How To Use Tuition Tax Credit It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40 percent of the

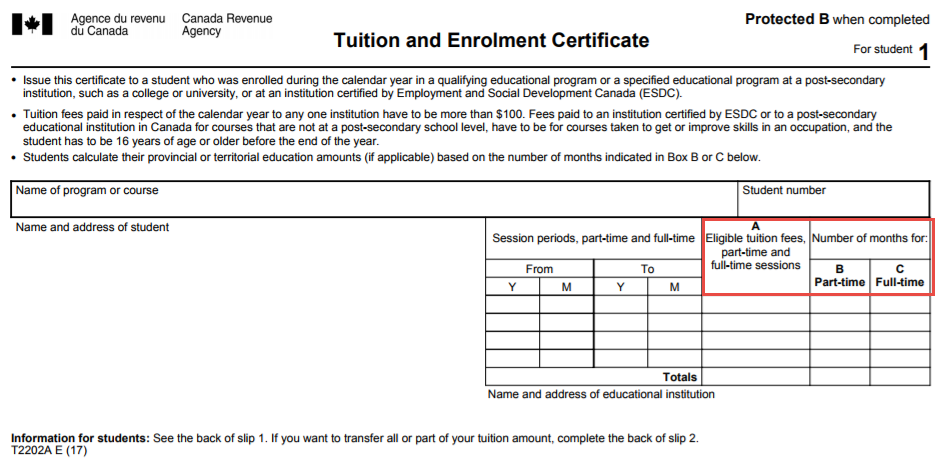

Eligible tuition fees Generally a course taken in 2023 at an institution in Canada will qualify for a tuition tax credit if it was either taken at a post secondary education institution With this non refundable tax credit you can potentially claim thousands of dollars in tax credits reducing your tax bill significantly Here s everything you need to

How To Use Tuition Tax Credit

How To Use Tuition Tax Credit

https://help17.hrblockonline.ca/hc/article_attachments/115004668593/DIY17_T2202A_EN.png

What Is The Tuition Tax Credit In Canada

https://reviewlution.ca/wp-content/uploads/2022/09/reviewlution-guide2-10.png

Tuition Tax Credit In Canada How It Works NerdWallet

https://www.nerdwallet.com/ca/wp-content/uploads/sites/2/2022/01/GettyImages-936987292-e1643665970419.jpg

The Canadian government offers a non refundable tax credit to help alleviate the cost of post secondary education for part time and full time students You can claim the federal tuition tax credit up to 5 000 and You have to first claim your current year s federal tuition fees and any unused tuition education and textbook amounts carried forward from previous years on your Income

To claim your tuition fees you may receive an official tax receipt from your educational institution instead to reflect the amount of eligible tuition fees you have paid for a How to Claim Tuition Tax Credits You can claim Tuition Tax in a few simple steps Obtain a tuition fee receipt You must have a receipt from an eligible educational institution in Canada that includes details like the

Download How To Use Tuition Tax Credit

More picture related to How To Use Tuition Tax Credit

What Happens To Unused Tuition Tax Credits Leftover Tuition Tax

https://www.liuandassociates.com/wp-content/uploads/2021/11/tuition-tax-credits-834x480.jpg

What Are Tuition Tax Credits Gallo LLP Chartered Professional

https://gallollp.ca/wp-content/uploads/2021/09/pexels-pixabay-261909-1024x731.jpg

How To Pay Tuition Fees Without Student Finance Acrosophy

https://acrosophy.co.uk/wp-content/uploads/2019/01/how-to-pay-tuition-fees-without-student-finance-big.jpg

How do I get a tuition tax credit To claim your tuition tax credit you can use your post secondary tax certificate to fill out a Schedule 11 and attach it to your tax How to Claim Tuition Tax Credits The tuition tax credit is a non refundable credit meaning that if the tuition amount is greater than the tax owed you won t get a

Unused tuition credit will carry forward to future years when you start paying income tax You can also transfer 5000 credits to a parent if you cannot use it yourself The credits The tuition tax credit for post secondary education allows students to get a non refundable federal and provincial credit for the cost of tuition fees paid for post secondary level

Everything You Need To Know About The College Tuition Tax Credit

https://cdn.collegereaction.com/who_should_claim_the_tuition_credit.png

Tuition Pain This Tax Credit Can Help Ideal Tax LLC Ideal Tax Solution

https://www.idealtax.com/wp-content/uploads/2020/02/tuition-tax-credit.webp

https://www.irs.gov/credits-deductions/individuals/...

It is a tax credit of up to 2 500 of the cost of tuition certain required fees and course materials needed for attendance and paid during the tax year Also 40 percent of the

https://www.canada.ca/.../eligible-tuition-fees.html

Eligible tuition fees Generally a course taken in 2023 at an institution in Canada will qualify for a tuition tax credit if it was either taken at a post secondary education institution

Is Using Credit Cards To Pay Tuition Permissible About Islam

Everything You Need To Know About The College Tuition Tax Credit

What Is The Tuition Tax Credit In Canada And How Does It Work

Use Your Tuition Tax Credits As Soon As You Can Or Risk Losing Them

How To Get Tuition Tax Credit QATAX

Tuition Tax Credits

Tuition Tax Credits

Which Education And Tuition Tax Credits Am I Eligible For

Everything You Need To Know About The College Tuition Tax Credit

Private School Tax Credit AZ Tax Credit Funds

How To Use Tuition Tax Credit - How to Claim Tuition Tax Credits You can claim Tuition Tax in a few simple steps Obtain a tuition fee receipt You must have a receipt from an eligible educational institution in Canada that includes details like the