How To Get Vat Refund In Switzerland Obtain a VAT refund After getting your export documents stamped head to a tax refund intermediary at the airport to claim your VAT refund in cash or on your credit card This article simplifies the process of getting your VAT refund before departing from Switzerland into a few easy steps

The deadline for submitting VAT refund claims in Switzerland is 30 June 2024 Non Swiss businesses without a Swiss VAT registration still have until the end of June 2024 to file their VAT refund claim for Swiss VAT incurred in 2023 Make Qualifying Tax Free Purchases Validate Your Tax Free Forms Receive Your VAT Refund Fully Digital VAT Refund The VAT refund process in Switzerland isn t digital and requires paperwork Refund Kiosk Availability There are no VAT refund kiosks currently available in Switzerland Cash VAT Refund

How To Get Vat Refund In Switzerland

How To Get Vat Refund In Switzerland

https://api.tourismthailand.org/upload/live/content_article/1124-20932.jpeg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

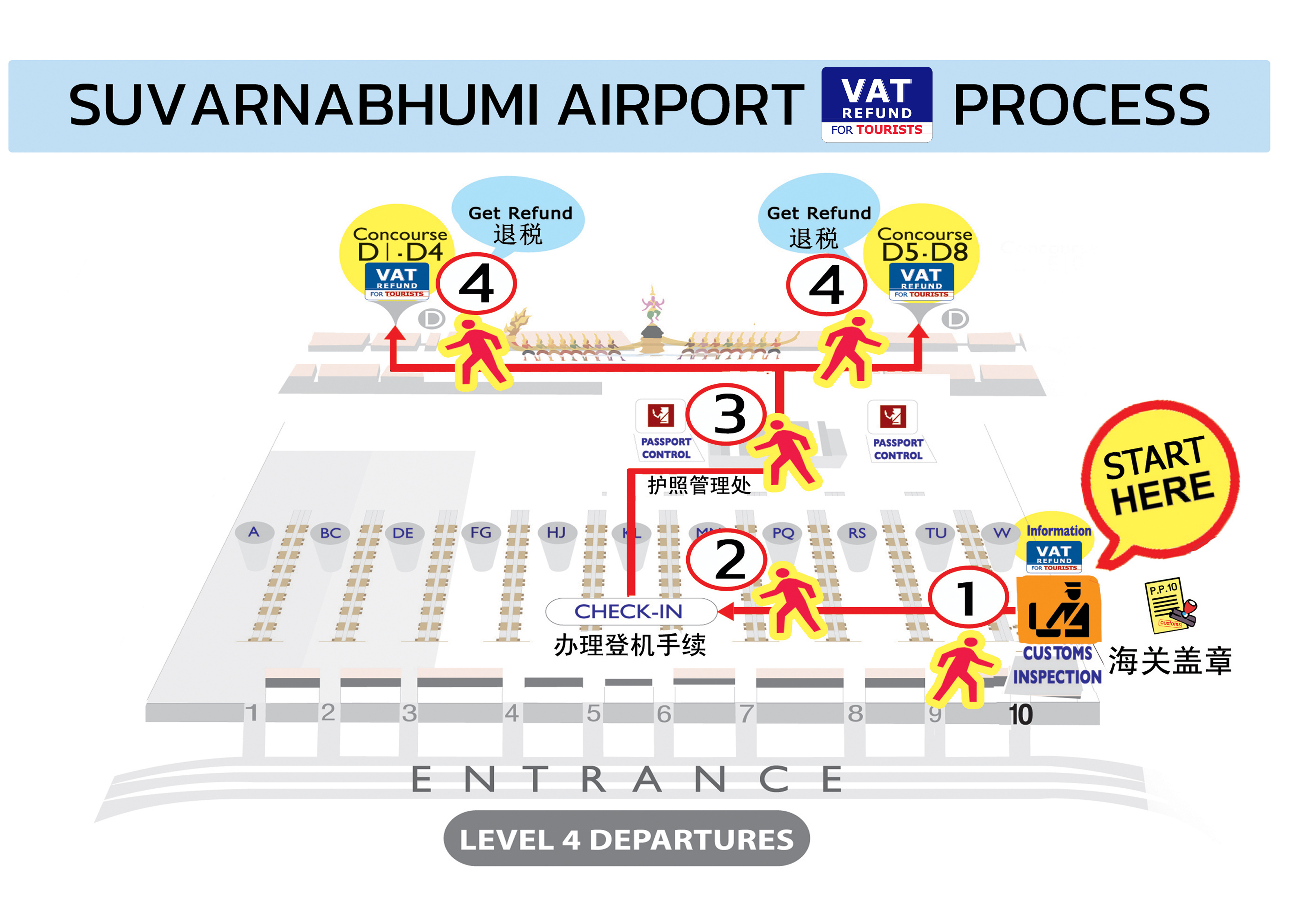

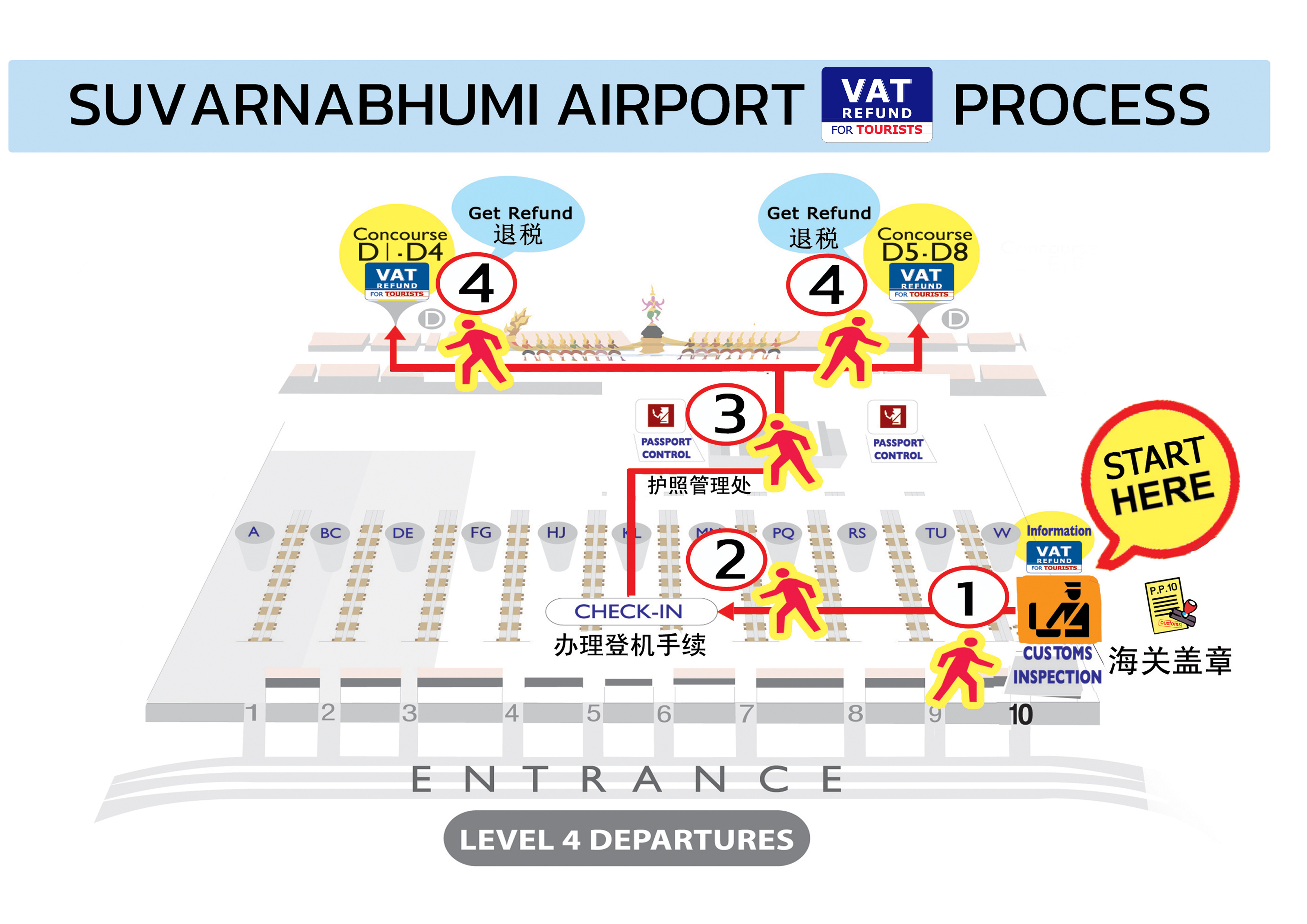

How To Get VAT Refund For Tourists In Thailand

https://image.mfa.go.th/mfa/0/4a5AsMHake/ประชาสัมพันธ์_บทความ/VAT_refund.jpg

You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on your claim to the authorities in the other country The VAT refund procedure is harmonised at EU level The VAT you pay on purchased goods in Switzerland is 7 7 You may ask at the shops for your Tax Free Form and reclaim the VAT Your total purchases in a shop must amount to more than CHF 300 including VAT

If you buy goods costing CHF 300 or more pick up a Tax Free Form at Globus Department Store and follow the steps above for how to get a VAT refund in Switzerland at the airport you depart from in Switzerland Customers who live outside of Switzerland and who purchase goods worth 300 CHF or more paid the same day and in the same shop receive a form at the cash desk for the refunding of VAT This form must Be stamped by a Swiss customs agent Be sent in the enclosed envelope to receive the refund Does the form have the Global Refund logo

Download How To Get Vat Refund In Switzerland

More picture related to How To Get Vat Refund In Switzerland

VAT Refund 101 What Is It And How To Claim Your VAT Refund It s All

https://selectitaly.com/blog/wp-content/uploads/2016/03/D_D_Italia-VAT-Refund-1024x677.jpg

How Tourists Can Get VAT Refund In UAE Saif Chartered Accountants UAE

http://www.saifaudit.com/blog/wp-content/uploads/2018/07/uae-tourist-VAT-refund-system.jpg

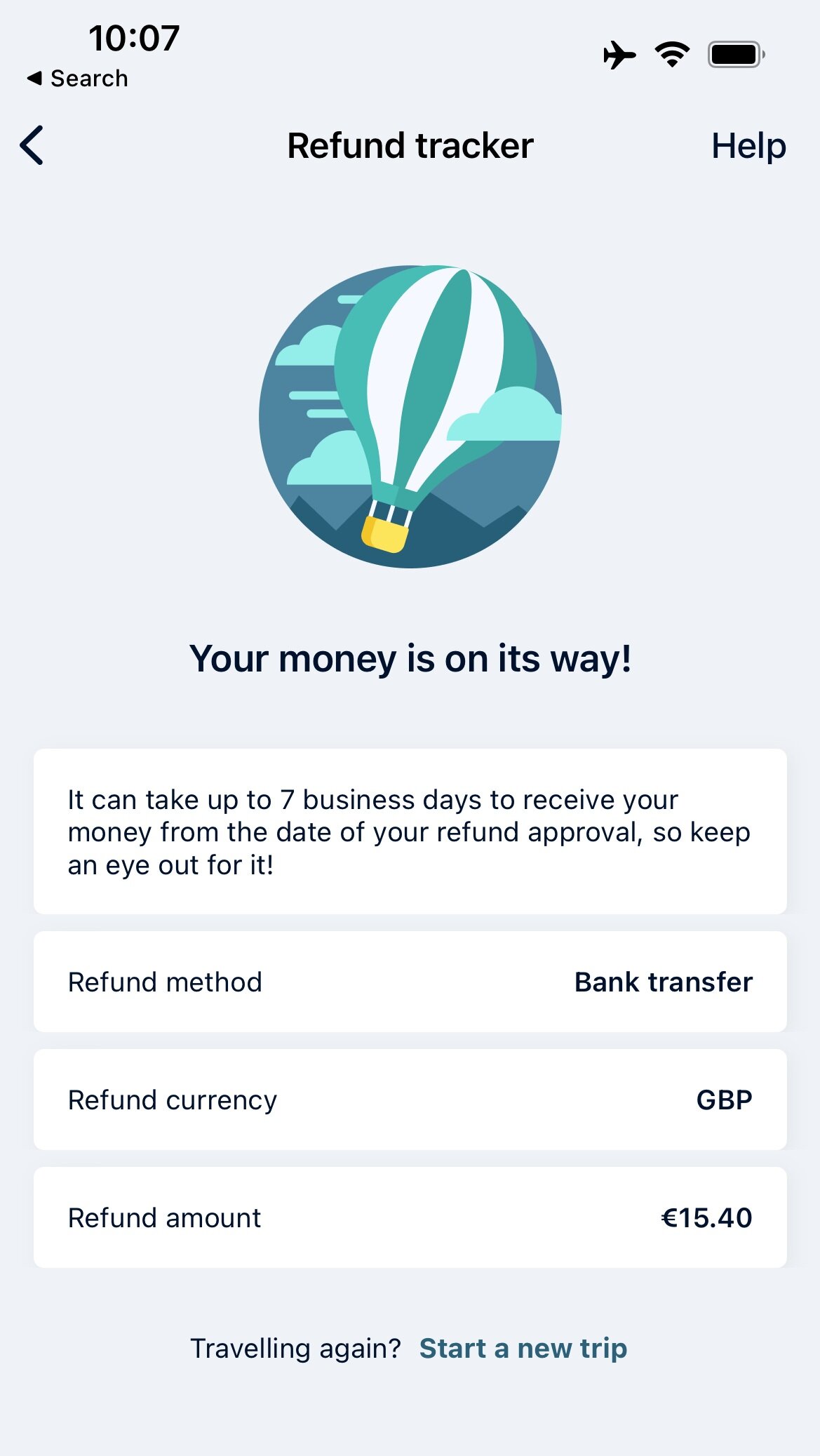

How To Get A VAT Refund In The UK With An App London Tips Travel

https://i.pinimg.com/736x/c5/28/1c/c5281c867db2558527372a69fc2ab8b4.jpg

Refunds of Swiss VAT Tax free shopping in Switzerland The salesperson can explain how and under what conditions you can make tax free purchases in Switzerland The minimum purchase value per sales transaction is CHF 300 including VAT There is VAT refunds If you are resident outside the EU you are entitled to a VAT refund on goods you have bought during your stay in the EU if the goods are shown to customs on departure within 3 months of their purchase together with the VAT refund documents The process itself i e the claim and refund is not harmonised at EU level

[desc-10] [desc-11]

UAE VAT Refund A Handy Guide For Businesses MBG

https://www.mbgcorp.com/ae/saseraf/2021/12/Blog-7-Image-how-to-get-vat-refund.jpg

How To Get VAT Refund In UK Amazon Seller Central Account VAT Refund

https://i.ytimg.com/vi/cvJrwcP0l8c/maxresdefault.jpg

https://wise.com › gb › blog › vat-refund-switzerland

Obtain a VAT refund After getting your export documents stamped head to a tax refund intermediary at the airport to claim your VAT refund in cash or on your credit card This article simplifies the process of getting your VAT refund before departing from Switzerland into a few easy steps

https://kpmg.com › ch › en › insights › taxes › vat-refund.html

The deadline for submitting VAT refund claims in Switzerland is 30 June 2024 Non Swiss businesses without a Swiss VAT registration still have until the end of June 2024 to file their VAT refund claim for Swiss VAT incurred in 2023

Co To Jest Deklaracja VAT FreeAgent I m Running

UAE VAT Refund A Handy Guide For Businesses MBG

How To Get Your VAT Refund In Paris Charles De Gaulle Airport France

How To Get VAT Refund In Thailand Tax Refund In Thailand Nomad Bento

How To Get VAT Refund In Oman Aviaan Accounting

VAT Refund In Dubai For Tourists 2024 Gudie

VAT Refund In Dubai For Tourists 2024 Gudie

How To Get A VAT Refund Travelsim

Guide To VAT Refund In Switzerland For EU And Non EU Claimants

How To Get A VAT Refund When Shopping In Europe

How To Get Vat Refund In Switzerland - Customers who live outside of Switzerland and who purchase goods worth 300 CHF or more paid the same day and in the same shop receive a form at the cash desk for the refunding of VAT This form must Be stamped by a Swiss customs agent Be sent in the enclosed envelope to receive the refund Does the form have the Global Refund logo