How To File A Late Tax Return Online Taxpayers who missed the April tax filing and payment deadline should file as soon as they can The IRS offers resources to help those who may be unable to pay

If you re due a tax refund for a prior year claim it by filing your tax return for that year You only have three years from the original tax return due date to claim Help filing your past due return You can download prior year IRS tax forms and instructions on IRS gov or order them by calling 800 829 3676 or 800 829 4059 for

How To File A Late Tax Return Online

How To File A Late Tax Return Online

https://www.sginccpa.com/wp-content/uploads/2020/10/Tax-Return-scaled.jpg

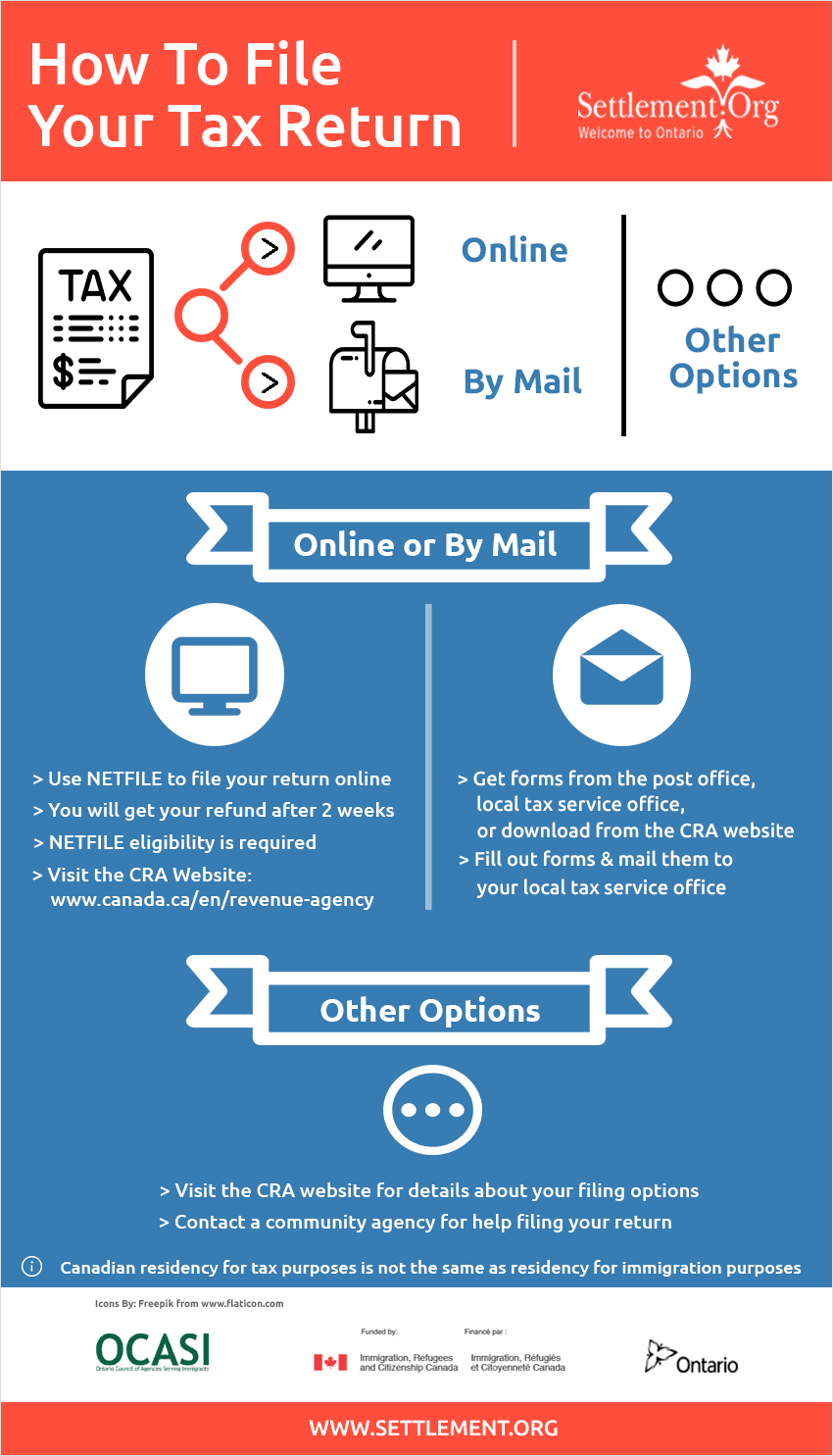

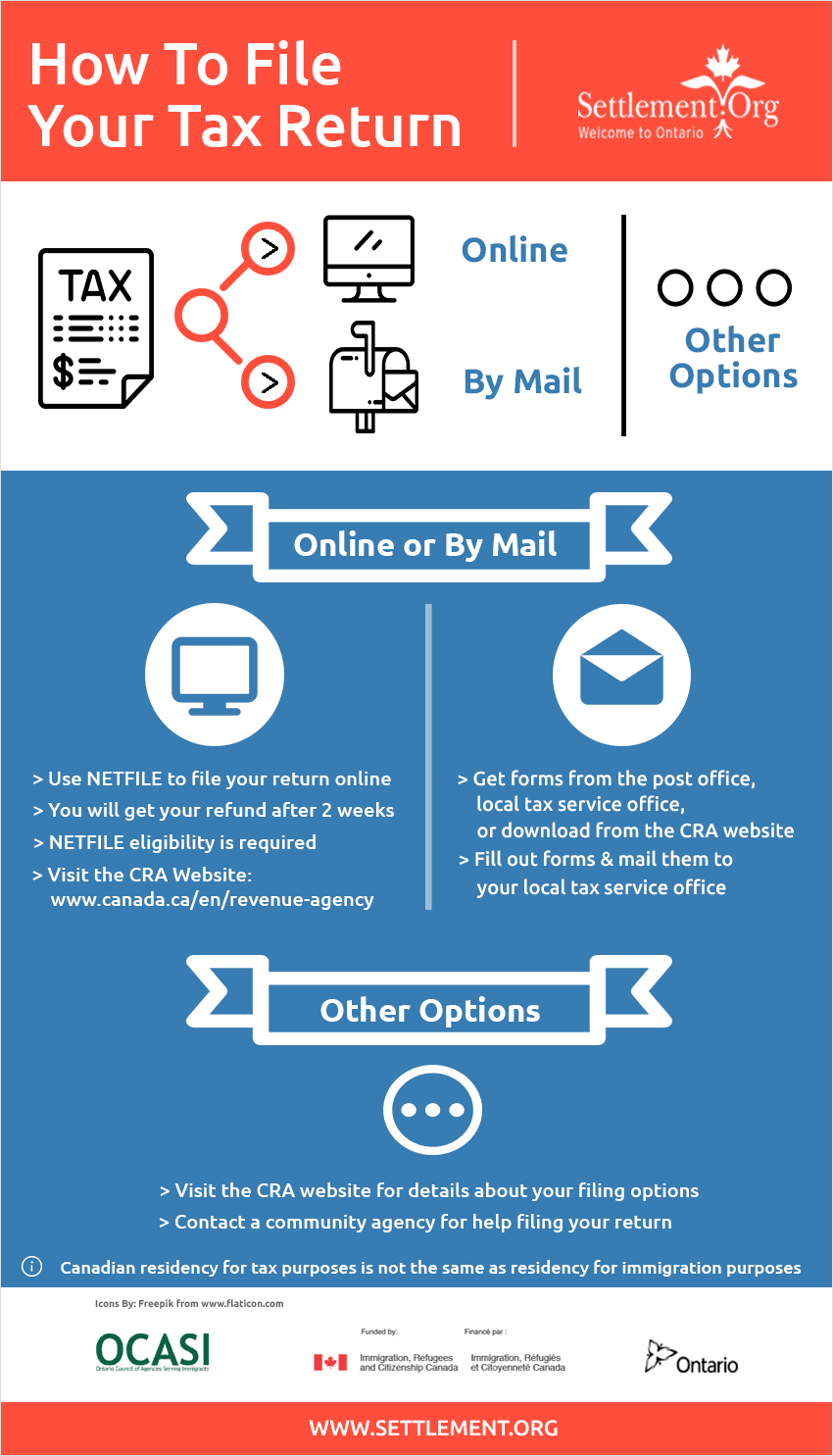

How To File A Late Tax Return In Canada

https://assets-global.website-files.com/61017e6b22c7fa6cb9edc36a/6111cb0f3dd3cb434dcf0f19_60d8c69921e2186d8599e392_working_paperwork_laptop_1300x867.jpeg

Importance Of Tax Return Online By Zahtax20 On DeviantArt

https://images-wixmp-ed30a86b8c4ca887773594c2.wixmp.com/f/a60d8f91-8604-4836-8685-7fefb4458b26/dfh8h1h-a6188512-1a81-4400-a873-39f3febe537e.jpg/v1/fill/w_894,h_894,q_70,strp/importance_of_tax_return_online_by_zahtax20_dfh8h1h-pre.jpg?token=eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzI1NiJ9.eyJzdWIiOiJ1cm46YXBwOjdlMGQxODg5ODIyNjQzNzNhNWYwZDQxNWVhMGQyNmUwIiwiaXNzIjoidXJuOmFwcDo3ZTBkMTg4OTgyMjY0MzczYTVmMGQ0MTVlYTBkMjZlMCIsIm9iaiI6W1t7ImhlaWdodCI6Ijw9MTA4MCIsInBhdGgiOiJcL2ZcL2E2MGQ4ZjkxLTg2MDQtNDgzNi04Njg1LTdmZWZiNDQ1OGIyNlwvZGZoOGgxaC1hNjE4ODUxMi0xYTgxLTQ0MDAtYTg3My0zOWYzZmViZTUzN2UuanBnIiwid2lkdGgiOiI8PTEwODAifV1dLCJhdWQiOlsidXJuOnNlcnZpY2U6aW1hZ2Uub3BlcmF0aW9ucyJdfQ.cRGTWkpQXhvV5cammw6KvqZ7mxvOYg2MGiK9_DMfZwE

Thankfully the IRS has a form you can fill out to request any tax information they have on file for you for a given year Form 4506 Tallows you to request a transcript Estimate your penalty for Self Assessment tax returns more than 3 months late and late payments You can appeal against a penalty if you have a reasonable excuse Find out

The only way to get this money back is to file a tax return Learn more about how to file back tax returns and how to reduce penalties and interest if you qualify Plus you can Learn more about filing a tax extension late payment and late filing penalties and what to do if you can t pay your taxes Still need to file An expert can

Download How To File A Late Tax Return Online

More picture related to How To File A Late Tax Return Online

How To File A Late Tax Return A Three Step Guide For Expats

https://www.greenbacktaxservices.com/wp-content/uploads/2020/07/How-to-File-a-Late-Tax-Return.jpg

Alert Why You Need To File Your Taxes Early

https://s.aolcdn.com/membership/ProductCentral/tax-return-form-closeup-concept-picture-id182492075

Gratis Apology Letter For Late Payment Of Tax

https://www.allbusinesstemplates.com/thumbs/4380e26e-682d-4d26-9bde-548750b40f6e_1.png

The IRS provides a lookup tool that helps you see your tax records so you can file a late return You have three years to claim a tax refund if you re owed one Learn how to file a tax extension with the IRS but remember that you still need to pay your taxes by the standard deadline Millions of Americans request federal

If you wish to file it on Income Tax Portal take a look at this step by step guide on how to file a belated return online and offline Online Method Step 1 Log in Filing taxes late Learn what may happen if you file past the deadline including the IRS late filing penalty with the experts at H R Block

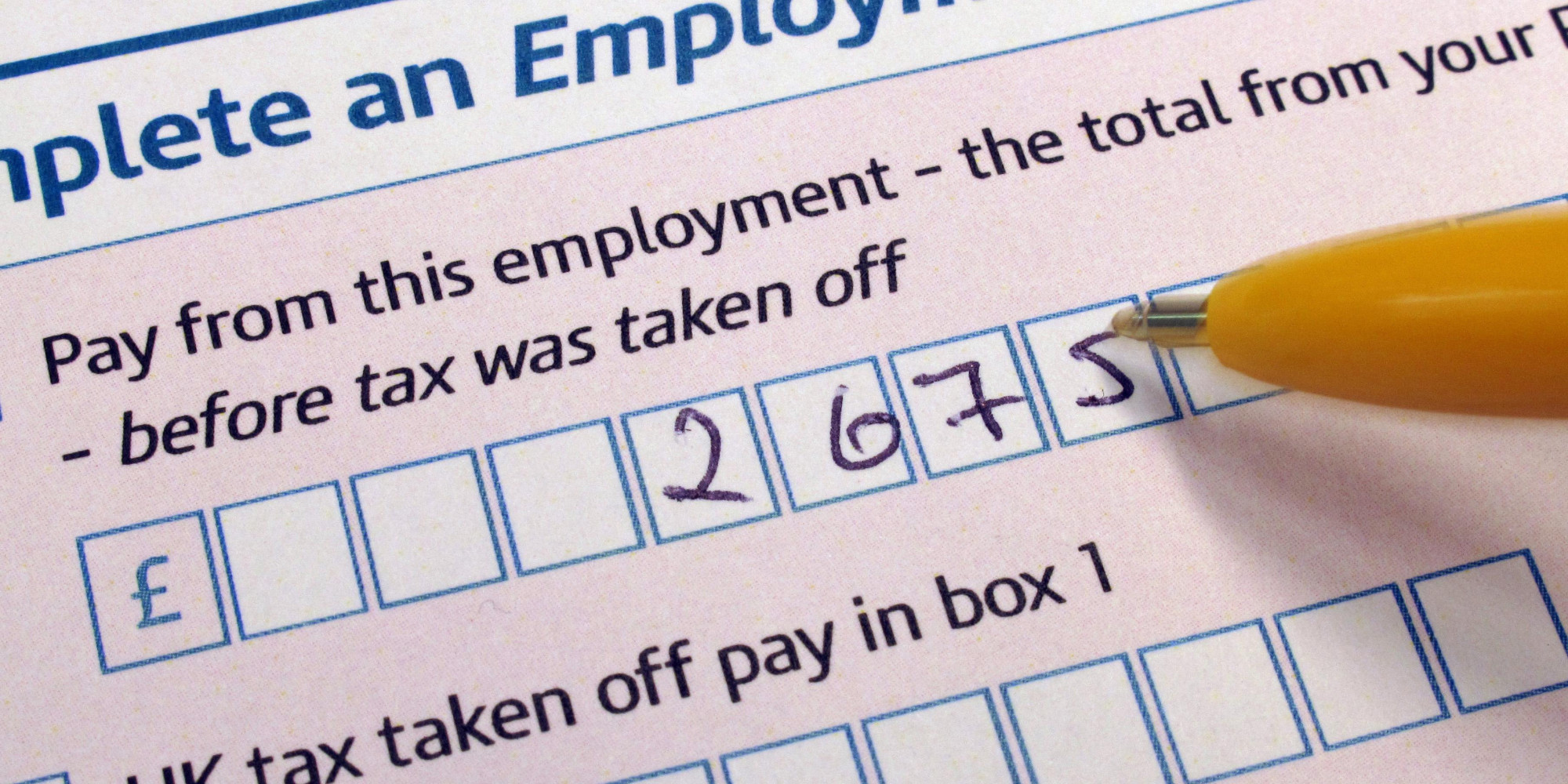

Income To File Tax Return INCOMEBAU

https://i2.wp.com/certicom.in/wp-content/uploads/2018/07/income-tax-return-online.jpg

/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif)

Draht Verantwortlicher F r Das Sportspiel Vermuten States Of Jersey

https://www.thebalance.com/thmb/n0qY5_o0VzoZ5tk64K_PBHbmHrs=/1333x1000/smart/filters:no_upscale()/how-soon-can-we-begin-filing-tax-returns-3192837_final-eab4eb98b0394fb1b93c6dc6876b4062.gif

https://www.irs.gov/newsroom/if-taxpayers-missed...

Taxpayers who missed the April tax filing and payment deadline should file as soon as they can The IRS offers resources to help those who may be unable to pay

https://www.nerdwallet.com/article/taxes/back...

If you re due a tax refund for a prior year claim it by filing your tax return for that year You only have three years from the original tax return due date to claim

Filing Late Tax Returns CRA Charges Penalties Liu Associates

Income To File Tax Return INCOMEBAU

Filing Tax Return Late Penalties Accountants TalkLocal Blog Talk

Late Tax Return Fines Have Been Written Off By HMRC HuffPost UK

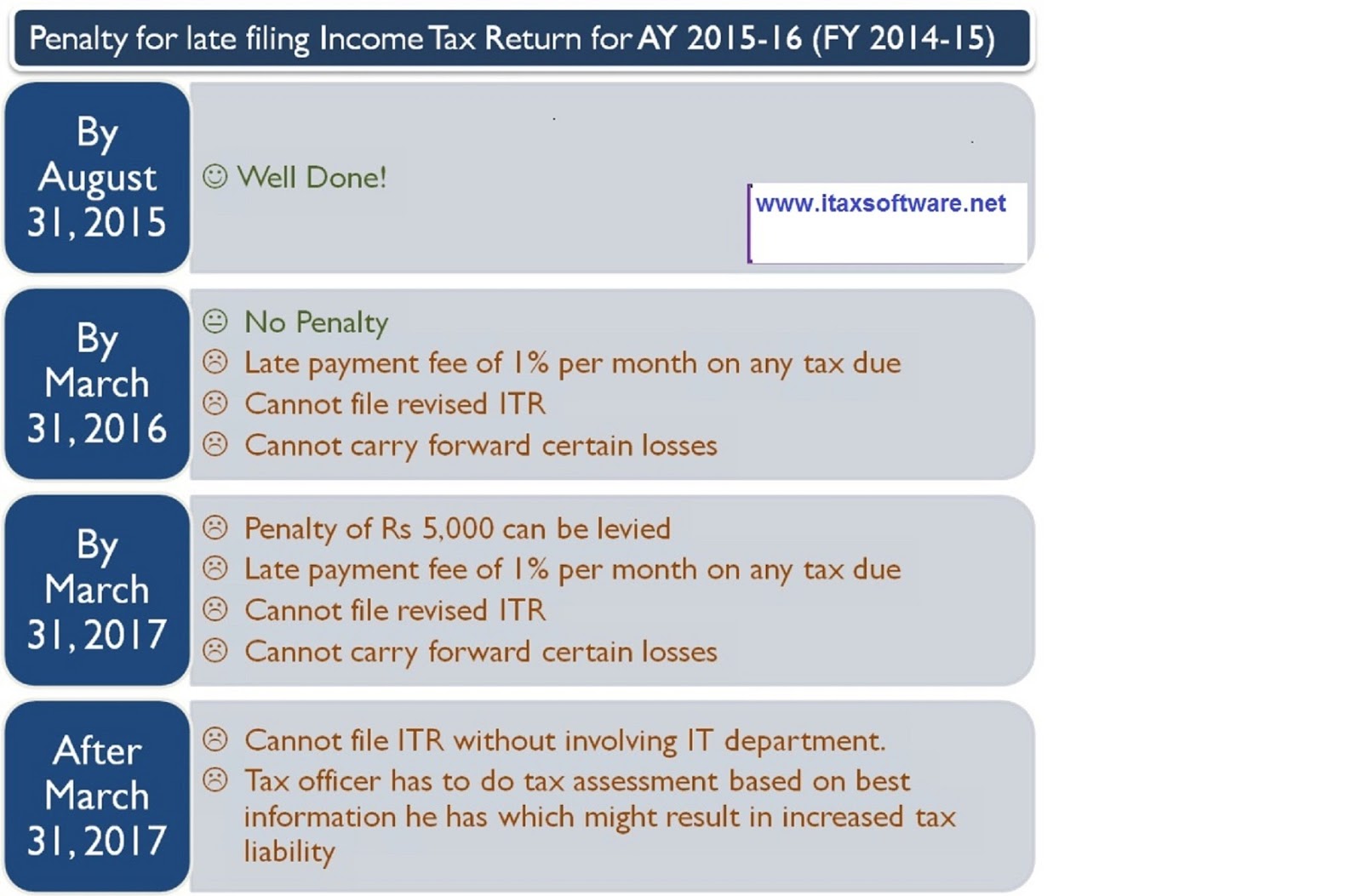

Penalty For Late Filing Of Income Tax Return For The Assessment Year

Infographic On How To File A Tax Return

Infographic On How To File A Tax Return

Filing Your Taxes Late TurboTax Tax Tips Videos

Penalties For Late Income Tax Return Filing In India Blog

Things You Should Know About Late Tax Return Online

How To File A Late Tax Return Online - Filing Form GSTR 5 Return for Non resident Taxable Person User Manual FAQs Preparing Filing Form GSTR 5A Filing Form GSTR 5A Details of supplies of