How To Get Tax Rebate Of 12500 Every Resident individuals with Total Income upto 5 00 000 is eligible for Rebate of Rs 12500 With a view to provide tax relief to the individual tax payers who

The income tax rebate will be up to Rs 12 500 on the total tax liability before adding the health and education cess of 4 New Tax Regime With effect from the FY 2023 24 a taxpayer can claim a tax Eligible candidates can claim a tax rebate of up to 12 500 or the total tax payable in an assessment year or whichever is lower before adding cess If you are curious to know

How To Get Tax Rebate Of 12500

How To Get Tax Rebate Of 12500

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

More Than 30 000 Homes Get Council Tax Rebate In West Berkshire

https://www.newburytoday.co.uk/_media/img/XWR3OS658K3AP70S77XD.jpg

Income Tax Rebate Under Section 87A Legalraasta

https://www.legalraasta.com/blog/wp-content/uploads/2021/08/Income-tax-rebate-tax-deduction-and-exemption-scaled.jpg

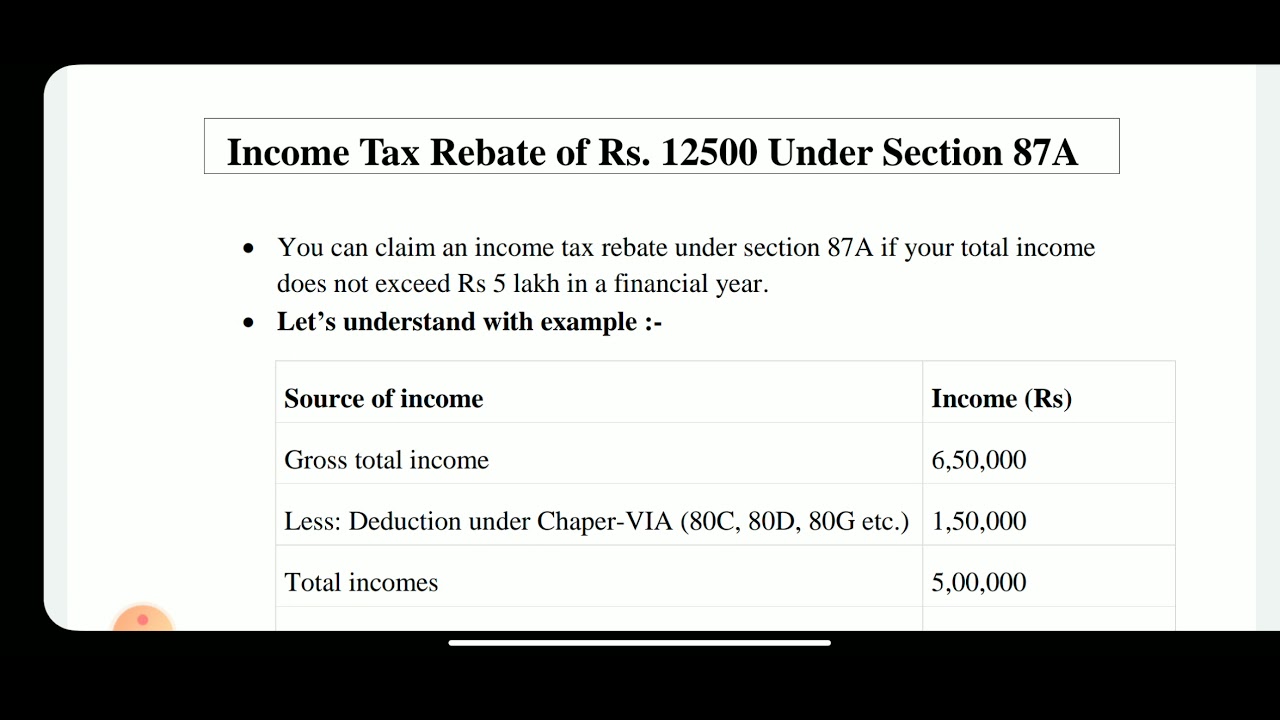

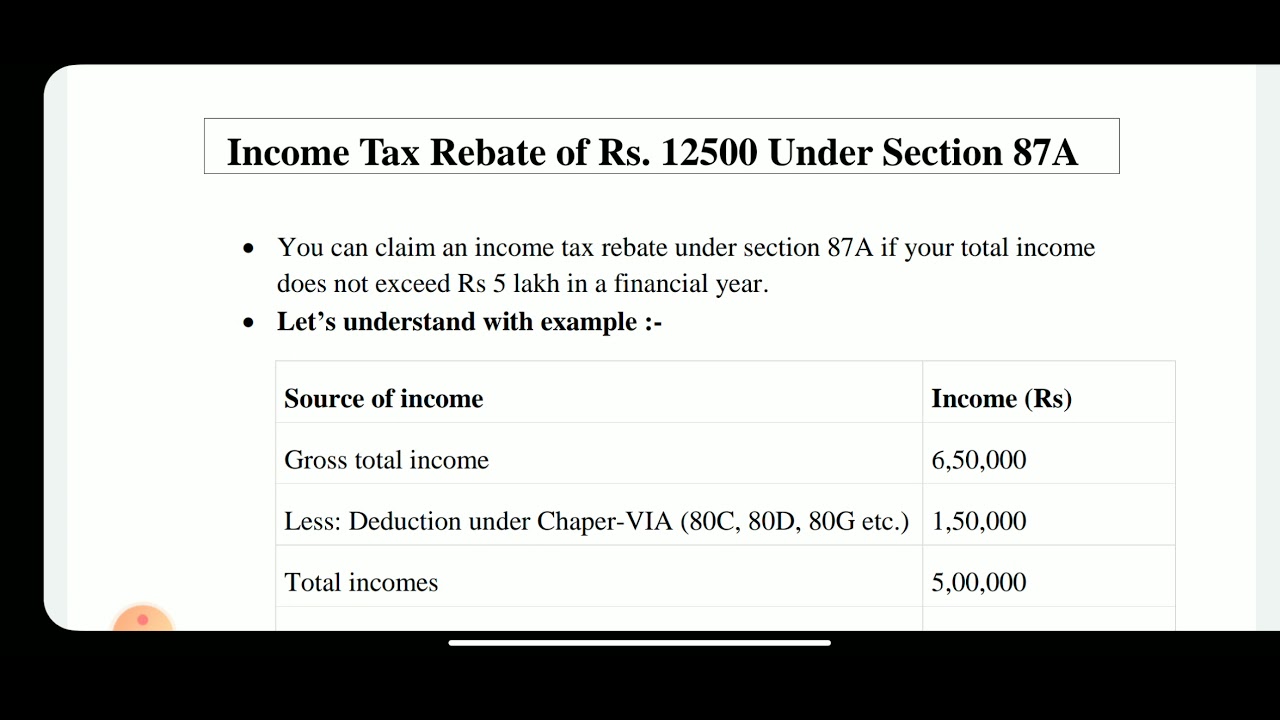

Presently an individual tax payer who is resident of India for income tax purpose is entitled to claim tax rebate up to Rs 12 500 against his tax liability if your income does not exceed 5 Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their taxable income does not exceed Rs 5 lakh in a financial year

The maximum tax rebate amount is 12 500 To claim the rebate you need to file income tax returns You can check your income tax refund status through different online portals How is Section 87a rebate calculated Any resident individual having total income not exceeding 500000 shall get a tax relief upto 12500 i e the rebate would

Download How To Get Tax Rebate Of 12500

More picture related to How To Get Tax Rebate Of 12500

How To Get Tax Rebate In Singapore Asia Travel Blog

https://asiamarvels.com/wp-content/uploads/2016/08/How-to-get-Tax-Rebate-in-Singapore_1.jpg

Owners Of Scrapped Vehicles To Get Tax Rebate In Punjab

https://www.thestatesman.com/wp-content/uploads/2023/01/bg.jpg

Can You Get Tax Rebate Mint

https://images.livemint.com/img/2019/02/05/600x338/taxbenefitspic_1549361416230.jpg

How to Claim Tax Rebate under Section 87A As per Income Tax Section 87A you can claim a rebate of 12 500 on your tax liability Here are the steps involved to claim this An individual whose total annual income is less than or equal to Rs5 lakh and whose total tax payable is over Rs2 000 is eligible to claim tax rebate under Section 87A This can

The rebate u s 87A is claimed by filing the tax return The fact that your total income exceeds the minimum threshold of Rs 2 50 000 you are liable to file a tax While filing your income tax return if your taxable income is less than Rs 5 00 000 after incorporating all the applicable deductions and exemptions you can

Rebate Under Section 87A Of Rs 12 500 Under Income Tax Important

https://i.ytimg.com/vi/ByPTqQHFkp4/maxresdefault.jpg

Income Tax Act 87A Rebate Of Resident Individual Income Upto 5 Lakh

https://i.ytimg.com/vi/osZhd7aceEk/maxresdefault.jpg

https://taxguru.in/income-tax/tax-relief-rs-2000...

Every Resident individuals with Total Income upto 5 00 000 is eligible for Rebate of Rs 12500 With a view to provide tax relief to the individual tax payers who

https://scripbox.com/tax/tax-rebate

The income tax rebate will be up to Rs 12 500 on the total tax liability before adding the health and education cess of 4 New Tax Regime With effect from the FY 2023 24 a taxpayer can claim a tax

Know In Detail How To Get Tax Rebate On Purchase And Sale Of Property

Rebate Under Section 87A Of Rs 12 500 Under Income Tax Important

How To Get Tax Rebate In Income Tax

IRS Struggles To Get Tax Refunds To Nearly 500 000 Victims Of ID Theft

How To Apply For A Rent Rebate Your Ultimate Guide Rent Rebates

Tax Rebate For Small And Medium Enterprise Battchoo Yong

Tax Rebate For Small And Medium Enterprise Battchoo Yong

Window To Enjoy Tax Reliefs Closing CN Advisory

Property Tax Rebate Checks Are Coming Here s How Much Money You re Due

Tax Rebate Calculations

How To Get Tax Rebate Of 12500 - Claim tax rebate under Section 87A only when the income does not exceed 5 lakhs The maximum rebate under section 87A for AY 2024 25 FY 2023 24 is 25 000 under the