Welcome to Our blog, an area where curiosity fulfills details, and where day-to-day topics become engaging discussions. Whether you're seeking insights on way of living, technology, or a little bit of every little thing in between, you have actually landed in the right location. Join us on this exploration as we dive into the worlds of the regular and remarkable, making sense of the globe one article at a time. Your journey into the remarkable and diverse landscape of our How To Save Income Tax In India On Salary 2021 22 begins below. Discover the fascinating material that waits for in our How To Save Income Tax In India On Salary 2021 22, where we untangle the complexities of various topics.

How To Save Income Tax In India On Salary 2021 22

How To Save Income Tax In India On Salary 2021 22

How To Calculate Income Tax On Salary With Example

How To Calculate Income Tax On Salary With Example

20 Easy Ways To Save Income Tax In 2023

20 Easy Ways To Save Income Tax In 2023

Gallery Image for How To Save Income Tax In India On Salary 2021 22

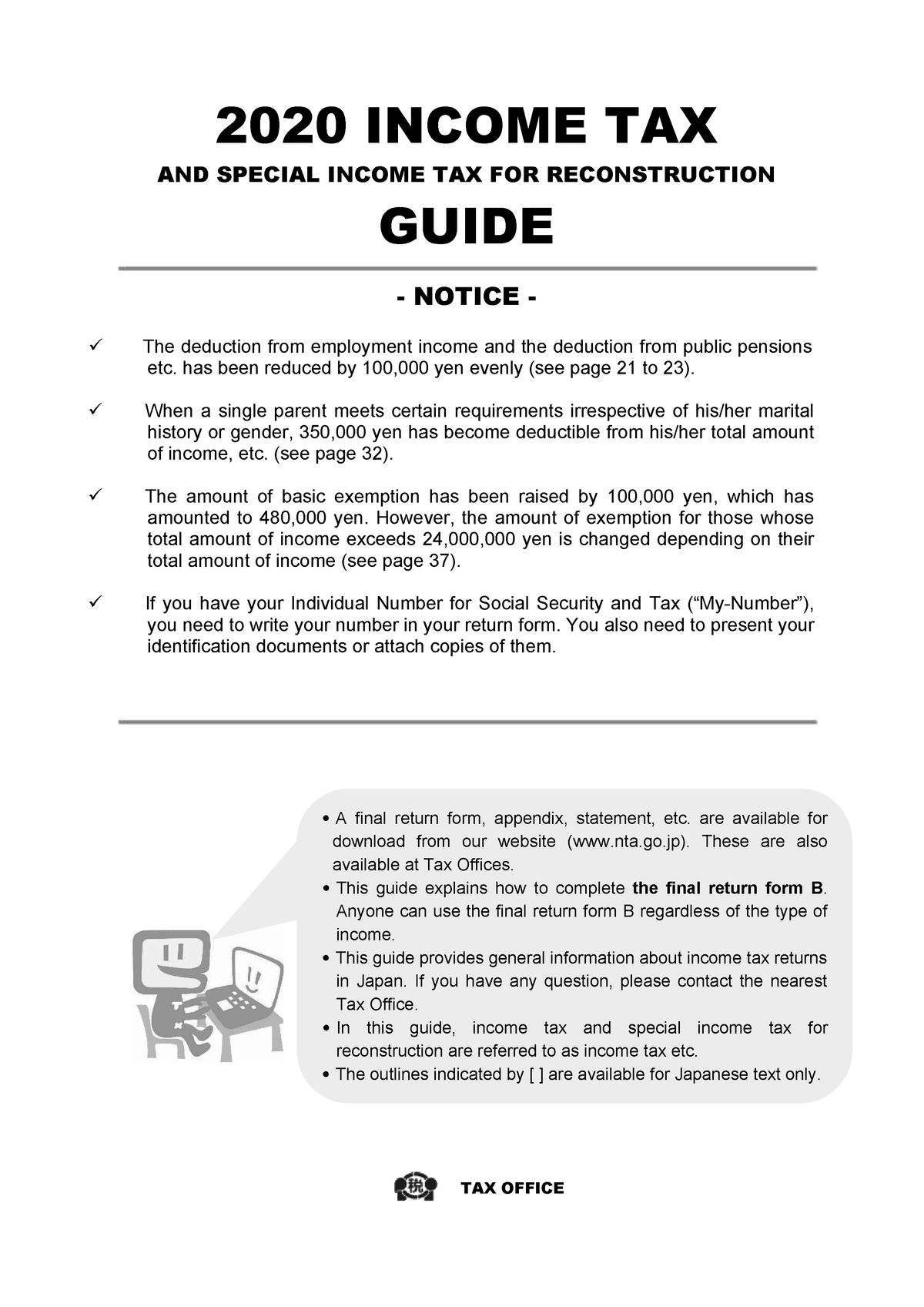

01 Helpful Notes About Income Tax 2020 INCOME TAX AND SPECIAL

Zero Tax On Salary Income INR 20 Lakhs Legal Way Here

Tax Laws Pre Exams Question Warning TT Undefined Function 32 CS

All You Need To Know On How To Save Income Tax Ebizfiling

17 Easy Ways To Save Tax On Your Salary EBook Mukherjee Prithiraj

How To Save Tax In India 2019 20 Income Tax Deductions Income Tax

How To Save Tax In India 2019 20 Income Tax Deductions Income Tax

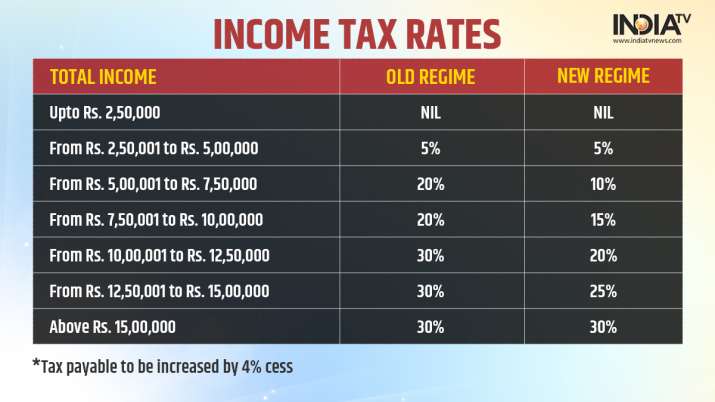

Income Tax Rates For FY 2021 22 How To Choose Between Old Regime And

Thanks for picking to explore our internet site. We regards wish your experience exceeds your assumptions, which you discover all the details and resources about How To Save Income Tax In India On Salary 2021 22 that you are looking for. Our commitment is to give an user-friendly and insightful platform, so do not hesitate to navigate with our web pages with ease.