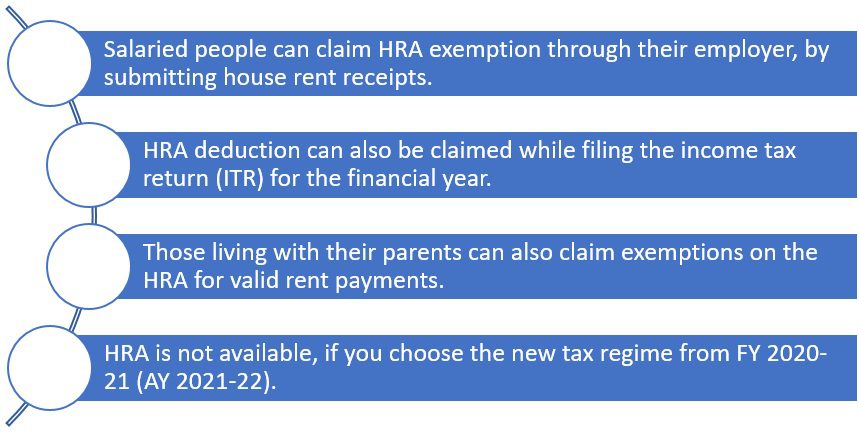

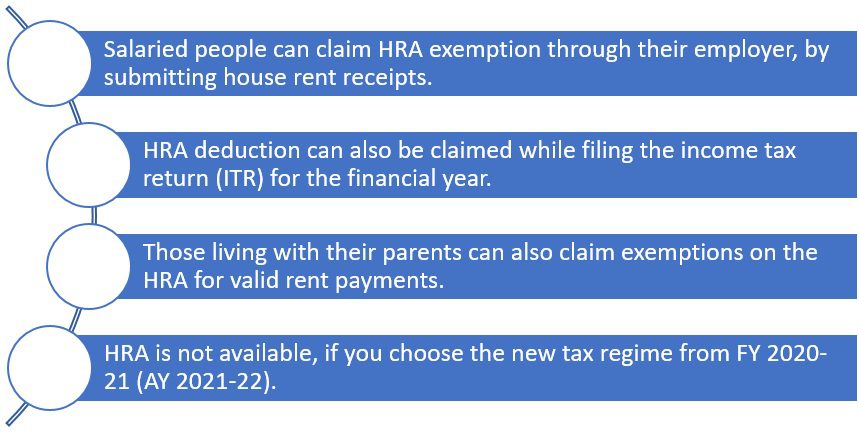

Hra Deduction In Income Tax HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will be fully taxable What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80GG towards rent that you pay Learn more

Hra Deduction In Income Tax

Hra Deduction In Income Tax

https://i.ytimg.com/vi/rjzwNweuVfc/maxresdefault.jpg

Salaried Person Here s All You Need To Know About HRA Tax Deduction

https://akm-img-a-in.tosshub.com/sites/btmt/images/stories/Newstaffpics/mt-24n25_2_071217100028.jpg

How To Claim HRA Allowance House Rent Allowance Exemption

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

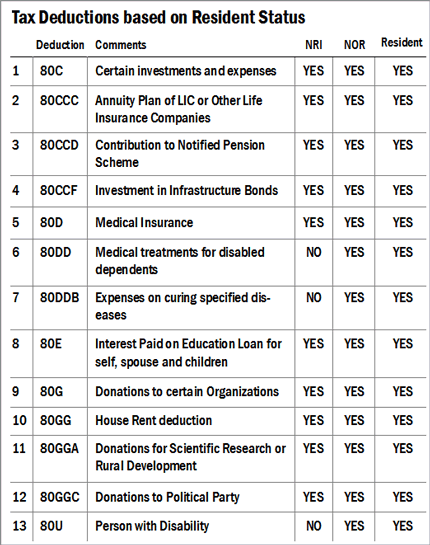

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both salaried individuals and self employed persons HRA is an allowance and is subject to income tax An employee can claim exemption on his House Rent Allowance HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer In order to claim the deduction an employee must actually pay rent for the house which he occupies

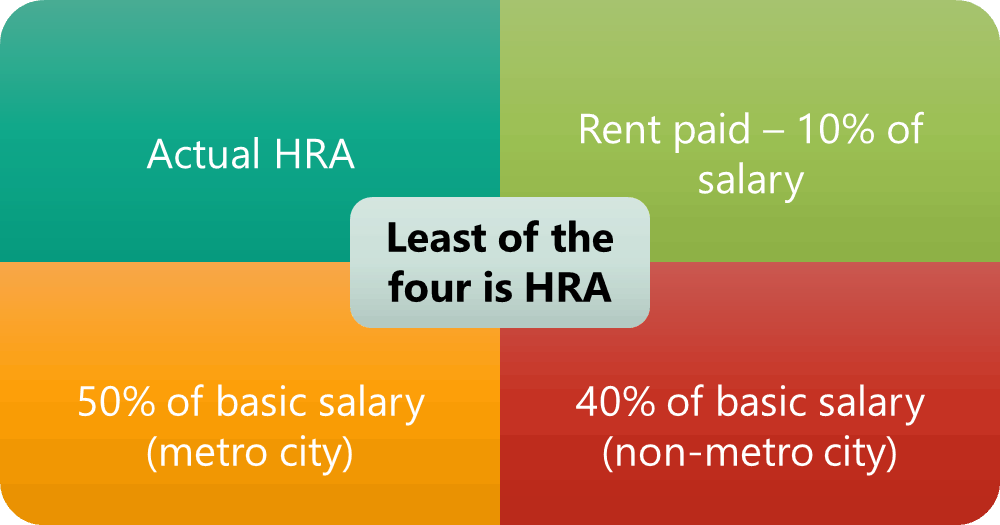

What is HRA HRA or House Rent Allowance is an allowance that salaried individuals receive from their employer for meeting the rental expenses of their house The amount received is partly exempted from tax for the employees who are residing in a rented house Tax on employment and entertainment allowance will also be allowed as a deduction from the salary income Employment tax is deducted from your salary by your employer and then it is deposited to the state government

Download Hra Deduction In Income Tax

More picture related to Hra Deduction In Income Tax

Income Tax Deduction U s 80C 80U Rajput Jain Associates

https://carajput.com/blog/wp-content/uploads/2020/10/24297_20140103_tax_deductions__w430__.png

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1068x830.png

HRA HRA CALCULATION HRA EXEMPTION SECTION 10 13A INCOME TAX HRA

https://i.ytimg.com/vi/YVoRsEkZ_nE/maxresdefault.jpg

House rent allowance HRA is one of the important components of your salary All employers have to provide HRA as compensation for house rental expenses However most of us are not aware of the fact that we can also save tax on it You can claim a deduction for HRA under Section 10 13A of the Income Tax Act but remember it can be fully or partially taxable The calculation of HRA deduction depends on multiple factors such as Your salary HRA received Actual rent paid City of residence 2 Eligibility Criteria To Claim Tax Deduction On HRA

[desc-10] [desc-11]

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

HRA Calculation Everything You Need To Know

https://www.canarahsbclife.com/content/dam/choice/tax-university/images/Picture2.png

https://taxguru.in/income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

https://cleartax.in/paytax/hracalculator

Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a rented accommodation but still get house rent allowance the allowance will be fully taxable

HRA House Rent Allowances Claim HRA Benefits Without Landlord s PAN

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

Form 12BB To Claim HRA Deduction By Salaried Employees

HRA Calculation How To Calculate HRA In Salary Razorpay Payroll

HRA Exemption Calculator For Windows 8 And 8 1

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

HRA Exemption Rules HRA Deduction HRA Calculation HRA Tax Saving

House Rent Allowance HRA Lenvica HRMS

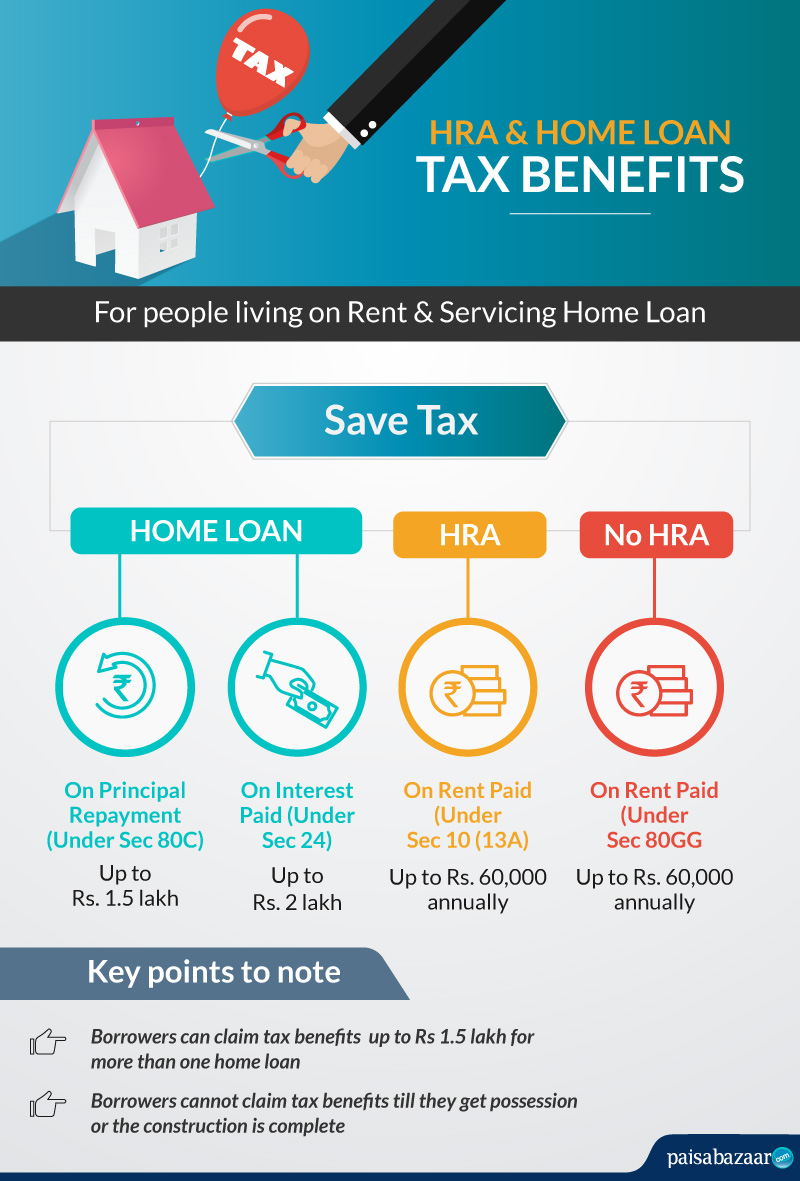

Can I Claim Both Home Loan And HRA Tax Benefits

HRA Exemption Calculator EXCEL House Rent Allowance Calculation To

Hra Deduction In Income Tax - HRA is an allowance and is subject to income tax An employee can claim exemption on his House Rent Allowance HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer In order to claim the deduction an employee must actually pay rent for the house which he occupies