How To Find Your Property Tax Assessment You can check your local assessor or municipality s website or call the tax office for a more exact figure for your home You can also search by state county and ZIP code on publicrecords

Use SmartAsset s property tax calculator by entering your location and assessed home value to find out your property tax rate and total tax payment Property taxes are calculated by multiplying your assessed home value and local tax rate Learn more about what affects your property tax bill and calculation methods

How To Find Your Property Tax Assessment

How To Find Your Property Tax Assessment

https://storables.com/wp-content/uploads/2023/11/how-do-i-obtain-tax-property-assessment-1700451009.jpg

Understanding Your Property Tax Assessment Schmidt Realty Group

https://schmidtrealtygroup.com/wp-content/uploads/2020/01/Enter-to-WIN.png

Appealing Your Property Tax Assessment Try These 14 Expert Recommended

https://imageio.forbes.com/blogs-images/forbesrealestatecouncil/files/2019/11/Appealing_Your_Tax_Assessment-Try_These_14_Expert-Recommended_Tips-1200x1213.png?format=png&width=1200

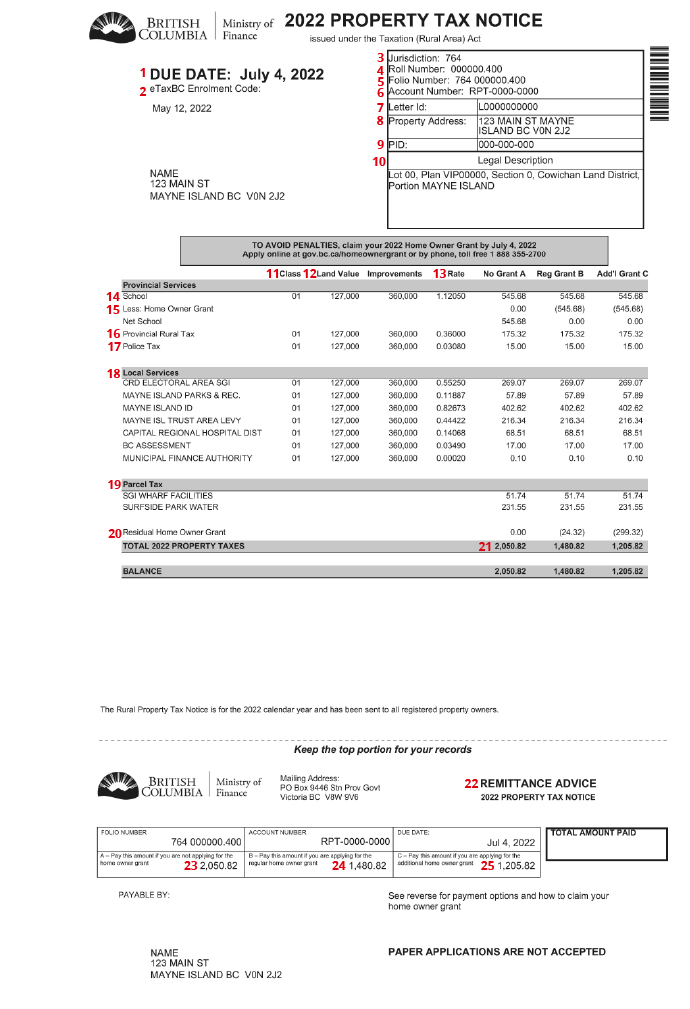

Check what makes up your property s assessment value and compare it with similar properties in your neighbourhood using myproperty edmonton ca Contact the City for one on one support by calling 311 780 442 5311 if outside Edmonton Assessed value is a value assigned to a home by an assessor and is used to determine the property tax bill It is often a percentage of fair market value

Property Tax Definition and How to Calculate Taxes on Real Estate Your property tax bill is mostly based on your property s location and value Here s more on what it is how to pay Check your assessment Assessment rolls list information for every property within a municipality Most towns and cities publish a tentative assessment roll on May 1 We encourage you to review your assessment by mid May This is your opportunity to ensure that your assessment is fair

Download How To Find Your Property Tax Assessment

More picture related to How To Find Your Property Tax Assessment

Tax Assessment Reductions Available To Some Property Owners

https://kubrick.htvapps.com/vidthumb/282a0ef8-4ceb-4e1f-ba10-6b83fb5f8fa5/282a0ef8-4ceb-4e1f-ba10-6b83fb5f8fa5_image.jpg?crop=1.00xw:1.00xh;0,0&resize=1200:*

How To Fight Property Tax Assessments Perkins Zayed PC

https://www.trust-lawgroup.com/wp-content/uploads/2021/08/property-tax-assessment.jpg

Cook County Tax Appeal How Do I Know If My Property Taxes Are Going Up

https://images.squarespace-cdn.com/content/v1/5a2f0546e9bfdfc02fc4d12f/1533190235931-YA1SRP0FKFB86P4TM38C/Property-tax-assessment-notice-cook-county-tax-assessment.jpg

You can also register for VAT if your taxable turnover is less than 90 000 known as voluntary registration You can use this tool to estimate what VAT might be owed or reclaimed by your Property Tax The property tax cycle in Iowa takes a total of eighteen months from start to finish It begins with the assessor determining the assessed values and classification for individual parcels of property January 1st of the assessment year The first half payment for property taxes related to this assessment is due in the fall of the

To calculate your property taxes start by typing the county and state where the property is located and then enter the home value Press calculate to see the average property tax rate along with an estimate of the monthly and yearly property tax costs Welcome to the Property Assessment Tax Tool Please note this tool now reflects the 2024 Property Tax amounts under the Tax Information Tab This easy to use tool will help you look up your property s current and previous assessed value market area information

Can I Find My Property Boundaries Online Login Pages Info

https://raleighrealtyhomes.com/storage/blogs/July2022/YHYy4wgb5F4DSDIJSAmo.png

How To Appeal Your Property Tax Assessment Sartoretti

https://www.sartoretti.org/wp-content/uploads/2022/07/How-to-Appeal-Your-Property-Tax-Assessment-1024x576.png

https://www.realtor.com/guides/homeowners-guide-to...

You can check your local assessor or municipality s website or call the tax office for a more exact figure for your home You can also search by state county and ZIP code on publicrecords

https://smartasset.com/taxes/property-taxes

Use SmartAsset s property tax calculator by entering your location and assessed home value to find out your property tax rate and total tax payment

How To Understand Your Property Tax Assessment Tips From The Pros

Can I Find My Property Boundaries Online Login Pages Info

Tax Assessment How Property Taxes Are Determined

Things You Should Know About Property Tax Assessments TR Spencer

Understanding Your Property Tax Assessment 828 Real Estate

Know The Steps To Make Appeal For Assessing Your Property Tax By

Know The Steps To Make Appeal For Assessing Your Property Tax By

Sample Rural Property Tax Notice Province Of British Columbia

Have Questions About Your Tax Assessment Participate In The Assessor s

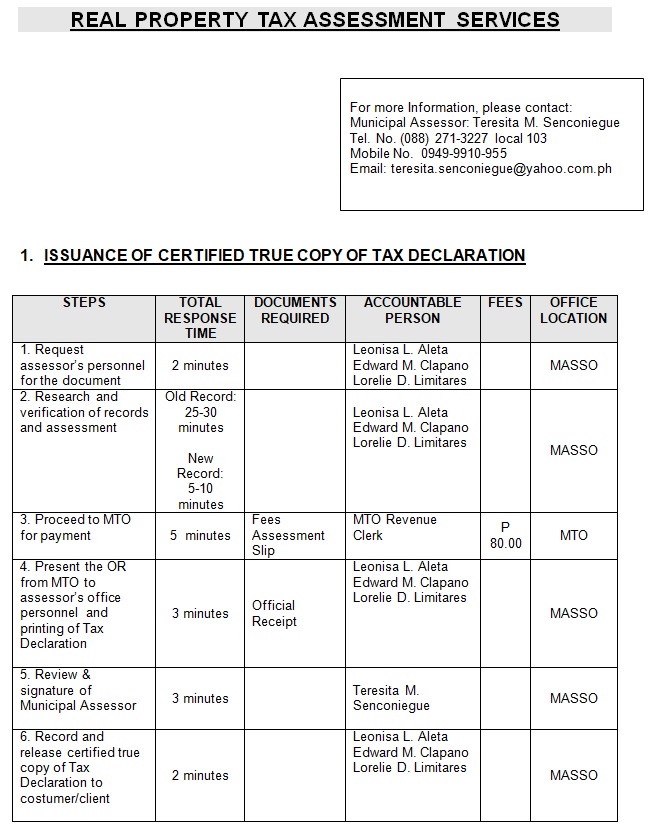

REAL PROPERTY TAX ASSESSMENT SERVICES

How To Find Your Property Tax Assessment - To help homeowners burdened by high property tax bills Pappas led a push to slash the interest rate charged for late taxes by half from 18 to 9 per year The reformed state law now means property owners who do not pay their taxes in full by the due date are charged interest of 0 75 per month instead of 1 5