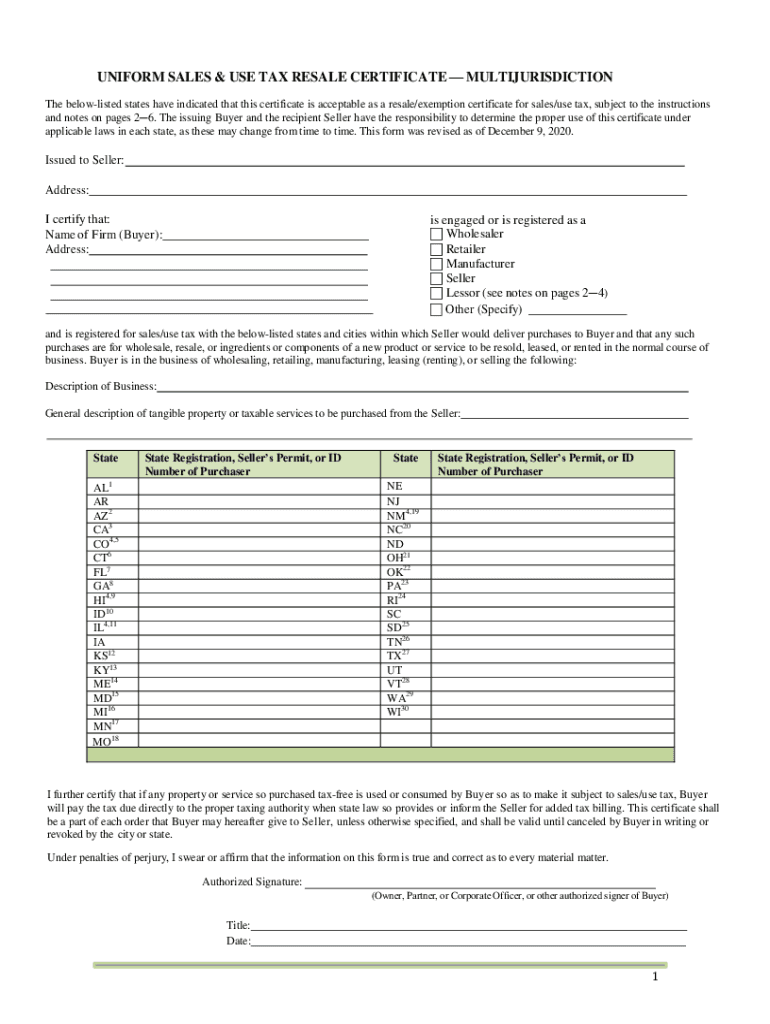

How To Get An Illinois Sales Tax Exemption Certificate Purchasers may either document their tax exempt purchases by completing Form CRT 61 Certificate of Resale or by making their own certificate A copy of the certificate must be provided to the retailer Certificates of Resale should be updated at least every three years For more information regarding valid Certificates of Resale

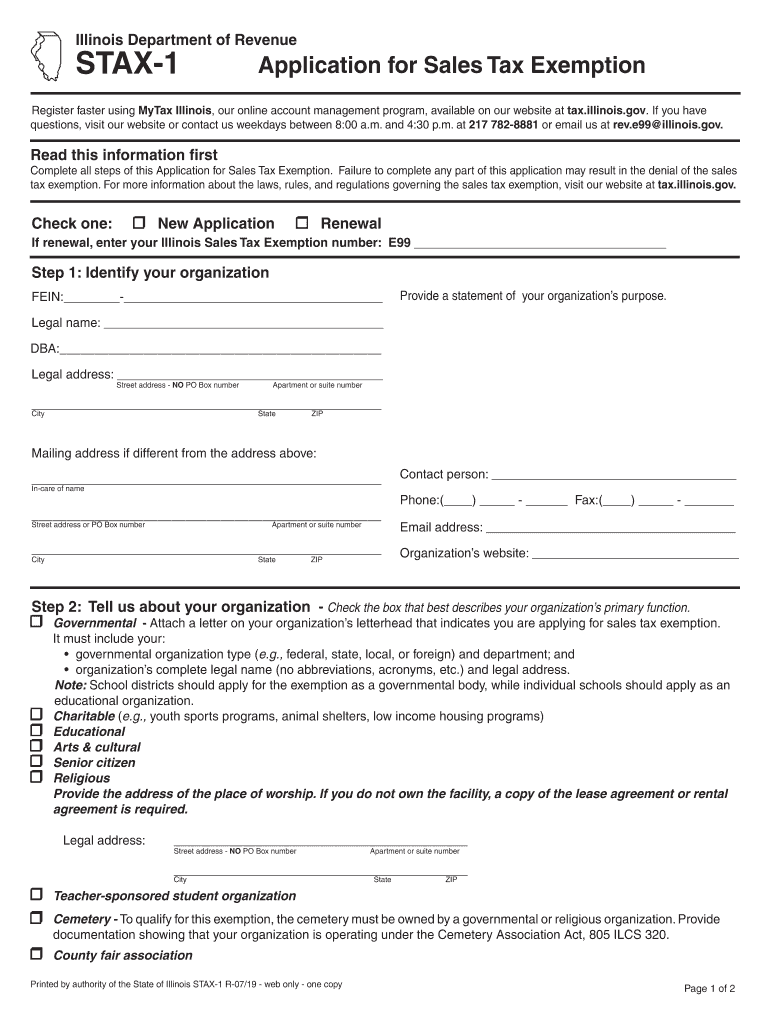

Complete all steps of this Application for Sales Tax Exemption Failure to complete any part of this application may result in the denial of the sales tax exemption For more information about the laws rules and regulations governing the sales tax exemption visit our website at tax illinois gov Check one New Application Renewal We have five Illinois sales tax exemption forms available for you to print or save as a PDF file If any of these links are broken or you can t find the form you need please let us know You can find resale certificates for other states here Contractor s Exemption Statement Download Now

How To Get An Illinois Sales Tax Exemption Certificate

How To Get An Illinois Sales Tax Exemption Certificate

https://rossum.ai/use-cases/img/illust/documents/sales_tax_exemption_certificate.png

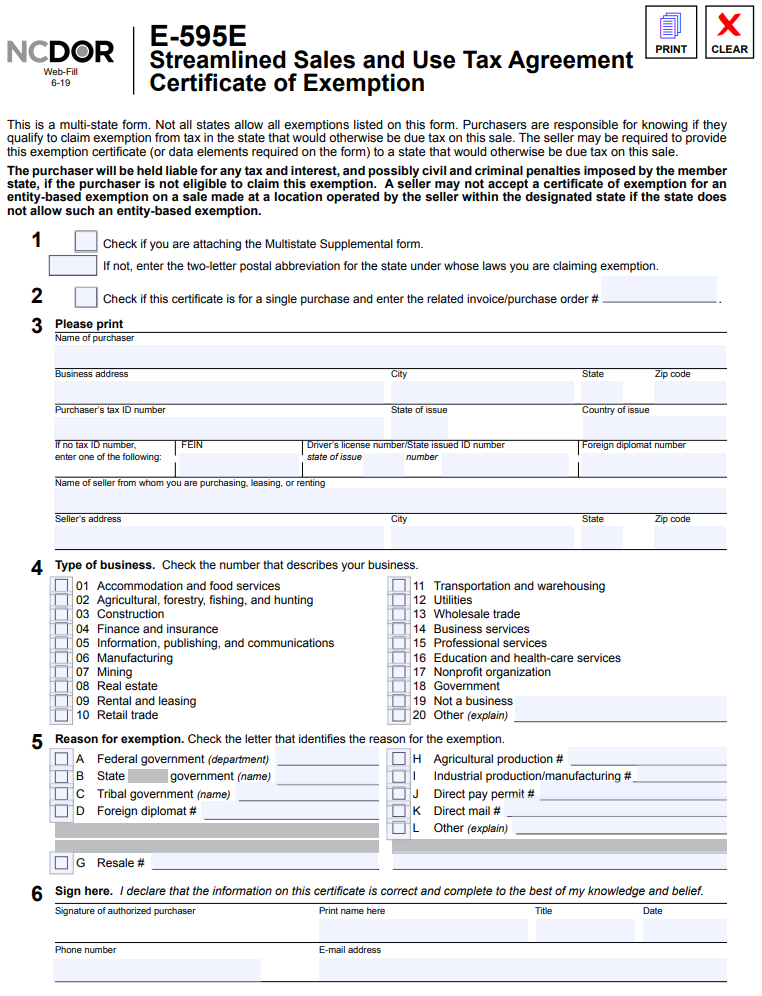

Sales Use Tax Exempt Form 2023 North Carolina ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/how-to-get-a-sales-tax-certificate-of-exemption-in-north-carolina-3.png

California Sales Tax 2020 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/541/304/541304812/large.png

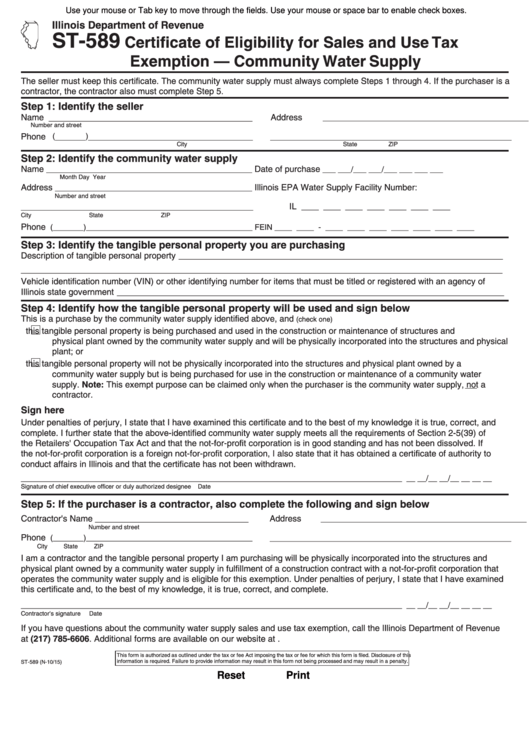

Illinois Use Tax Return ST 586 Annual Certification of No Solicitation ST 587 Exemption Certificate for Manufacturing Production Agriculture and Coal and Aggregate Mining ST 589 Certificate of Eligibility for Sales and Use Tax Exemption Community Water Supply ST 590 M Instructions Certificate of Eligibility for Military Organizations Qualified organizations as determined by the department are exempt from paying sales and use taxes on most purchases in Illinois Upon approval we issue each organization a sales tax exemption number The organization must give this number to a merchant in order to make certain purchases tax free

You must register with the Illinois Department of Revenue if you conduct business in Illinois or with Illinois customers This includes sole proprietors individual or husband wife civil union exempt organizations or government agencies withholding for Illinois employees To register your business you must Resale Exemption Certificate A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Illinois sales tax You can download a PDF of the Illinois Resale Exemption Certificate Form CRT 61 on this page

Download How To Get An Illinois Sales Tax Exemption Certificate

More picture related to How To Get An Illinois Sales Tax Exemption Certificate

Senior Exemption Certificate Fill Out And Sign Printable Pdf Template

https://www.signnow.com/preview/489/44/489044156/large.png

Certificate Of Exemption Tax Exemption Sales Taxes In The United States

https://imgv2-1-f.scribdassets.com/img/document/26404047/original/f7f9f667d9/1568237767?v=1

Printable Florida Sales Tax Exemption Certificates

http://www.salestaxhandbook.com/img/MTC_Thumbnail.jpg

Learn more about Certificate of Resale requirements for Illinois businesses IDOR Business Tax Account Summary View e Services available for businesses IDOR View information on Illinois sales tax requirements for retailers IDOR Sales Tax Web Filing File sales taxes online utlizing MyTax Illinois IDOR Steps for filling out the CRT 61 Illinois Certificate of Resale Step 1 Begin by downloading the Illinois Certificate of Resale Form CRT 61 Step 2 Identify the name and business address of the seller Step 3 Identify the name and business address of the buyer Step 4 Complete information about the buyer by selecting one of the

Illinois Department of Revenue ST 587 Exemption Certificate for Manufacturing Production Agriculture and Coal and Aggregate Mining Step 1 Identify the seller The seller must keep this certificate Name Some customers are exempt from paying sales tax under Illinois law Examples include government agencies some nonprofit organizations and merchants purchasing goods for resale Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/50/825/50825271/large.png

Virginia Sales Tax Exemption Form St 11 Fill Out And Sign Printable

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/virginia-sales-tax-exemption-form-st-11-fill-out-and-sign-printable-6.png

https://tax.illinois.gov/businesses/crtinfo.html

Purchasers may either document their tax exempt purchases by completing Form CRT 61 Certificate of Resale or by making their own certificate A copy of the certificate must be provided to the retailer Certificates of Resale should be updated at least every three years For more information regarding valid Certificates of Resale

https://tax.illinois.gov/content/dam/soi/en/web/...

Complete all steps of this Application for Sales Tax Exemption Failure to complete any part of this application may result in the denial of the sales tax exemption For more information about the laws rules and regulations governing the sales tax exemption visit our website at tax illinois gov Check one New Application Renewal

Sales Tax Exemption Certificate Illinois

Sales Tax Exempt Certificate Fill Online Printable Fillable Blank

Texas Sales Tax Exemption Certificate From The Texas Human Rights

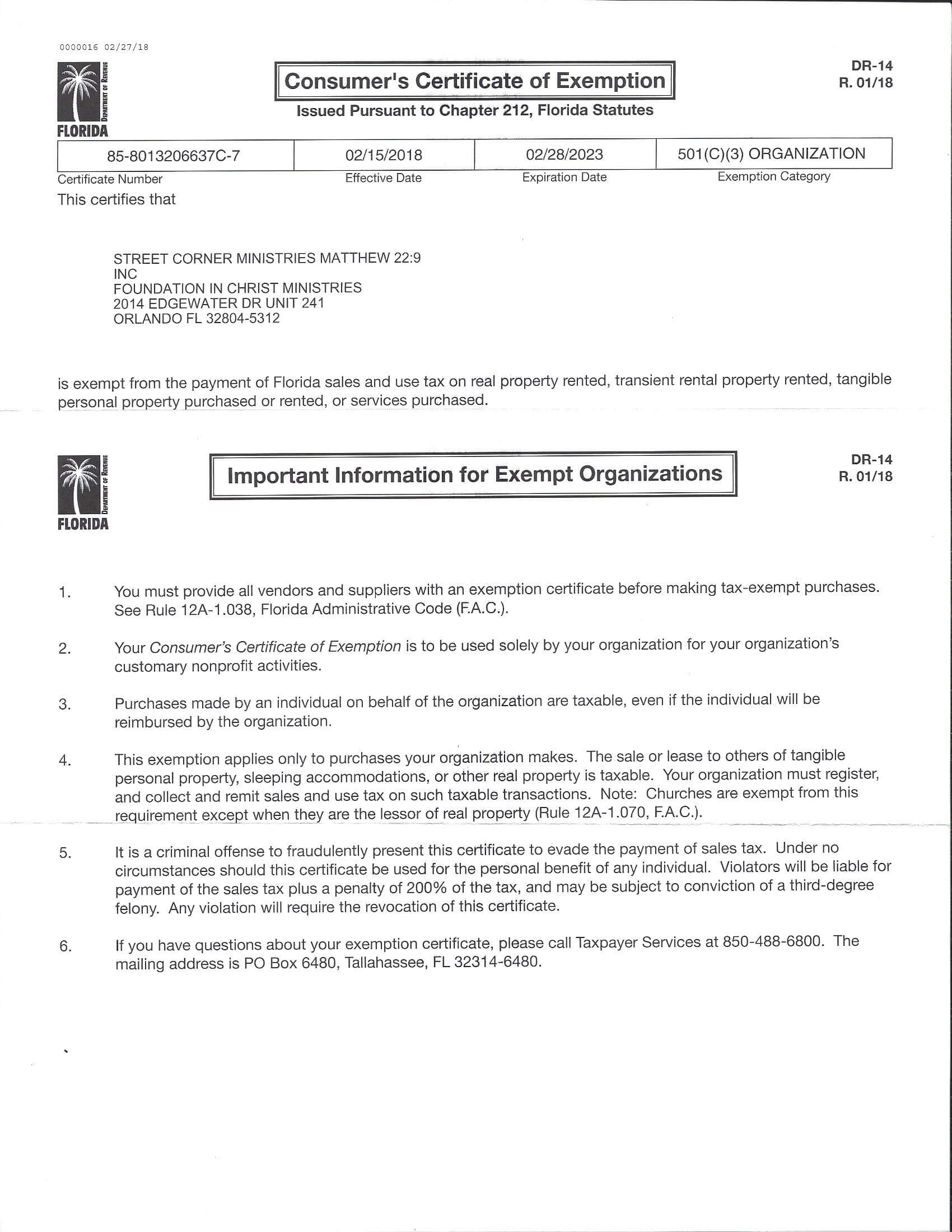

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

Fillable Illinois Department Of Revenue St 589 Certificate Of

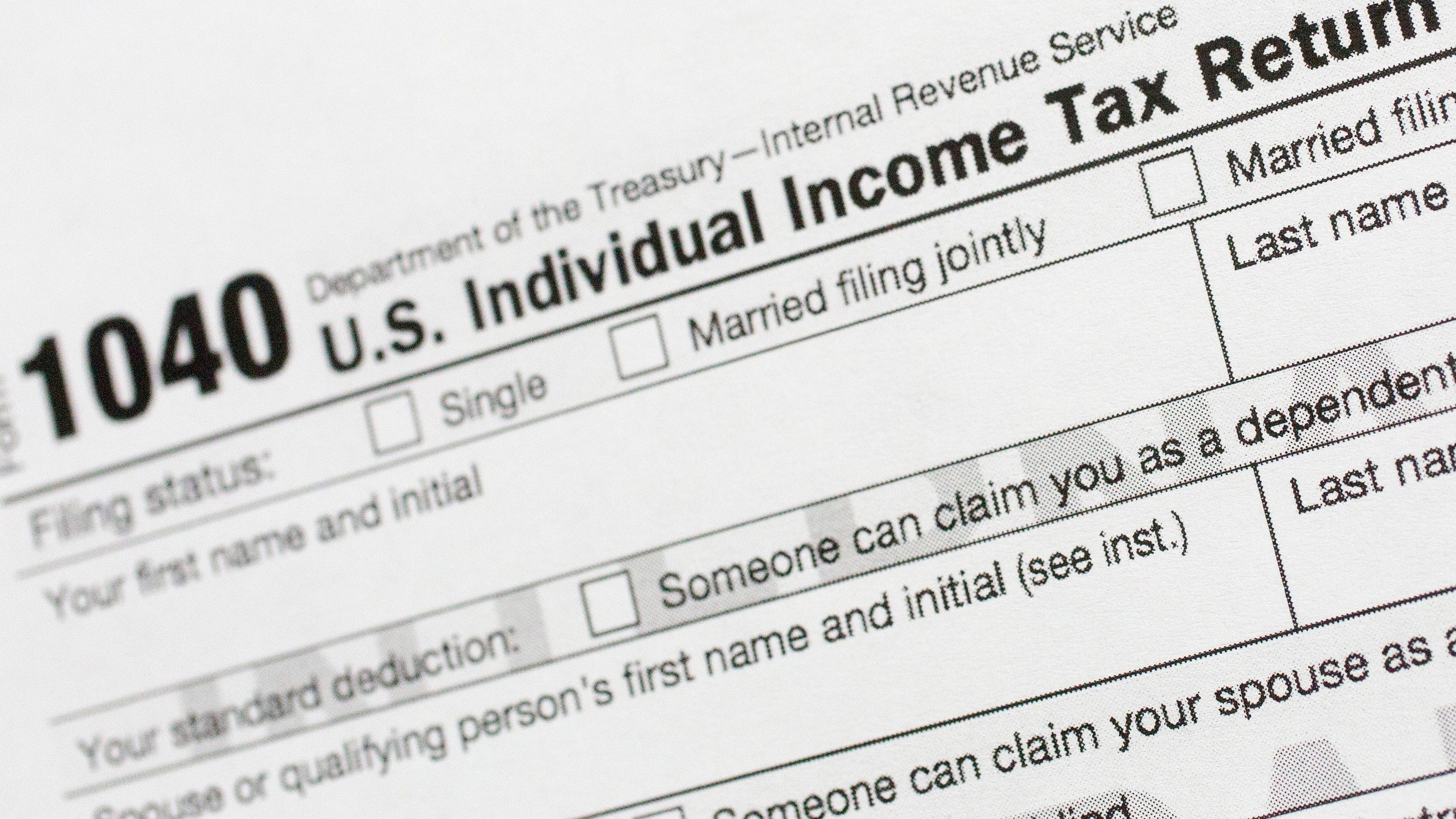

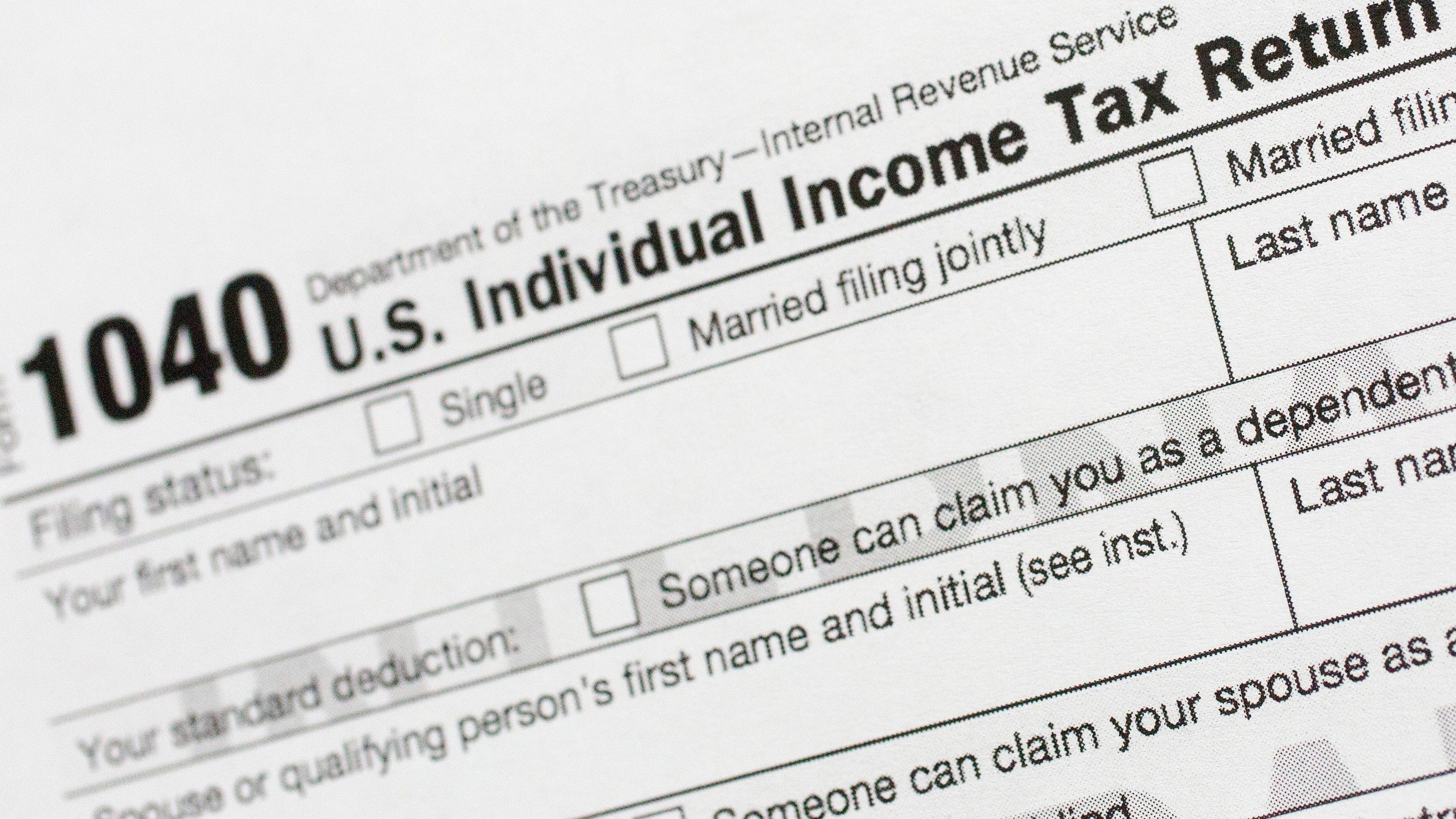

Tax Day NY How To File For A Tax Extension From The IRS New York

Tax Day NY How To File For A Tax Extension From The IRS New York

Illinois Tax Exempt Certificate Five Mile House

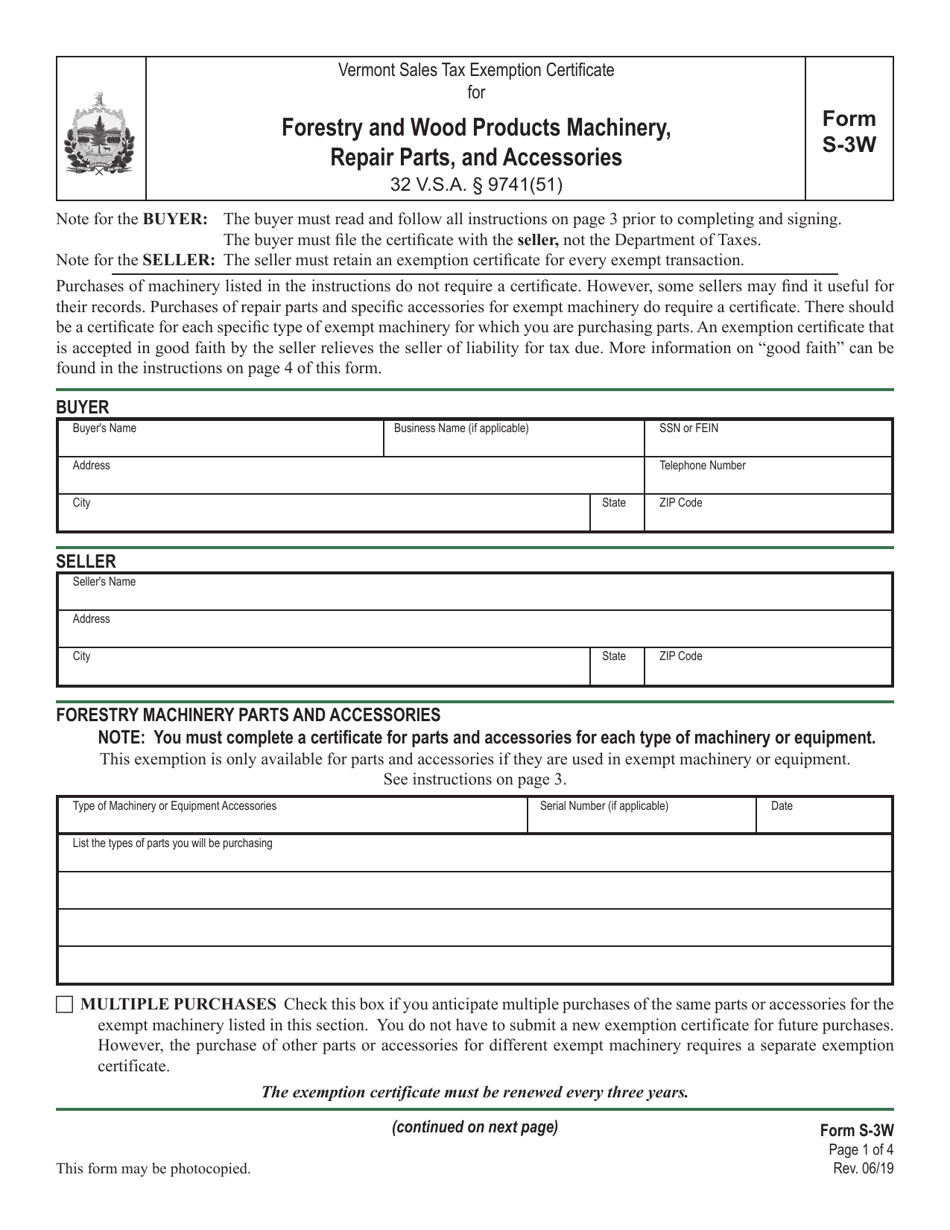

Form S 3W Fill Out Sign Online And Download Printable PDF Vermont

Tax Exemption Certificate Sachet Riset

How To Get An Illinois Sales Tax Exemption Certificate - Organizations Qualified organizations as determined by the department are exempt from paying sales and use taxes on most purchases in Illinois Upon approval we issue each organization a sales tax exemption number The organization must give this number to a merchant in order to make certain purchases tax free