How To Get Tax Refund In Singapore Checking for Tax Credits and Unclaimed Monies Modes of Tax refunds From April 2023 IRAS will be introducing PayNow as an additional refund mode for Property Tax If you are not on GIRO simply register and link your NRIC FIN to your personal bank account to receive your refund via PayNow

To be eligible for GST refund you must be a tourist You have to meet the following criteria You are 16 years of age or above on the date of the purchase You are not a citizen or a permanent resident of Singapore You are not a member of the crew of an aircraft on which you are departing Singapore and The scheme allows tourists to claim a refund of the Goods and Services Tax GST paid on goods purchased from participating retailers if the goods are brought out of Singapore via Changi International Airport or Seletar Airport

How To Get Tax Refund In Singapore

How To Get Tax Refund In Singapore

https://i.ytimg.com/vi/hv0iV3AsN44/maxresdefault.jpg

UK TAX Refund How To Get TAX REFUND In UK Very

https://i.ytimg.com/vi/5c_c7TNP7ek/maxresdefault.jpg

How To Get Tax Refund In Japan YouTube

https://i.ytimg.com/vi/gjTZoxnlgJs/maxresdefault.jpg

REFUND At the eTRS self help kiosk you may choose your preferred refund option If you choose cash refund please proceed to the GST Cash Refund Counter located in the Departure Transit Lounge area after immigration You are required to present your passport at the GST Cash Refund counter To be eligible for GST refund under the eTRS you must meet the following criteria You are 16 years of age or above on the date of the purchase You are not a citizen or a permanent resident of Singapore

As a tourist in Singapore you can claim the Goods and Services Tax GST paid on your purchases at participating retail shops when you depart Singapore with your purchases via Changi International Airport or Seletar Airport This GST refund process is known as the electronic Tourist Refund Scheme eTRS How to Get your Tax Refund In order to get your tax refund simply apply for GST refund before departing from the airport or international cruise centre the Marina Bay Cruise Centre Singapore MBCCS and the International Passenger

Download How To Get Tax Refund In Singapore

More picture related to How To Get Tax Refund In Singapore

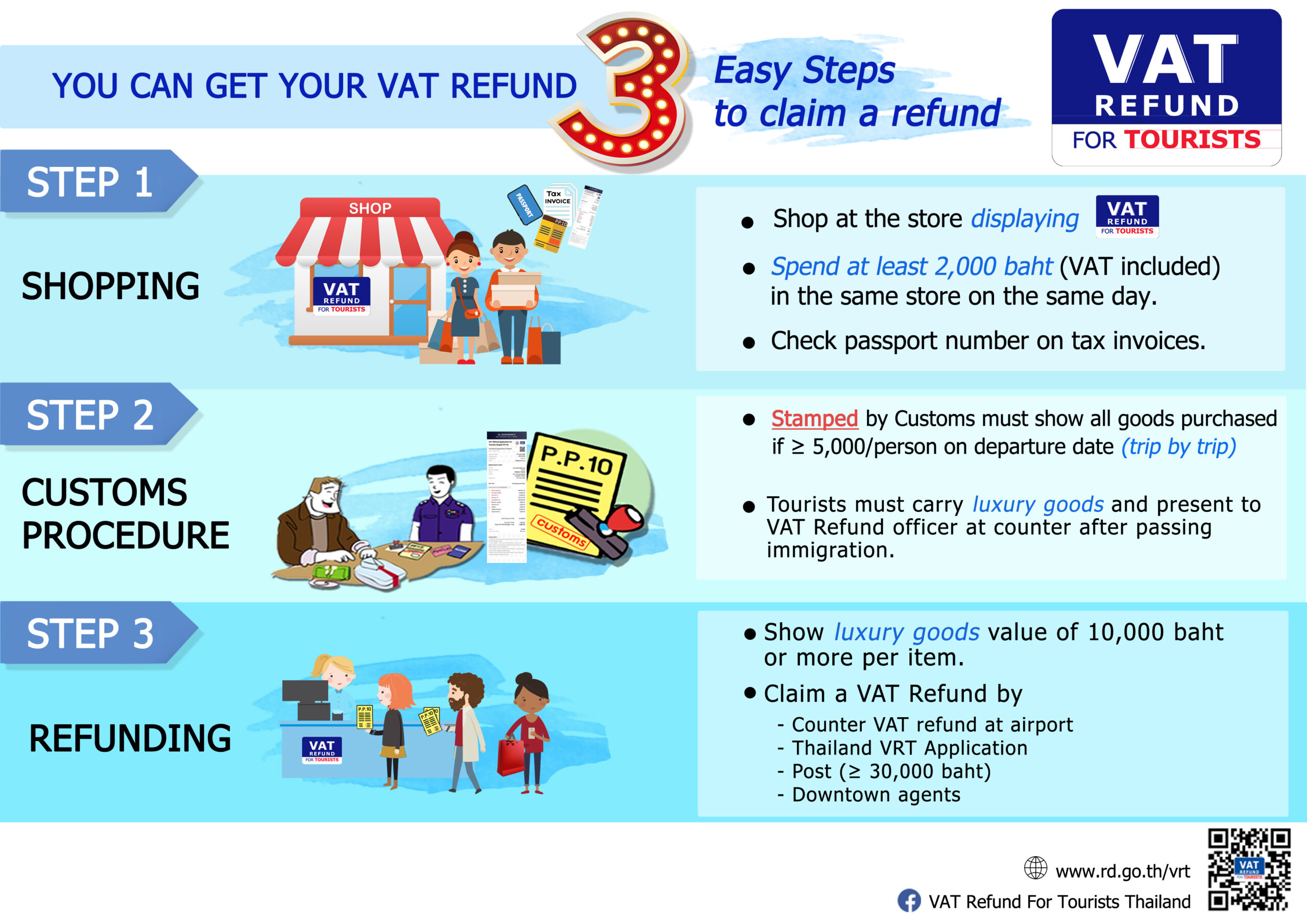

Vat Tax Refund Tourism Authority Of Thailand Singapore Office

https://tourismthailand.sg/wp-content/uploads/3easysteps_Page_1-scaled.jpg

How To Apply For A Tax Refund Theatrecouple12

https://redbus2us.com/wp-content/uploads/2019/02/US-CBP-Tax-Refund-Clarification-US-Govt-does-not-refund-tax.png

3 Reasons You Shouldn t Receive A Tax Refund Next Year

https://s.yimg.com/ny/api/res/1.2/JIoLoNr_QJe3C1icuE0MAg--/YXBwaWQ9aGlnaGxhbmRlcjt3PTY0MDtoPTM2MA--/https://media.zenfs.com/en/gobankingrates_644/b7a1d2b2c529af141deffd558b1cb65b

Check Status Make Appointment Tourist Refund Scheme The Tourist Refund Scheme TRS is for tourists who wish to claim a refund of the Goods and Services Tax GST paid on their purchases For more information on the TRS and procedures please visit the Singapore Customs website 9 Steps to Obtain Tourist Refund when Departing from Singapore at the Airport 9 1 If you have bulky goods or goods to be checked in please apply for your GST refund at the designated GST refund area in the Departure Check in Hall before Departure immigration before you check in your purchases

Refunds Generally tax credits of at least 15 are automatically refunded Tax refunds made via PayNow receiving GST and Corporate Tax refunds and GIRO will be received within 7 days from the date of the tax credit arises IRAS will pay interest on tax refunds made after 30 days from the date the tax credit arises unless it is a situation If there is any overpayment or wrong payment of duties or Goods and Services Tax GST you can make a claim for refund by writing to Singapore Customs for our assessment Within 5 years from the date of payment of duty Within 5 years from the date of payment of GST Common reasons for refund include Double declaration Double payment

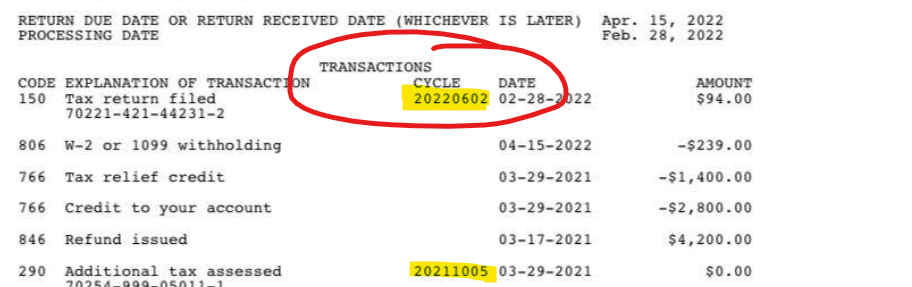

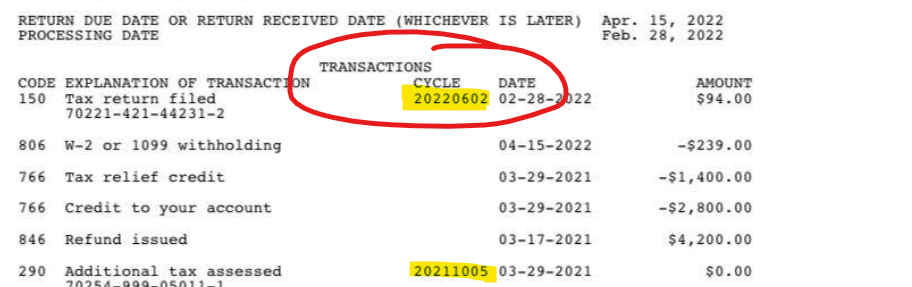

2022 IRS Cycle Code Using Your Free IRS Transcript To Get Tax Return

https://savingtoinvest.com/wp-content/uploads/2022/02/image-2.png?is-pending-load=1

How To Get Tax Refund In Nigeria

https://media.licdn.com/dms/image/C4D12AQFm5CmoU2GrZQ/article-cover_image-shrink_600_2000/0/1571665412967?e=2147483647&v=beta&t=MynyGZ5PnronJT8aP9uARynMyAgYLRl6KC64IV_RNeU

https://www.iras.gov.sg/quick-links/refunds

Checking for Tax Credits and Unclaimed Monies Modes of Tax refunds From April 2023 IRAS will be introducing PayNow as an additional refund mode for Property Tax If you are not on GIRO simply register and link your NRIC FIN to your personal bank account to receive your refund via PayNow

https://www.iras.gov.sg/taxes/goods-services-tax...

To be eligible for GST refund you must be a tourist You have to meet the following criteria You are 16 years of age or above on the date of the purchase You are not a citizen or a permanent resident of Singapore You are not a member of the crew of an aircraft on which you are departing Singapore and

How Long To Get Colorado Tax Refund Coots Nathan

2022 IRS Cycle Code Using Your Free IRS Transcript To Get Tax Return

IRS Refund Schedule When To Expect Your Tax Refund

2022 Tax Refund Schedule Chart Caf Group 2024 Calendar Printable

How To Apply For A Tax Refund Theatrecouple12

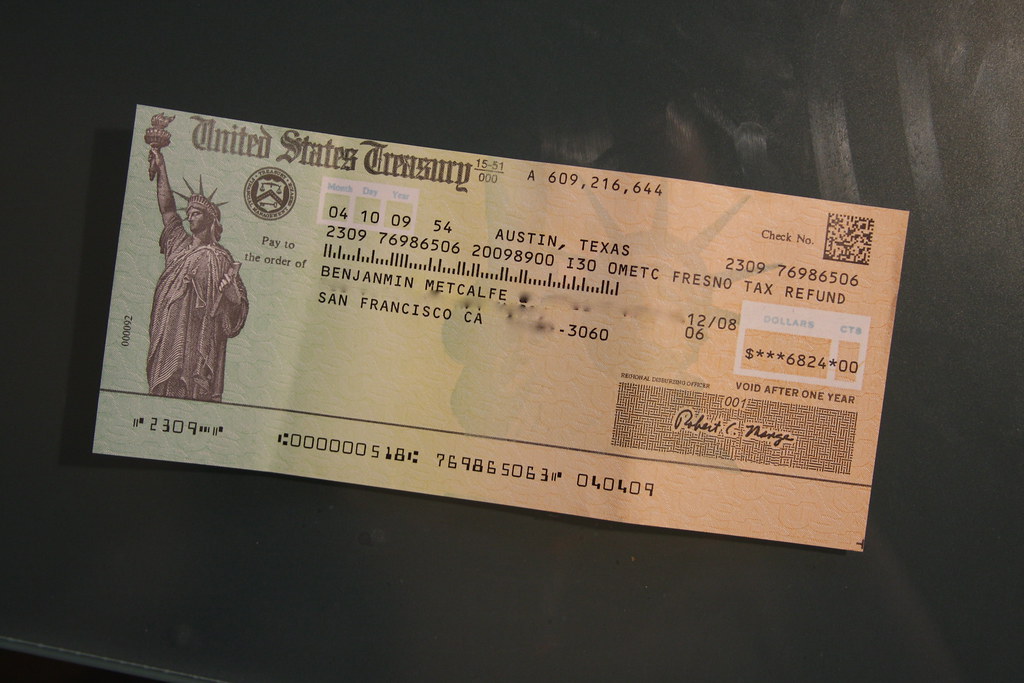

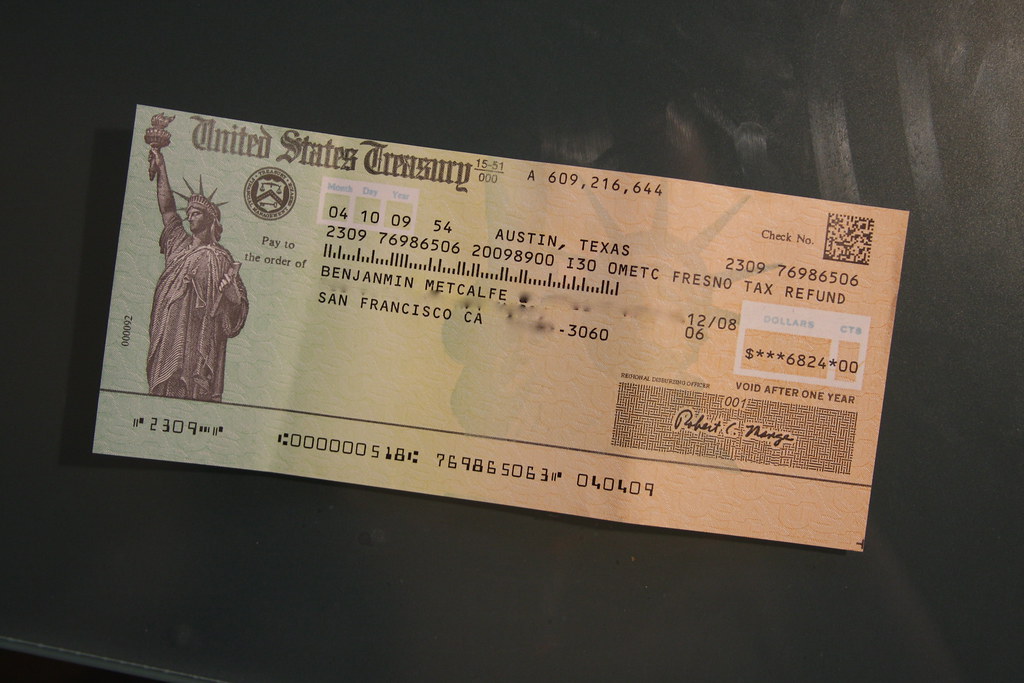

Tax Refund Check Wow The US Treasury Opened Up It s Vice Flickr

Tax Refund Check Wow The US Treasury Opened Up It s Vice Flickr

How To Compute Income Tax Refund In The Philippines A Definitive Guide

How To Get Tax Refund In Japan MacRumors Forums

How To Get Tax Refund In Gare Du Nord In Paris France Eurostar

How To Get Tax Refund In Singapore - How to Get your Tax Refund In order to get your tax refund simply apply for GST refund before departing from the airport or international cruise centre the Marina Bay Cruise Centre Singapore MBCCS and the International Passenger