How To Get A Nonprofit Tax Exempt Number How do I get an Employer Identification Number EIN for my organization You can apply for an EIN online by fax by mail International applicants may apply by phone See the

The organization must then apply for an Employer Identification Number EIN with the IRS by completing Form SS 4 Applications for nonprofit status must be submitted online to Most of the real benefits of being a nonprofit flow from your 501 c 3 tax exempt status such as the tax deductibility of donations access to grant money and income and

How To Get A Nonprofit Tax Exempt Number

How To Get A Nonprofit Tax Exempt Number

https://rossum.ai/use-cases/img/illust/documents/sales_tax_exemption_certificate.png

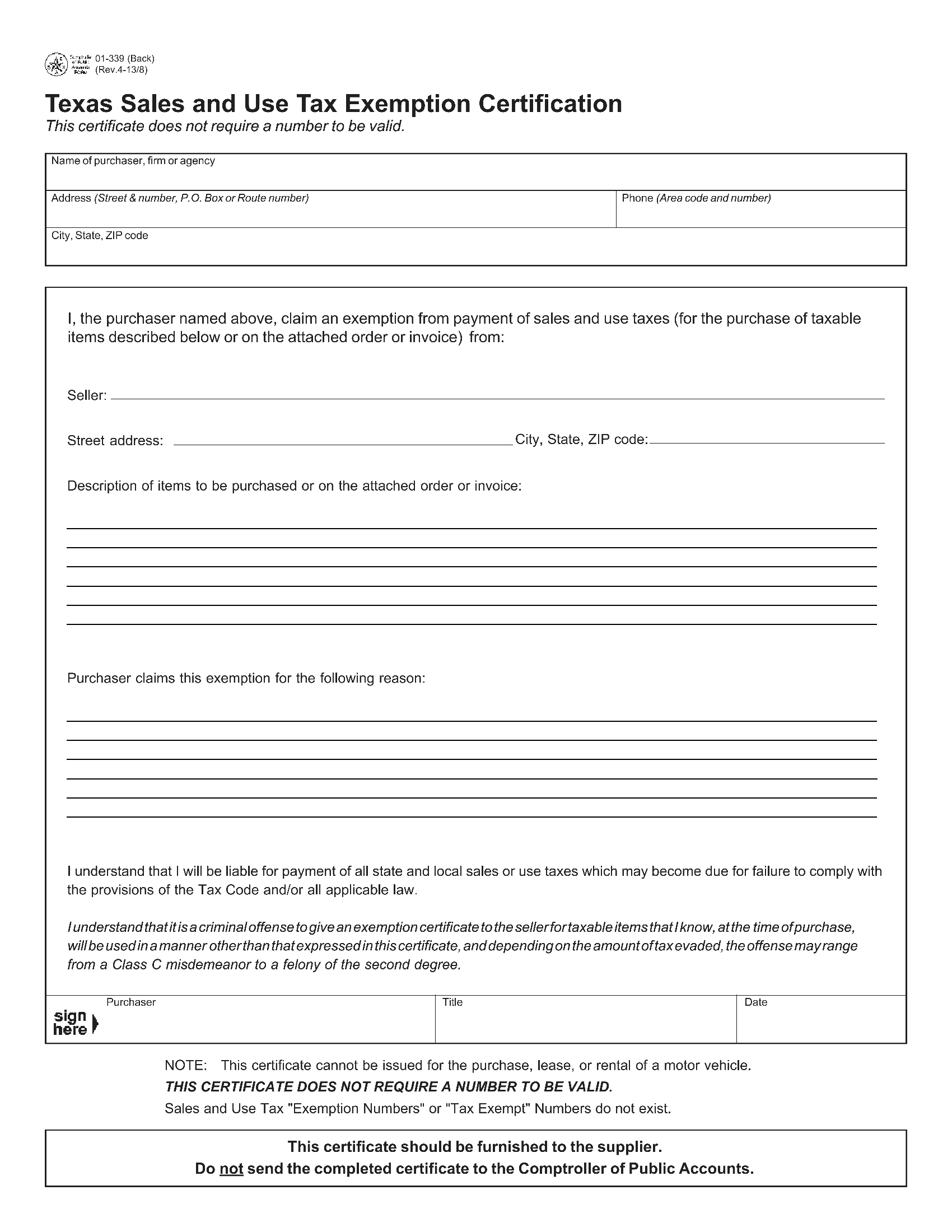

Texas Sales And Use Tax Exemption Certification Forms Docs 2023

https://blanker.org/files/images/01-339b.png

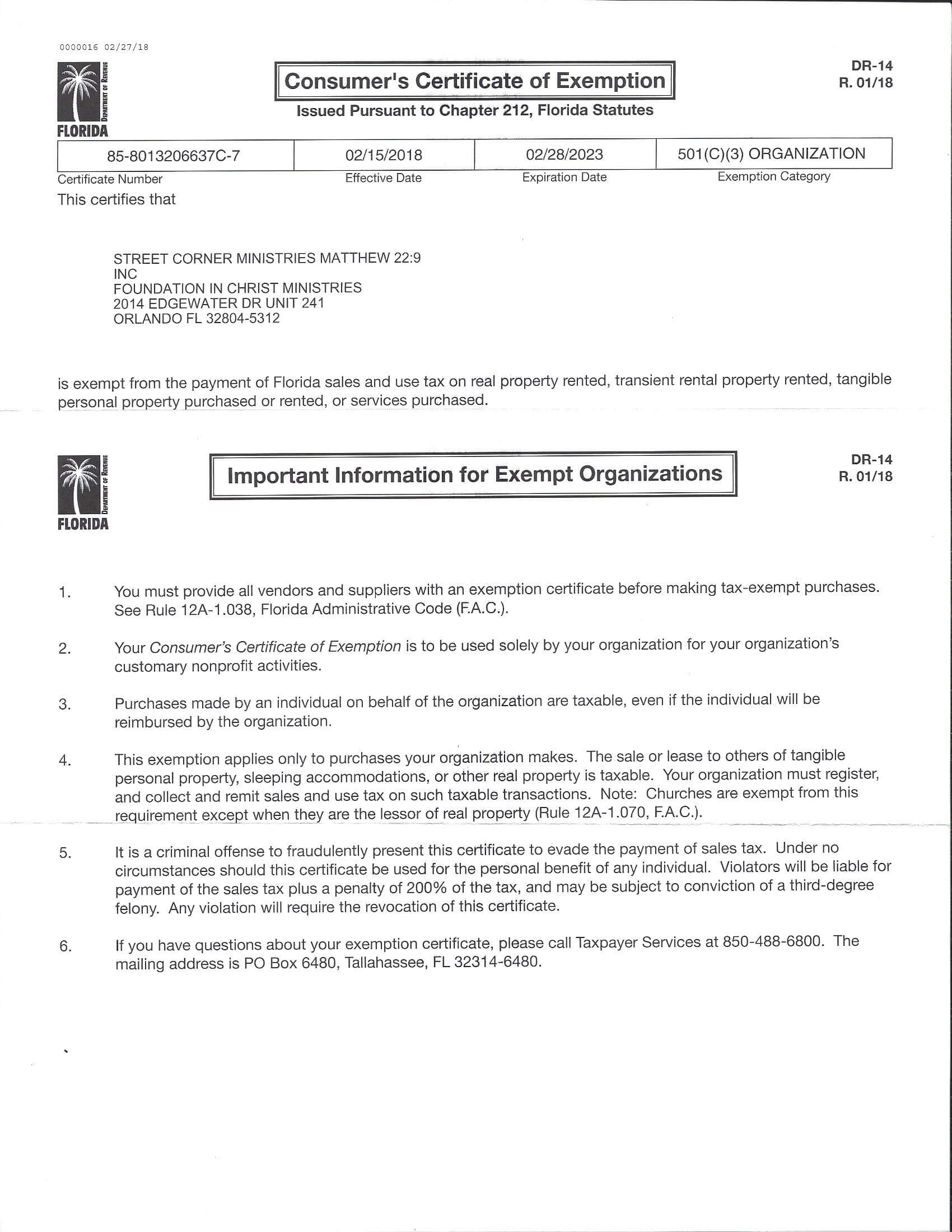

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

https://eoqsmt5wite.exactdn.com/wp-content/uploads/FL-Sales-Tax-Exemption-Certificate.jpg?strip=all&lossy=1&w=2560&ssl=1

Table Of Contents How To Get a Non Profit Tax Exempt Number Knowing how to get a non profit tax exempt number is a necessity for charitable organizations to register for To apply for an EIN call 1 800 829 4933 or use IRS Form SS 4 a downloadable form on the IRS website Fax or mail it in or apply online and download the letter the IRS emails

Steps for obtaining tax exempt status for your nonprofit Incorporate Nonprofit incorporation creates your nonprofit with your chosen home state Also a copy of your Obtaining tax exempt status is a crucial step in forming a nonprofit organization in order to reap benefits such as tax deductibility of donations access to grant funds and income

Download How To Get A Nonprofit Tax Exempt Number

More picture related to How To Get A Nonprofit Tax Exempt Number

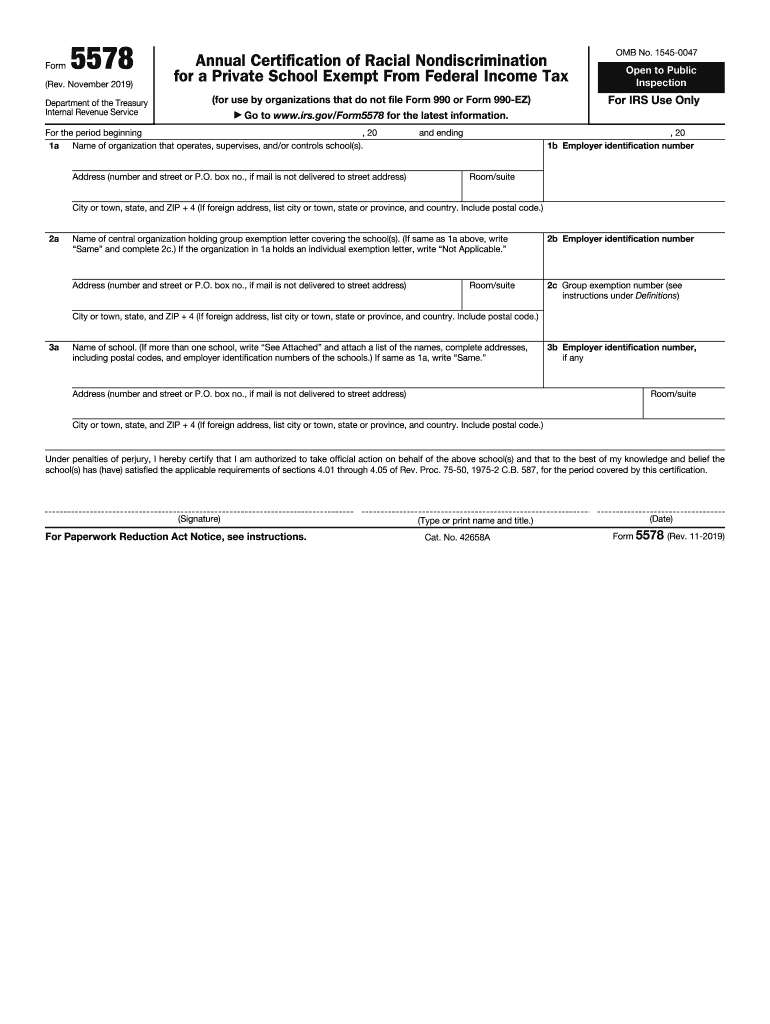

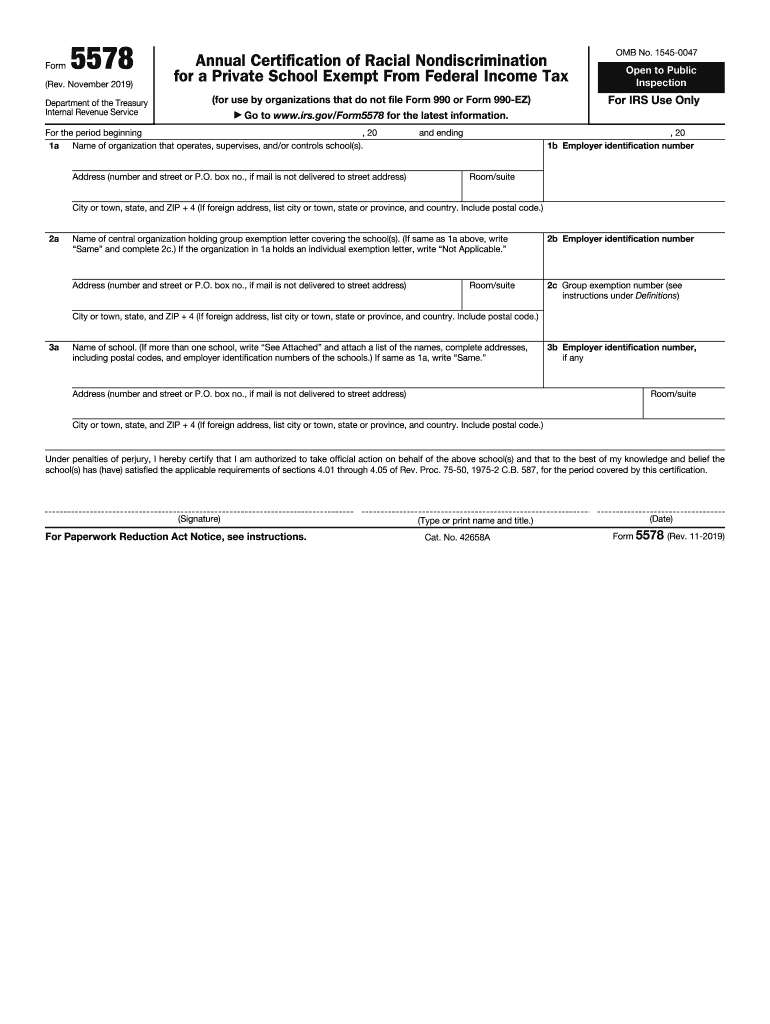

Tax Exemption Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/11/44/11044386/large.png

What Is The Difference Between Nonprofit And Tax Exempt

http://cullinanelaw.com/wp-content/uploads/2014/04/nonprofit-vs-tax-exempt-1.jpg

Tax Exempt Certificate How To Get A Tax Exemption Certificate CBSE

https://cbselibrary.com/wp-content/uploads/2020/12/Tax-Exempt-Certificate.png

Tax Exempt Organization Search Tax Exempt Organization Search Select Database Search All Pub 78 Data Auto Revocation List Determination Letters Form 990 N e Form W 9 Request for Taxpayer Identification Number TIN and Certification Form 4506 T Request for Transcript of Tax Return Form W 4 Employee s Withholding Certificate

Tax Exempt Organization Search Tool You can check an organization s eligibility to receive tax deductible charitable contributions Pub 78 Data You can also search for Apply for an EIN An employer identification number is assigned by the IRS to identify your group as a legal business entity You need this to open a bank account and to apply for

Statement Of Activities Reading A Nonprofit Income Statement The

https://thecharitycfo.com/wp-content/uploads/2022/01/Restricted-Revenue.png

Printable Welcome To The Team Letter Archives Template DIY

https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/Donation-Letter-for-Taxes.jpg?fit=1414%2C2000&ssl=1

https://www.irs.gov/charities-non-profits/...

How do I get an Employer Identification Number EIN for my organization You can apply for an EIN online by fax by mail International applicants may apply by phone See the

https://www.forbes.com/advisor/business/501c3-application-online

The organization must then apply for an Employer Identification Number EIN with the IRS by completing Form SS 4 Applications for nonprofit status must be submitted online to

Ohio Tax Exempt Form Fill Out Sign Online DocHub

Statement Of Activities Reading A Nonprofit Income Statement The

Tax Exempt Forms San Patricio Electric Cooperative

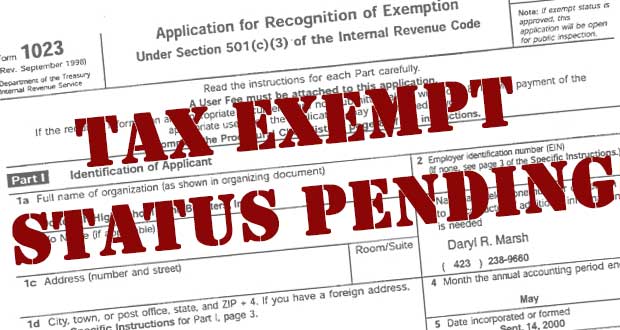

Where Is My IRS Tax Exempt Application Nonprofit Ally

Tax Exempt Cert 1 Revelation Gardens

Business Tax Exempt Form Fill Out Sign Online DocHub

Business Tax Exempt Form Fill Out Sign Online DocHub

How To Get A Sales Tax Certificate Of Exemption In North Carolina

State Lodging Tax Exempt Forms ExemptForm

Taxact Online Fillable Tax Forms Printable Forms Free Online

How To Get A Nonprofit Tax Exempt Number - Apply for a CES number by completing Form S 103 Application for Wisconsin Sales and Use Tax Certificate of Exempt Status Include a copy of your organization s 501 c 3