How To Get Tax Benefit On Under Construction Property Tax Benefits on under construction property The income tax law provides for the claim of interest paid during the pre construction period as a deduction in five

Under section 24 of the Income Tax Act pre construction interest can be claimed for under construction residential property However this can be claimed only You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only

How To Get Tax Benefit On Under Construction Property

How To Get Tax Benefit On Under Construction Property

https://img.staticmb.com/mbcontent/images/uploads/2023/1/under-construction-property-tax-benefit.jpg

How To Claim Tax Benefit On Home Loan For Under Construction Property

https://i.pinimg.com/originals/3b/e0/41/3be0412655e7c5c3531db9f96c835ab2.jpg

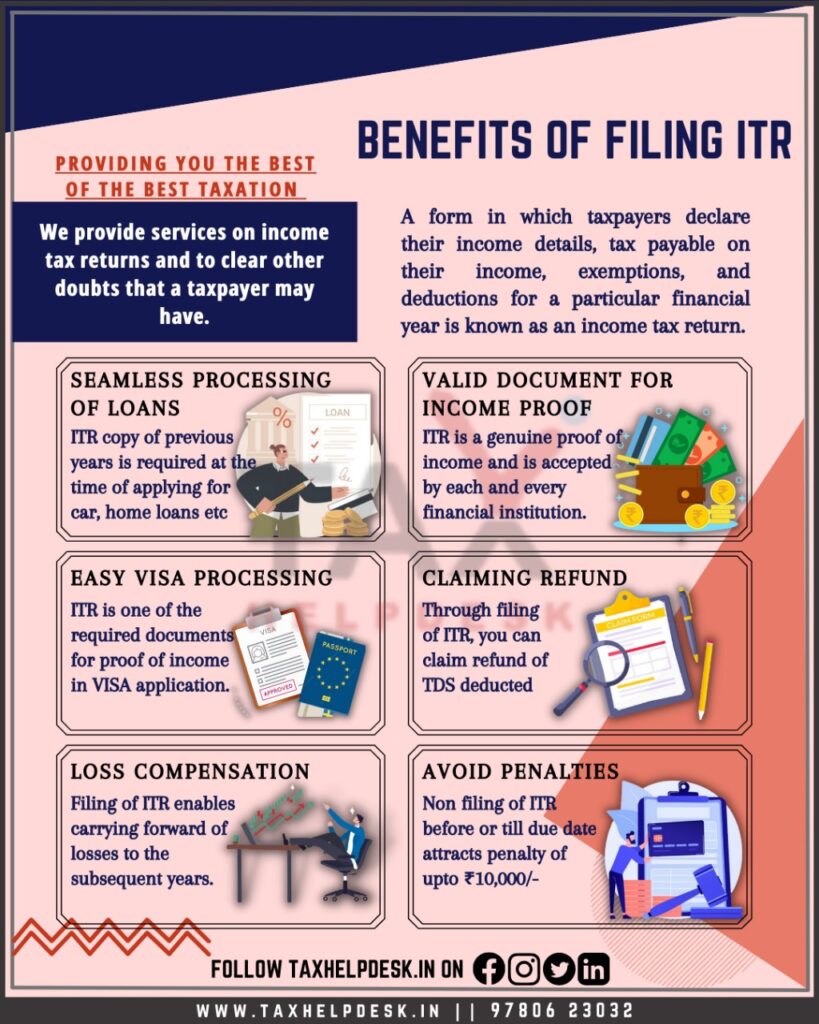

7 Reasons Why You File Your Income Tax Return In India TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/12/benefits-of-filing-income-tax-return-2-819x1024.jpeg

In this comprehensive guide we will delve into the specifics of Section 80EEA of the Income Tax Act and its applicability to under construction properties You can claim tax benefits on a Home Loan under construction property up to Rs 2 Lakh under Section 24B and up to 1 5 Lakh under Section 80C of the Income

Home Real Estate Under Construction House How to claim tax deduction on Home Loan Interest payments A home loan borrower can claim Income Tax exemption on interest payments of up to Short term capital gain from selling an under construction house is taxable at the applicable income tax slab rates The long term capital gains after claiming the

Download How To Get Tax Benefit On Under Construction Property

More picture related to How To Get Tax Benefit On Under Construction Property

How To Get Tax Benefits On A Personal Loan For Education

https://www.learnesl.net/wp-content/uploads/2023/02/Loan-Feature.jpg

How To Get Tax Benefit On Loan Against Property Tata Capital

https://www.tatacapital.com/blog/wp-content/uploads/2022/05/How-to-get-tax-benefit-on-loan-against-property.-768x399.jpg

GST On Under Construction Property 2023 Rates India s Leading

https://instafiling.com/wp-content/uploads/2022/12/New-GST-Rate-on-Property-Under-Construction-and-Completed-1024x565.png

Discover the crucial details about tax advantages associated with under construction home loans Learn how you can maximize tax benefits while financing your dream home If you took a Home Loan to buy an under construction property and are currently paying EMIs for the same Section 80C of the Income Tax Act allows you to claim deductions of

So without further adieu let s see how to claim a tax deduction on Home Loan Interest payments for Under Construction house Or how to claim income tax exemption on loans taken for under construction property Tax benefits are not available for an under construction property However any interest before completion of construction can be claimed in five equal

How Are Calculate VAT And Service Tax On Under Construction Property In

https://www.addressofchoice.com/aoc_assets/blog/1566554633_Calculate_Service_Tax_Vat_on_Under_construction_Property.jpg

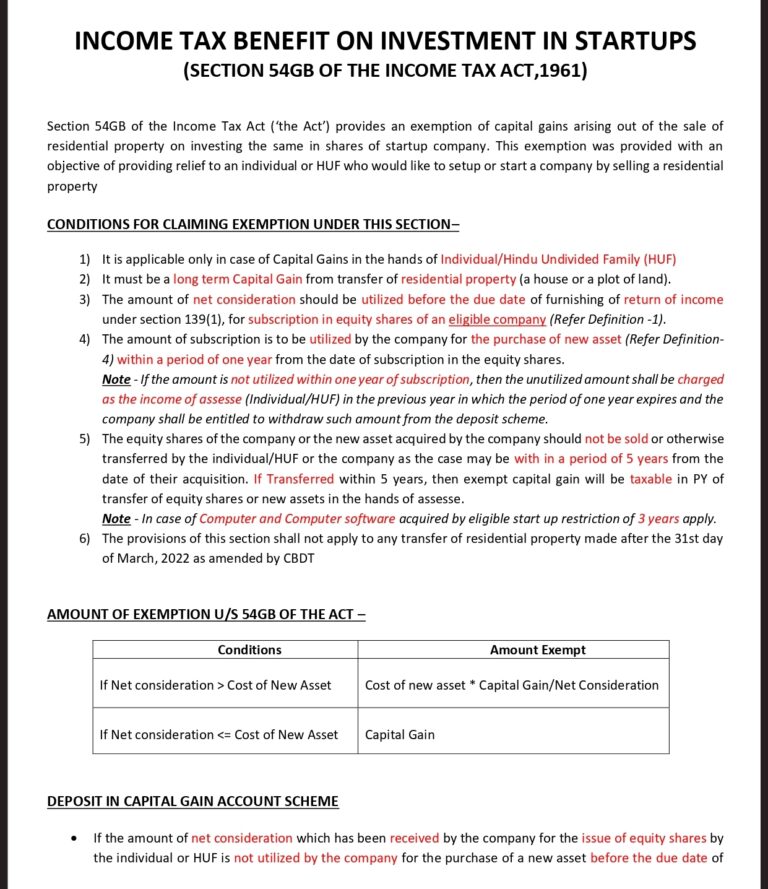

TAX BENEFIT ON INVESTMENT IN STARTUPS U S 54GB CA Rajput

https://carajput.com/blog/wp-content/uploads/2022/04/INCOME-TAX-BENEFIT-ON-INVESTMENT-IN-STARTUPS-Section-54GB-1-768x889.jpg

https://www.youtube.com/watch?v=93E4OKTOUhs

Tax Benefits on under construction property The income tax law provides for the claim of interest paid during the pre construction period as a deduction in five

https://cleartax.in/s/case-study-deduction-for-pre-construction-interest

Under section 24 of the Income Tax Act pre construction interest can be claimed for under construction residential property However this can be claimed only

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

How Are Calculate VAT And Service Tax On Under Construction Property In

Income Tax Benefits On Housing Loan In India

What Are The Tax Benefit On Home Loan FY 2020 2021

Income Tax Benefits On Home Loan Loanfasttrack

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank

Income Tax Benefit On Home Loan Repayment IDFC FIRST Bank

How To Claim Tax Benefit On Home Loan For Under Construction Property

Handling Tax Audits And Disputes In Nigeria Vi M Professional Solutions

Tax Accounting Clients On Demand Build A Multiple 6 Figure Tax

How To Get Tax Benefit On Under Construction Property - In this comprehensive guide we will delve into the specifics of Section 80EEA of the Income Tax Act and its applicability to under construction properties