How To Find Assessed Value Of Property In Jackson County Missouri The assessor determines the market value of the property For real property the market value is determined as of January 1 of the odd numbered years For personal property it is determined

An assessment notice is not a tax bill and does not set your taxes it assigns an estimate of market value to your property Local taxing jurisdictions such as school districts cities library Those concerned with their property tax assessments in Jackson County now have the option to search values and make appointments online KANSAS CITY Mo KCTV Jackson County taxpayers can

How To Find Assessed Value Of Property In Jackson County Missouri

How To Find Assessed Value Of Property In Jackson County Missouri

https://www.jacksongov.org/files/sharedassets/public/news/images/2022/myjacksoncounty.png?w=1200

Property Tax Reduction Consultants How Is A Home s Assessed Value

https://4.bp.blogspot.com/-0_qDdZt8qcQ/V6yfFQ2d8FI/AAAAAAAAAlQ/2FWxZv9fQfg1QKIeT1fo_0xWb0J7T8P2wCLcB/s1600/Home%2BAssessment.jpg

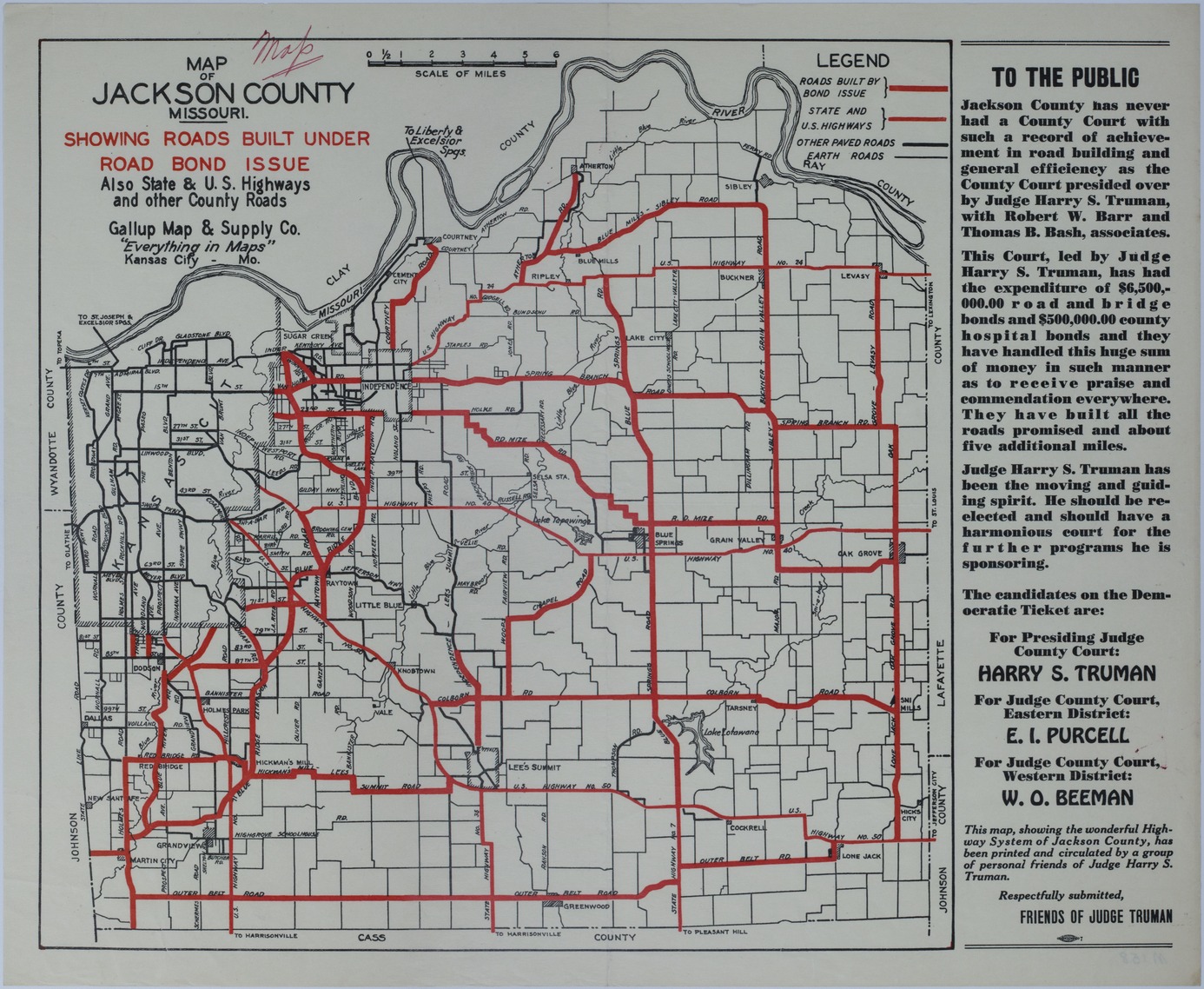

Map Of Jackson County Missouri Road Improvements Harry S Truman

https://www.trumanlibrary.gov/sites/default/files/maps/M158.jpg

Click here to begin a search on this website to see if a parcel was involved in a segregation or merge occurring within the past five years and to see a list of parent parcel s The Jackson County Missouri Assessor s Office announced today that property value assessments for both residential and commercial properties can now be accessed via a

The Jackson County Assessors Office situated in Kansas City Missouri is responsible for valuing all real and personal property within Jackson County As part of the Leasing The Jackson County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Jackson County and may establish the amount of tax due on that

Download How To Find Assessed Value Of Property In Jackson County Missouri

More picture related to How To Find Assessed Value Of Property In Jackson County Missouri

FY23 03 05 Assessed Value Of Real Property

https://stories.opengov.com/staffordcountyva/uploads/557f4ce5fe5e-8_Assessed_Value_of_Real_Property.jpg

Missouri

https://episcopalnewsservice.org/wp-content/uploads/2022/11/Ashes2.jpg

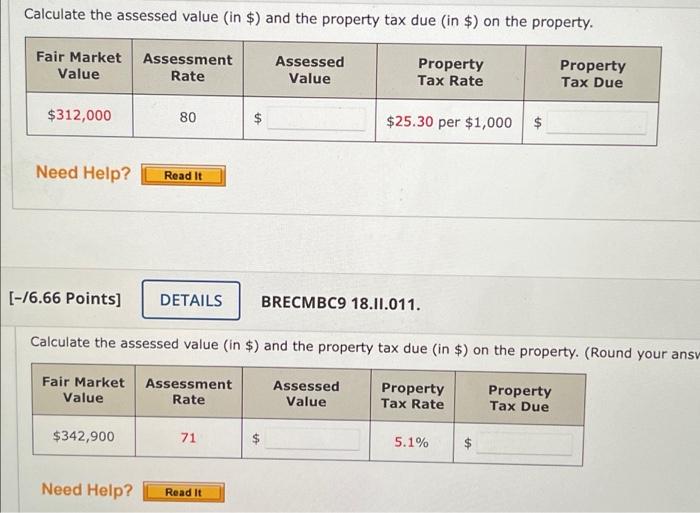

Solved Calculate The Assessed Value In And The Property Chegg

https://media.cheggcdn.com/study/988/988cbca8-0fcd-4b3e-97b3-69891c6167db/image

Jackson County is assessing all 301 000 land parcels in the county Here s how that could affect your property tax bill in 2023 An increase in property value does not necessarily mean a property tax increase The Jackson County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax The

Property taxes in Jackson County average 2 600 annually with a median assessed market value of 177 000 Search our free real estate database to access detailed property records Enter Assessed Value Assessed value is a percentage of the market value as determined by the assessor s office In order to calculate the assessed value multiply the market value by the

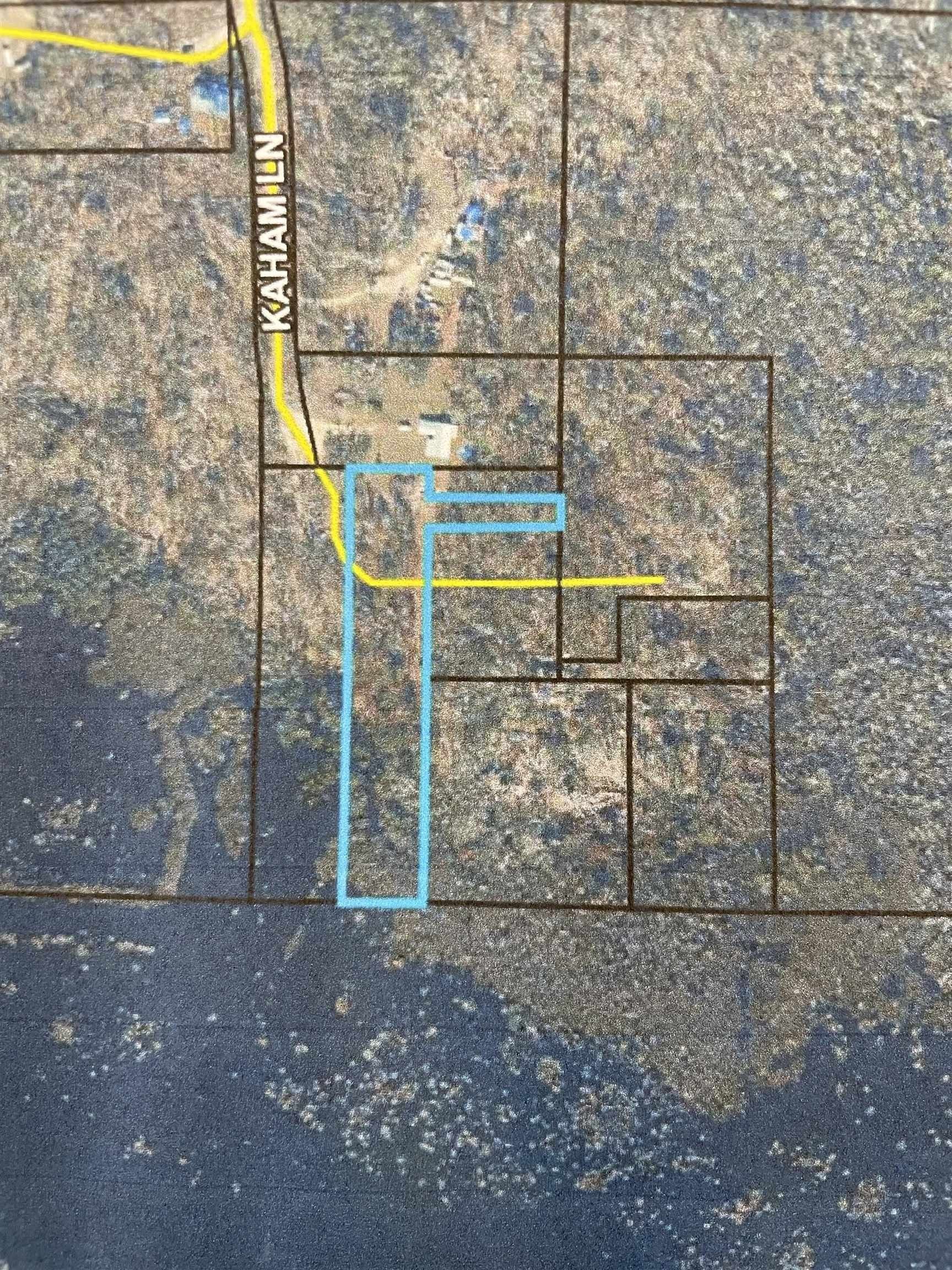

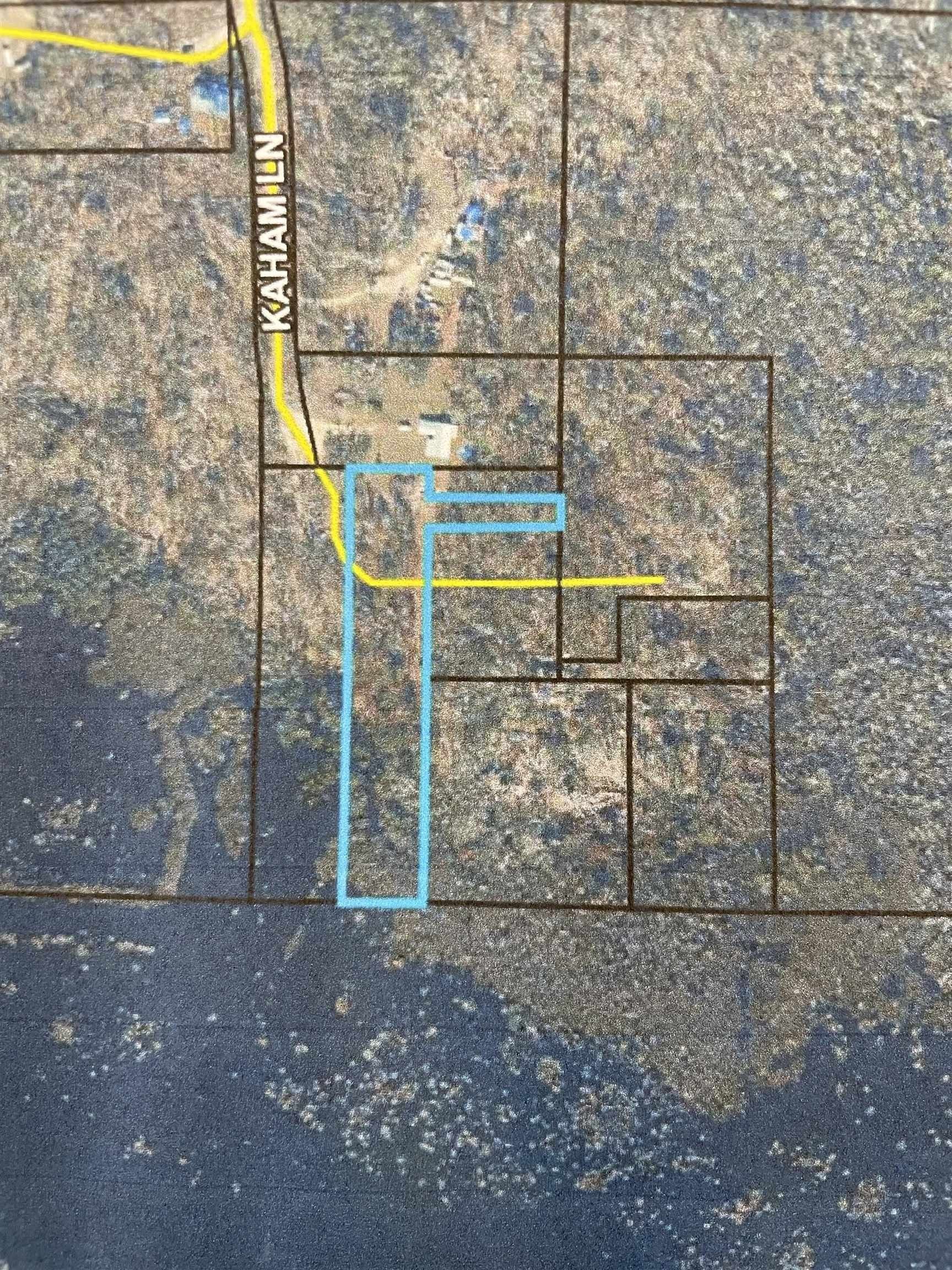

11 8 Acres In Jackson County Missouri

https://assets.land.com/resizedimages/10000/0/h/80/1-5046529276

Assessed Value Vs Market Value How To Calculate Market Value Of

https://myagent.site/content/uploads/sites/4491/2020/05/What’s-the-difference-Assessed-Value-vs-Market-Value-template-2.jpg

https://stc.mo.gov › faq › why-is-my-bill-so-high

The assessor determines the market value of the property For real property the market value is determined as of January 1 of the odd numbered years For personal property it is determined

https://www.jacksongov.org › Government › Departments › ...

An assessment notice is not a tax bill and does not set your taxes it assigns an estimate of market value to your property Local taxing jurisdictions such as school districts cities library

35 06 Acres In Jackson County Georgia

11 8 Acres In Jackson County Missouri

A County Collects Property Taxes On The Assessment Value Of Quizlet

Escaped Inmates Missouri Michael Wilkins Among 5 Captured After St

FY22 03 05 Assessed Value Of Real Property

Grand Ridge Jackson County FL Undeveloped Land Lakefront Property

Grand Ridge Jackson County FL Undeveloped Land Lakefront Property

15 3 Acres In Jackson County Missouri

19 5 Acres In Jackson County Jackson County Sylva NC

Exploring The Travel Restrictions In Jackson County Missouri What You

How To Find Assessed Value Of Property In Jackson County Missouri - Search our free real estate database to access detailed property records Enter an address to find property deeds owner information property tax history assessments home values sales