How To Fill Out Child Tax Credit Form Web July 7 2021 This guide is meant to help you successfully complete the Non filer Sign up Tool to get Child Tax Credit CTC payments as well as any Economic Impact Payments EIP also

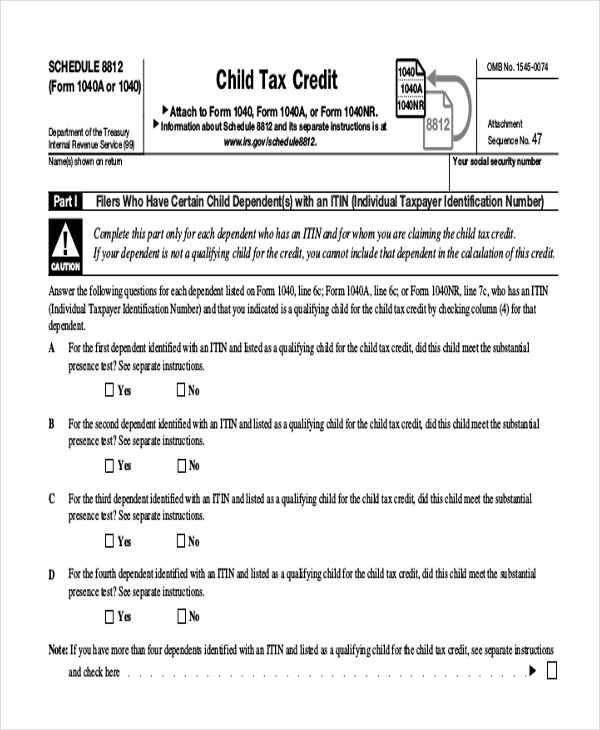

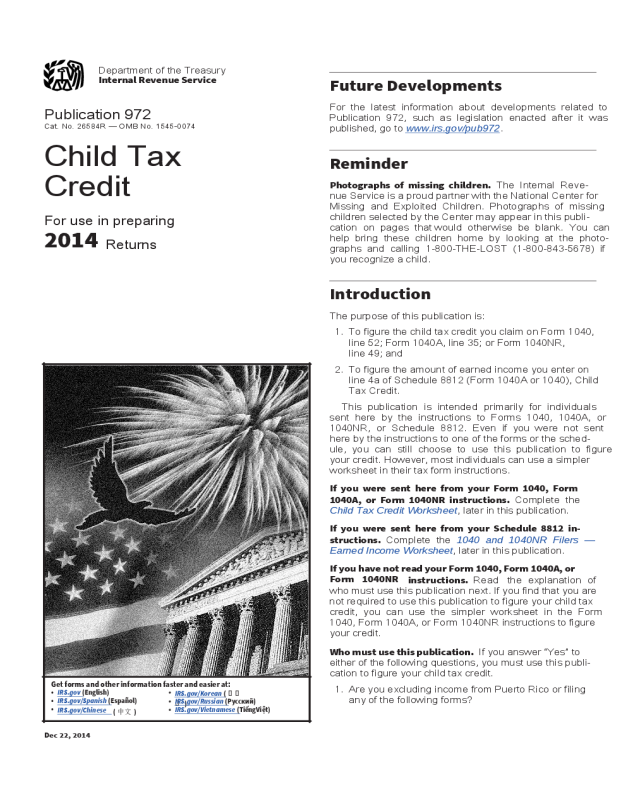

Web Vor 5 Tagen nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married filing jointly or 200 000 or below all Web 25 Nov 2023 nbsp 0183 32 Key Takeaways The Child Tax Credit is a 2 000 per child tax benefit claimed by filing Form 1040 and attaching Schedule 8812 to the return To qualify for the credit the taxpayer s

How To Fill Out Child Tax Credit Form

How To Fill Out Child Tax Credit Form

https://www.pdffiller.com/preview/1/434/1434186/large.png

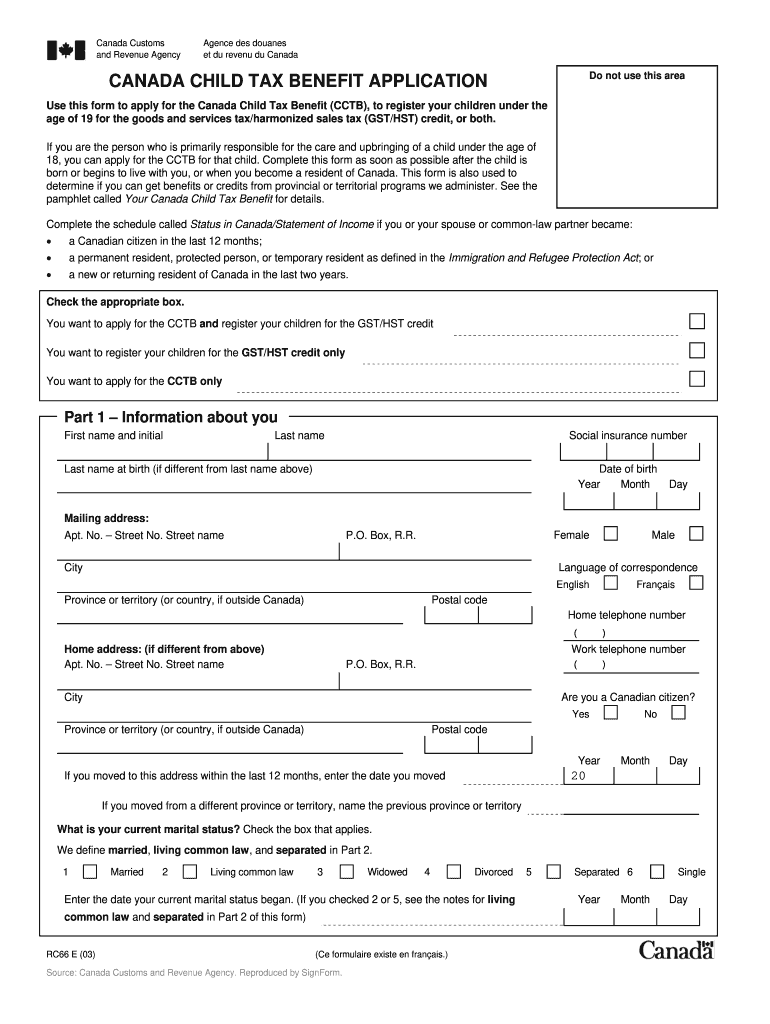

Child Tax Credit Worksheet 2017 Fillable Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/58/100058528/large.png

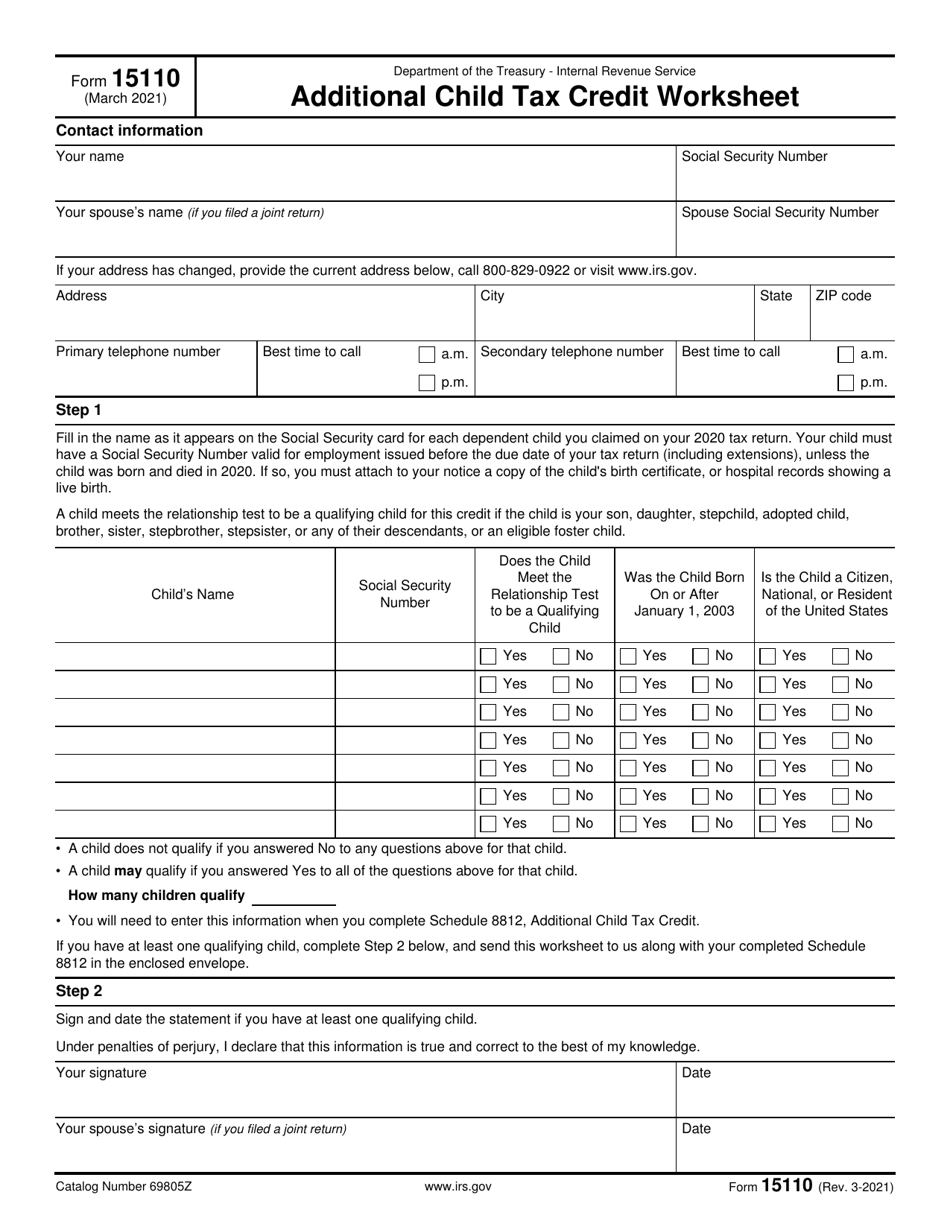

IRS Form 15110 Fill Out Sign Online And Download Fillable PDF

https://data.templateroller.com/pdf_docs_html/2146/21468/2146860/irs-form-15110-additional-child-tax-credit-worksheet_print_big.png

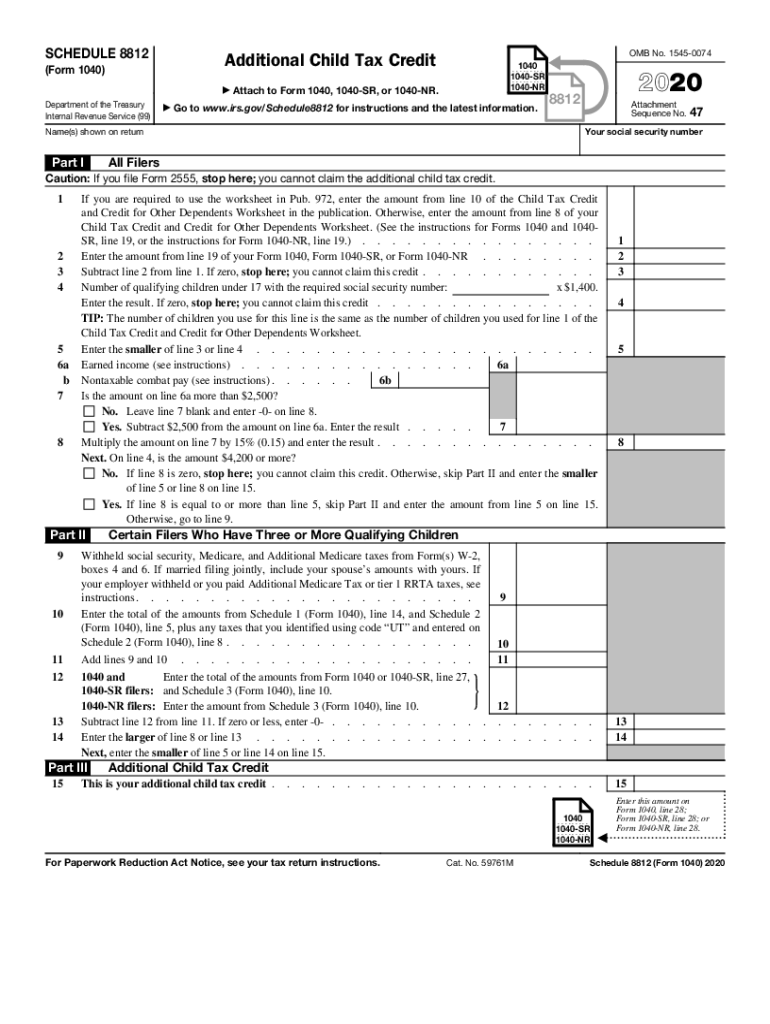

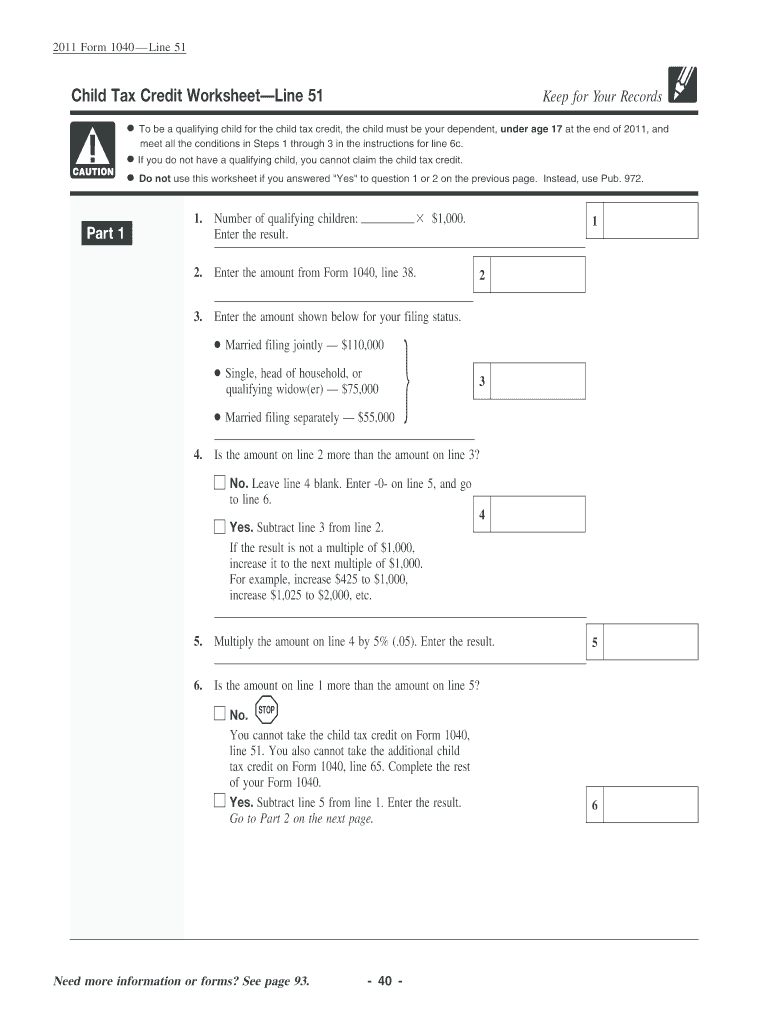

Web 31 Jan 2023 nbsp 0183 32 How to file your taxes with TurboTax In this 10th video I cover how to complete the Child Tax Credit CTC and Additional Child Tax Credit ACTC forms in T Web 19 Okt 2023 nbsp 0183 32 If you have children and a low tax bill you may need IRS Form 8812 to claim all of your Child Tax Credit TABLE OF CONTENTS Form 8812 Changes to the Additional Child Tax Credit Qualifying children requirement Click to expand Key Takeaways The Child Tax Credit CTC is worth up to 2 000 per qualifying child tax

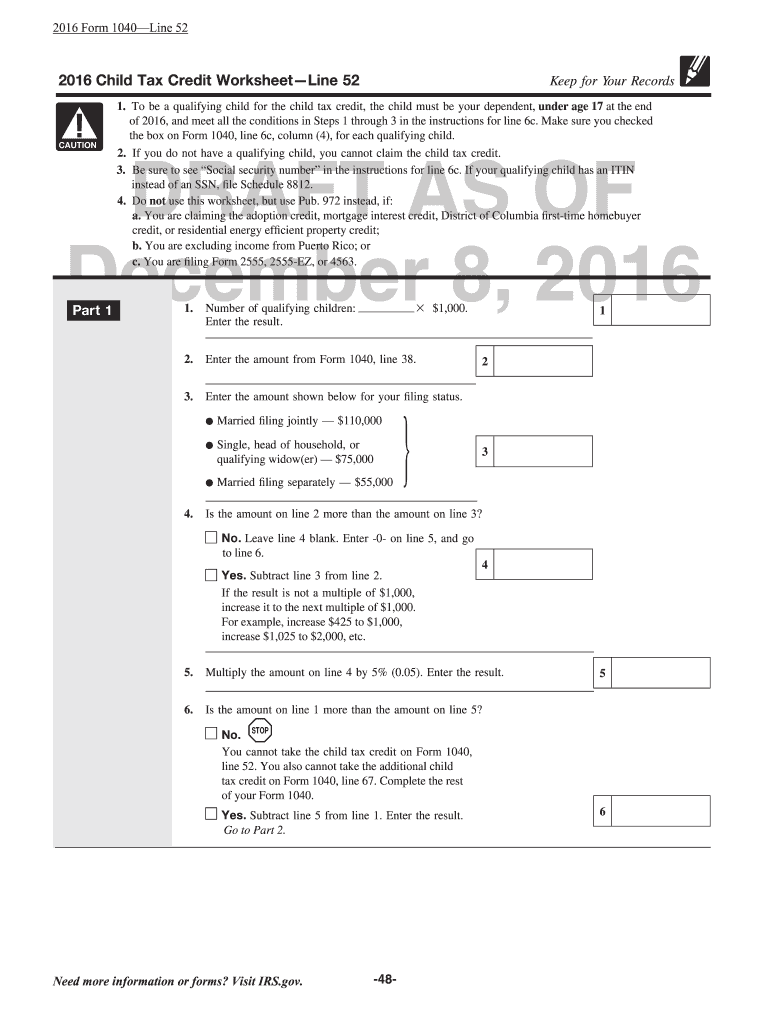

Web 26 Dez 2023 nbsp 0183 32 Who is eligible To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or Entered your information in 2020 to get stimulus Economic Impact payments with the Non Filers Enter Payment Info Here tool or Web First complete the Child Tax Credit and Credit for Other Dependents Worksheet that applies to you See the instructions for Form 1040 or 1040 SR line 19 or the instructions for Form 1040 NR line 19 If you meet the condition given in the TIP at the end of your Child Tax Credit and Credit for Other De pendents Worksheet use Schedule 8812 to

Download How To Fill Out Child Tax Credit Form

More picture related to How To Fill Out Child Tax Credit Form

2014 Child Tax Credit Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/100/71/100071134/large.png

2020 Form IRS 1040 Schedule 8812Fill Online Printable Fillable

https://www.pdffiller.com/preview/533/38/533038516/large.png

Fillable Form 8812 Additional Child Tax Credit Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/122/1226/122623/page_1_thumb_big.png

Web 24 Jan 2023 nbsp 0183 32 To qualify for the credit complete IRS Schedule 8812 and attach it to your Form 1040 tax return The CTC is nonrefundable but for those who qualify the Additional Child Tax Credit ACTC is refundable The Child Tax Credit CTC has been available to taxpayers since 1997 when it was first launched under the terms of the Taxpayer Relief Act Web Vor 3 Tagen nbsp 0183 32 The child tax credit CTC is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The maximum tax credit per qualifying child is 2 000 while the maximum for the additional child tax credit ACTC is 1 600 per qualifying child at least for tax year 2023 The ACTC is the refundable

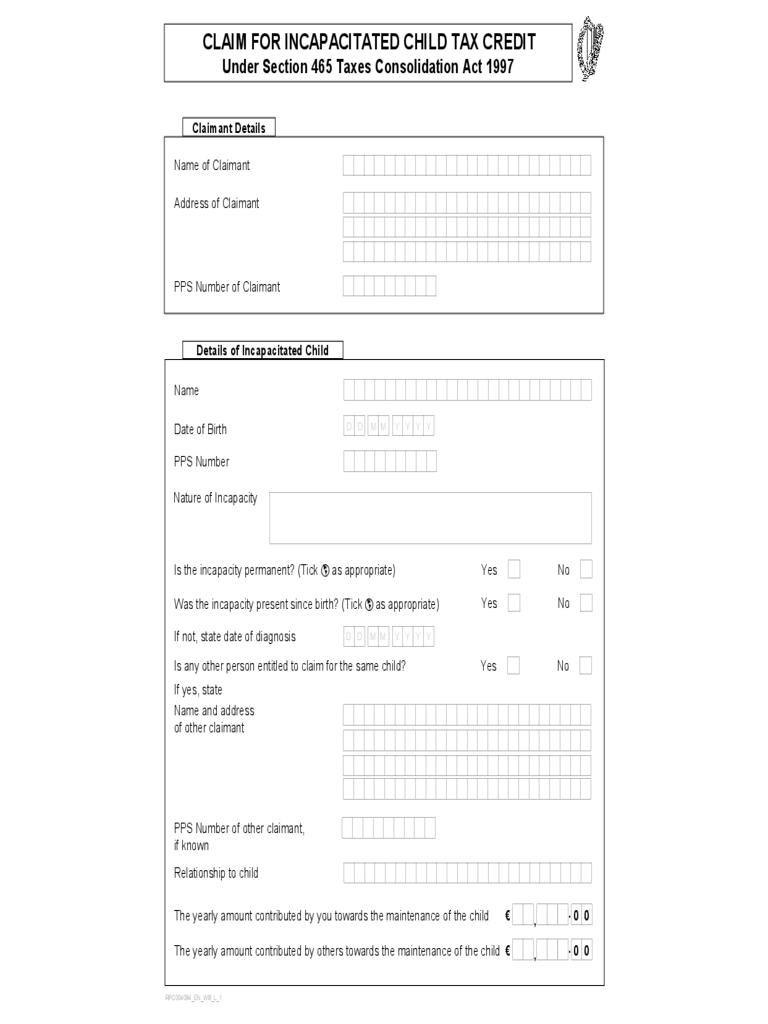

Web You can only make a claim for Child Tax Credit if you already get Working Tax Credit If you get Working Tax Credit To claim Child Tax Credit update your existing tax credit claim Web The Schedule 8812 Form 1040 and its instructions have been revised to be the single source for figuring and reporting the child tax credits and credit for other dependents The in structions now include all applicable worksheets for figuring these credits As a result Pub 972 will not be revised

Child Tax Credits Form IRS Edit Fill Sign Online Handypdf

https://handypdf.com/resources/formfile/htmls/fb/child-tax-credits-form-irs/bg1.png

2023 Child Tax Form Fillable Printable PDF Forms Handypdf

https://handypdf.com/resources/formfile/images/fb/source_images/child-tax-sample-form-d1.png

https://www.whitehouse.gov/wp-content/uploads/2021/07/CT…

Web July 7 2021 This guide is meant to help you successfully complete the Non filer Sign up Tool to get Child Tax Credit CTC payments as well as any Economic Impact Payments EIP also

https://www.nerdwallet.com/article/taxes/qualify-child-child-care-tax-credit

Web Vor 5 Tagen nbsp 0183 32 For 2023 the child tax credit is worth 2 000 per qualifying dependent child if your modified adjusted gross income is 400 000 or below married filing jointly or 200 000 or below all

Form 8812 Additional Child Tax Credit Printable Pdf Download

Child Tax Credits Form IRS Edit Fill Sign Online Handypdf

Child Tax Credit Form Free Download

FREE 22 Sample Tax Forms In PDF Excel MS Word

Child Tax Credit Form Free Download

Child Tax Credit Form Free Download

Child Tax Credit Form Free Download

Child Tax Credits Form IRS Free Download

2023 Tax Credit Form Fillable Printable PDF Forms Handypdf

Child Tax Credit Form Free Download

How To Fill Out Child Tax Credit Form - Web 31 Jan 2023 nbsp 0183 32 How to file your taxes with TurboTax In this 10th video I cover how to complete the Child Tax Credit CTC and Additional Child Tax Credit ACTC forms in T