How To Treat Cash Discount In Accounting A 5 cash discount on 100 is 5 and the amount of cash the customer pays is 95 A cash discount is a type of sales discount sometimes called an early settlement discount and is recorded in the accounting records using two journals

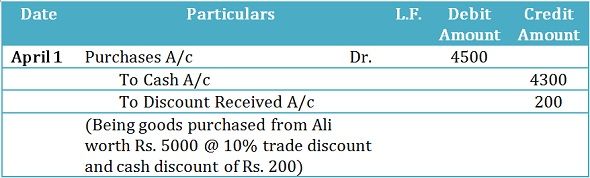

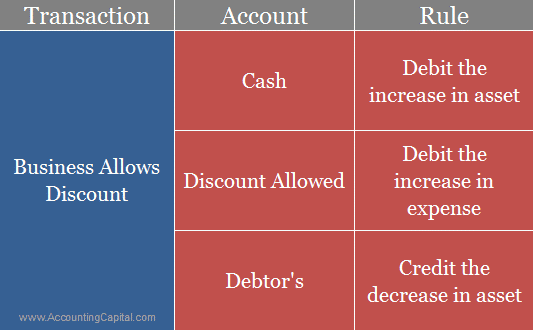

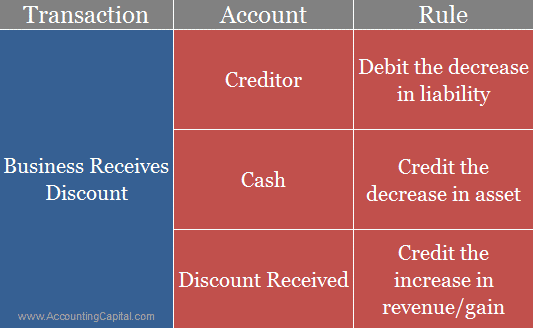

To record a payment from the buyer to the seller that involves a cash discount debit the cash account for the amount paid debit a sales discounts expense account for the amount of the discount and credit the accounts receivable account for the full amount of the invoice being paid Accounting for discounts Prompt payment discounts also known as settlement or cash discounts are offered to credit customers to encourage prompt payment of their account

How To Treat Cash Discount In Accounting

How To Treat Cash Discount In Accounting

https://i.ytimg.com/vi/j0ergHW1YDA/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGHIgXihEMA8=&rs=AOn4CLAe6uuwR_BiShKybcopC68ymXjs4A

Meaning And Distinction Between Cash And Trade Discount YouTube

https://i.ytimg.com/vi/gAkX9FdJB8k/maxresdefault.jpg

Life Insurance Treat Cash Value With Care Kensington Financial

http://www.kensingtonfa.com/wp-content/uploads/2021/11/treat-cash-value_1500.jpg

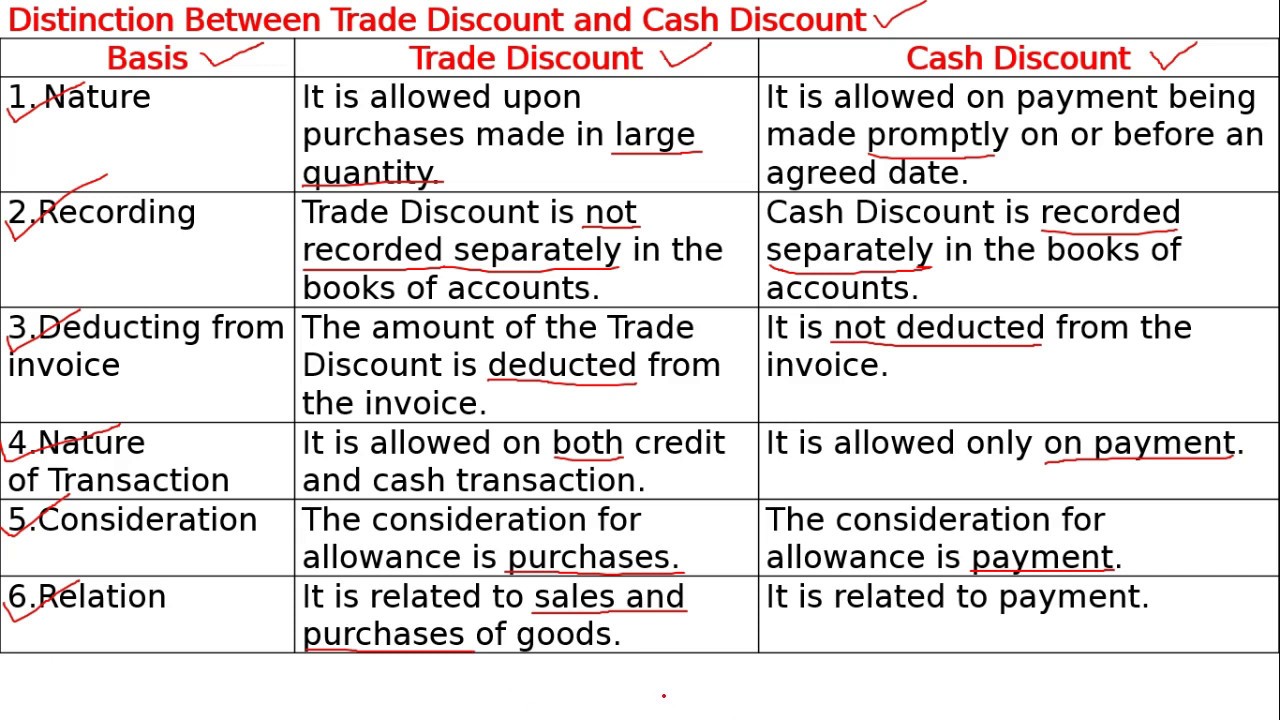

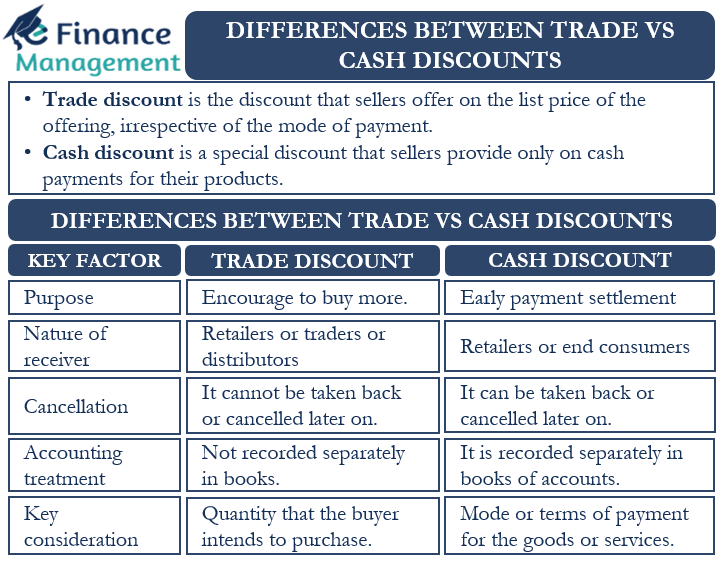

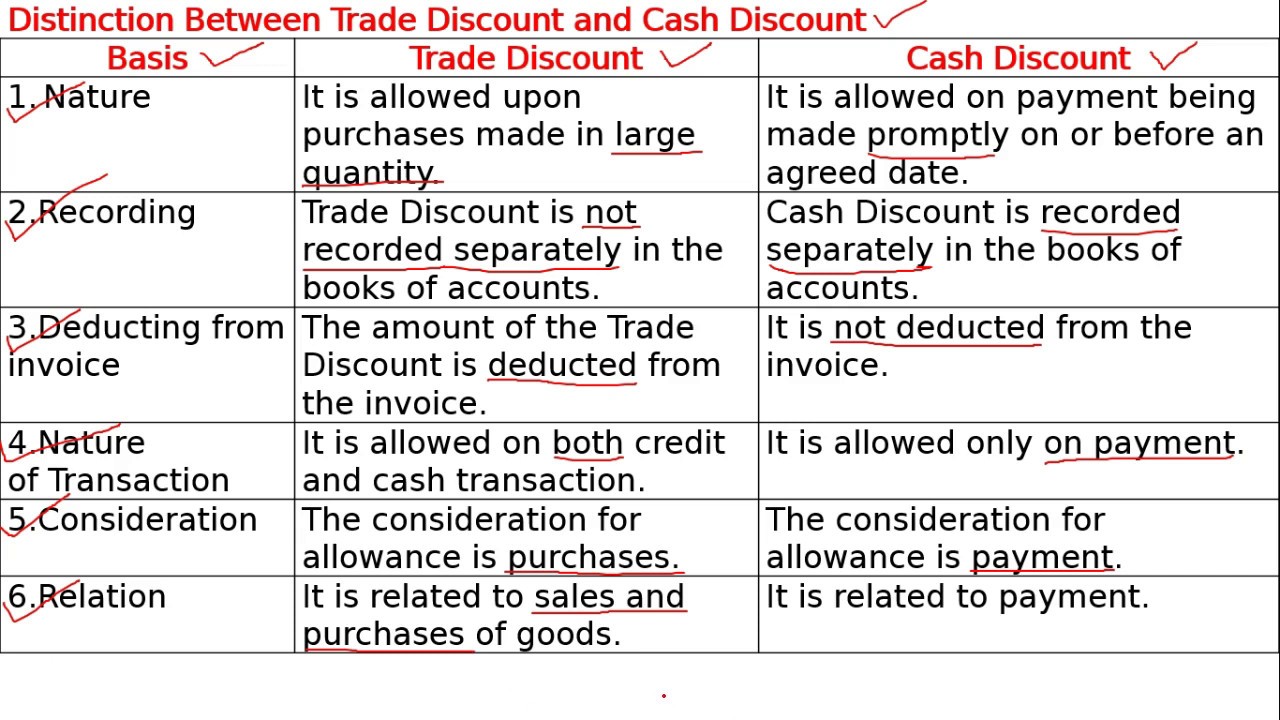

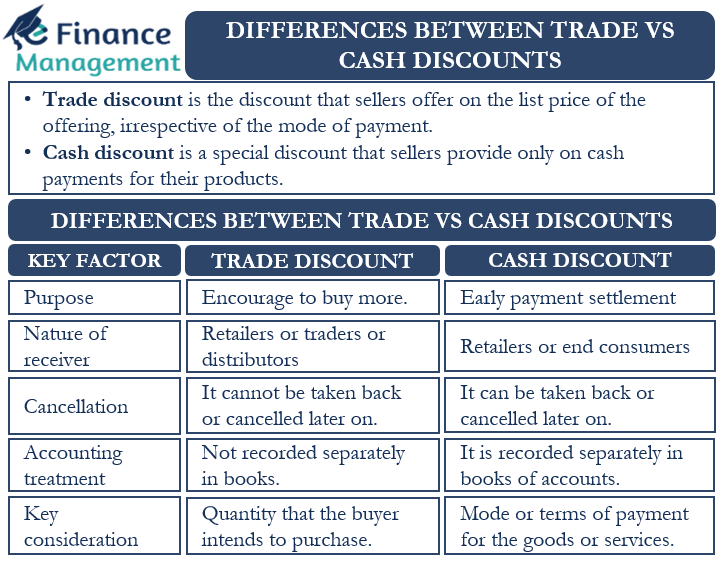

Why We all have personally experienced a discount which is an upfront reduction in selling price While the business does offer such type of discount upfront reduction in selling price there is another type which is popularly known as Cash Discount Generally business practises 2 types of discount as shown in the below How to record cash discounts in accounting There are two different methods for recording cash discounts in your accounting journals the gross method and the net method In the gross method discounts that aren t taken by the buyer e g when the buyer does not pay within the discount period are simply treated as a portion of total sales

Definition A cash discount also called a purchase discount or sales discount is a reduction in the purchase price of a good because of early cash payment In other words the seller of goods is willing to reduce the price of the goods if the buyer is willing to pay for the good earlier How do companies decide on the rate of cash discount to offer Companies determine the rate of cash discount to offer by analyzing their cost of capital the operational cost of carrying receivables and the potential benefits of improved cash flow

Download How To Treat Cash Discount In Accounting

More picture related to How To Treat Cash Discount In Accounting

Discount Allowed Double Entry

https://keydifferences.com/wp-content/uploads/2014/12/journal-entry1.jpg

What Is An Early Payment Discount NetSuite

https://www.netsuite.com/portal/assets/img/business-articles/accounting-software/infographic-bsa-early-payment-discount-static.jpg

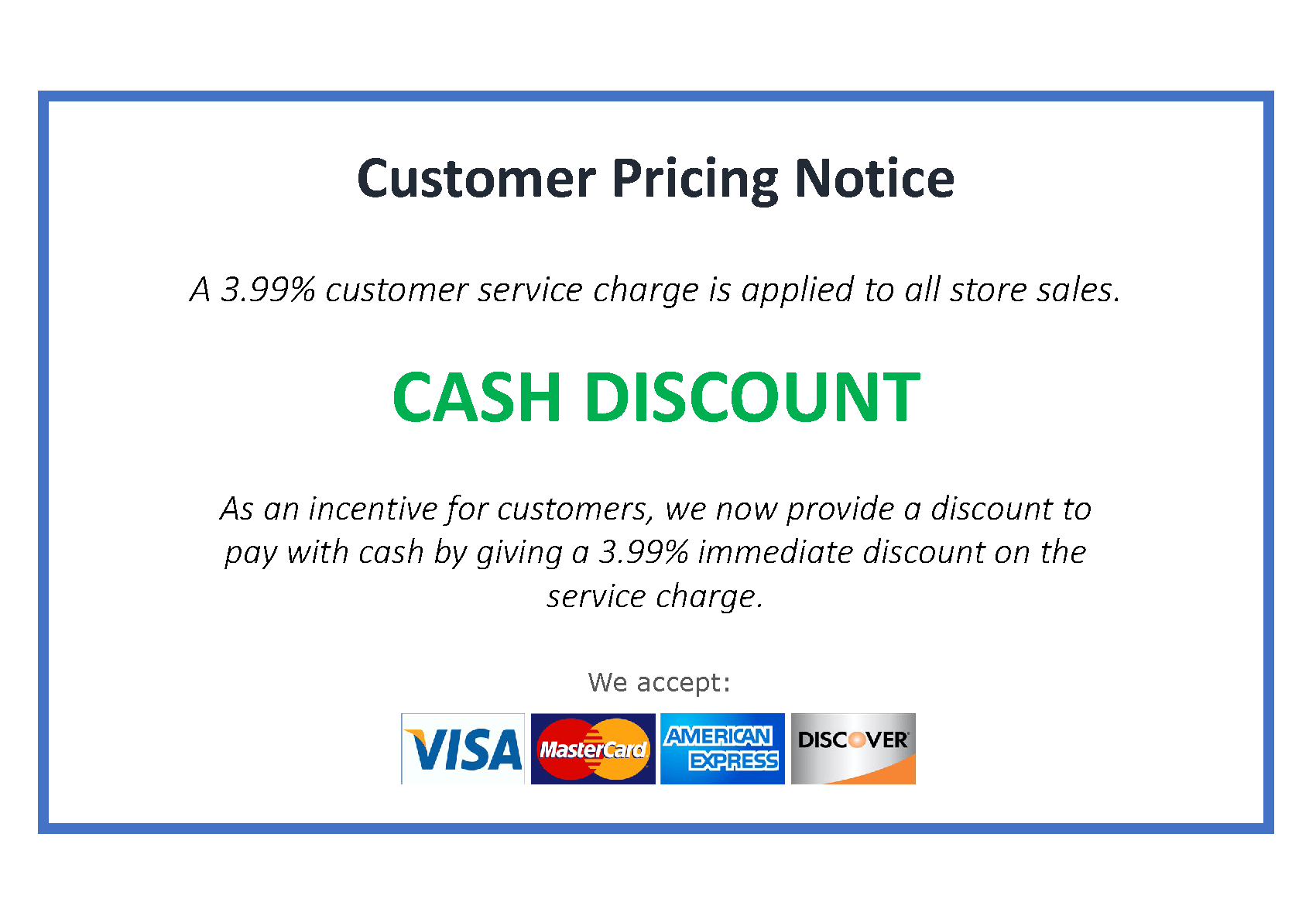

Cash Discount Program Signage

https://lirp.cdn-website.com/499b3704/dms3rep/multi/opt/Cash+Discount+Signage-df206e01-1920w.png

A seller might offer a buyer a cash discount to 1 use the cash earlier if the seller is experiencing a cash flow shortfall 2 avoid the cost and effort of billing the customer or 3 reinvest The purchase discount is based on the purchase price of the goods and is sometimes referred to as a cash discount on purchases settlement discount or discount received Purchase Discount Example

[desc-10] [desc-11]

Differences Between Trade Discounts And Cash Discounts EFM

https://efinancemanagement.com/wp-content/uploads/2021/10/Differance-between-Trade-Discount-cash-Discount.png

Accounting For Cash Discounts Basic Approach YouTube

https://i.ytimg.com/vi/wAi8Hb4rnNU/maxresdefault.jpg

https://www.double-entry-bookkeeping.com/accounts...

A 5 cash discount on 100 is 5 and the amount of cash the customer pays is 95 A cash discount is a type of sales discount sometimes called an early settlement discount and is recorded in the accounting records using two journals

https://www.accountingtools.com/articles/what-is-a...

To record a payment from the buyer to the seller that involves a cash discount debit the cash account for the amount paid debit a sales discounts expense account for the amount of the discount and credit the accounts receivable account for the full amount of the invoice being paid

Solved You Are Given The Following Cash Discount in Chegg

Differences Between Trade Discounts And Cash Discounts EFM

Treatment Of Cash Discounts Explanation Journal Entry And Examples

What Are Discount Trade Discount And Cash Discount Notes With PDF

Difference Between Trade Discount And Cash Discount with Example

Discount Formula Calculator Examples With Excel Template

Discount Formula Calculator Examples With Excel Template

Discount Received Journal Entry KaydenceminJoyce

Discount Received Journal Entry KaydenceminJoyce

Cash Accounting How It Works Should You Use It YouTube

How To Treat Cash Discount In Accounting - [desc-14]