How To Get Tax Deductions For Donations Verkko 5 tammik 2024 nbsp 0183 32 How tax deductible donations work 1 Donate to a qualifying organization Your charitable giving will qualify for a tax deduction only if it goes to a tax exempt organization as defined

Verkko 2 tammik 2024 nbsp 0183 32 A Look at the Rules Deductions for charitable donations generally cannot exceed 60 of your adjusted gross income AGI though in some cases limits of 20 30 or 50 may apply In order to Verkko 5 p 228 iv 228 228 sitten nbsp 0183 32 Taxes Charitable Donations Charitable Contribution Deduction Tax Years 2023 and 2024 How to use your donations to save on taxes By Michelle P Scott Updated January 08 2024

How To Get Tax Deductions For Donations

How To Get Tax Deductions For Donations

http://www.wikihow.com/images/5/53/Get-Tax-Deductions-on-Goodwill-Donations-Step-10.jpg

Tips On Tax Deductions For Donations

http://bargainbabe.com/wp-content/uploads/2014/02/taxable_donations.jpg

How To Maximize Your Charity Tax Deductible Donation WealthFit

https://wealthfit-staging.cdn.prismic.io/wealthfit-staging/412c54c56299372c10093120ad811293a9e703bd_02-maximize-charitable-deductions.jpg

Verkko 1 jouluk 2022 nbsp 0183 32 You can claim a deduction for charitable giving on Schedule A You ll add up your contributions plus any other itemized deductions then enter the total on Form 1040 You can t itemize and claim the standard deduction at the same time The schedule isn t just for claiming charitable donations Verkko 20 marrask 2020 nbsp 0183 32 To qualify for the deduction the donation must be made in cash paying by check or credit card is OK stock volunteer hours or donated goods don t qualify And the donation must be made to

Verkko 15 jouluk 2023 nbsp 0183 32 With a donor advised fund you make one large contribution to the fund cash or assets and deduct the entire amount as an itemized deduction in the year you make it Money from the fund is Verkko 16 jouluk 2021 nbsp 0183 32 For tax year 2021 you can potentially donate 100 of your income to charity and receive a full tax deduction for 100 of your donation This is assuming you itemize your tax deductions in 2021

Download How To Get Tax Deductions For Donations

More picture related to How To Get Tax Deductions For Donations

How To Maximize Your Charity Tax Deductible Donation WealthFit

https://images.prismic.io/wealthfit-staging/5a24d2af02c0d250c371601bf4063747e9901677_03-maximize-charitable-deductions.jpg?auto=compress,format&w=1772

How To Get Tax Deductions On Goodwill Donations 15 Steps

http://www.wikihow.com/images/c/c8/Get-Tax-Deductions-on-Goodwill-Donations-Step-15-Version-2.jpg

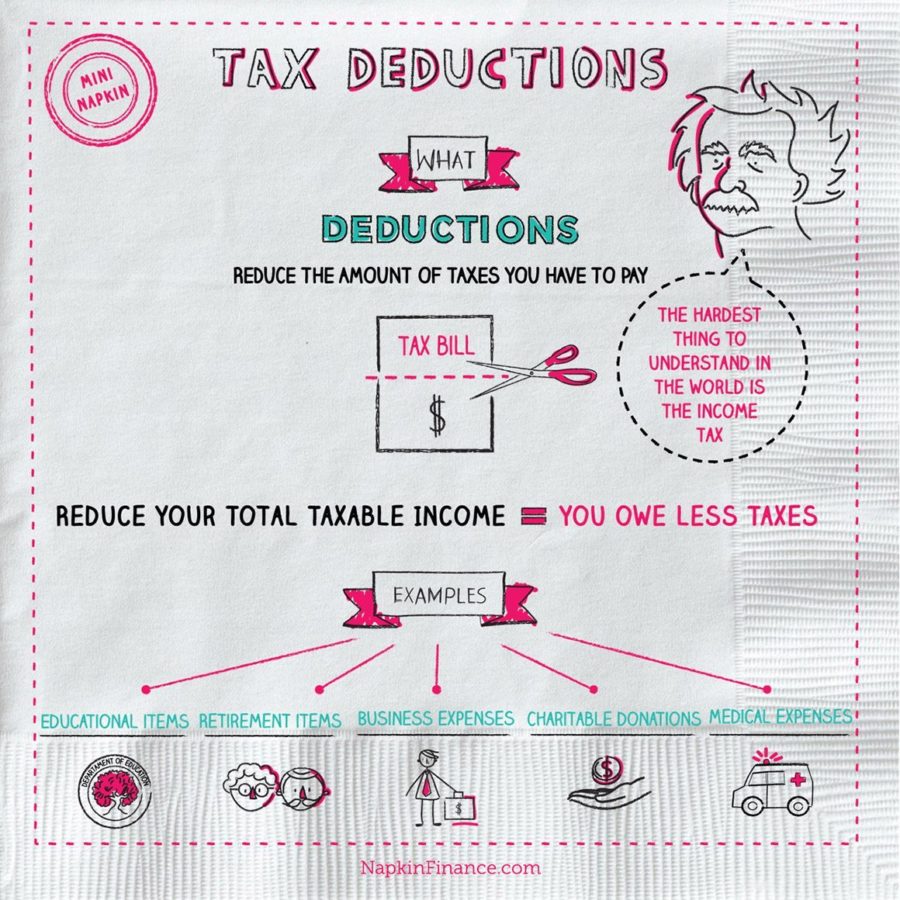

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Verkko 1 p 228 iv 228 sitten nbsp 0183 32 Typically the most you can write off for donations is 60 percent of your adjusted gross income AGI But tighter restrictions can apply for some donations and you may face a limit of 20 percent Verkko 12 huhtik 2023 nbsp 0183 32 How Do Tax Deductible Donations Work Certain donations are tax deductible and can reduce your taxable income The deduction amount you can claim for charitable contributions is based on your adjusted gross income AGI though some contributions aren t subject to the limit which means you can deduct up to 100 of

Verkko 22 syysk 2021 nbsp 0183 32 Charitable contributions can lower your taxable income as well as your tax bill To get the full benefit however your donations to charity and other itemized tax deductions must Verkko 5 jouluk 2023 nbsp 0183 32 In most cases the amount of charitable cash contributions taxpayers can deduct on Schedule A as an itemized deduction is limited to a percentage usually 60 percent of the taxpayer s adjusted gross income AGI Qualified contributions are not subject to this limitation

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Business

https://i.pinimg.com/originals/b9/4f/08/b94f08851ce71939ba13414fa7a2854b.png

5 Tax Deductions Small Business Owners Need To Know

https://www.workinghomeguide.com/wp-content/uploads/2017/12/tax-deductions.jpeg

https://www.nerdwallet.com/article/taxes/tax-deductible-donations-charity

Verkko 5 tammik 2024 nbsp 0183 32 How tax deductible donations work 1 Donate to a qualifying organization Your charitable giving will qualify for a tax deduction only if it goes to a tax exempt organization as defined

https://www.investopedia.com/financial-edge/0411/donations-how-to...

Verkko 2 tammik 2024 nbsp 0183 32 A Look at the Rules Deductions for charitable donations generally cannot exceed 60 of your adjusted gross income AGI though in some cases limits of 20 30 or 50 may apply In order to

How Do Tax Deductions Work

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Business

Tax Deductions For Small Business How To Claim Tax Deductions

Charitable Contributions And How To Handle The Tax Deductions

Teacher Tax Deductions Teacher Organization Teaching

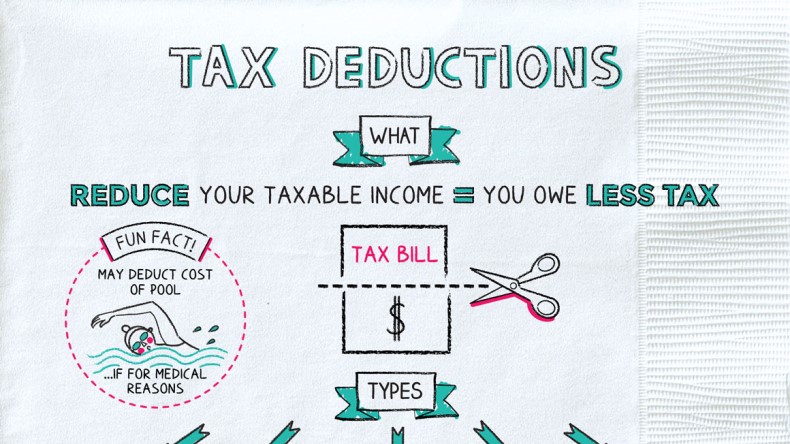

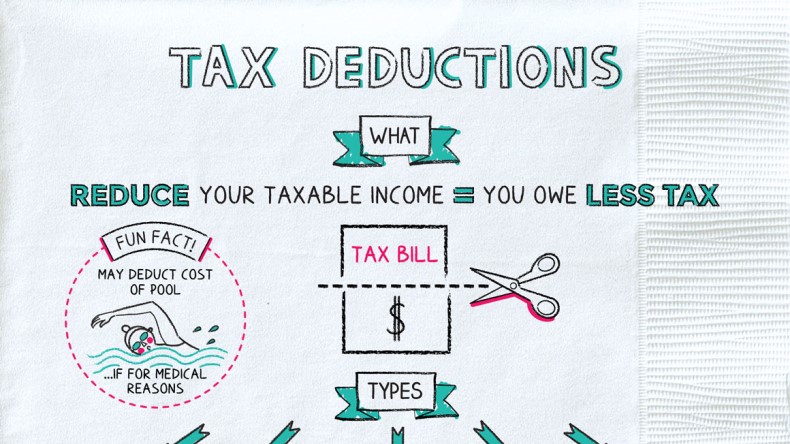

What Are Tax Deductions Napkin Finance

What Are Tax Deductions Napkin Finance

Top 20 Tax Deductions For Small Business

Printable List Of Tax Deductions Form Fill Out And Sign Printable PDF

5 Itemized Tax Deduction Worksheet Worksheeto

How To Get Tax Deductions For Donations - Verkko 28 lokak 2022 nbsp 0183 32 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State