How To Submit A Manual Vat Return A VAT return is a form used to submit tax payments to TRA Currently VAT registered traders are supposed to submit returns to TRA online through e filing or in paper form VAT is payable on 20 th day of the following month of the business that is a due date of submitting the return

VAT Return has to be filed on or before 20th of every month following the month of sales using TRA Taxpayers Portal A VAT return is a statement submitted by VAT registered businesses to report their VAT transactions for a specific month To Submit a ITX240 01 B VAT Return the E Filer should first login then once successfully logged in the E Filer should click on the Value Added Tax RETURN link where a ITX240 01 B VAT form will load

How To Submit A Manual Vat Return

How To Submit A Manual Vat Return

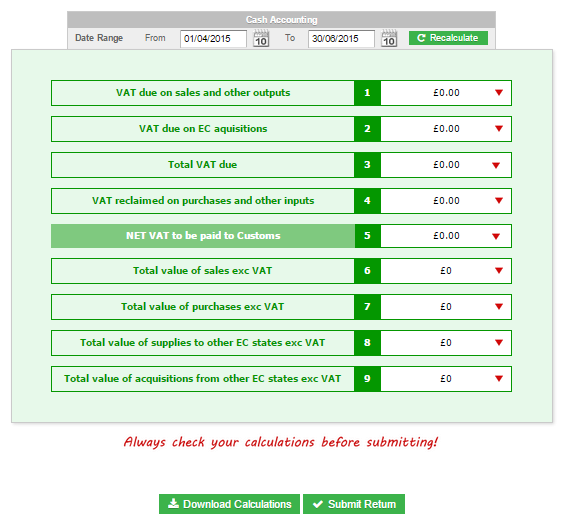

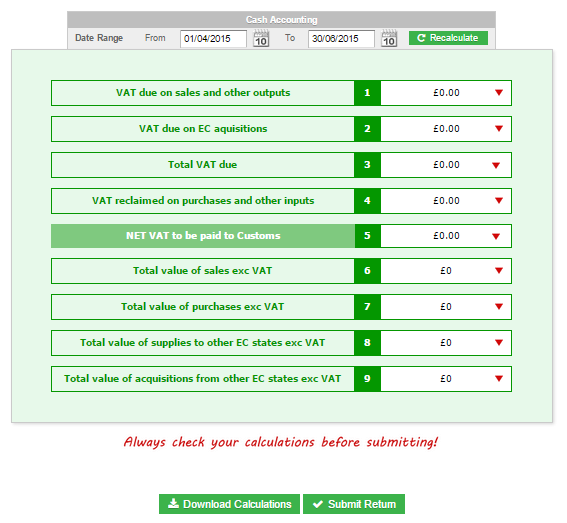

https://community.quickfile.co.uk/uploads/default/original/2X/4/48203105a42f2921150e849f046123b9dfa9f5ce.png

How To Submit A VAT Return Fleximize

https://images.fleximize.com/images/SubmittingVATReturn_RT_28-03-22_pexels-mikhail-nilov-8296970.jpg

How To Prepare And Submit VAT Return

https://www.affinityassociates.com/wp-content/uploads/2023/06/Submit-VAT-Return.jpg

In order to file returns click on Returns on the log in home screen where you will select Unfiled Returns for individual e filer and Entity Unfiled Returns for a declarant of the entity Find out how to fill in your VAT return about using VAT accounting schemes and how to submit your return electronically

Step 1 Log into your account You need to start by logging in to your account using your TIN or National ID no and your password If you do not have an eFiling account then you must first register by visiting the eFiling system on the TRA website and providing the details as required Once you do so you should log into your account How to do a VAT Return pay your VAT bill correct errors in your VAT Return what to do if you re late with your return or payment

Download How To Submit A Manual Vat Return

More picture related to How To Submit A Manual Vat Return

FreeAgent VAT Online Submission 1Stop Accountants

https://1stopaccountants.co.uk/wp-content/uploads/2014/10/freeagent-vat-return-example-1150x673.png

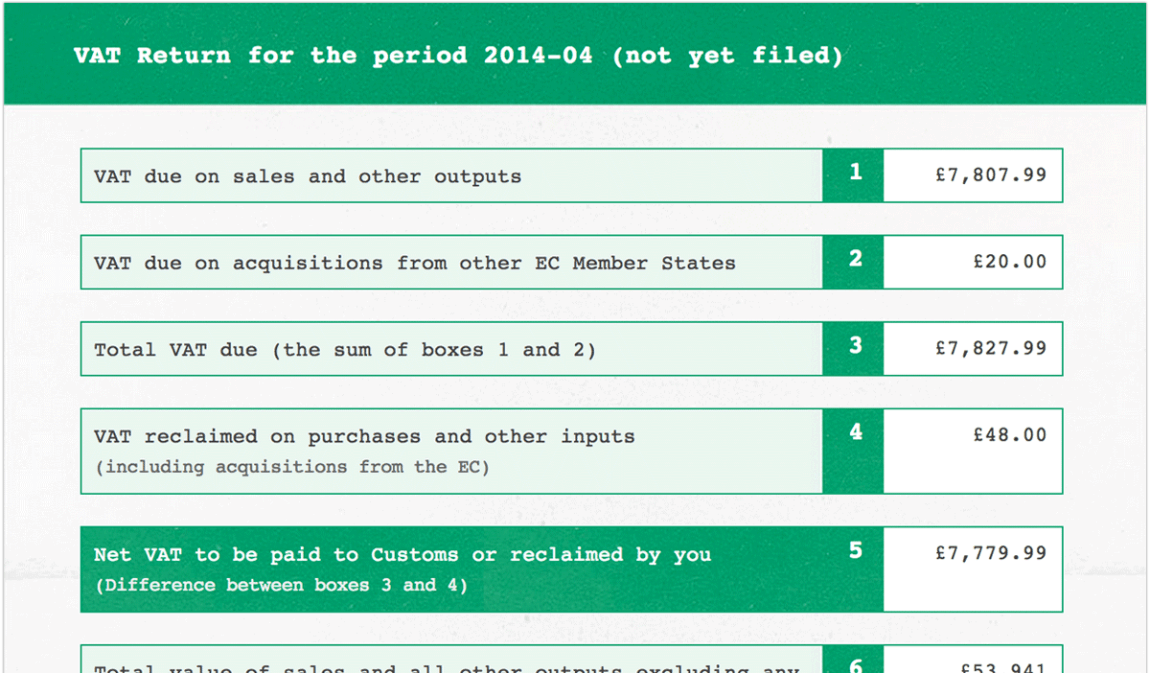

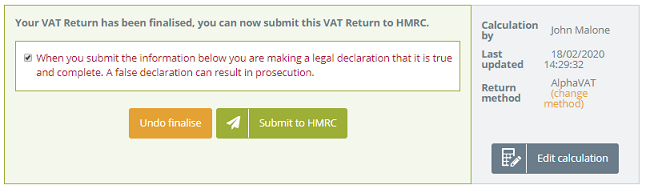

VAT Return Get Hands On Help With Your VAT Return

https://enaccounting.com/wp-content/uploads/2021/10/free-agent-vat-example.jpg

How To Upload And Submit Deliverables Market Logic Knowledge Center

https://support.marketlogicsoftware.com/hc/article_attachments/4565844989585/Supplier_RM_How_to_Upload_and_submit_the_final_deliverables.gif

This manual is prepared to help you navigate through the Federal Tax Authority FTA website and create an EmaraTax account with the FTA 2 Manage online user profile This manual is prepared to provide you an understanding on Login process user types forgot password and modify online user profile functionalities 3 Vendors who submit their VAT201 returns manually must do so by the 25th of the month while vendors who use eFiling have until the last business day of the month to submit VAT201 returns and payments

[desc-10] [desc-11]

HOW TO SUBMIT Gaming Laboratories International

https://spanish.gaminglabs.com/images/Headers/new/submit-text2.png

Submit Video On Behance

https://mir-s3-cdn-cf.behance.net/projects/max_808/661f9a128147487.Y3JvcCw4MDgsNjMyLDAsMA.jpg

https://www.tra.go.tz/index.php/value-added-tax-vat/98-vat-returns

A VAT return is a form used to submit tax payments to TRA Currently VAT registered traders are supposed to submit returns to TRA online through e filing or in paper form VAT is payable on 20 th day of the following month of the business that is a due date of submitting the return

https://miamia.co.tz/.../how-to-file-tra-vat-return-using-taxpayer-portal

VAT Return has to be filed on or before 20th of every month following the month of sales using TRA Taxpayers Portal A VAT return is a statement submitted by VAT registered businesses to report their VAT transactions for a specific month

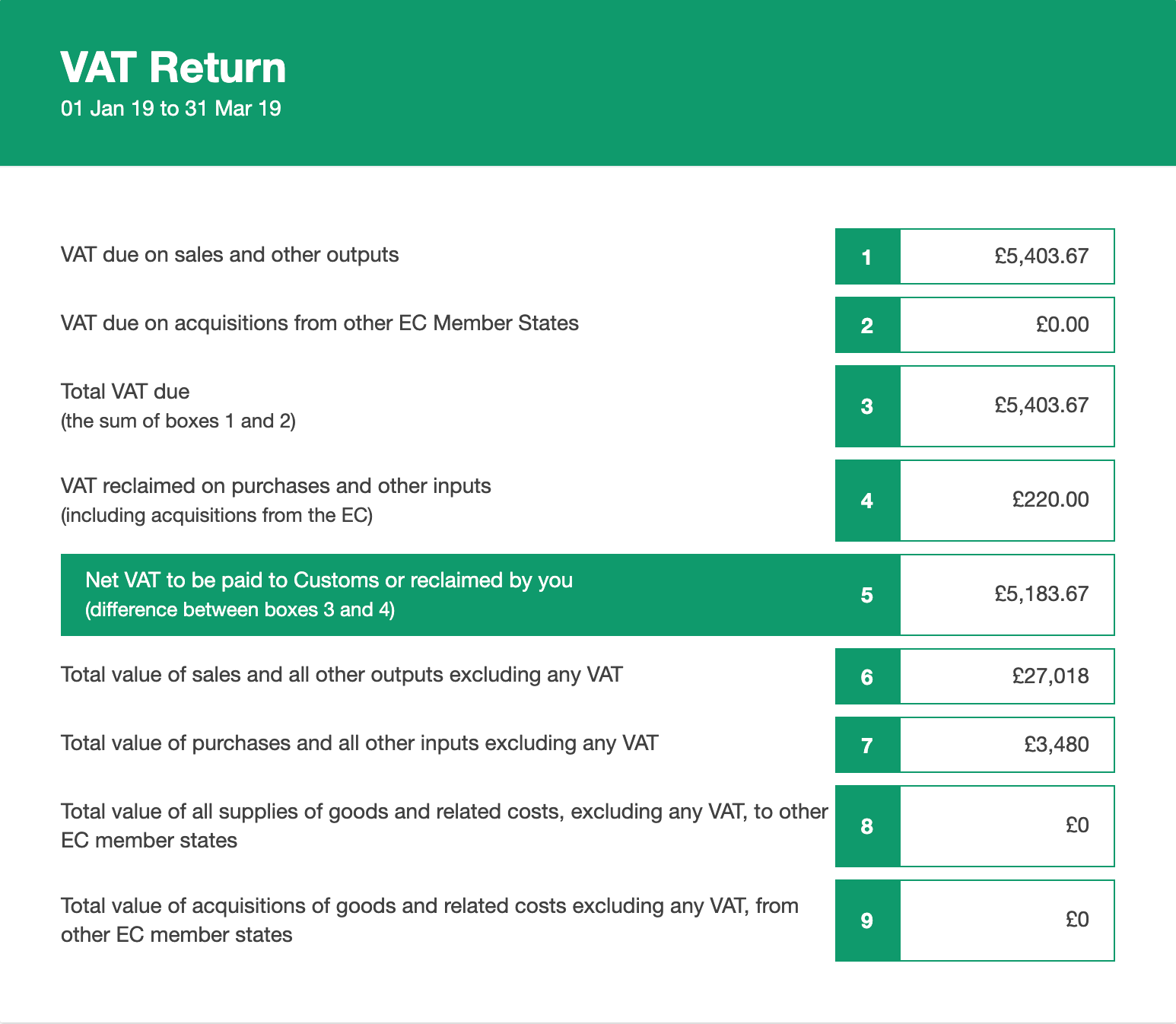

How To Submit Your VAT Return FSB The Federation Of Small Businesses

HOW TO SUBMIT Gaming Laboratories International

Submit Your VAT Return

The VAT Flat Rate Scheme FRS FreeAgent

How To Submit A Site To Search Engines In 2022

How To Submit A VAT Return In Under 10 Minutes

How To Submit A VAT Return In Under 10 Minutes

How To Submit A Technical Request On Vimeo

Guidelines To Submit A Clean Claim By ALICE CARLOS Issuu

HMRC VAT How Often Should I Submit A VAT Return Fleximize

How To Submit A Manual Vat Return - How to do a VAT Return pay your VAT bill correct errors in your VAT Return what to do if you re late with your return or payment