How To Pay Tax For Rental Property You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of

Rental income is any payment you receive for the use or occupation of property You must report rental income for all your properties In addition to amounts Generally you work out what tax there is to pay by deducting your allowable rental expenses from your gross rental income Your total allowable rental expenses and

How To Pay Tax For Rental Property

How To Pay Tax For Rental Property

https://i.ytimg.com/vi/bZjTIHPyY94/maxresdefault.jpg

How To Pay Your Corporation Tax

https://whitesidesca.com/wp-content/uploads/2016/01/shutterstock_274577444-tax-e1452606482780-1024x425.jpg

Claiming Expenses On Rental Properties 2022 TurboTax Canada Tips

https://turbotax.intuit.ca/tips/images/rental-income-tax.jpg

As a landlord all income you receive through your rental property is considered taxable This includes tenants rent payments security deposits leasing fees and other cash flowing through the How you pay tax You can get your rent either in full and pay tax through Self Assessment if HMRC allows you to do this with tax already deducted by your letting

If you re a landlord earning rental income you ll need to pay income tax on your profit this is what s left after you ve deducted any allowable expenses Find out how to make sure you re paying the right Key Takeaways Rental income is typically taxable and you likely need to report your rental income and any qualifying deductions on Schedule E Supplemental Income and

Download How To Pay Tax For Rental Property

More picture related to How To Pay Tax For Rental Property

New Ways To Pay Tax How To Pay Income Tax In 2023 How To Pay

https://i.ytimg.com/vi/B9KtyqzxZz0/maxresdefault.jpg

8 Ways To Pay Less In Taxes And Save Money Business Tax Tax

https://i.pinimg.com/originals/f3/3f/96/f33f9697cbf4b37e6f4f972bfc18d500.jpg

How To Pay Tax Online In The Philippines Paying Taxes How To Pay

https://i.pinimg.com/originals/d7/ae/b9/d7aeb9ef4547bc4d579ef49dab09d06b.png

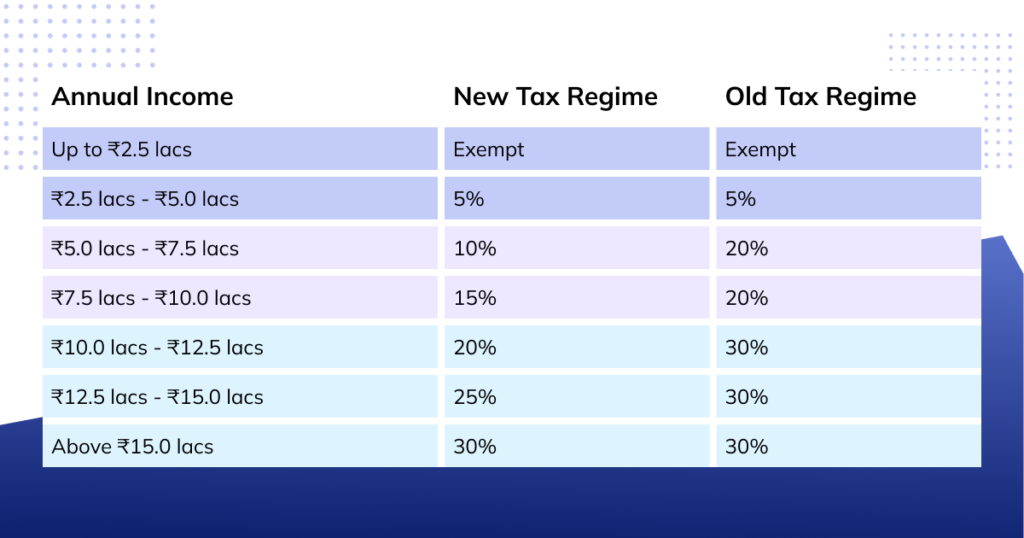

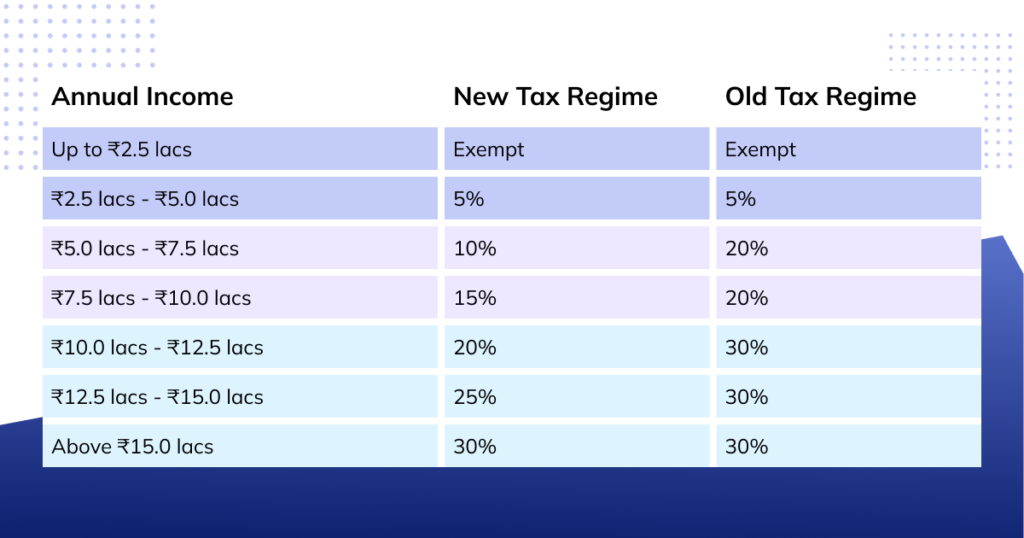

Amazon has launched its own credit card that gives 1 back on all purchases through the site Partnering up with Barclaycard the online giant s card gives customers Here s how to calculate tax on rental income in India Calculate the Gross Annual Value GAV of the rented property This is defined as the annual rent received from the

In this article we ll explain how rental income tax rates work and how to use expenses from owning and operating a rental property to reduce taxable net income while still Florida Rental Property Taxes If you re a Florida landlord you may need to pay income tax property tax or sales tax Here s an overview of those taxes what you

How To Calculate Income Tax On Salary With Example

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/02/Facebook-post-16-1024x538.png

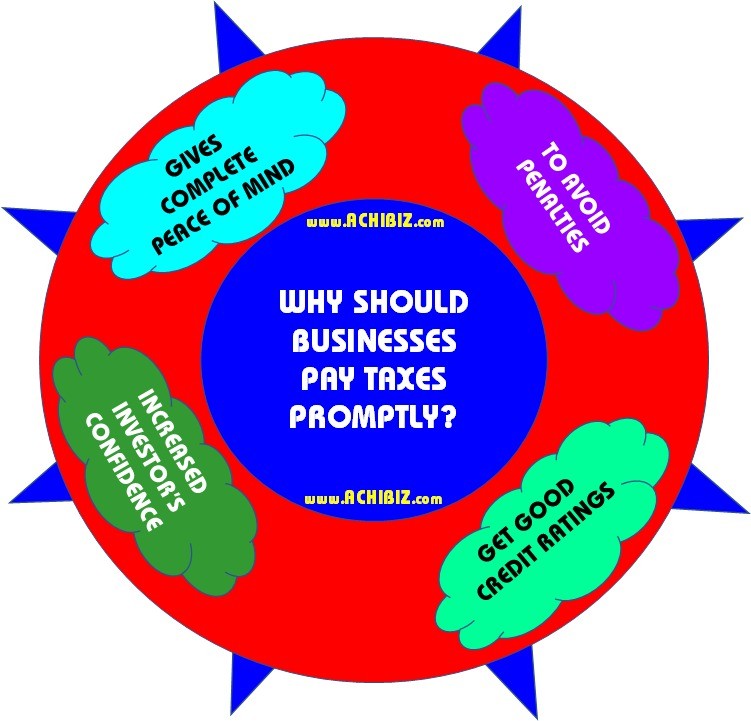

Why Should Businesses Pay Taxes Promptly ACHIBIZ

https://w8y4v7c7.rocketcdn.me/wp-content/uploads/2018/11/ABS-Blog-Design-083-V-01-Why-Should-Pay-Tax.jpg

https://www.gov.uk/guidance/income-tax-when-you...

You can deduct expenses from your rental income when you work out your taxable rental profit as long as they are wholly and exclusively for the purposes of

https://www.irs.gov/businesses/small-businesses...

Rental income is any payment you receive for the use or occupation of property You must report rental income for all your properties In addition to amounts

Calculating Federal Income Tax Per Pay Period GracieMaeAmi

How To Calculate Income Tax On Salary With Example

Detailed Interpretation How To Pay Tax For Individuals Holding

Tax For Rental Property Top 10 Tips Tips To Avoid Mistakes

How To Pay Tax On Rental Property 14 Steps with Pictures

Does A Class D Beneficiary Have To Pay Tax On This Inheritance

Does A Class D Beneficiary Have To Pay Tax On This Inheritance

Learn How To Pay Your Bills With One Income Money Saving Tips

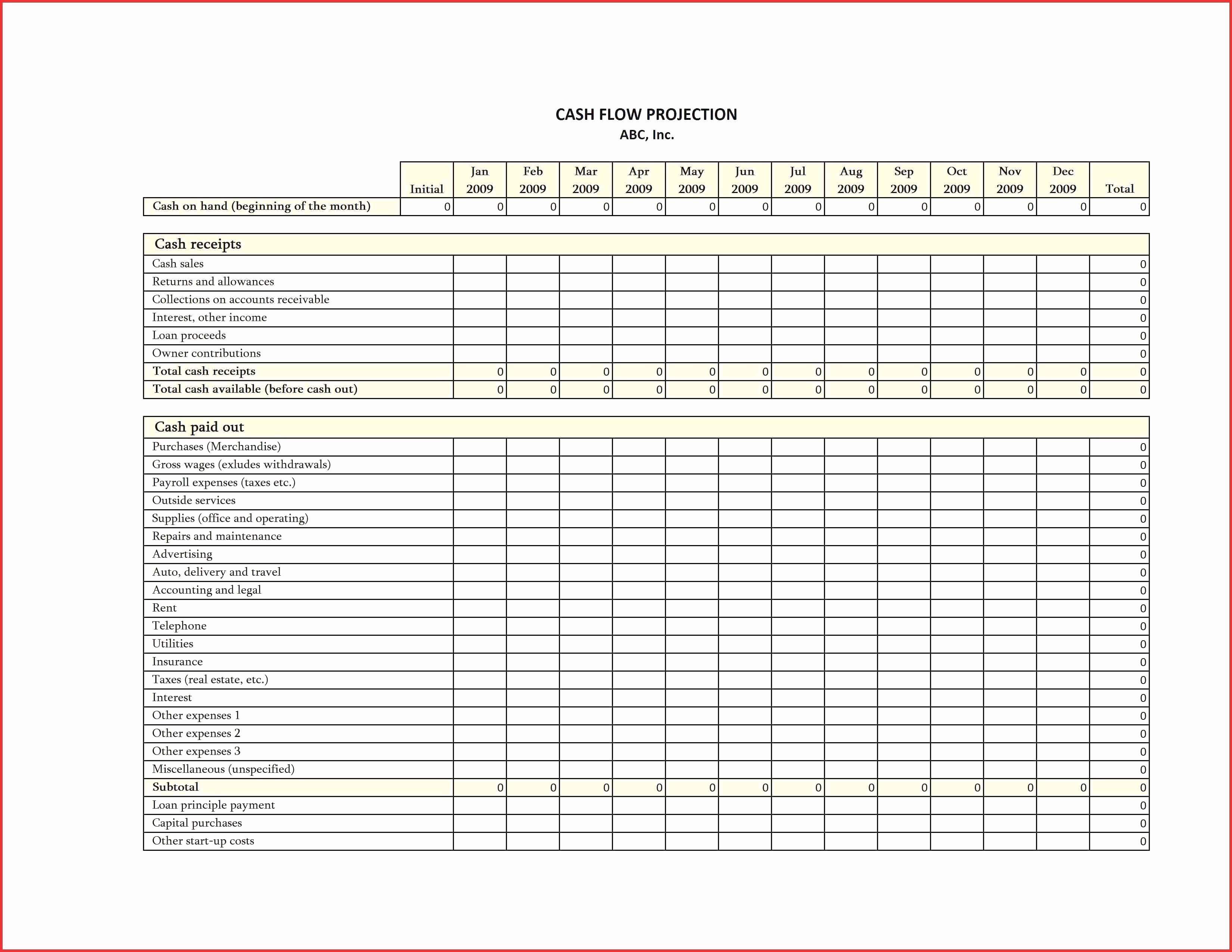

Tax Expenses Template

No Income Tax

How To Pay Tax For Rental Property - As a landlord all income you receive through your rental property is considered taxable This includes tenants rent payments security deposits leasing fees and other cash flowing through the