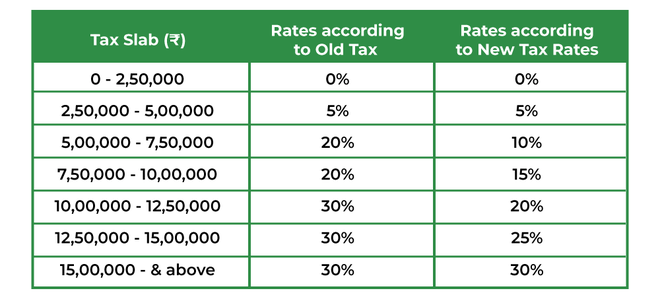

Hra Can Be Claimed In New Tax Regime Can I claim HRA exemption in the new regime Under the old tax regime House Rent Allowance HRA is exempted under section 10 13A for salaried individuals However this exemption is not available in the new tax regime

The new tax regime is the default regime from the assessment year AY 2024 25 onwards and there are no income tax changes for the financial year 2024 25 If you choose the new tax regime in the current fiscal year 2024 Currently HRA exemption under section 10 13A of the Income Tax Act is a relief for individuals paying substantial house rents This exemption is the least of the following actual HRA

Hra Can Be Claimed In New Tax Regime

Hra Can Be Claimed In New Tax Regime

http://bemoneyaware.com/wp-content/uploads/2016/07/hra-in-form-16-section-10.jpg

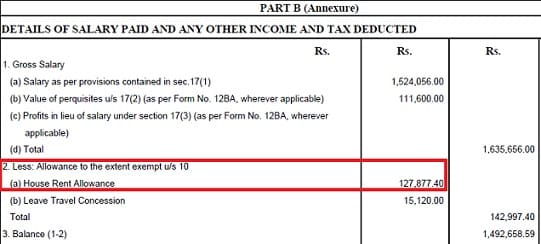

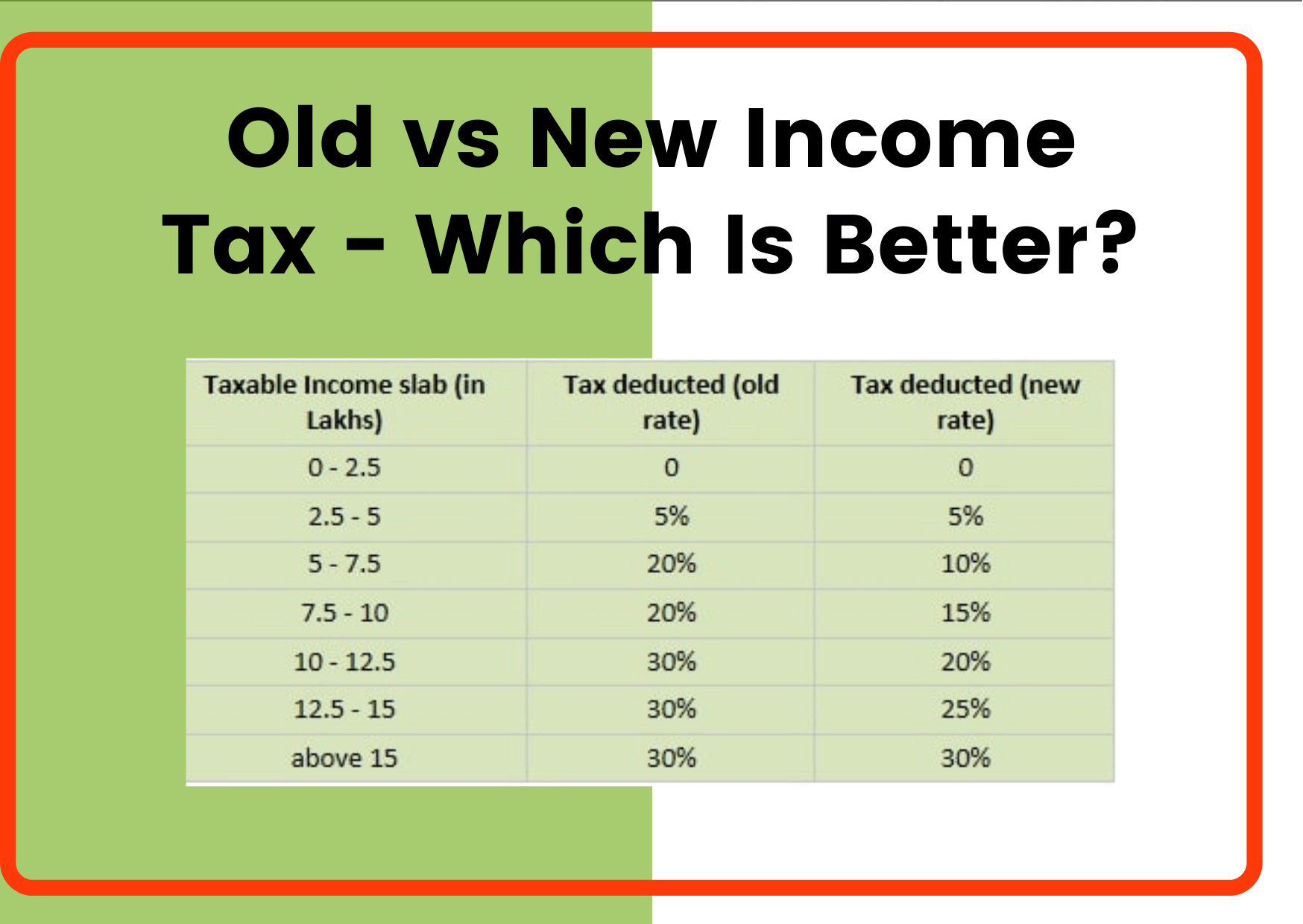

Old Tax Regime Vs New Tax Regime GeeksforGeeks

https://media.geeksforgeeks.org/wp-content/uploads/20220927170008/DifferenceBetweenOldVsNewTaxRegime1-660x299.png

Opinion It s Time For A New Tax Regime The Daily Iowan

https://dailyiowan.com/wp-content/uploads/2022/06/taxop.jpg

You can claim HRA exemption by submitting proof of rent receipts to your employer Alternatively you can claim the HRA exemption yourself while filing your income tax return if you forgot to How does the new tax regime impact HRA You can continue claiming HRA only if you opt for the old tax regime

Availability of HRA Exemption under New Tax Regime If the employee is opting for New Tax Regime u s 115BAC of income tax act he is not eligible to claim HRA exemption as New Tax Regime does not contain any deductions HRA is a part of salary that is not fully taxable but only for those who choose the old tax regime The new tax regime is the default option from FY 2023 24 and does not offer any deductions or exemptions for HRA

Download Hra Can Be Claimed In New Tax Regime

More picture related to Hra Can Be Claimed In New Tax Regime

Difference Between Old Vs New Tax Regime Which Is Better Vrogue

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

https://images.hindustantimes.com/img/2023/02/01/original/Tax_Regime_table_Web_1675260619284.png

How To Choose Between The New And Old Income Tax Regimes Chandan

https://images.moneycontrol.com/static-mcnews/2022/02/New-vs-old-tax-regime-Make-a-wise-choice-R.jpg

HRA exemption is not allowed under the New Tax Regime The only deduction allowed under the new regime for salaried individuals is Standard Deduction of Rs 50 000 If you want to claim HRA Notably the HRA exemption is not permitted in the new tax regime So in case you want to claim the tax exemption for rent allowance you must stick to the old tax regime only

An individual can claim tax exemption under section 10 13A of the Income tax Act 1961 Usually HRA is part of the CTC of an employee To claim the tax exemption an By claiming HRA exemption the portion of your salary designated as HRA is deducted from your total taxable income thereby lowering your overall tax liability This can

Old Versus New Regime Thousands Use Tax Department s Calculator To

https://images.cnbctv18.com/wp-content/uploads/2023/02/tax2.jpg

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

https://www.incometax.gov.in/iec/foporta…

Can I claim HRA exemption in the new regime Under the old tax regime House Rent Allowance HRA is exempted under section 10 13A for salaried individuals However this exemption is not available in the new tax regime

https://economictimes.indiatimes.com…

The new tax regime is the default regime from the assessment year AY 2024 25 onwards and there are no income tax changes for the financial year 2024 25 If you choose the new tax regime in the current fiscal year 2024

Easy Way To Switch New To Old Income Tax Scheme For Taxpayers

Old Versus New Regime Thousands Use Tax Department s Calculator To

Brief Comparison Between New Tax Regime And Old Tax Regime FY 2023 24

Budget 2023 Here Are The Fresh New Income Tax Regime Slabs India Today

Income Tax Clarification Opting For The New Income Tax Regime U s

Income Tax Rebate 10 7 Slab 2 5

Income Tax Rebate 10 7 Slab 2 5

Budget Decoder How To Choose Between Old And New Tax Regime Times Of

New Tax Regime To Benefit Middle Class Leave More Money In Their Hands

New Tax Regime Vs Outdated Tax Regime Which One To Choose Https

Hra Can Be Claimed In New Tax Regime - HRA is a part of salary that is not fully taxable but only for those who choose the old tax regime The new tax regime is the default option from FY 2023 24 and does not offer any deductions or exemptions for HRA