How To Track Child Tax Rebate 2024 Step 1 See if you qualify using the Child Tax Credit Eligibility Assistant Step 2 If you don t normally file a return register with the IRS using the Non filer Sign up Tool Alternatively file a return with the IRS Step 3 Check the status of your monthly payments and update your information using the Child Tax Credit Update Portal

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents How to check the amount and payment of your tax refund in MyTax Submit your bank account number to the Tax Administration if you have not submitted it yet or if it has changed When is the deadline to submit the account number Refunds can

How To Track Child Tax Rebate 2024

How To Track Child Tax Rebate 2024

https://www.tododisca.com/en/wp-content/uploads/2023/07/You-will-get-a-Tax-Rebate-if-you-want-to-buy-a-bicycle-in-Denver.jpg

CT Families Should Begin Receiving Child Tax Rebates This Week Governor NBC Connecticut

https://media.nbcconnecticut.com/2022/08/child-tax-rebate-news-conference.jpeg?quality=85&strip=all&resize=1200%2C675

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-1024x536.jpg

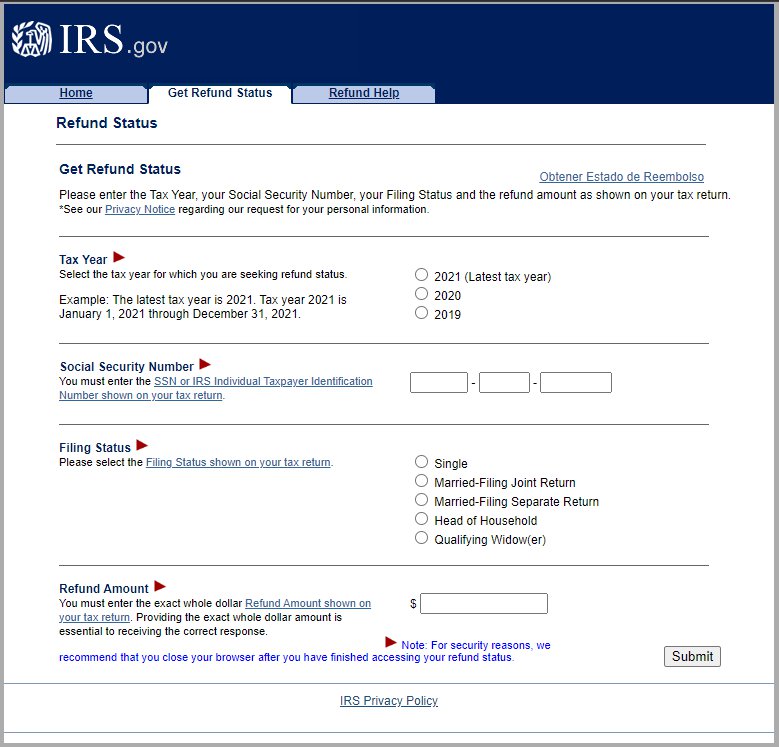

If you re still waiting to get your child tax credit refund and it s been more than 21 days since you filed with the IRS it s time to track your money down You can do this by using the Taxpayers can claim the 2024 child tax credit on the tax return they will file in 2025 If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15 2024

For 2024 returns you ll typically file in early 2025 the refundable portion of the child tax credit is 1 700 For the prior 2023 tax year only 1 600 was refundable Note Remember if you ACTC is refundable for the unused amount of your Child Tax Credit up to 1 600 per qualifying child tax year 2023 and 2024 The amount of your Child Tax Credit will be reduced if your adjusted gross income exceeds 400 000 if married filing jointly or 200 000 for all other tax filing statuses

Download How To Track Child Tax Rebate 2024

More picture related to How To Track Child Tax Rebate 2024

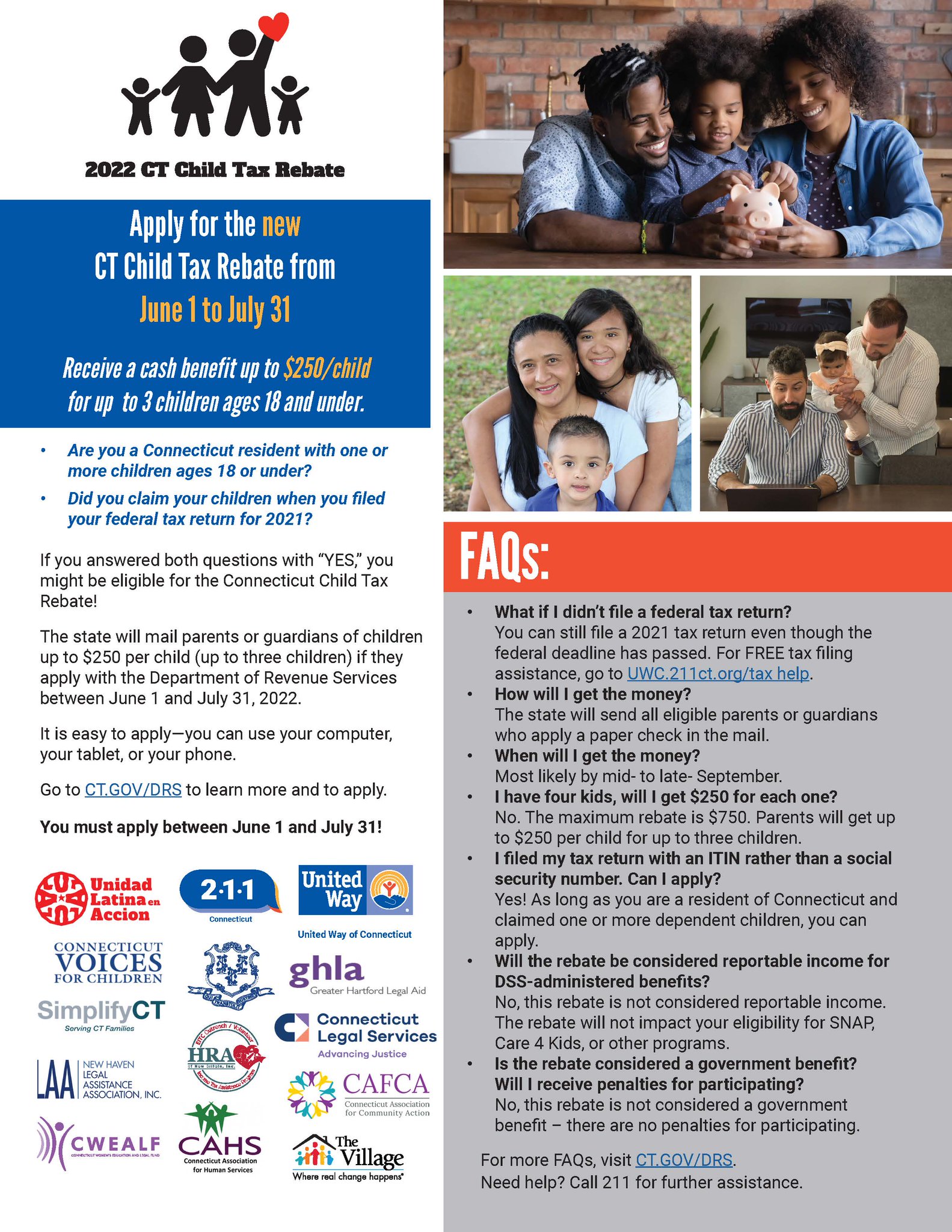

2022 Connecticut Child Tax Rebate Bailey Scarano

https://baileyscarano.com/wp-content/uploads/2022/06/Depositphotos_329030836_XL.jpg

CT Child Tax Rebate Checks Are In The Mail Lamont Across Connecticut CT Patch

https://patch.com/img/cdn20/users/22994611/20220825/105526/styles/patch_image/public/money-bills___25105510368.jpg

Minnesota Rebate Checks And Child Tax Credit Coming Soon Kiplinger

https://cdn.mos.cms.futurecdn.net/6s7GLrUiaDFw4PtLwHLk5U-1024-80.jpg

If you would like to track these individual payments yourself the Taxpayer Advocate Service has created an unofficial Advance Child Tax Credit Payment Tracker form on which you can do that The form is a PDF document that is fillable and will auto calculate the total advance payment amount for you How much is the 2024 child tax credit The maximum tax credit available per kid is 2 000 for each child under 17 on Dec 31 2023 Only a portion is refundable this year up to 1 600 per child

For every child living in Finland and covered by Finnish social security Kela pays child benefit Child benefit is paid until the child turns 17 You can apply for child benefit from Kela either via Kela s website or by a paper form The online service is available in Finnish and Swedish There are two ways to start the trace by phone or by mail fax To make the request by phone call the IRS 800 919 9835 If you d rather send the request by mail or fax send a completed Form 3911 Taxpayer Statement Regarding Refund Note If you file jointly BOTH spouses must sign the form It takes about six weeks to complete the

Child Tax Credit 2022 How Much Is It And When Will I Get It The US Sun

https://www.the-sun.com/wp-content/uploads/sites/6/2022/09/SC-Child-Tax-Credit-Comp-copy.jpg?w=1440

Child Tax Credit 2023 Can You Claim CTC With No Income YouTube

https://i.ytimg.com/vi/rCtfzX_GBIw/maxresdefault.jpg

https://www.irs.gov/newsroom/child-tax-credit-most...

Step 1 See if you qualify using the Child Tax Credit Eligibility Assistant Step 2 If you don t normally file a return register with the IRS using the Non filer Sign up Tool Alternatively file a return with the IRS Step 3 Check the status of your monthly payments and update your information using the Child Tax Credit Update Portal

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 U S Individual Income Tax Return and attaching a completed Schedule 8812 Credits for Qualifying Children and Other Dependents

Wondering About Your Idaho Tax Rebate Track Its Status With A New Online Tool Idaho Capital Sun

Child Tax Credit 2022 How Much Is It And When Will I Get It The US Sun

The 1 100 Per Child Tax Rebate Bonus For Divorced And Unmarried Parents

New Haven CSA On Twitter Applications For The Child Tax Rebate Are Open June 1st To July 31st

Nearly 200 000 Families Can Still Apply For 2022 CT Child Tax Rebate Before July 31 Deadline

HMRC Paid My Tax Rebate Into Someone Else s Bank Account Consumer Affairs The Guardian

HMRC Paid My Tax Rebate Into Someone Else s Bank Account Consumer Affairs The Guardian

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

Uniform Tax Rebate HMRC Tax Rebate Refund Rebate Gateway

Application For 2022 Connecticut Child Tax Rebate Now Open

How To Track Child Tax Rebate 2024 - Taxpayers can claim the 2024 child tax credit on the tax return they will file in 2025 If you still need to file your 2023 tax return that was due April 15 2024 or is due Oct 15 2024