How To Report Severance Pay On Tax Form The process for reporting severance pay on your tax return generally involves the following steps Step 1 Receive a W 2 Form Your employer should provide

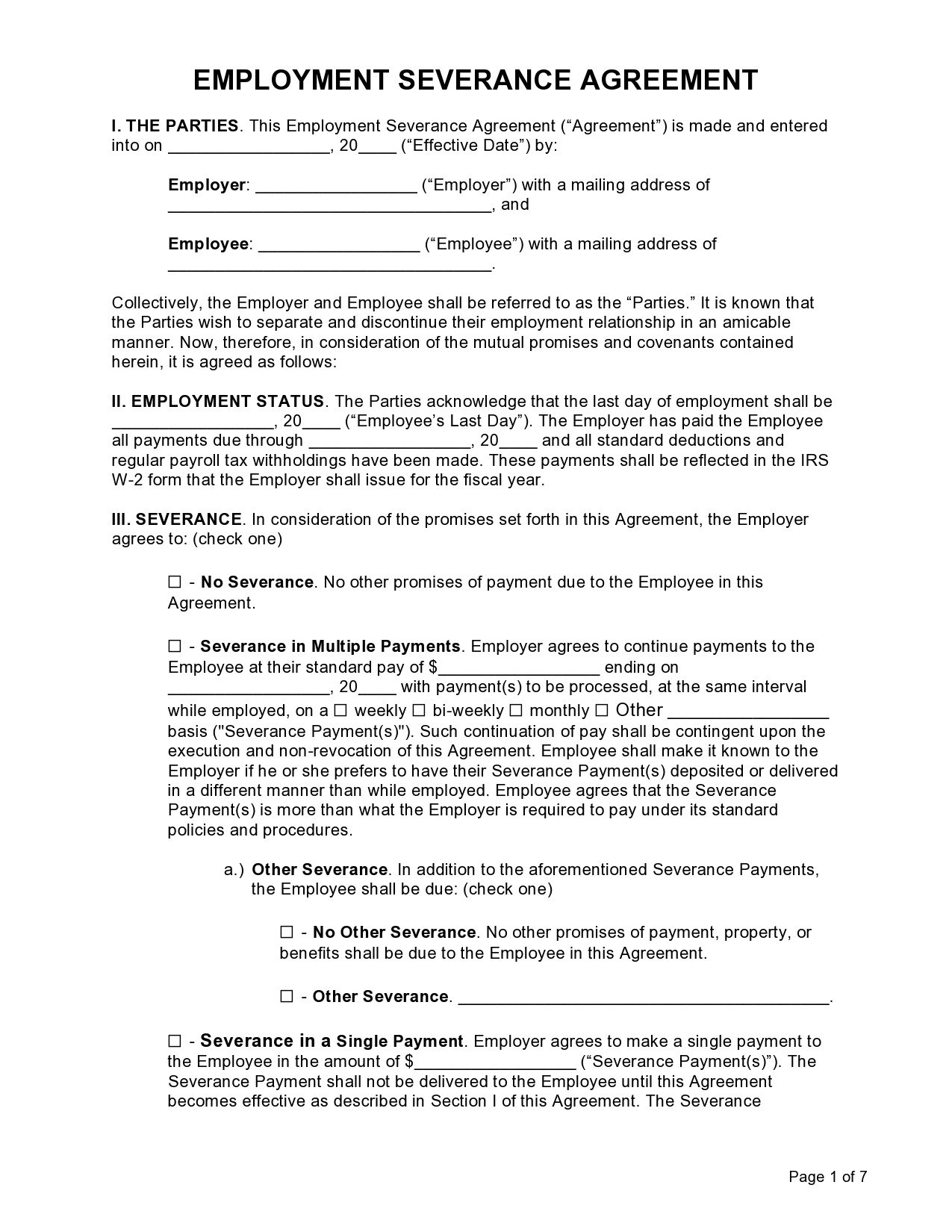

Is severance pay taxable Yes severance pay is taxable in the year that you receive it Your employer will include this amount on your Form W 2 and will withhold appropriate Where to declare redundancy and severance payments You should record your normal earnings on the Employment pages of your tax return but then go to Additional Information page 2 Employment

How To Report Severance Pay On Tax Form

How To Report Severance Pay On Tax Form

https://www.rosslawgroup.com/wp-content/uploads/2022/02/Severance-Agreement-scaled.jpeg

Average Tax Refund Check So Far Is Down 11 IRS Says Crain s

https://s3-prod.crainscleveland.com/s3fs-public/396987953_i.jpg

Effect Of Severance Pay On Unemployment Benefits California EasleyLAW

https://i0.wp.com/www.easleylawfirm.com/wp-content/uploads/2020/06/AdobeStock_334116392-scaled.jpeg?fit=2560%2C1707&ssl=1

Paying income tax on your severance pay You must pay income tax on severance pay How much tax you pay depends in part on how your employer pays your severance pay Severance pay is taxable in the year of payment along with any unemployment compensation you receive and payments for accumulated vacation and sick time Employers usually simplify the tax

Manual Transmittal March 29 2022 Purpose 1 This transmits new IRM 6 550 3 Severance Pay Material Changes 1 Severance pay has been relocated to this IRM Your severance pay is subject to income tax in Canada so you may not take home as much as you think you will receive With any form of severance pay the best case

Download How To Report Severance Pay On Tax Form

More picture related to How To Report Severance Pay On Tax Form

Severance And Taxes Is Severance Taxable H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2022/11/severance-and-taxes-feature.jpg

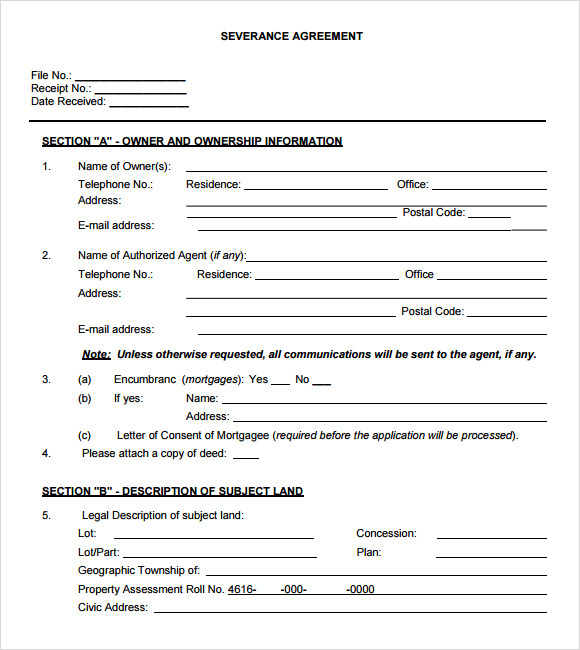

Severance Agreement Template 1

https://source.cocosign.com/images/employment/severance/severance_1.jpg

Are Veterans VA Disability Benefits Taxable CCK Law

https://cck-law.com/wp-content/uploads/2019/07/are-veterans-va-disability-benefits-taxable.jpg

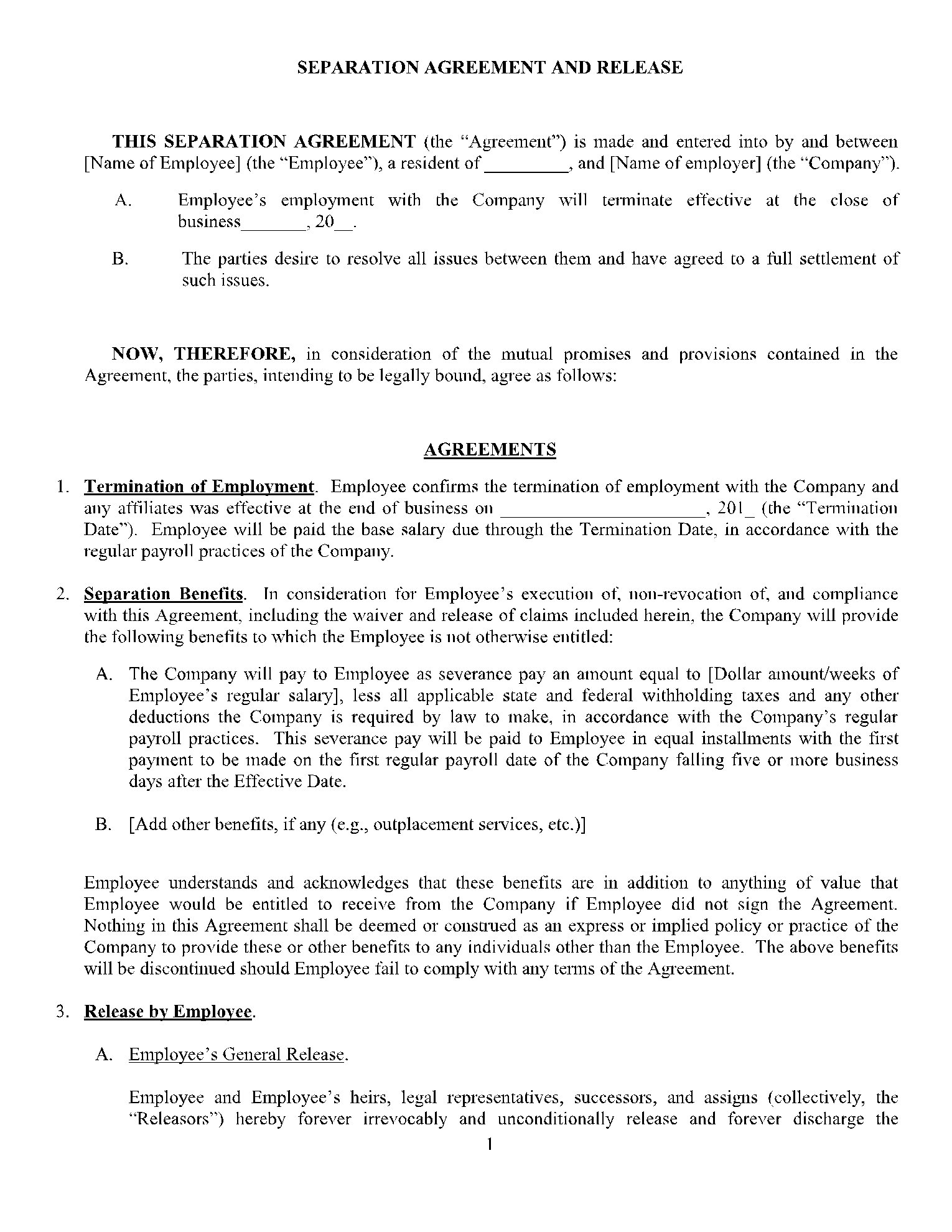

Employment Severance pay How losing a job impacts your taxes Jo Willetts EA Director Tax Resources Published on July 21 2023 Share on social The severance pay is subject to withholding and employment taxes The rest would be paid on a gross check with no withholding and reported on a Form 1099

What may be tax free You do not usually pay tax on the first combined 30 000 of statutory redundancy pay additional severance or enhanced redundancy payments your Severance pay may be given to individuals by their company when their employment is terminated It s taxed as ordinary income and the employer will withhold

Eligible Veterans Can Seek Refund For Taxes On Disability Severance

https://media.defense.gov/2018/Jul/18/2001944030/-1/-1/0/180716-D-BN624-0001.JPG

How Do I Minimize Taxes On Severance Payments YouTube

https://i.ytimg.com/vi/MlF3FaBUrBc/maxresdefault.jpg

https://www.usemultiplier.com/payroll/severance-pay-taxation-explained

The process for reporting severance pay on your tax return generally involves the following steps Step 1 Receive a W 2 Form Your employer should provide

https://www.irs.gov/pub/irs-pdf/p4128.pdf

Is severance pay taxable Yes severance pay is taxable in the year that you receive it Your employer will include this amount on your Form W 2 and will withhold appropriate

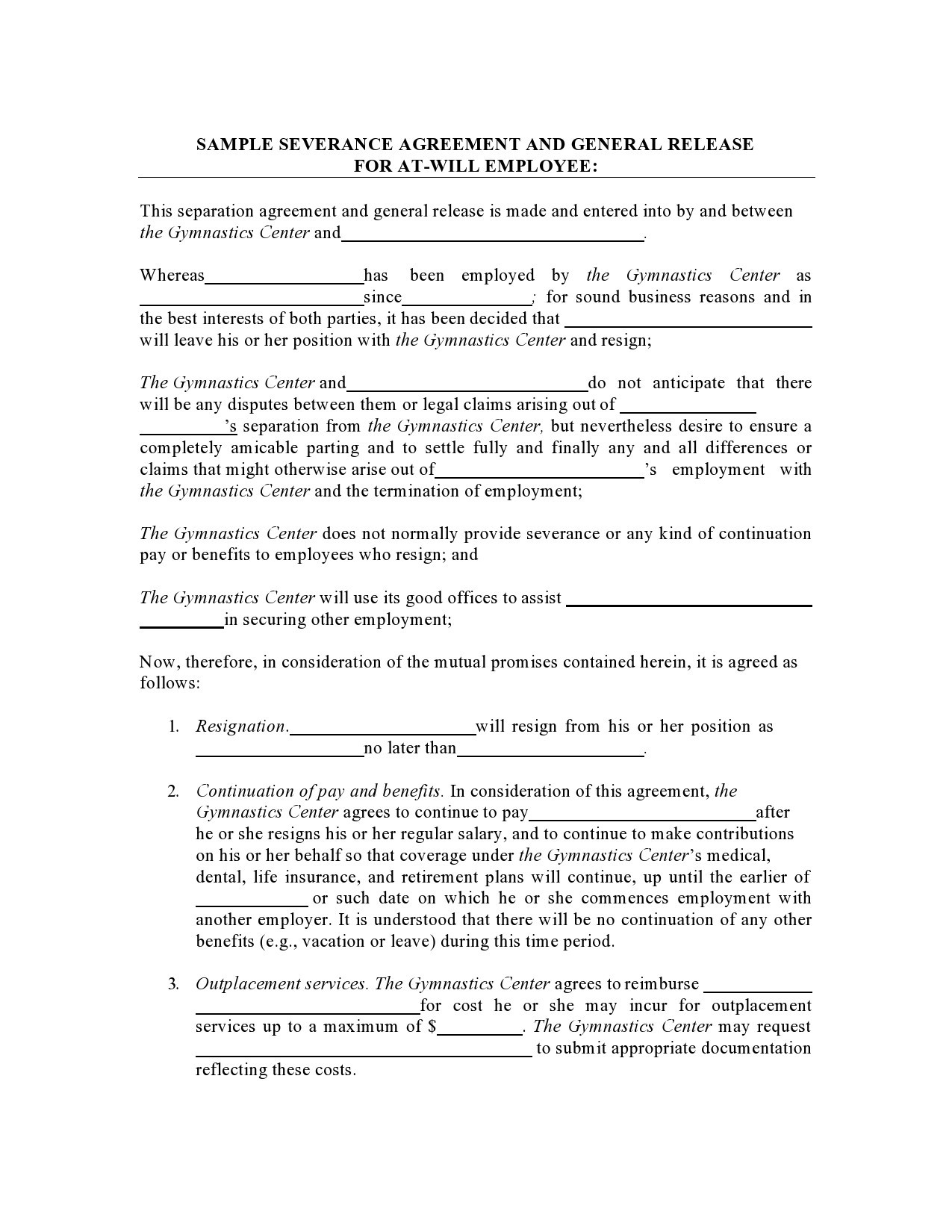

39 Best Severance Agreement Templates Examples

Eligible Veterans Can Seek Refund For Taxes On Disability Severance

How To Report Severance Pay On A California Unemployment Form Quora

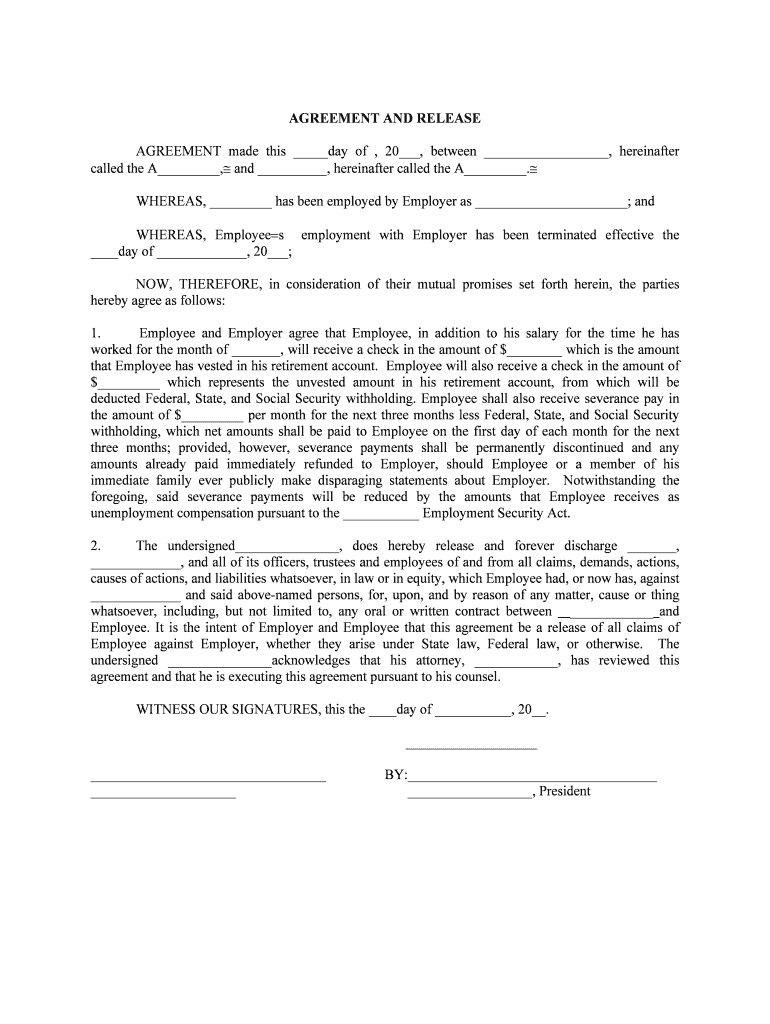

Severance Form Fill Out And Sign Printable PDF Template AirSlate

TIP INCOME REPORTING How To Report TIP INCOME On Your 2021 TAX RETURNS

What Are Severance Benefits

What Are Severance Benefits

39 Best Severance Agreement Templates Examples

What You Need To Know About Severance Packages Taxes Optima Tax Relief

What Is A W2 Employee Check City

How To Report Severance Pay On Tax Form - Severance pay is taxable in the year of payment along with any unemployment compensation you receive and payments for accumulated vacation and sick time Employers usually simplify the tax