How To Get A Vat Tax Refund In Paris How to qualify for a VAT refund tax refund Step 1 Request a sales note BVE bordereau de vente When paying for your items ask the seller for the slip to benefit from the tax refund

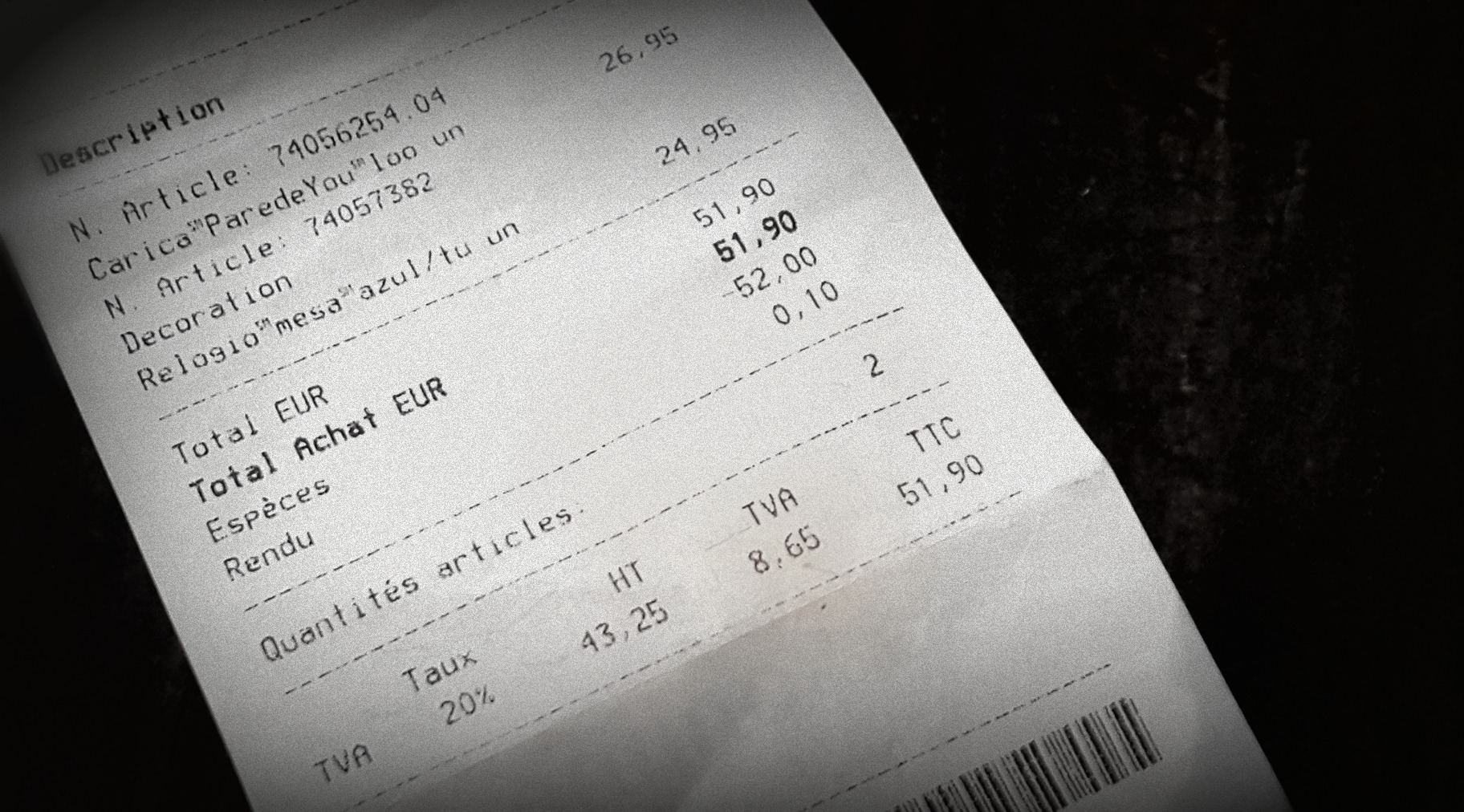

You must pay the full VAT inclusive price for the goods in the shop you will get the VAT refunded once you have complied with the formalities and can show proof of export How do I go about this When you are in the shop ask the shop assistant in advance whether they provide this service How to qualify for the VAT Tax Refund in France Wevat application In order to qualify for the VAT TAX refund in France you must Traditional Process Spend 100 01 Euros or more at one given store Wevat Digital Refund Process Spend 100 01 Euros total at multiple stores Be Over the age of 16

How To Get A Vat Tax Refund In Paris

How To Get A Vat Tax Refund In Paris

https://images.squarespace-cdn.com/content/v1/5eccccff3108d31237957f5a/af696d12-c7f1-4e1a-b365-aa772fe534a1/How+to+get+your+tax-refund+in+Paris+Charles+de+Gaulle+Airport%2C+France-7

Pin By Marie On Paris Paris Travel Paris Tips Paris

https://i.pinimg.com/originals/58/3c/fd/583cfd6947e6ce16f04e3013a8510d32.jpg

VAT Tax Refund Paris Guide Paris Insider Guide

https://i.pinimg.com/originals/99/b1/c4/99b1c4d53cc814db3dd71bdcce7076d8.jpg

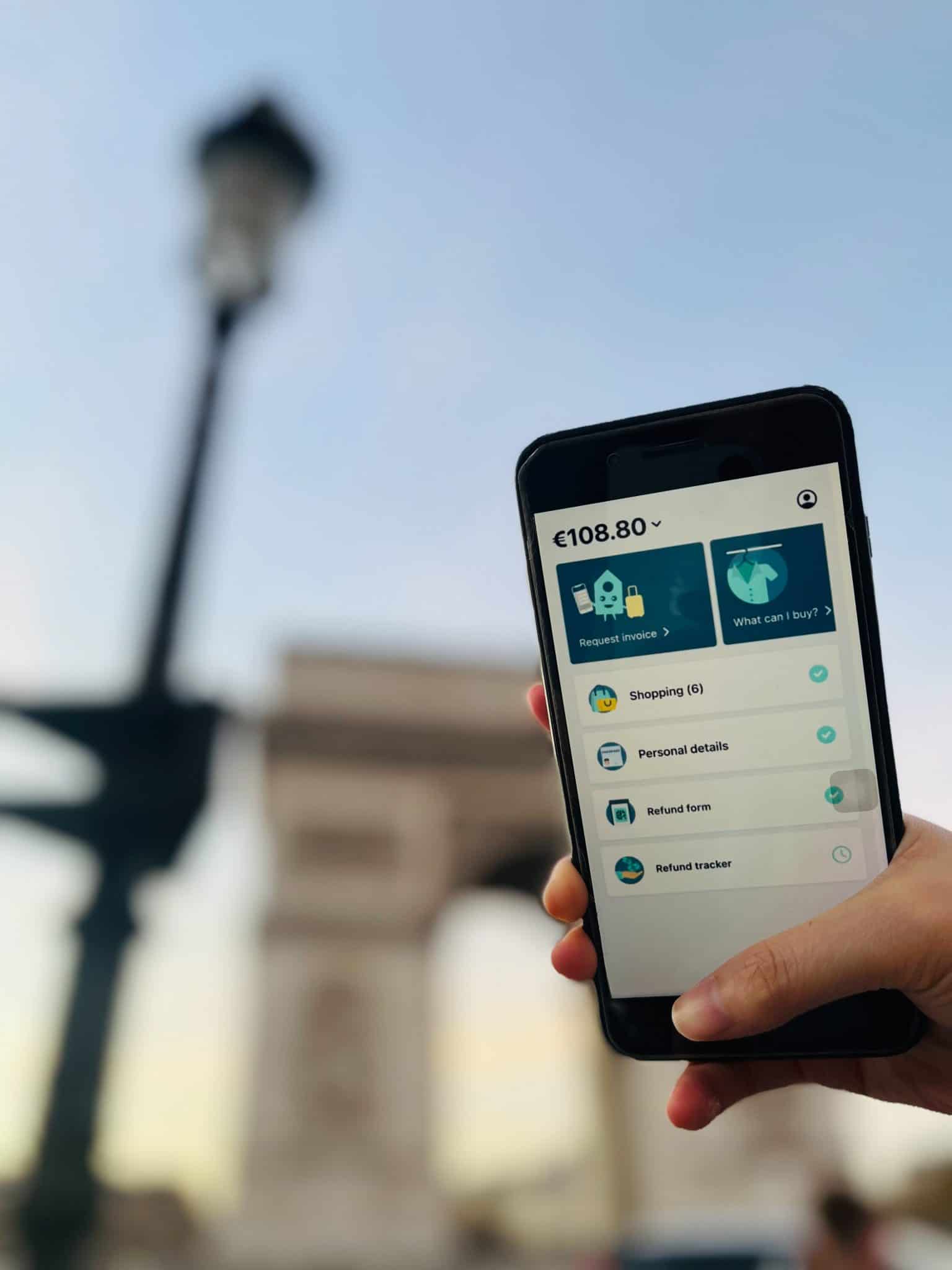

File your claim by 30 September of the calendar year following the refund period You may file claims prior to this date in order to speed up the processing of your claim supply your banking details in the form of IBAN and BIC codes You may be represented by a representative of your choice There are two main ways you can get a tax refund using a traditional in store paper method or a digital app like Wevat The main perk of using a digitalised method with Wevat is you get 23 more money back compared with the in store method

Steps to take to acquire a refund without the stores mentioned above are After a purchase of 175 or more acquire the VAT refund form and keep the sales receipt Before airport check in complete the form and have it stamped by a customs officer at one of the airport locations listed below As non EU citizens and travel leisure consumers we are entitled to received the VAT Tax Refund for the goods and services we purchased in Paris and the entirety of France Again you must be a non EU member meaning not on an EU passport visa etc and must be above the age of 16 to qualify

Download How To Get A Vat Tax Refund In Paris

More picture related to How To Get A Vat Tax Refund In Paris

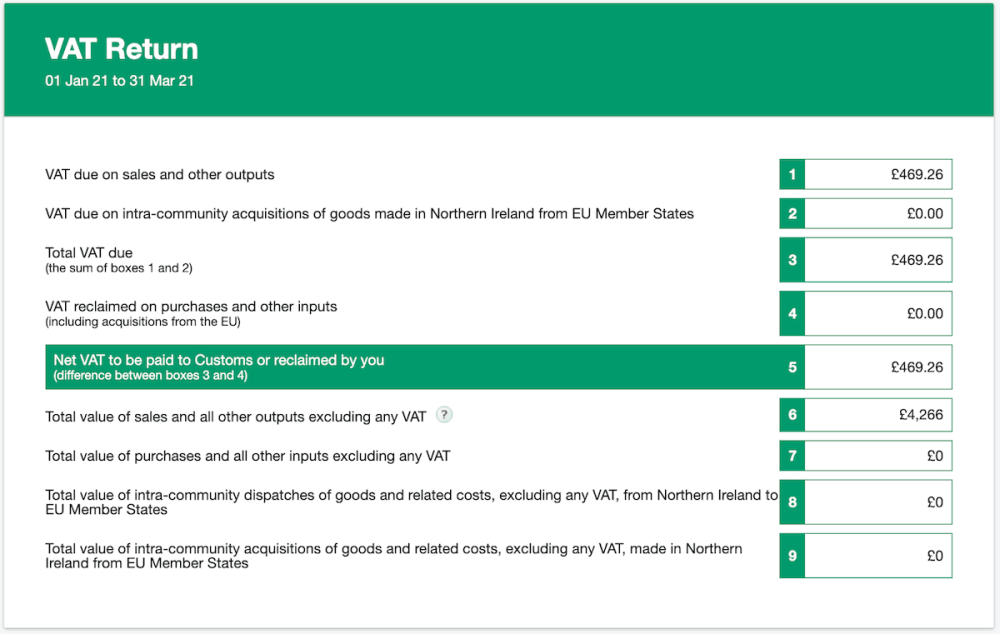

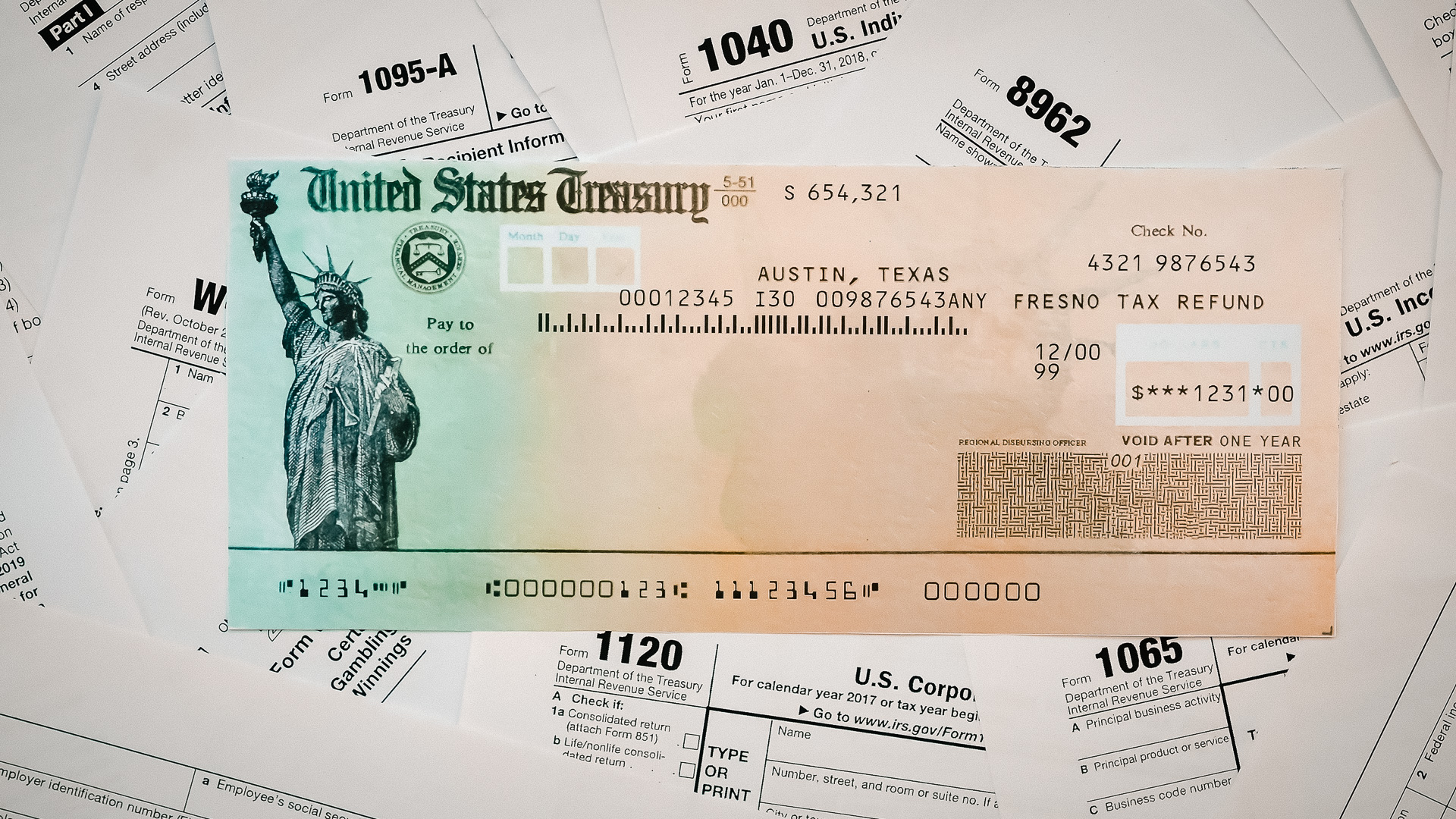

Co To Jest Deklaracja VAT FreeAgent I m Running

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1000/dpr_auto,f_auto/website-images/screenshots/screenshot_vat-return.png

2022 VAT Tax Refund Process In Paris France Petite In Paris Tax

https://i.pinimg.com/originals/53/7a/8f/537a8f897f20cf9d0884ad744bbae720.jpg

2024 VAT Tax Refund Process In Paris France Petite In Paris

https://petiteinparis.com/wp-content/uploads/2019/11/VAT-TAx-refund-process-in-PAris.jpg

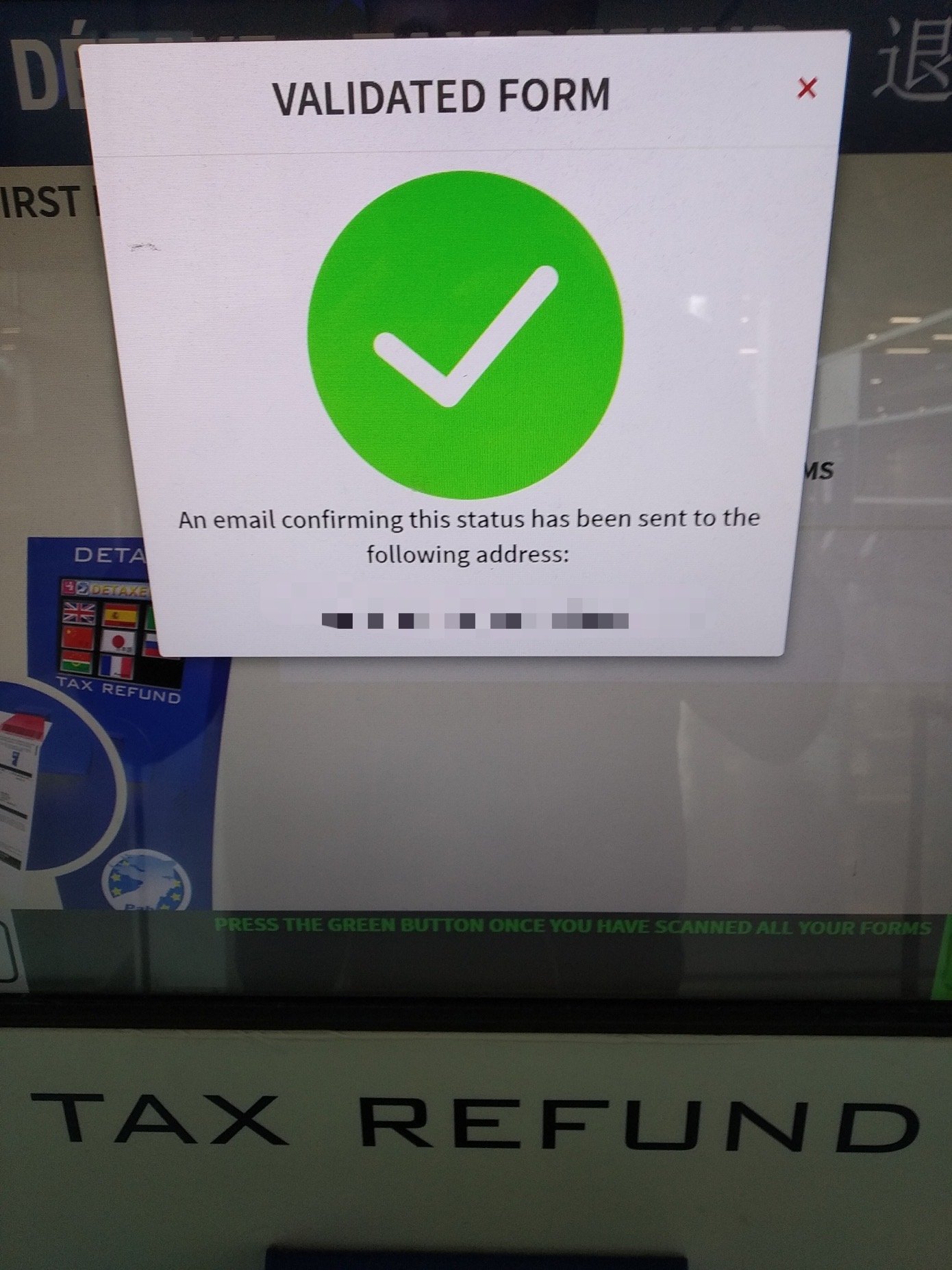

1 Select your language 2 Scan the bar code on your form 3 Obtain Customs approval a green screen will appear with the message OK form valid At Tax refund desks Terminal 1 CDGVAL Level Hall 6 Terminal 2A Exit 5 Terminal B Arrivals level Terminal 2C Exit 12 Terminal 2E Departures level Exit 8d Terminal 2F Arrivals level Exit 10a November 14 2019 Heather Stimmler Non EU residents are eligible to receive a refund of the Value Added Tax VAT or d taxe TVA in French on goods purchased in France This is 12 15 for regular goods up to 33 for luxury goods no refunds applicable for services food beverages tobacco products postage stamps weapons cultural

When making eligible purchases in shops that offer tax free shopping you will be issued with a PABLO enabled VAT refund form You ll see the PABLO logo on it All you have to do is scan the barcode of your VAT form at the PABLO terminals This is equivalent to having your form stamped by Customs To be entitled to a tax refund you must present the duty free slip at customs on leaving France You may be asked to produce the objects purchased so that they can be verified You can easily obtain an electronic duty free slip by using the Pablo terminals at the airports For an immediate VAT refund you should present all your documents at

New Digital VAT Tax Refund Process In Paris France With Wevat Petite

https://petiteinparis.com/wp-content/uploads/2021/12/new-digital-vat-tax-refund-in-Paris-1639x2048.jpg

Demystifying The VAT Tax Refund Process In Paris A Shopper s Guide

https://image10.photobiz.com/8495/16_20230526114841_10053233_large.png

https://www.parisaeroport.fr/en/passengers/services/tax-refund

How to qualify for a VAT refund tax refund Step 1 Request a sales note BVE bordereau de vente When paying for your items ask the seller for the slip to benefit from the tax refund

https://taxation-customs.ec.europa.eu/guide-vat-refund-visitors-eu

You must pay the full VAT inclusive price for the goods in the shop you will get the VAT refunded once you have complied with the formalities and can show proof of export How do I go about this When you are in the shop ask the shop assistant in advance whether they provide this service

Claim Your Paris VAT Refund Tax In France Before You Leave

New Digital VAT Tax Refund Process In Paris France With Wevat Petite

Europe Search Marketing Country Information

Demystifying The VAT Tax Refund Process In Paris A Shopper s Guide

New Digital VAT Tax Refund Process In Paris France With Wevat Petite

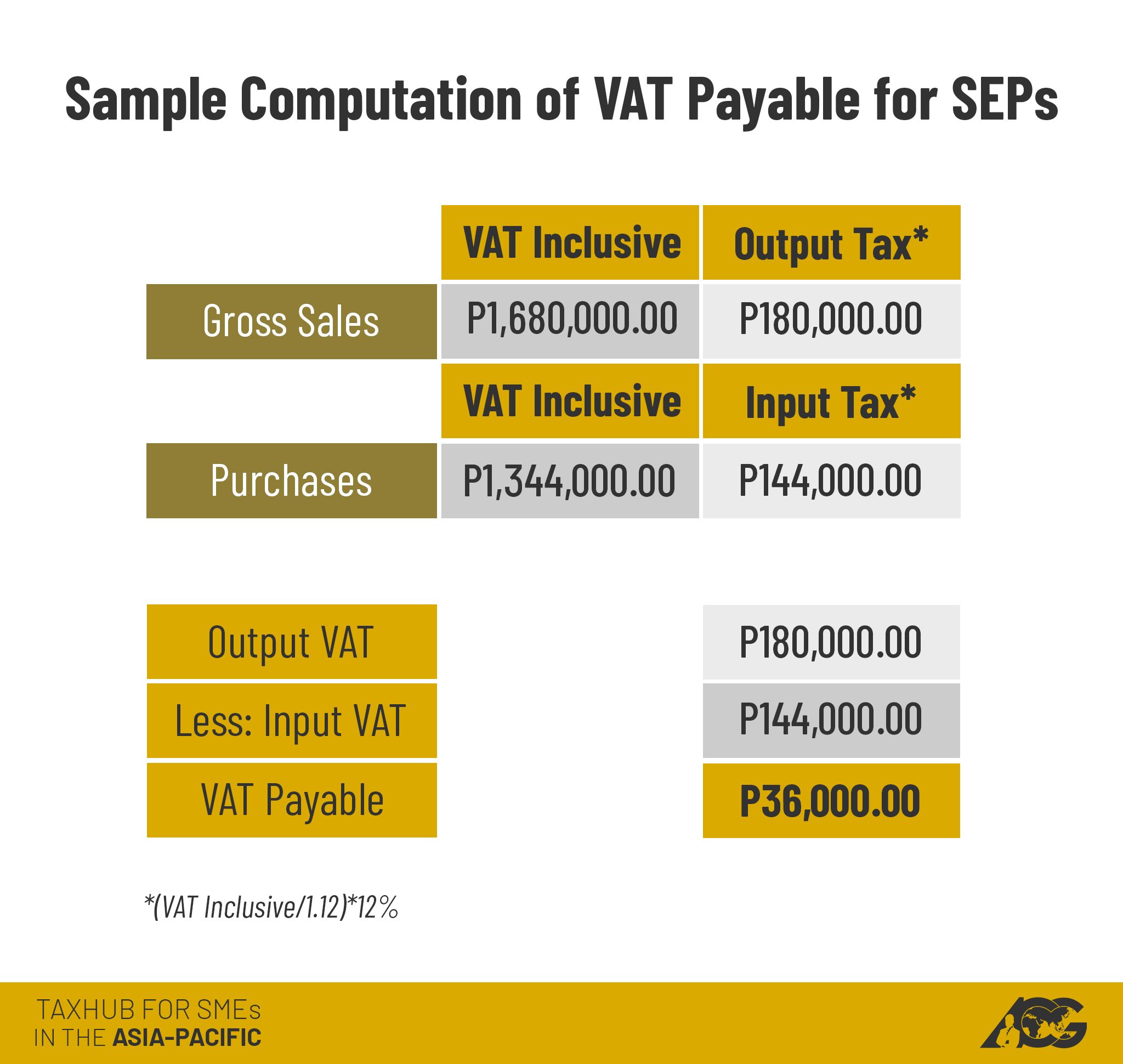

AskTheTaxWhiz VAT Or Non VAT Taxpayer

AskTheTaxWhiz VAT Or Non VAT Taxpayer

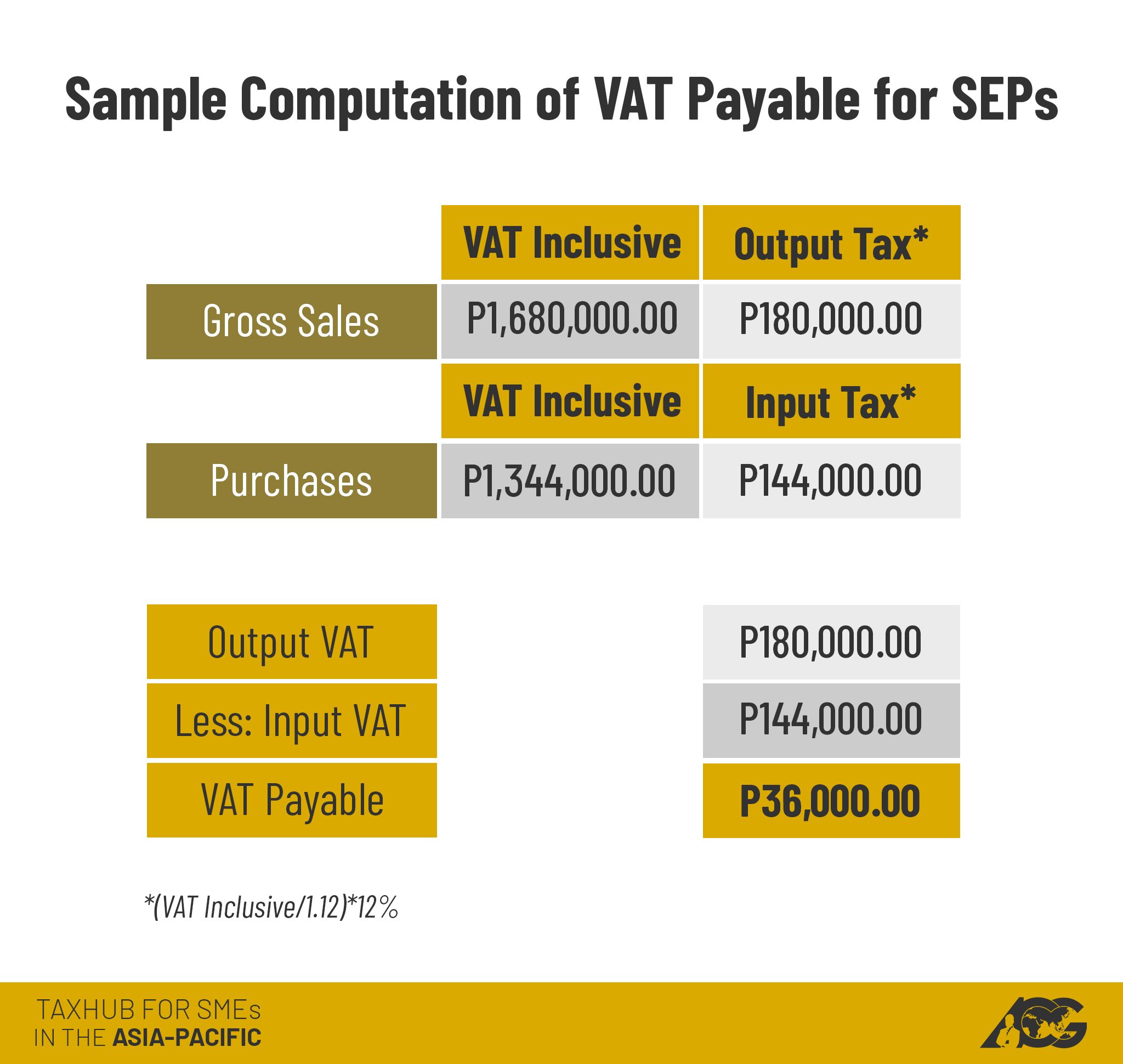

FreeAgent VAT Online Submission 1Stop Accountants

Is Louis Vuitton Really Cheaper In Paris FifthAvenueGirl

Here s The Average IRS Tax Refund Amount By State GOBankingRates

How To Get A Vat Tax Refund In Paris - Steps to take to acquire a refund without the stores mentioned above are After a purchase of 175 or more acquire the VAT refund form and keep the sales receipt Before airport check in complete the form and have it stamped by a customs officer at one of the airport locations listed below