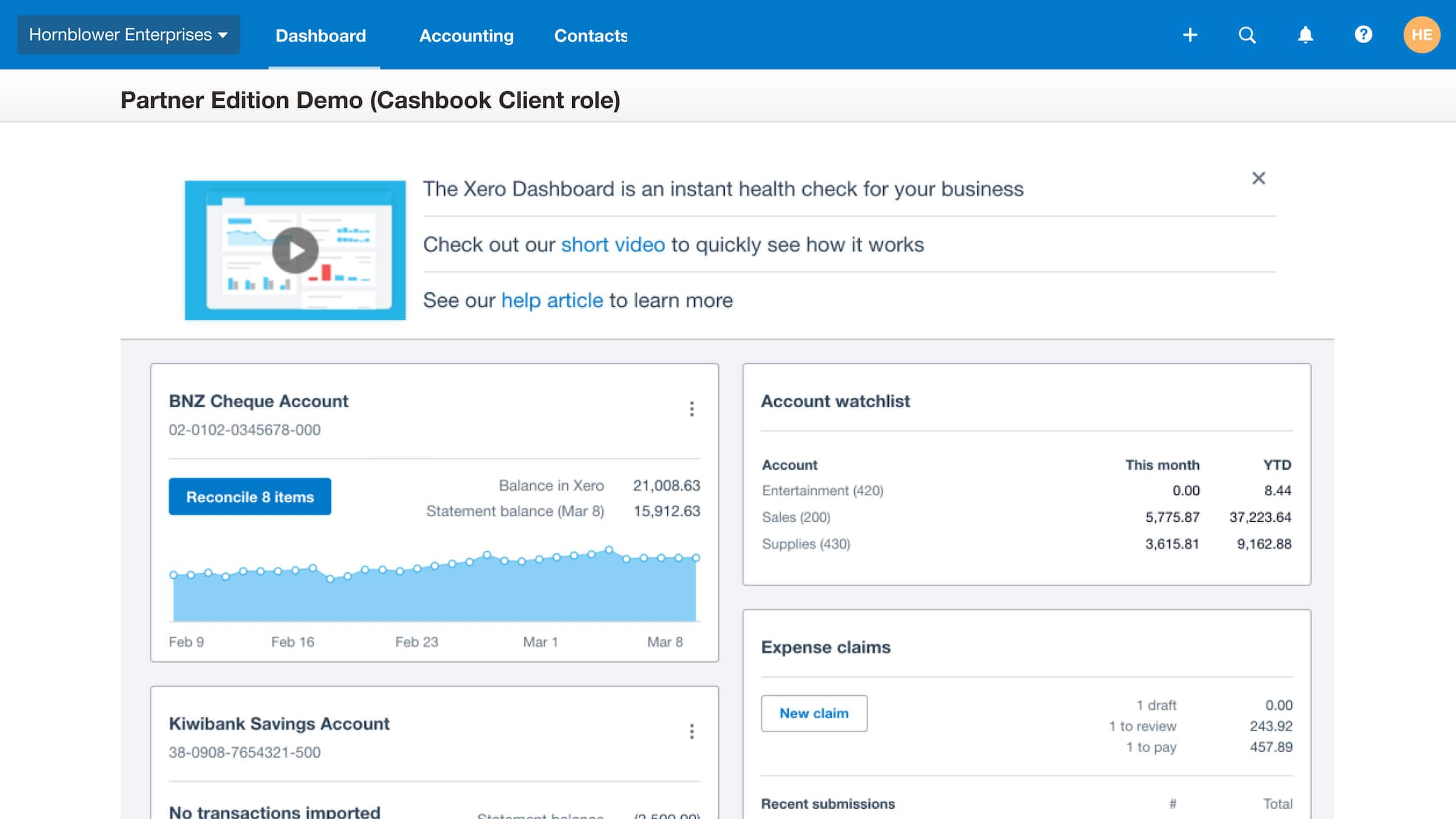

In this video I show you how to do a VAT return in Xero It s not just 5 clicks you also need to do some checking before you submit the return I show you step by step how to do these All VAT registered businesses need to file their VAT returns using our MTD VAT return This filing process replaces all previous filing methods including filing through HMRC s

A video showing how to set up the VAT return in Xero for MTD registered businesses Calculate and submit VAT returns online directly to HMRC with Making Tax Digital compatible software Xero manages the VAT on transactions for you

Download How To Create A Vat Return In Xero

More picture related to How To Create A Vat Return In Xero

Filing Your VAT Return VAT Guide Xero UK

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to GST-VAT_returnsx2.1646877577706.png

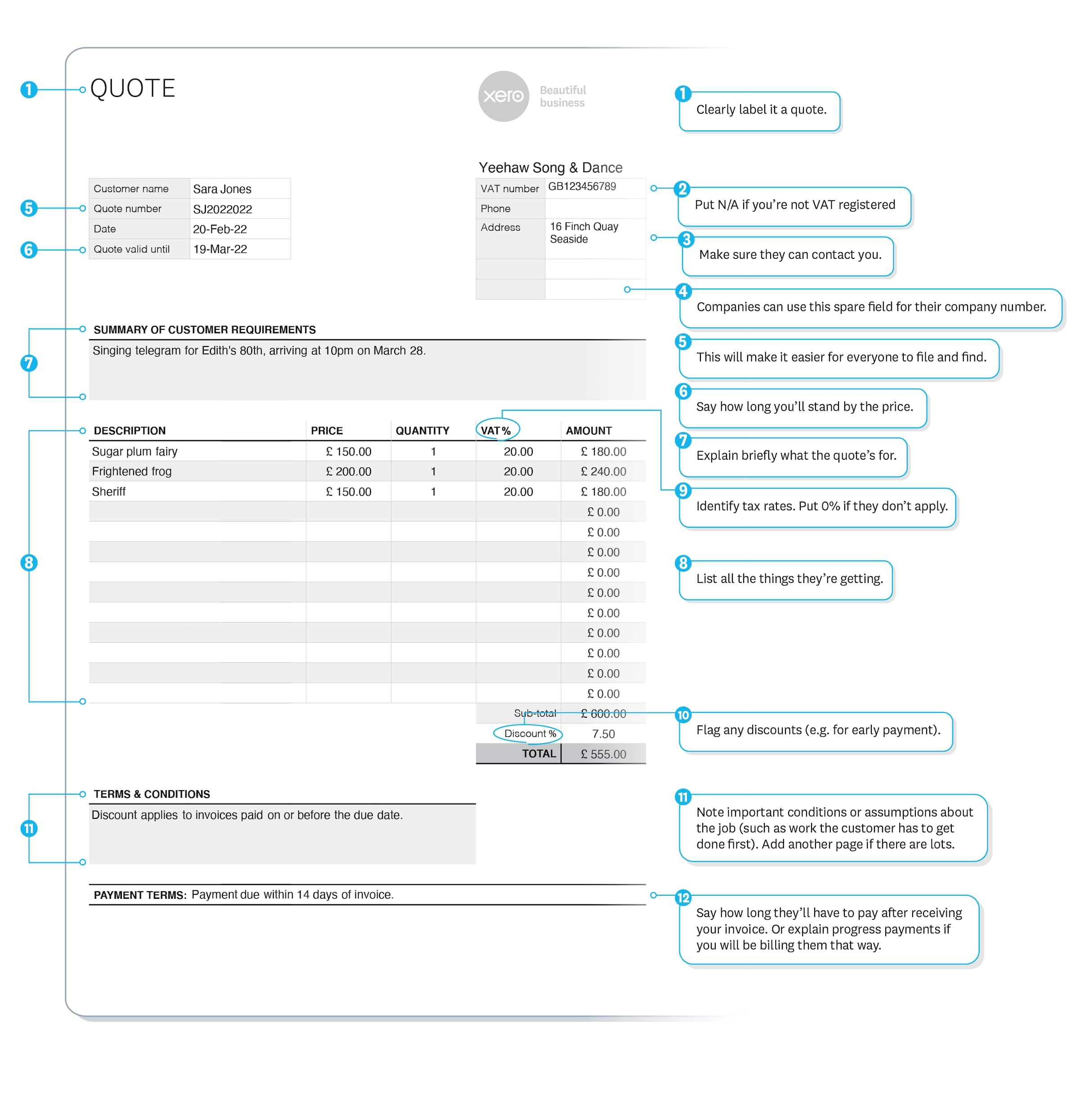

Quote Example And Formatting Tips Xero UK

https://www.xero.com/content/dam/xero/pilot-images/downloads/templates/quote-template/quote-example-uk.1647818168101.png

Understanding Your VAT Return In Xero EOG Accounting

https://www.edwardsofgwynedd.com/wp-content/uploads/2022/11/Xero-VAT-Return.webp

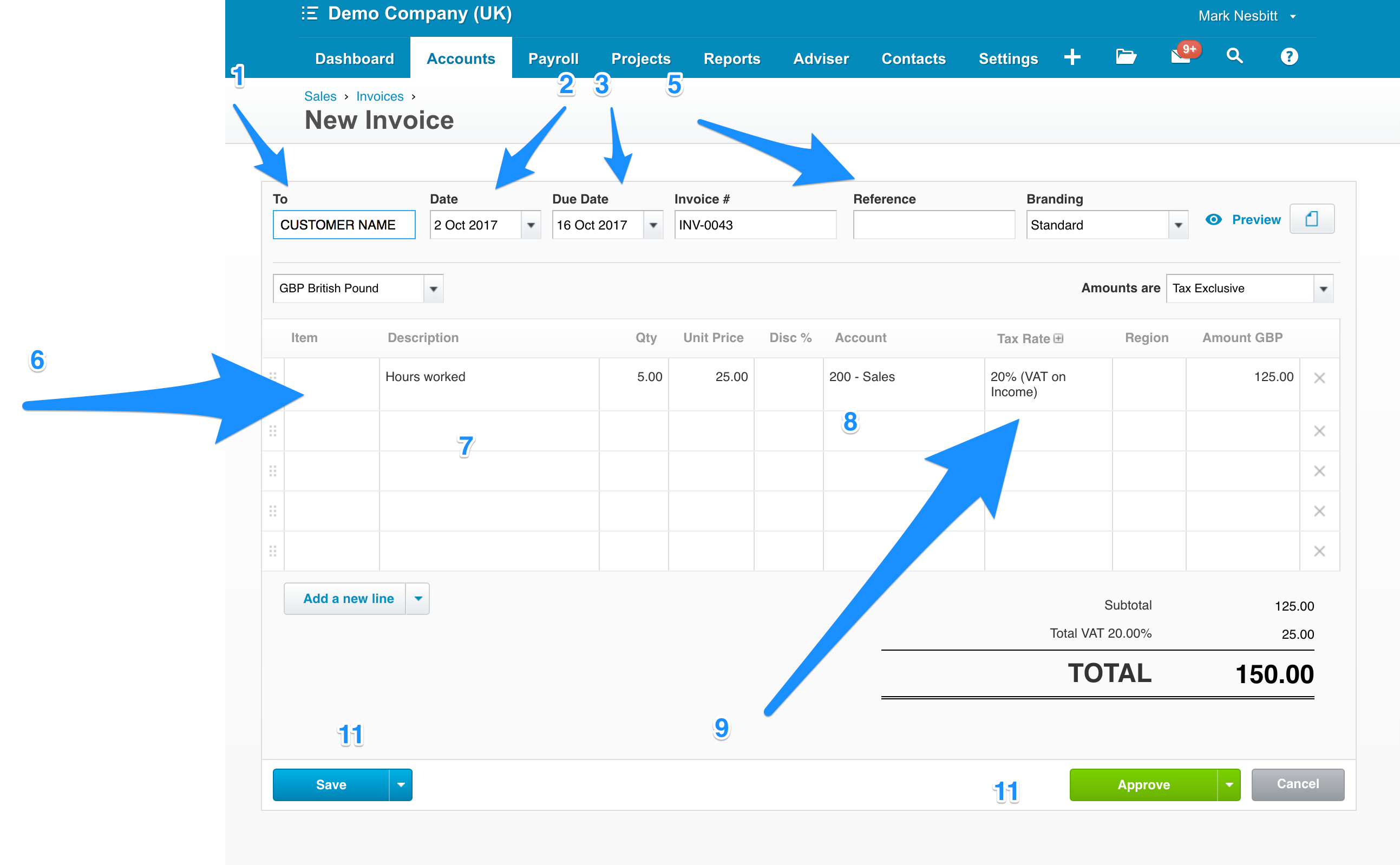

To adjust a VAT box amount on a VAT return you can adjust the VAT box only or create an accounting transaction to update the VAT amount and your account balances You can We show you how to submit an MTD VAT return in Xero accounting software It s a simple and easy process Xero uses transactions entered to calculate the VAT return automatically for

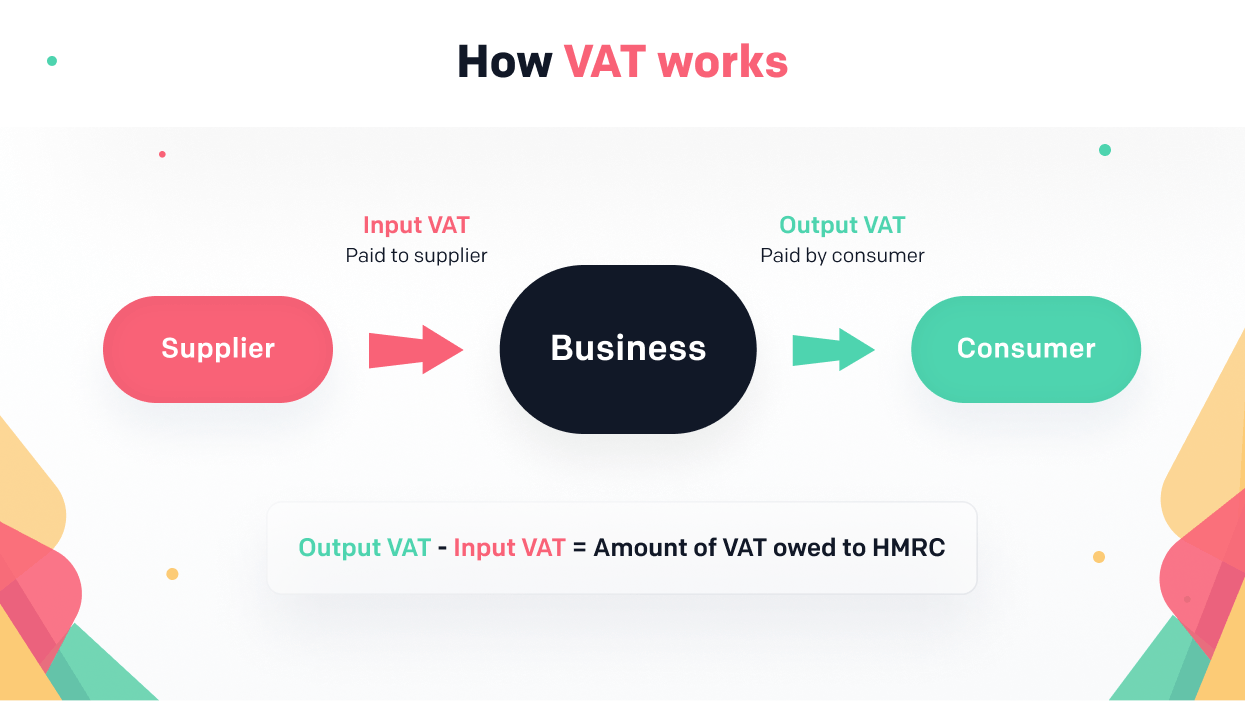

Filing VAT return through Making Tax Digital Once you ve registered for VAT you ll need to submit returns online regularly and square up with HMRC Here s how Prepare VAT returns Use the sales tax report to complete a return Customise VAT rates Default VAT rates are set up initially to 0 for tax on purchases sales and imports

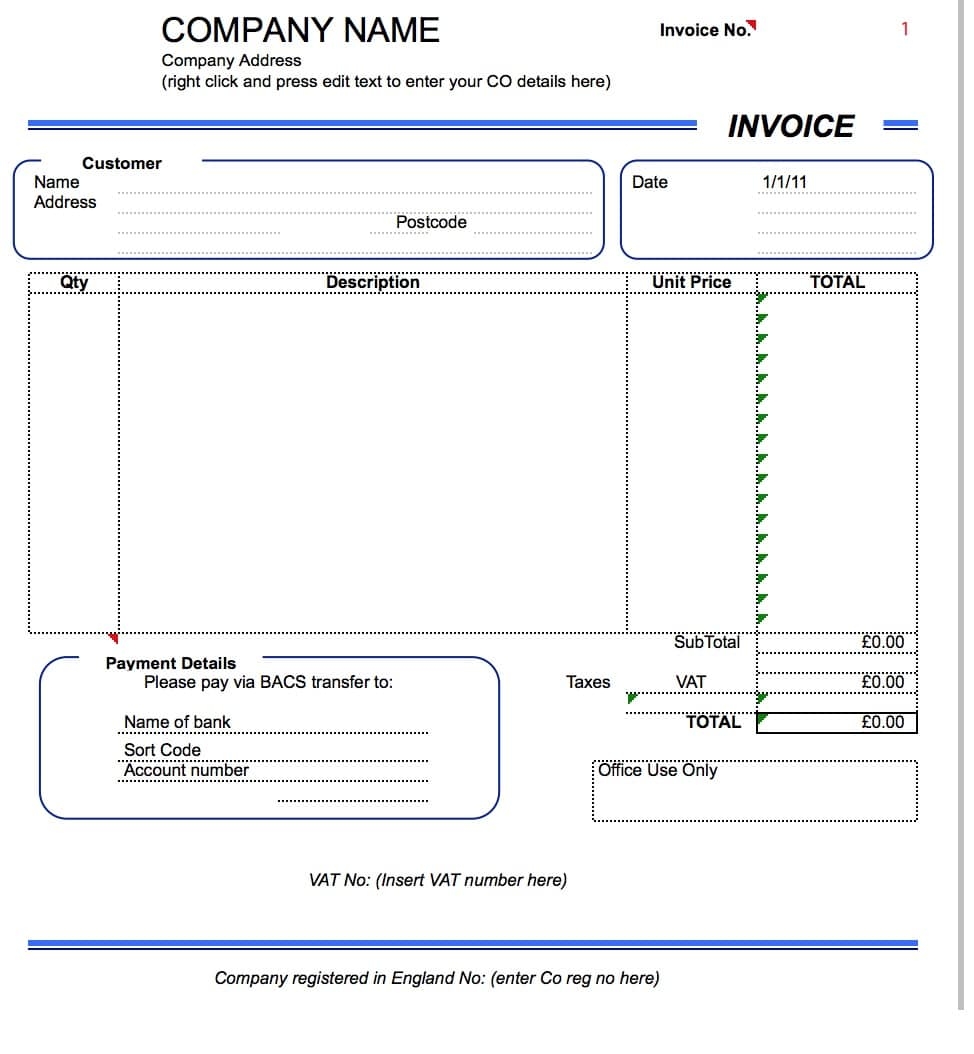

Example Of Vat Invoice Invoice Template Ideas

https://simpleinvoice17.net/wp-content/uploads/2017/08/free-value-added-tax-vat-invoice-template-excel-pdf-word-example-of-vat-invoice.jpg

FreeAgent VAT Online Submission 1Stop Accountants

https://1stopaccountants.co.uk/wp-content/uploads/2014/10/freeagent-vat-return-example-1150x673.png

https://www.xero.com/uk/guides/vat/filin…

Filing your VAT return through Making Tax Digital Once you ve registered for VAT you ll need to submit returns online regularly and square up with HMRC Here s how

https://central.xero.com/s/article/Prepare-a-new-non-MTD-VAT-return

You need to select your flat rate VAT scheme in your financial settings to create a flat rate VAT return in Xero Your VAT scheme also controls which transactions your VAT return

Excel Spreadsheet Templates To Comply With Making Tax Digital For VAT

Example Of Vat Invoice Invoice Template Ideas

How To Do A VAT Return In Xero YouTube

How To Create A Sales Invoice In Xero Love Accountancy Limited

Xero Cashbook And Xero Ledger Xero AU

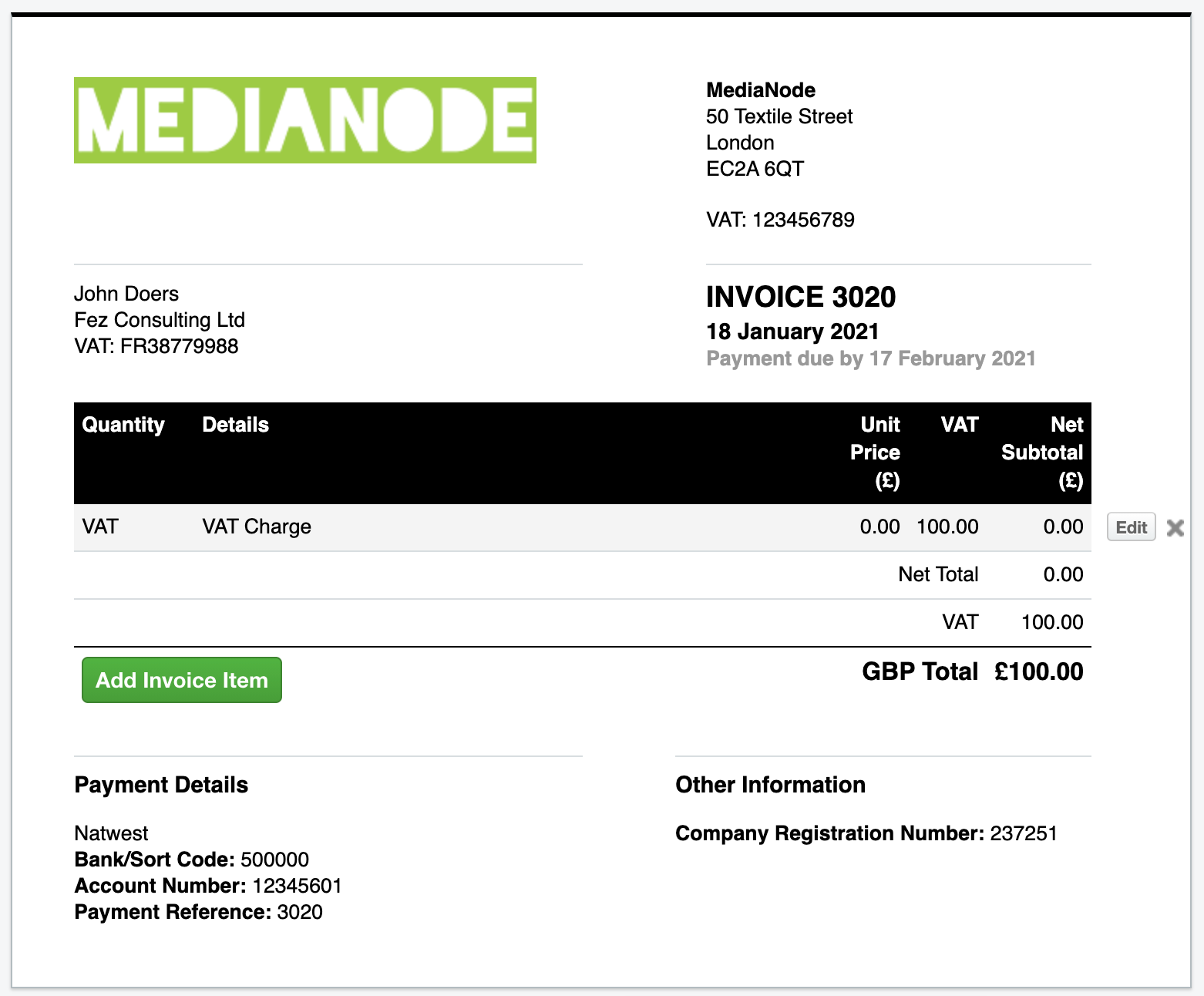

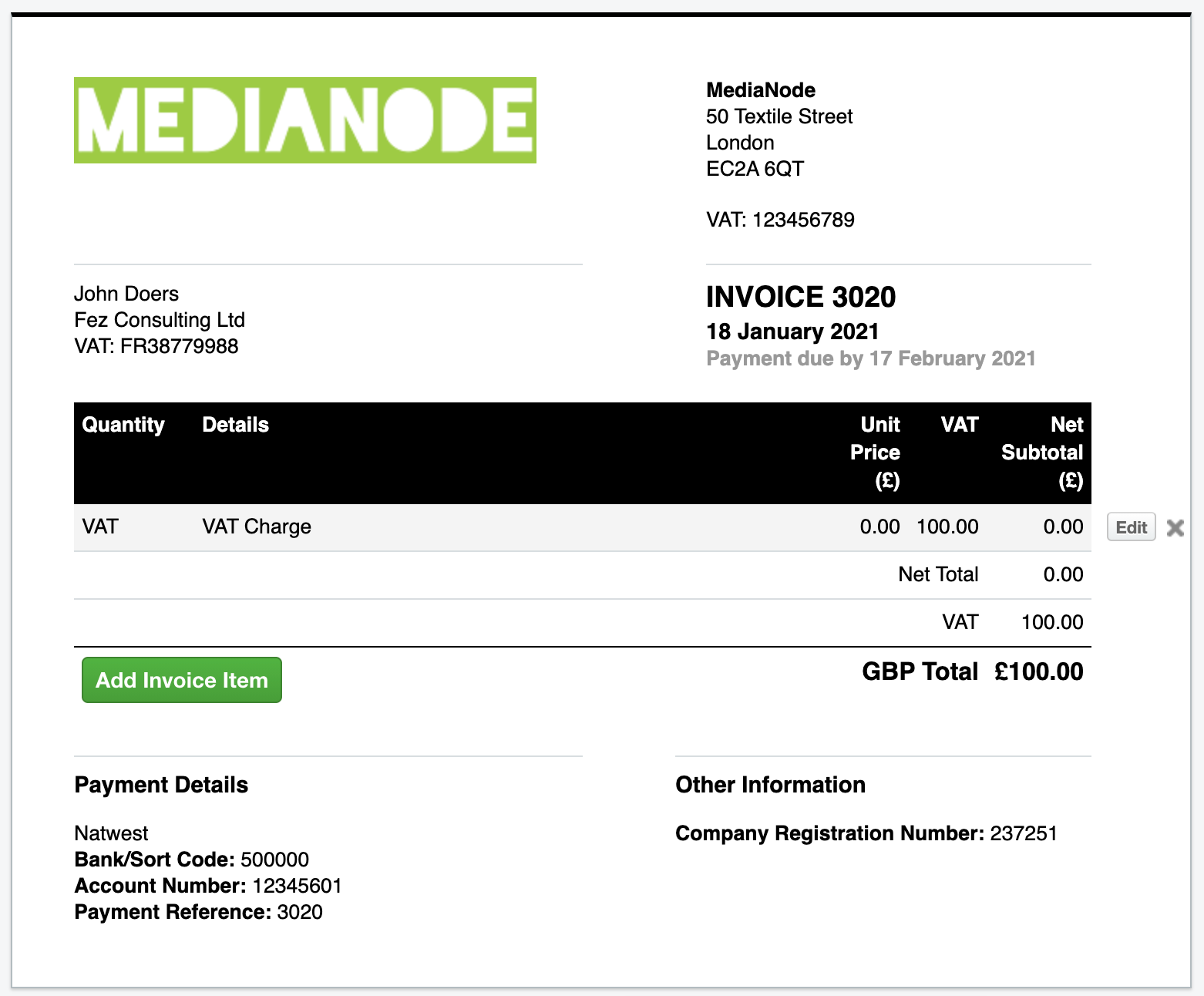

How To Create A VAT Only Invoice FreeAgent

How To Create A VAT Only Invoice FreeAgent

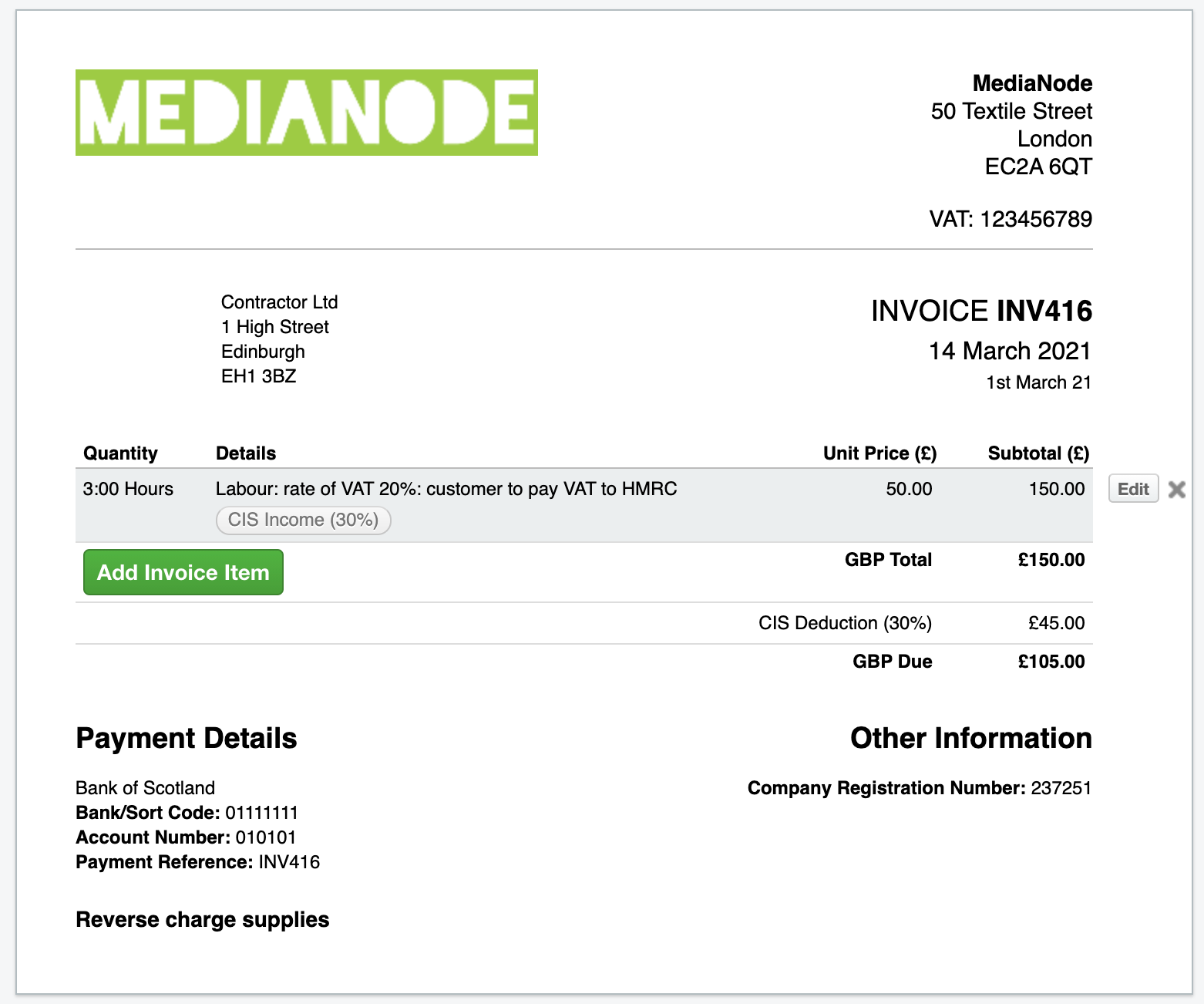

CIS How FreeAgent Handles The Domestic VAT Reverse Charge For

What Is A VAT Return FreeAgent

Can A Sole Trader Be VAT Registered

How To Create A Vat Return In Xero - How do I file a group VAT return for 2 companies in Xero and be digitally compliant I have 2 companies in a VAT group both use Xero and I combine the VAT