How To Plan Tax For Salaried Employees In India Web How to Save Income Tax in India for FY 2023 24 You will need to keep a careful eye on the available tax saving financial products if you want to save a significant portion of your income in India Sections 80C 80CCC and 80CCD provide tax savings opportunities

Web 28 Nov 2022 nbsp 0183 32 How to Save Income Tax for Salary Above 10 Lakhs in India You can save 100 tax on salary income of Rs 10 lakhs Here s a tax calculation example for Web 6 Aug 2022 nbsp 0183 32 For the very first time in India you will came to know that if you plan your expenses in such a way that you make expenses on tax free structures you can plan to

How To Plan Tax For Salaried Employees In India

How To Plan Tax For Salaried Employees In India

https://i0.wp.com/www.myfirmcare.com/wp-content/uploads/2023/01/How-to-Save-Tax-for-Salaried-Employees-in-India-scaled.jpg

Financial Planning For Salaried Employee And Strategies For Tax Savings

https://imgv2-1-f.scribdassets.com/img/document/446416877/original/69b04da5f0/1658504109?v=1

How To Calculate Income Tax On Salary With Example In Excel FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/01/calculate-tax-on-salary-payslip-example-video.webp

Web 28 Dez 2023 nbsp 0183 32 Here s a simplified overview of the process Determine Gross Salary Start by calculating your gross salary This includes your basic salary allowances bonuses Web 25 Mai 2023 nbsp 0183 32 How to Plan Tax for Salaried Employees in India According to Deloitte India has one of the most complex tax systems in the world The various tax laws and

Web 6 mins read by Angel One Strategic tax planning can lower your tax burden while helping you meet tax compliance With careful personal tax planning salaried employees can Web 1 House rental allowance HRA is exempted u s 10 13A of the income tax act 1961 What needs to be kept in consideration is that HRA received from an employer is fully taxable if the employee lives in his own house or is

Download How To Plan Tax For Salaried Employees In India

More picture related to How To Plan Tax For Salaried Employees In India

Tax Saving Guide 10 Smart Ways To Save Income Tax For Salaried Employees

https://cdn.dnaindia.com/sites/default/files/styles/full/public/2021/07/20/986128-813334-saving-istock-041619.jpg

Income Tax For Salaried Employees In India FY 2022 23 By Saurabh

https://miro.medium.com/max/1200/1*jrpZc3xi9-IlQD9iLnDuOA.png

All The Salaried Employees Out There Save More With These Simple Tax

https://www.avivaindia.com/sites/default/files/All the Salaried Employees out there- Save More with these Simple Tax Planning Tips.jpg

Web Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The Web 26 Mai 2023 nbsp 0183 32 Tax planning and income tax return ITR filing are crucial for salaried employees in India By adopting effective tax planning strategies individuals can minimize their tax liabilities and make the most of the

Web 11 Mai 2023 nbsp 0183 32 The amount of HRA exempt from tax is the least of the following a Actual HRA received from the employer b Rent paid minus 10 of salary c 50 of the Web Following are the steps to use the tax calculator 1 Choose the financial year for which you want your taxes to be calculated 2 Select your age accordingly Tax liability in India differs based on the age groups 3

13161 Pdf Tax Saving Strategies A Study On Financial Planning For

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/c5e4dcf9aa033e3c571f177c87677452/thumb_1200_1698.png

Five Tax Saving Tips For Salaried Individuals Business Times Of India

https://static.toiimg.com/thumb/msid-61656944,width-1070,height-580,imgsize-49664,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

https://babatax.com/tax-planning-tips-for-salaried-employees-fy-2023-24

Web How to Save Income Tax in India for FY 2023 24 You will need to keep a careful eye on the available tax saving financial products if you want to save a significant portion of your income in India Sections 80C 80CCC and 80CCD provide tax savings opportunities

https://cleartax.in/s/how-to-save-tax-for-salary-above-10-lakhs

Web 28 Nov 2022 nbsp 0183 32 How to Save Income Tax for Salary Above 10 Lakhs in India You can save 100 tax on salary income of Rs 10 lakhs Here s a tax calculation example for

5 Tax Saving Tips For Salaried Employees How To Save Maximum Tax For

13161 Pdf Tax Saving Strategies A Study On Financial Planning For

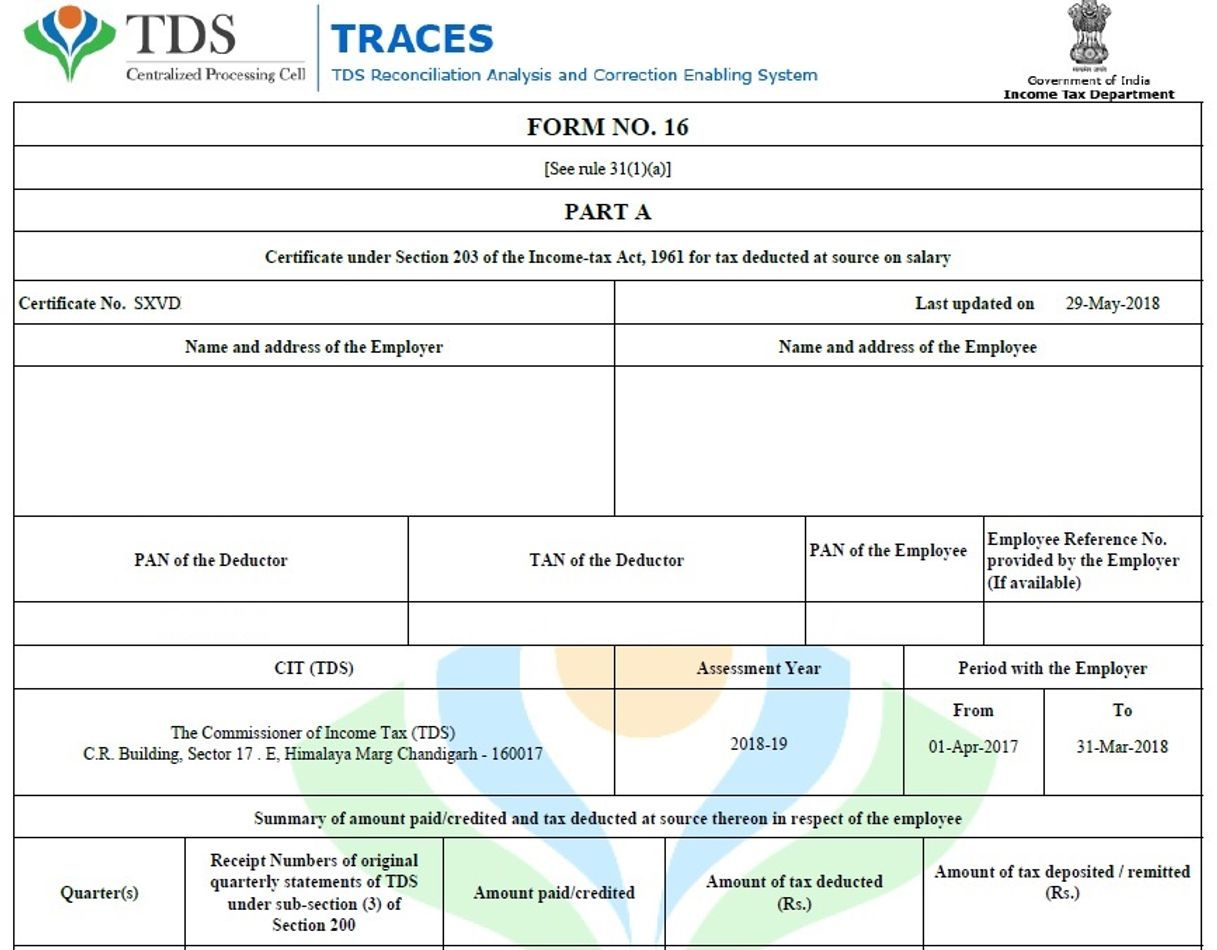

Providing Form 16 To All Pensioners And Family Pensioners CPAO

Govt Announced Seven Slabs For Salaried Class In Budget 2022 23

HRA Exemption In Income Tax HRA Exemption For Salaried Employees how

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax On Salary With Example

Tax Planning For Salaried Employees Saffollya

Income Tax Calculation Example 2 For Salary Employees 2023 24

Standard Deduction Budget Announcements Budget 2018 Gives Rs 40 000

How To Plan Tax For Salaried Employees In India - Web Income Tax Planning For Salaried Employees In this blog we will discuss the best ways that can help you to save your taxes Tax Planning with the help of Salary Restructuring