How To Get Property Tax Rebate In Montana 2024 September 26 2023 The last day to claim the Montana Property Tax Rebate is Monday October 2 The Montana Department of Revenue is extending the deadline to claim the property tax rebate by one day to October 2 The original deadline in House Bill 222 was October 1 However October 1 is a Sunday

The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online The rebate provides Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 WHAT ARE THE QUALIFICATIONS To qualify for the property tax rebate you must have 3 Owned a Montana residence for at least seven months in 2022 3 Lived in that Montana residence for at least seven months in 2022

How To Get Property Tax Rebate In Montana 2024

How To Get Property Tax Rebate In Montana 2024

https://townsquare.media/site/990/files/2023/03/attachment-032923-MT-Tax-Rebate-.jpg?w=980&q=75

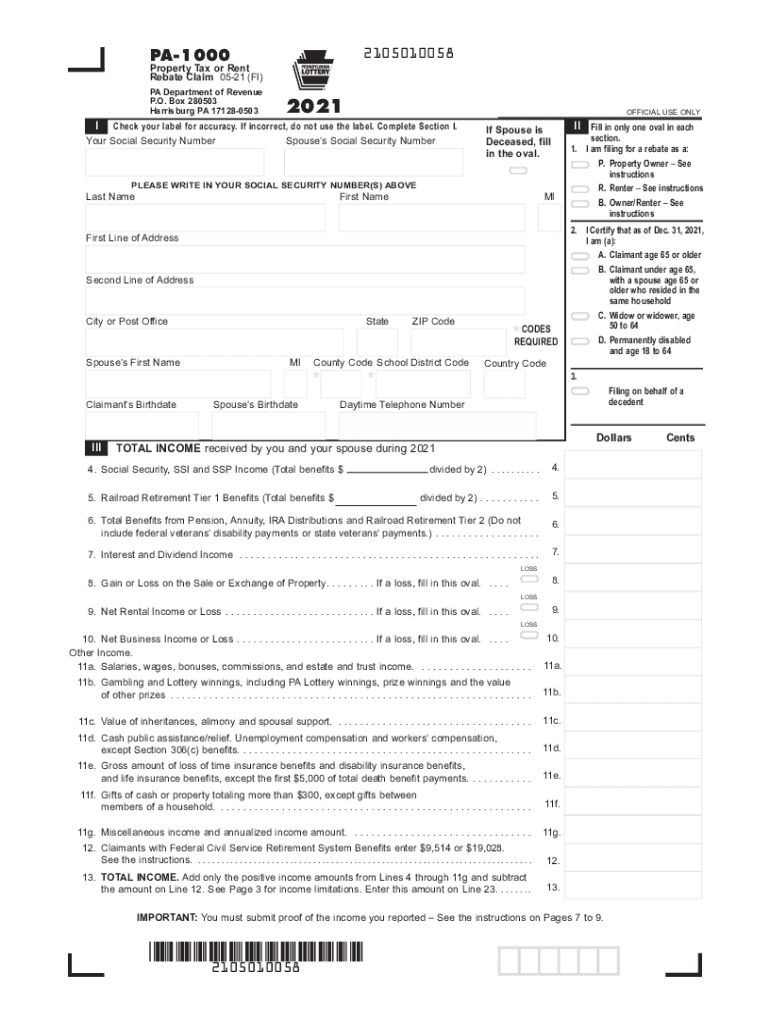

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

Individual Income Tax Rebate

https://custercountymt.gov/wp-content/uploads/2023/06/June-2023-Tax-Rebate.jpg

This spring the governor also delivered Montanans 120 million in permanent long term property tax relief and secured up to 1 350 in property tax rebates for Montana homeowners over the next two years Eligible Montana homeowners may now claim their first rebate up to 675 at getmyrebate mt gov The deadline for claims is October 1 2023 Montana homeowners will be eligible for a second property tax rebate up to 675 in 2024 for property taxes paid on a principal residence for 2023 Last November the governor proposed 2 000 in property tax rebates for Montana homeowners at their primary residence in his Budget for Montana Families

Montana property owners apply in TAP https tap dor mt govFind your geocode in Cadastral https cadastral mt govFAQs https mtrevenue gov PropertyTaxR WHAT DO I HAVE TO DO TO GET THE PROPERTY TAX REBATES These you have to apply for The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 2023 to Oct 1 2023

Download How To Get Property Tax Rebate In Montana 2024

More picture related to How To Get Property Tax Rebate In Montana 2024

Pennsylvanians Can Now File Property Tax Rent Rebate Program Applications Online Beaver County

https://s3.amazonaws.com/static.beavercountyradio.com/wp-content/uploads/2021/01/25060432/unnamed-7-1536x1024.jpg

Property Tax Rebate In Montana Sandra Johnson Realtor

https://bigskyliving.com/wp-content/uploads/2023/05/Property-Tax-Rebate-in-Montana.jpg

Here s How To Claim Your Montana Property Tax Rebate

https://townsquare.media/site/1107/files/2023/08/attachment-Tax-Rebate.jpg?w=980&q=75

Published August 17 2023 at 5 29 AM MDT Montana homeowners can now apply to claim up to 675 in property tax rebates Residents who owned and lived in their home for at least seven months in 2022 qualify The deadline to apply through the Montana Department of Revenue is Oct 1 The rebate application requires the home s physical address The application period for Montana s new property tax rebate is open The refund is for up to 675 of taxes paid on a principal residence for the 2022 tax year C

The department says taxpayers can apply for the 2022 property tax rebates through its online TransAction Portal or via a paper form during an application period that runs from Aug 15 to Oct 1 2023 A second application period for 2023 rebates will be open across the same dates in 2024 I don t remember how much I paid in 2021 state income taxes You can receive the rebate by direct deposit or a paper check Homeowners can apply online at getmyrebate mt gov or by submitting a paper form The agency says filing online is the fastest way to

Montana Homeowners Can Now Claim Property Tax Rebate

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1fj0J6.img?w=1280&h=720&m=4&q=40

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

https://mtrevenue.gov/last-call-to-claim-property-tax-relief/

September 26 2023 The last day to claim the Montana Property Tax Rebate is Monday October 2 The Montana Department of Revenue is extending the deadline to claim the property tax rebate by one day to October 2 The original deadline in House Bill 222 was October 1 However October 1 is a Sunday

https://mtrevenue.gov/all-montana-property-tax-rebates-will-be-sent-by-paper-check-tax-news-you-can-use/

The Montana Property Tax Rebate provides qualifying Montanans up to 675 of property tax relief on a primary residence in both 2023 and 2024 The qualifications to claim the rebate are at GetMyRebate mt gov The fastest way for taxpayers to apply for and get the rebate is by applying online

Unlocking Your 2022 Montana Tax Rebate A Step by Step Guide To Finding Your Property Geocode

Montana Homeowners Can Now Claim Property Tax Rebate

How Texans Could Get Property Tax Relief In Special Session Texas Scorecard

Income And Property Tax Relief Montana s 675 Rebate For 2023 Explained

Homeowner Renters District 16 Democrats

Property Tax Rebate Pennsylvania LatestRebate

Property Tax Rebate Pennsylvania LatestRebate

Montana Tax Rebate 2023 Benefits Eligibility How To Apply PrintableRebateForm

PA Property Tax Rebate What To Know Credit Karma

Montana Sends 260 Tax Rebate Checks To Minnesota Taxpayers Blogging Big Blue

How To Get Property Tax Rebate In Montana 2024 - Property Tax Rebate How To Apply Under HB222 eligible residents will get a property tax rebate of up to 500 a year on the property taxes paid on a principal residence for 2022